Bond Sustainable

What criteria should be met for a bond to be classified as a green bond ?

Green bonds are fixed-income instruments specifically designed to raise capital for climate and environmental projects. To be classified as a green bond, the issuer must meet certain criteria, including how the funds will be used, which projects are eligible, transparency in reporting, certification and review by third parties, and additional requirements depending on the framework being used. These criteria ensure that the funds raised through issuance of the bond are used for environmentally sustainable purposes. Green bonds play a crucial role in financing sustainable development and promoting a low-carbon economy.

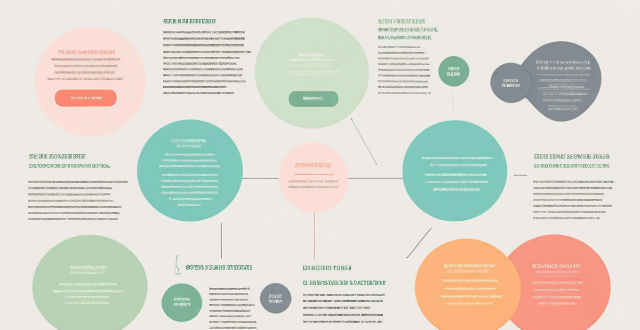

How can investors identify credible green bond opportunities ?

Investing in green bonds is becoming increasingly popular as more investors seek to align their portfolios with environmental sustainability goals. However, it is crucial for investors to identify credible green bond opportunities to ensure that their investments truly contribute to positive environmental impacts. Here are some key steps and considerations for identifying credible green bond opportunities: 1. Understand the definition of green bonds. 2. Look for certification and verification. 3. Examine the use of proceeds. 4. Assess the environmental impact. 5. Check transparency and reporting. 6. Consider the credit quality. 7. Review the legal framework. 8. Consult professional advice.

How do bond yields affect my investment returns ?

Bond yields significantly impact investment returns, particularly for bond and bond-related security investors. Yields represent the interest rate paid by bond issuers to holders and are crucial for expected returns. Higher yields generally result in increased interest income but can also cause price volatility. Inflation affects real returns, and lower yields may increase opportunity costs. Strategies like diversification, duration management, active management, and staying informed can help maximize returns amidst changing bond yield environments.

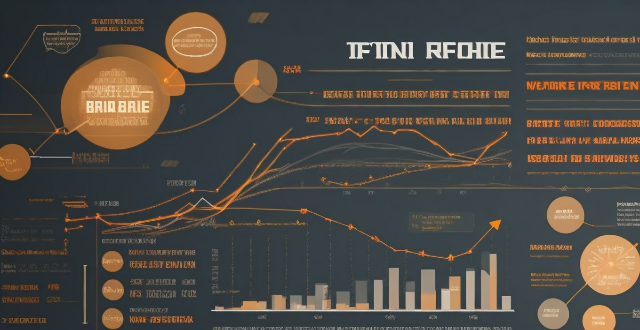

How do interest rates affect bond prices and yields ?

Bond prices and yields are inversely related to interest rates. When interest rates rise, bond prices fall, and vice versa. This is because the yield on a bond is determined by its coupon rate, which is fixed at the time of issuance. Therefore, if interest rates increase after the bond is issued, the yield on the bond will be lower than the current market rate, making it less attractive to investors. Conversely, if interest rates decrease after the bond is issued, the yield on the bond will be higher than the current market rate, making it more attractive to investors. Other factors that affect bond prices and yields include credit risk, inflation expectations, and economic growth. When interest rates rise, bond prices fall, and the yield curve steepens. When interest rates decrease, bond prices rise, and the yield curve flattens. To manage interest rate risk, investors can diversify their portfolio across different types of bonds and maturities, use hedging strategies such as interest rate swaps and futures and options contracts, and engage in active management through market timing and credit analysis.

How do I get started with bond investing ?

Bond investing is a popular way to diversify your portfolio and earn a steady income. Here are some steps to help you get started: 1. Understand the basics of bonds. 2. Determine your investment objectives. 3. Choose the right type of bond for you. 4. Consider the duration of the bond. 5. Research and select brokers or intermediaries. 6. Diversify your portfolio by investing in various types of bonds issued by different entities. 7. Monitor your investments regularly and adjust your portfolio as needed based on changing market conditions or personal circumstances.

How can I diversify my portfolio with bond investments ?

