Ac Risk

What are some common applications for AC stepping motors ?

AC stepping motors have a wide range of applications due to their precise control and high torque output. Here are some common uses: 1. Printers and Plotters: AC stepping motors are used in printers and plotters to move the print head or pen with precision, and they can control the speed of the print head or pen, allowing for variable printing speeds. 2. CNC Machines: In computer numerical control (CNC) machines, AC stepping motors are used to control the path of the cutting tool and adjust the feed rate of the tool, allowing for precise machining of parts. 3. Robotics: AC stepping motors are often used in robotic joints to provide precise movement and positioning, and they can control the force applied by the robot's end effector, allowing for delicate manipulation of objects. 4. Textile Industry: In textile machinery, AC stepping motors are used to feed fabric through the machine at a controlled rate and control the pattern being woven into the fabric by adjusting the position of the weaving elements. 5. Automation Systems: AC stepping motors are used to control the speed and direction of conveyor belts in automation systems, and they are often used as actuators in automated systems, providing precise control over the position and movement of components.

Can an AC stepping motor be used in robotics applications ?

AC stepping motors can be used in robotics applications, offering precise control and high torque. However, they have speed limitations and can overheat, requiring cooling mechanisms. Consider application requirements and compatibility with control systems before choosing an AC stepping motor for a robotic project.

What is the difference between a bipolar and unipolar AC stepping motor ?

AC stepping motors are widely used in various applications such as robotics, CNC machines, and automation systems. They convert electrical pulses into mechanical movements with high precision and repeatability. There are two main types of AC stepping motors: bipolar and unipolar. This article will discuss the differences between these two types of motors. Bipolar AC stepping motors have two windings that are connected in series or parallel. Each winding is energized by an alternating current (AC) source, which creates a magnetic field. The direction of the magnetic field depends on the polarity of the current flowing through the windings. By changing the polarity of the current flowing through the windings, the direction of rotation can be reversed. Bipolar AC stepping motors have several advantages over unipolar motors, including higher torque output at lower speeds, better heat dissipation due to larger surface area of the windings, and more efficient use of electrical energy due to lower resistance of the windings. Unipolar AC stepping motors have only one winding that is energized by an alternating current (AC) source. The direction of the magnetic field created by this winding is always the same, regardless of the polarity of the current flowing through it. Unlike bipolar motors, unipolar motors cannot change the direction of rotation without additional hardware. Unipolar AC stepping motors have some advantages over bipolar motors, including simpler control circuitry since only one winding needs to be controlled, lower cost due to fewer components required for operation, and smaller size and weight, making them suitable for compact applications. In conclusion, bipolar and unipolar AC stepping motors differ in terms of their number of windings, ability to reverse direction, torque output, heat dissipation, efficiency, control circuitry complexity, cost, and size/weight. Depending on the specific requirements of your application, you may choose either type of motor based on these factors.

What is an AC stepping motor and how does it work ?

An AC stepping motor is a type of electric motor that operates on alternating current and moves in discrete steps. It is commonly used in applications requiring precise control, such as robotics, CNC machines, 3D printers, and automation systems. The motor's movement is achieved by energizing its coils in a specific sequence, causing the rotor to turn a fixed angle for each step. The components of an AC stepping motor include the stator, rotor, and drive system. The stator is the stationary part of the motor containing coils or windings. The rotor is the rotating part of the motor, which has magnetic teeth. The drive system controls the sequence and timing of electrical pulses sent to the stator coils. The operational principle of an AC stepping motor involves winding energization, rotor alignment, stepping action, and repeating sequence. When an electrical current is applied to the stator windings, it creates a magnetic field. The magnetic field interacts with the rotor's magnetic teeth, causing them to align with the stator's field. By changing the sequence of the energized coils, the rotor is forced to rotate to a new position where the teeth again align with the stator's magnetic field. Continuously changing the energized coils causes the rotor to move in a series of small steps. There are two phases of operation for an AC stepping motor: single phase and multi-phase. Single phase operates using only one phase of AC power, typically for simpler applications. Multi-phase uses multiple phases of AC power for more complex movements and higher torque requirements. Control and drive systems for an AC stepping motor include microstepping, drivers, and controllers. Microstepping allows the motor to move in even smaller steps than its inherent step angle by controlling the current through the windings. The driver translates digital commands into the appropriate current levels and patterns required by the motor. The controller sends commands to the driver based on input from sensors or user interfaces. Advantages of an AC stepping motor include precision, simple control, and high reliability. Disadvantages include low top speed, resonance issues, and torque drop-off. In summary, an AC stepping motor converts electrical pulses into discrete mechanical movements through the interaction of its stator and rotor components. Its operational simplicity and precision make it ideal for various control applications despite some limitations in speed and resonance concerns.

What are the advantages of using an AC stepping motor compared to a DC stepping motor ?

The text discusses the advantages of using AC stepping motors compared to DC stepping motors. The main points include: 1. **Simplified Drive Circuitry**: AC stepping motors have simpler drive circuitry than DC stepping motors, leading to fewer components and a more streamlined design, which reduces complexity and lowers manufacturing costs. 2. **Higher Torque Output**: AC stepping motors typically offer higher torque output than DC stepping motors, making them ideal for applications requiring high torque at low speeds. This also leads to improved efficiency and reduced energy consumption. 3. **Better Heat Dissipation**: AC stepping motors often have better heat dissipation capabilities due to their larger surface area and improved cooling mechanisms, allowing them to operate at higher temperatures without overheating and extending their lifespan. 4. **Compatibility with Standard AC Power Sources**: AC stepping motors are compatible with standard AC power sources widely available in industrial and commercial settings, eliminating the need for additional power supplies or conversion equipment and simplifying installation. 5. **Lower Maintenance Requirements**: AC stepping motors generally require less maintenance than DC stepping motors, as they have fewer moving parts and simpler drive circuitry, reducing maintenance costs and downtime. Overall, the text highlights that AC stepping motors offer significant benefits over DC stepping motors in terms of simplicity, performance, efficiency, compatibility, and maintenance, making them a popular choice for various applications where precision control and reliability are essential.

Can you explain the differences between AC and DC drive motors ?

Electric motors are essential components in various industries, ranging from manufacturing to transportation. Two of the most common types of electric motors are AC (Alternating Current) and DC (Direct Current) drive motors. While both serve similar functions, there are several differences between them that affect their performance and applications. AC and DC drive motors differ in their construction and design, with AC motors having a simpler design with fewer parts, while DC motors have more complex designs with additional components such as brushes and commutators. This complexity can lead to higher maintenance costs for DC motors compared to AC motors. One of the main differences between AC and DC drive motors is their ability to control speed. AC motors generally operate at a fixed speed, which makes them less suitable for applications requiring variable speed control. On the other hand, DC motors offer precise speed control, making them ideal for applications such as robotics, CNC machines, and conveyor systems. AC motors are generally more efficient than DC motors due to their simpler design and lower power consumption. However, the efficiency of a motor also depends on its size, load capacity, and operating conditions. In some cases, DC motors may be more energy-efficient when used in low-power applications or when precise speed control is required. Another difference between AC and DC drive motors is their starting torque. AC motors generally have a higher starting torque than DC motors, which makes them better suited for heavy-duty applications such as pumps, fans, and compressors. DC motors, on the other hand, provide a smoother start-up but may require additional components to achieve the desired starting torque. The cost and availability of AC and DC drive motors vary depending on their size, type, and manufacturer. Generally, AC motors are more widely available and less expensive than DC motors due to their simpler design and lower production costs. However, the total cost of ownership should also consider factors such as maintenance, repair, and energy consumption over the motor's lifetime.

How do you control the speed and torque of an AC stepping motor ?

The text provides a comprehensive overview of controlling the speed and torque of an AC stepping motor, emphasizing the importance of understanding its basic principles and utilizing appropriate control techniques. Key points include the motor's working principle, torque generation, and step resolution, as well as various control methods such as pulse rate modulation, microstepping, closed-loop control, current limiting, voltage control, and soft start/stop. Practical considerations like drive system compatibility, thermal management, load factors, and safety precautions are also highlighted for optimal motor performance and longevity.