Diversifying your portfolio with bond investments can reduce investment risk and provide a steady stream of income. There are several types of bonds, including government, corporate, municipal, and foreign bonds, each with its own characteristics and risks. Bond mutual funds and ETFs offer automatic diversification across multiple issuers and types of bonds. When investing in bonds, consider factors such as credit quality, interest rate risk, inflation risk, and liquidity. To effectively diversify your portfolio with bonds, allocate a portion of your portfolio to bonds, invest in different types of bonds, consider bond maturities, and rebalance regularly. Consulting with a financial advisor can help determine the best bond strategies for your individual financial goals and risk tolerance.

What is the difference between a bond and a stock ?

Bonds and stocks are two different types of financial instruments that companies use to raise capital. While both are used for funding, they have distinct differences in terms of ownership, returns, risks, and other factors. Here are some key differences between bonds and stocks: - Bonds represent debt and provide regular interest payments with a fixed maturity date, while stocks represent equity and offer potential dividends and capital appreciation without a set maturity date. - When you buy a bond, you are essentially lending money to the issuer (usually a company or government). In return, you receive a bond certificate that represents your loan. You do not own any part of the company; you are simply a creditor. - When you buy a stock, you become a part owner of the company. This means you have a claim on the company's assets and earnings, as well as a say in how the company is run through voting at shareholder meetings. - The primary return from owning a bond comes from interest payments made by the issuer. These payments are usually fixed and paid at regular intervals until the bond matures, at which point the principal amount is repaid. - The return on stocks comes from dividends (if the company chooses to pay them) and capital gains (the increase in the stock price over time). Stock prices can be volatile, so the potential for high returns is greater than with bonds, but so is the risk. - Generally considered less risky than stocks because they offer a fixed rate of return and have priority over stockholders in the event of bankruptcy. However, there is still risk involved, especially if the issuer defaults on its payments. - More risky than bonds because their value fluctuates with market conditions and the performance of the underlying company. If the company does poorly, the stock price may fall significantly, and investors could lose part or all of their investment. - Have a defined maturity date when the principal amount must be repaid by the issuer. This provides a clear timeline for investors. - Do not have a maturity date; they exist as long as the company remains in business. Investors can sell their shares at any time in the open market. - Interest income from bonds is typically taxed as ordinary income. - Long-term capital gains from stock sales may be taxed at a lower rate than ordinary income, depending on the tax laws of the jurisdiction.

How does inflation impact bond investments ?

Inflation significantly impacts bond investments by decreasing purchasing power, increasing interest rate risk, creating opportunity costs, and affecting fixed-income investors. Inflation-indexed bonds can mitigate these effects.

What is the role of credit rating agencies in bond investing ?

Credit rating agencies are pivotal in bond investing, offering independent assessments of issuers' creditworthiness. They conduct thorough analyses and assign ratings reflecting the likelihood of default, aiding investors in risk evaluation and portfolio diversification. These ratings contribute to market transparency, efficient price discovery, and enhanced liquidity. They also play a role in regulatory compliance for institutional investors and capital markets regulation. However, concerns about conflicts of interest and rating accuracy during crises highlight the need for improved methodologies and increased accountability.

How can businesses contribute to sustainable consumption ?

Businesses can contribute to sustainable consumption by adopting circular economy principles, managing green supply chains, using eco-friendly packaging, practicing product stewardship, improving energy efficiency, conserving water, engaging in responsible marketing, promoting innovation, engaging stakeholders, and supporting environmental initiatives. These practices help reduce waste, minimize resource use, and inspire sustainable consumer behavior.

What kind of indoor games can parents play with their children to strengthen their bond ?

The article provides a list of indoor games that can help strengthen the bond between parents and children. The games include board games like Monopoly and Chess, card games such as Uno and Go Fish, puzzles and brain teasers like Sudoku and crossword puzzles, arts and crafts activities, indoor treasure hunts, and cooking/baking projects. These games not only provide entertainment but also offer opportunities for learning and quality time spent together.

What role do green bonds and other financial products play in climate financing ?

Green bonds and other financial products are crucial for climate financing, enabling investors to support environmentally friendly projects. These instruments fund renewable energy, energy efficiency, waste management, biodiversity conservation, and other eco-friendly initiatives, contributing to climate change mitigation and sustainable development. Key features of green bonds include transparency and verification, offering benefits such as attracting capital and pricing advantages but facing challenges like standardization and secondary market liquidity. Other financial products include climate-themed investment funds, CERs, green loans, and credit facilities, which directly finance green projects and stimulate innovation in sustainable practices. By aligning financial returns with environmental benefits, these instruments play a vital role in mobilizing private capital towards climate action, helping to bridge the funding gap for sustainable projects and mitigate climate change.