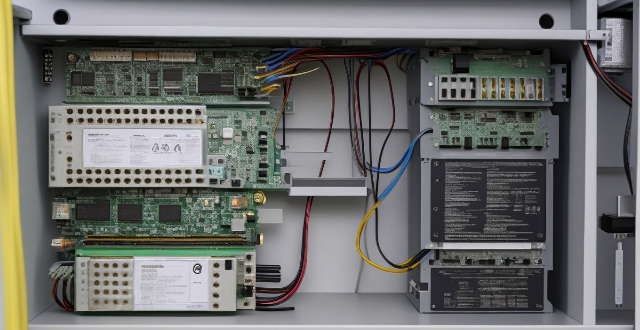

How do you connect an AC stepping motor to a microcontroller or driver board ?

Connecting an AC stepping motor to a microcontroller or driver board involves selecting the right board, connecting the power supply, attaching the motor, programming the board, testing the connection, and troubleshooting any issues. Materials needed include the motor, board, power supply, wires, and optionally a breadboard for temporary connections. Tips include double-checking connections and code, using a breadboard before soldering, and following safety guidelines when working with high voltages.

How do you choose the right AC stepping motor for your project ?

Choosing the right AC stepping motor requires understanding project needs, selecting the appropriate motor type, ensuring compatibility with control systems, considering physical constraints, evaluating performance characteristics, accounting for environmental factors, managing budgetary considerations, relying on supplier support and reputation, and conducting thorough testing.

What are the key parameters to consider when selecting an AC stepping motor ?

Selecting an AC stepping motor involves considering key parameters such as torque, step angle, voltage and current ratings, resolution, size and weight, compatibility with the control system, and cost. These factors ensure the motor meets the application's requirements, providing enough rotational force, handling load demands, fitting within space and weight restrictions, and operating smoothly and precisely. Compatibility with the controller is crucial for proper operation, while cost considerations help stay within budget constraints.

How do you troubleshoot common issues with AC stepping motors, such as missing steps or low torque ?

Troubleshooting common issues with AC stepping motors involves addressing problems such as missing steps or low torque. This is done by checking the power supply, examining the drive system, analyzing mechanical components, evaluating control signals, and considering environmental factors. It is important to approach the problem methodically, starting with basic checks before moving on to more complex diagnostics.

What is the risk involved in investing in bonds ?

Investing in bonds carries risks such as interest rate, credit, inflation, liquidity, reinvestment, call, prepayment, foreign currency, and political/regulatory changes. Understanding and managing these risks is crucial for protecting your investment. Diversifying your portfolio across different types of bonds and monitoring market conditions can help mitigate these risks.

What are the key components of a successful disaster risk management plan ?

Key Components of a Successful Disaster Risk Management Plan include: 1. Risk Assessment 2. Prevention and Mitigation Strategies 3. Preparedness Activities 4. Response Mechanisms 5. Recovery and Rehabilitation 6. Continuous Improvement

Why is it important to conduct a climate risk assessment ?

Climate risk assessment is crucial for understanding the potential impacts of climate change on different sectors and systems, identifying vulnerabilities and risks, developing adaptation strategies and policies, enhancing resilience and reducing losses, and supporting decision making. It helps in building a more resilient and sustainable future for all.

How can governments implement climate risk management policies to protect their citizens and infrastructure ?

Governments can implement climate risk management policies by assessing the risks, developing a comprehensive plan, investing in resilience and adaptation measures, engaging stakeholders and building public awareness, and monitoring and evaluating progress.

What is disaster risk management ?

Disaster risk management (DRM) is a comprehensive approach aimed at reducing the impact of natural and human-made disasters on communities. It involves understanding, assessing, and reducing risks through prevention, preparedness, response, and recovery strategies. The goal is to ensure that people's lives and livelihoods are not compromised by disaster events. Key components include risk assessment, hazard mitigation, early warning systems, emergency planning, community education, immediate action, coordination, rehabilitation, reconstruction, and sustainable development. Best practices involve multi-stakeholder collaboration, gender sensitivity, use of technology, inclusive planning, and regular review and updating. Challenges include limited resources, political will, information gaps, and cultural differences. Effective DRM requires a multifaceted approach that considers social, economic, and environmental factors.