What are the main sources of sustainable energy ?

The text discusses the various main sources of sustainable energy, including solar energy, wind energy, hydropower, geothermal energy, bioenergy, tidal and wave energy, and hydrogen energy. It also highlights the importance of adopting sustainable energy for environmental impact, economic benefits, energy security, and health considerations. The transition to sustainable energy requires investment, policy support, and technological innovation.

How does sustainable consumption impact the economy ?

Reduced resource depletion, lower energy costs, increased innovation, and improved public health are some of the key benefits of sustainable consumption. While there may be short-term costs associated with transitioning to more sustainable practices, the long-term benefits far outweigh these costs.

How can sustainable investing help achieve the United Nations Sustainable Development Goals ?

Sustainable investing, which incorporates environmental, social, and governance criteria into investment decision-making, can significantly contribute to achieving the United Nations Sustainable Development Goals. It promotes environmentally friendly practices, enhances social well-being, advances economic growth and innovation, upholds good governance and partnerships, drives market trends towards sustainability, and attracts conscience-driven consumers. By aligning financial objectives with positive societal impact, sustainable investing creates a framework for long-term, sustainable growth that benefits people, planet, and profit.

How do I choose a sustainable investment fund ?

Choosing a sustainable investment fund requires careful consideration of various factors, including your investment goals, the fund's ESG criteria and performance history, the experience of the fund manager, the fund's holdings and alignment with your values, fees and expenses, and ongoing monitoring of your investment. By following these steps, you can select a sustainable fund that aligns with your financial goals and personal values.

What are the risks of sustainable investing ?

Sustainable investing carries risks such as inconsistent screening criteria, limited investment opportunities, higher costs, regulatory and legal issues, market risks, and reputational risks. Investors should carefully consider these risks before making investment decisions to ensure that sustainable investing aligns with their goals and risk tolerance.

What impact have celebrities had on promoting sustainable fashion ?

### Summary: Celebrities significantly influence sustainable fashion promotion by raising awareness, shaping trends, supporting eco-friendly brands, driving industry changes, and setting personal examples of sustainability. Through campaigns, social media engagements, and public appearances in sustainable fashion, they encourage followers to adopt more environmentally conscious choices. Their actions not only increase the visibility of sustainable brands but also push for greater transparency and ethical practices within the fashion industry.

What are the benefits of using sustainable energy sources ?

Using sustainable energy sources provides environmental, economic, and social benefits. These include reduced greenhouse gas emissions, improved air quality, conservation of natural resources, protection of ecosystems, cost savings, job creation, energy independence, stable energy prices, improved public health, community resilience, education and innovation, and increased energy access. Transitioning to sustainable energy is essential for our future prosperity and survival.

How can we ensure that the benefits of sustainable development reach everyone, including the most vulnerable groups ?

The text discusses how sustainable development can be ensured to reach everyone, including the most vulnerable groups. It suggests a multifaceted approach that involves balancing economic growth, social inclusion, and environmental protection. The strategies include developing inclusive policies, ensuring access to opportunities like education and training, investing in sustainable infrastructure and accessible services, encouraging community engagement and advocacy, and implementing monitoring and accountability measures. By working together across sectors and levels of society, a more equitable and sustainable future can be built for all.

What are the benefits of sustainable consumption ?

The text discusses the benefits of sustainable consumption, which include environmental protection, economic benefits, social well-being, and ethical considerations. By making conscious choices about what we consume and how we dispose of our waste, we can reduce our carbon footprint, conserve natural resources, preserve biodiversity, save costs, create jobs, promote healthier lifestyles, ensure equitable distribution of resources, build community, protect animal welfare, support fair trade, and encourage transparency and accountability in businesses. Sustainable consumption is crucial for creating a more sustainable future for ourselves and future generations.

What is the importance of sustainable agriculture in achieving the Sustainable Development Goals ?

Sustainable agriculture is crucial for achieving the United Nations' Sustainable Development Goals by ensuring food security, improving rural livelihoods, and protecting the environment. It promotes soil health, increases crop yields, encourages biodiversity, creates jobs in rural areas, enhances income, promotes gender equality, reduces greenhouse gas emissions, conserves water resources, prevents land degradation, supports climate change mitigation and adaptation, stimulates economic growth, and reduces poverty. By adopting sustainable agriculture practices, we can create a more equitable and resilient world for future generations.