What is climate risk assessment ?

Climate risk assessment is a systematic process that identifies, evaluates, and prioritizes the potential impacts of climate change on a specific region or sector. It involves analyzing the likelihood and severity of various climate-related risks, such as extreme weather events, sea level rise, and changes in temperature and precipitation patterns. The goal of climate risk assessment is to inform decision-makers about the risks associated with climate change and help them develop strategies to manage and adapt to these risks. Key components of climate risk assessment include identifying potential risks, evaluating their potential impacts, prioritizing them based on severity and likelihood of occurrence, and developing adaptation strategies to reduce potential impacts. By implementing these strategies, decision-makers can help ensure that their communities are better prepared for the challenges posed by climate change.

How does risk management relate to compliance and regulatory requirements ?

Risk management and compliance are interconnected aspects of organizational operations, aimed at safeguarding against potential losses and legal issues. Risk management identifies and prioritizes risks impacting objectives, while compliance ensures adherence to laws and regulations. An integrated approach enhances efficiency, and collaboration between departments is key for success. Regulatory requirements significantly influence risk management and compliance strategies, with direct rules and indirect environmental changes. Understanding these dynamics is vital for maintaining reputation and avoiding compliance breaches.

How do banks manage credit risk ?

Banks manage credit risk through a variety of methods and strategies to ensure the stability of their operations and protect against potential losses. They identify and assess credit risk using credit scoring models, financial analysis, and credit reports. They mitigate credit risk through diversification, collateral and guarantees, and credit derivatives. Banks monitor and control credit risk by ongoing monitoring, loan loss reserves, and regulatory compliance. In case of credit risk events, banks recover through workout agreements, legal recourse, and communication with stakeholders. By employing these strategies, banks aim to minimize credit risk while still providing essential lending services to support economic growth and individual prosperity.

What role do scientists play in climate risk assessments ?

Scientists are crucial in climate risk assessments, analyzing data, developing models, and providing recommendations for mitigating risks. They collect data from multiple sources and use statistical methods to identify trends, create computer models to predict impacts, develop strategies to mitigate risks, and communicate their findings to build support for policies and actions.

How can organizations create a culture of risk awareness among employees ?

Organizations can create a culture of risk awareness among employees by implementing strategies such as leadership buy-in, training and education, open communication channels, integrating risk management into daily operations, recognizing and rewarding risk awareness, and continuous improvement. These efforts will help employees proactively identify, assess, and manage risks more effectively.

How can companies implement effective risk management strategies ?

Effective Risk Management Strategies for Companies Risk management is a critical aspect of any business operation. It involves identifying, assessing, and prioritizing potential risks that could impact the company's objectives. Here are some effective risk management strategies that companies can implement: 1. Identify Potential Risks: The first step in implementing effective risk management is to identify potential risks. This involves analyzing the company's operations and processes to determine what could go wrong. Some common types of risks include financial risks, operational risks, strategic risks, and compliance risks. 2. Assess and Prioritize Risks: Once potential risks have been identified, they need to be assessed and prioritized based on their likelihood and potential impact. This involves assigning each risk a score based on its severity and probability of occurrence. The risks can then be ranked in order of priority, with the most significant risks being addressed first. 3. Develop Risk Mitigation Plans: For each identified risk, a mitigation plan should be developed. This plan should outline the steps that will be taken to reduce or eliminate the risk. Mitigation plans can include avoidance, reduction, transfer, or acceptance. 4. Monitor and Review Risks Regularly: Risk management is an ongoing process, and companies should regularly monitor and review their risks. This involves tracking changes in the business environment and updating risk assessments accordingly. It also involves evaluating the effectiveness of risk mitigation plans and making adjustments as needed. In conclusion, effective risk management strategies involve identifying potential risks, assessing and prioritizing them, developing mitigation plans, and regularly monitoring and reviewing them. By implementing these strategies, companies can reduce their exposure to risks and protect their operations and bottom line.

Can children get vaccinated against COVID-19 ?

Children are eligible for COVID-19 vaccination based on their age and health status. The Pfizer-BioNTech vaccine is authorized for children aged 5-11, while both the Pfizer-BioNTech and Moderna vaccines are authorized for those aged 12-17. Children with no history of severe allergic reactions or other health conditions that may increase the risk of adverse reactions to the vaccine are generally considered suitable candidates. Vaccinating children can help protect them from contracting the virus and developing symptoms, reduce the risk of severe illness and complications, and contribute to achieving herd immunity. While there are potential risks and side effects associated with vaccination, they are generally outweighed by the benefits. Parents should consult with their child's healthcare provider to determine if vaccination is appropriate for their child.

What are some common tools and techniques used in risk management ?

Risk management is a process that involves identifying, assessing, and prioritizing potential risks. There are various tools and techniques used in risk management, including brainstorming, Delphi method, checklists, qualitative and quantitative assessment, risk matrix, cost-benefit analysis, avoidance, reduction, transference, acceptance, continuous monitoring, and audits. These tools and techniques help organizations and individuals manage risks effectively and make informed decisions.

How can climate risk management help reduce the impact of climate change on the environment ?

Climate risk management is a multi-step approach that helps mitigate the effects of climate change on the environment. It involves identifying and assessing risks, prioritizing them, developing adaptation strategies, implementing mitigation efforts, fostering collaboration, and continuously monitoring outcomes. This proactive method aims to protect natural systems from adverse climate impacts, promote sustainable practices, and reduce greenhouse gas emissions. By adopting these measures, we can build resilience against climate-related risks and contribute to a more sustainable future for all.

What is risk management and why is it important ?

Risk management is a systematic approach used by organizations to identify, assess, and prioritize potential risks that may impact their objectives. It involves implementing strategies to monitor and control these risks effectively. The goal of risk management is to minimize the probability and impact of negative events and maximize the opportunities for positive outcomes. The importance of risk management includes mitigating uncertainty, enhancing decision-making, compliance and regulatory requirements, protection of reputation, financial performance, and promoting innovation. Effective risk management is crucial for any organization looking to sustain its operations, protect its assets, enhance decision-making, maintain compliance, preserve its reputation, and improve its financial performance. It enables companies to navigate challenges proactively and capitalize on opportunities while minimizing the impact of potential threats.

What role do insurers play in climate risk management ?

Insurers play a crucial role in climate risk management by providing financial protection against losses and damages caused by climate-related events. They help manage exposure to climate risks through insurance policies, risk assessments, and risk transfer tools. Insurers contribute to climate risk management by assessing risks, offering insurance policies, utilizing risk transfer tools, investing in resilience and adaptation, collaborating with governments and stakeholders, raising awareness, and conducting research and development.

How can climate data analysis help in disaster risk reduction and management ?

Climate data analysis is crucial for disaster risk reduction and management. It helps identify high-risk areas, predict future weather patterns, develop mitigation strategies, and enhance disaster response and recovery efforts. By analyzing past and current climate data, we can better prepare for and respond to natural disasters such as floods, hurricanes, wildfires, and droughts.

How does climate change affect disaster risk management strategies ?

The article discusses how climate change affects disaster risk management strategies. It explains that as the Earth's climate warms, extreme weather events such as hurricanes, floods, and wildfires are becoming more frequent and severe. This means that disaster risk management strategies must be adapted to address these new challenges. The article explores the increased frequency of extreme weather events, changes in agriculture and food security, and impacts on human health. It suggests that disaster risk management strategies should focus on improved forecasting, infrastructure improvements, evacuation planning, sustainable farming practices, crop diversification, food storage and distribution systems, healthcare infrastructure, public health education, and disease surveillance. By taking these steps, we can better prepare for and respond to natural disasters in a changing climate.

How can I invest in stocks with a minimal risk ?

How to Invest in Stocks with Minimal Risk Investing in stocks can be risky, but there are strategies to minimize these risks. Diversification across stocks, sectors, and asset classes is crucial. Dollar-cost averaging helps smooth market fluctuations. Stop-loss orders limit potential losses. Long-term investing allows for market recoveries. Understanding the companies you invest in reduces unknown risks. Start small and learn as you go, staying informed about financial news. Working with a financial advisor can provide personalized guidance. Remember, no investment is completely risk-free, so assess your comfort level before making decisions.