How can we promote sustainable development to reduce the risk of climate conflicts ?

Sustainable development is crucial for reducing the risk of climate conflicts. To promote it, we can increase awareness and education, promote renewable energy sources, implement sustainable agriculture practices, invest in green infrastructure, encourage waste reduction and recycling, and collaborate with governments and NGOs.

Why are green bonds important for sustainable development ?

Green bonds are crucial for sustainable development as they provide funding for environmental projects, broaden investor base, support environmental standards, stimulate innovation, advance global SDGs, and raise awareness about sustainability in finance.

Why is sustainable investing important ?

Sustainable investing is crucial for the future of our planet and society. It considers environmental impact, social responsibility, long-term returns, risk management, and ethical considerations of companies. By investing in sustainable companies, investors can help combat climate change, create a more equitable society, and achieve long-term financial returns. Sustainable investing also aligns with many people's personal values and ethics.

How does sustainable investing work ?

Sustainable investing, also known as responsible or impact investing, involves making investment decisions based on environmental, social, and governance (ESG) criteria. The goal is to generate long-term financial returns while also considering the broader impact of investments on society and the environment. Here's how sustainable investing works: 1. Identify ESG Criteria: The first step in sustainable investing is to identify the ESG criteria that align with your values and risk tolerance. This could include factors such as carbon emissions, labor practices, diversity, board composition, and more. 2. Screen Investments: Once you have identified your ESG criteria, you can screen potential investments to ensure they meet your standards. This can be done through negative screening (excluding companies that don't meet certain criteria) or positive screening (selecting companies that exceed certain criteria). 3. Integrate ESG into Investment Process: Sustainable investing goes beyond simply screening investments; it involves integrating ESG considerations into the entire investment process. This includes researching companies' ESG performance, engaging with them to encourage improvements, and monitoring their progress over time. 4. Measure Performance: Like any investment strategy, it's important to measure the performance of your sustainable investments. This includes tracking financial returns as well as evaluating the impact of your investments on society and the environment. 5. Rebalance and Review: Finally, sustainable investing requires ongoing monitoring and rebalancing of your portfolio to ensure it continues to align with your ESG criteria and financial goals. This may involve selling off underperforming investments or reallocating funds to new opportunities that better meet your standards.

What challenges do we face in achieving a continuous supply of sustainable energy ?

The challenges to achieving a continuous supply of sustainable energy include technological limitations, economic barriers, political and social factors, infrastructure and grid integration issues, and environmental impacts. Addressing these challenges requires collaboration between governments, businesses, and individuals to work towards a more sustainable future for our planet.

What are some examples of sustainable investments ?

Sustainable investments are becoming increasingly popular as investors seek to generate financial returns while also contributing to environmental and social causes. Examples of sustainable investments include green bonds, sustaple stocks, impact investing, and sustainable real estate. These investments offer benefits such as reducing carbon emissions, promoting renewable energy sources, supporting fair labor practices, and potentially earning competitive returns over time. By choosing to invest sustainably, investors can play an active role in protecting the environment, creating a more equitable society, and achieving financial success.

How can we promote sustainable consumption ?

Sustainable consumption is a key factor in achieving a sustainable future. It involves making conscious choices about the products we buy, the resources we use, and the impact we have on the environment. Here are some ways to promote sustainable consumption: 1. Education and Awareness: Raise awareness about the importance of sustainable consumption; provide information on sustainable products and services; encourage responsible consumption habits. 2. Government Policies and Incentives: Implement policies that support sustainable consumption; offer incentives for sustainable practices; encourage circular economy principles. 3. Corporate Responsibility and Innovation: Encourage corporate responsibility; foster innovation in sustainable products and services; collaborate with stakeholders. 4. Community Action and Collaboration: Organize community events; create networks of sustainable businesses; engage with schools and youth organizations. By taking these actions at individual, community, business, and government levels, we can collectively move toward a more sustainable future where our consumption patterns support rather than harm the planet.

How can I incorporate sustainable fashion into my lifestyle ?

Incorporating sustainable fashion into your lifestyle is essential for preserving the environment and promoting fair labor practices. To do so, educate yourself on sustainable brands and fast fashion's impact, support ethical and sustainable brands, reduce consumption by practicing mindful shopping and creating a capsule wardrobe, maintain and care for your clothes properly, recycle or donate old clothes, and advocate for change by using your voice and engaging with brands.