Bond Used

What criteria should be met for a bond to be classified as a green bond ?

Green bonds are fixed-income instruments specifically designed to raise capital for climate and environmental projects. To be classified as a green bond, the issuer must meet certain criteria, including how the funds will be used, which projects are eligible, transparency in reporting, certification and review by third parties, and additional requirements depending on the framework being used. These criteria ensure that the funds raised through issuance of the bond are used for environmentally sustainable purposes. Green bonds play a crucial role in financing sustainable development and promoting a low-carbon economy.

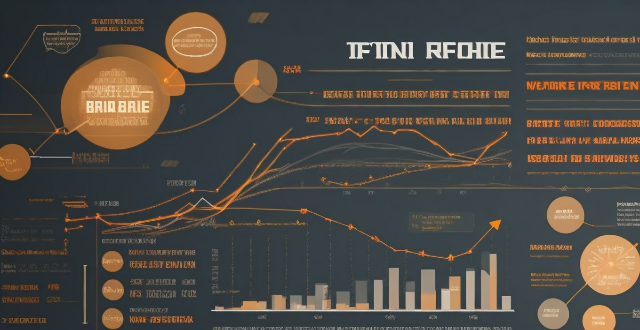

How do bond yields affect my investment returns ?

Bond yields significantly impact investment returns, particularly for bond and bond-related security investors. Yields represent the interest rate paid by bond issuers to holders and are crucial for expected returns. Higher yields generally result in increased interest income but can also cause price volatility. Inflation affects real returns, and lower yields may increase opportunity costs. Strategies like diversification, duration management, active management, and staying informed can help maximize returns amidst changing bond yield environments.

What is the difference between a bond and a stock ?

Bonds and stocks are two different types of financial instruments that companies use to raise capital. While both are used for funding, they have distinct differences in terms of ownership, returns, risks, and other factors. Here are some key differences between bonds and stocks: - Bonds represent debt and provide regular interest payments with a fixed maturity date, while stocks represent equity and offer potential dividends and capital appreciation without a set maturity date. - When you buy a bond, you are essentially lending money to the issuer (usually a company or government). In return, you receive a bond certificate that represents your loan. You do not own any part of the company; you are simply a creditor. - When you buy a stock, you become a part owner of the company. This means you have a claim on the company's assets and earnings, as well as a say in how the company is run through voting at shareholder meetings. - The primary return from owning a bond comes from interest payments made by the issuer. These payments are usually fixed and paid at regular intervals until the bond matures, at which point the principal amount is repaid. - The return on stocks comes from dividends (if the company chooses to pay them) and capital gains (the increase in the stock price over time). Stock prices can be volatile, so the potential for high returns is greater than with bonds, but so is the risk. - Generally considered less risky than stocks because they offer a fixed rate of return and have priority over stockholders in the event of bankruptcy. However, there is still risk involved, especially if the issuer defaults on its payments. - More risky than bonds because their value fluctuates with market conditions and the performance of the underlying company. If the company does poorly, the stock price may fall significantly, and investors could lose part or all of their investment. - Have a defined maturity date when the principal amount must be repaid by the issuer. This provides a clear timeline for investors. - Do not have a maturity date; they exist as long as the company remains in business. Investors can sell their shares at any time in the open market. - Interest income from bonds is typically taxed as ordinary income. - Long-term capital gains from stock sales may be taxed at a lower rate than ordinary income, depending on the tax laws of the jurisdiction.

How do interest rates affect bond prices and yields ?

Bond prices and yields are inversely related to interest rates. When interest rates rise, bond prices fall, and vice versa. This is because the yield on a bond is determined by its coupon rate, which is fixed at the time of issuance. Therefore, if interest rates increase after the bond is issued, the yield on the bond will be lower than the current market rate, making it less attractive to investors. Conversely, if interest rates decrease after the bond is issued, the yield on the bond will be higher than the current market rate, making it more attractive to investors. Other factors that affect bond prices and yields include credit risk, inflation expectations, and economic growth. When interest rates rise, bond prices fall, and the yield curve steepens. When interest rates decrease, bond prices rise, and the yield curve flattens. To manage interest rate risk, investors can diversify their portfolio across different types of bonds and maturities, use hedging strategies such as interest rate swaps and futures and options contracts, and engage in active management through market timing and credit analysis.

How do I get started with bond investing ?

Bond investing is a popular way to diversify your portfolio and earn a steady income. Here are some steps to help you get started: 1. Understand the basics of bonds. 2. Determine your investment objectives. 3. Choose the right type of bond for you. 4. Consider the duration of the bond. 5. Research and select brokers or intermediaries. 6. Diversify your portfolio by investing in various types of bonds issued by different entities. 7. Monitor your investments regularly and adjust your portfolio as needed based on changing market conditions or personal circumstances.

How can investors identify credible green bond opportunities ?

Investing in green bonds is becoming increasingly popular as more investors seek to align their portfolios with environmental sustainability goals. However, it is crucial for investors to identify credible green bond opportunities to ensure that their investments truly contribute to positive environmental impacts. Here are some key steps and considerations for identifying credible green bond opportunities: 1. Understand the definition of green bonds. 2. Look for certification and verification. 3. Examine the use of proceeds. 4. Assess the environmental impact. 5. Check transparency and reporting. 6. Consider the credit quality. 7. Review the legal framework. 8. Consult professional advice.

How can I diversify my portfolio with bond investments ?

Diversifying your portfolio with bond investments can reduce investment risk and provide a steady stream of income. There are several types of bonds, including government, corporate, municipal, and foreign bonds, each with its own characteristics and risks. Bond mutual funds and ETFs offer automatic diversification across multiple issuers and types of bonds. When investing in bonds, consider factors such as credit quality, interest rate risk, inflation risk, and liquidity. To effectively diversify your portfolio with bonds, allocate a portion of your portfolio to bonds, invest in different types of bonds, consider bond maturities, and rebalance regularly. Consulting with a financial advisor can help determine the best bond strategies for your individual financial goals and risk tolerance.

How does inflation impact bond investments ?

Inflation significantly impacts bond investments by decreasing purchasing power, increasing interest rate risk, creating opportunity costs, and affecting fixed-income investors. Inflation-indexed bonds can mitigate these effects.

What is the role of credit rating agencies in bond investing ?

Credit rating agencies are pivotal in bond investing, offering independent assessments of issuers' creditworthiness. They conduct thorough analyses and assign ratings reflecting the likelihood of default, aiding investors in risk evaluation and portfolio diversification. These ratings contribute to market transparency, efficient price discovery, and enhanced liquidity. They also play a role in regulatory compliance for institutional investors and capital markets regulation. However, concerns about conflicts of interest and rating accuracy during crises highlight the need for improved methodologies and increased accountability.

What kind of indoor games can parents play with their children to strengthen their bond ?

The article provides a list of indoor games that can help strengthen the bond between parents and children. The games include board games like Monopoly and Chess, card games such as Uno and Go Fish, puzzles and brain teasers like Sudoku and crossword puzzles, arts and crafts activities, indoor treasure hunts, and cooking/baking projects. These games not only provide entertainment but also offer opportunities for learning and quality time spent together.

What materials are used to make durable iPhone cases ?

Durable iPhone cases are designed to protect your device from drops, scratches, and other types of damage. The materials used to make these cases play a crucial role in determining their durability and effectiveness. In this article, we will explore the different materials used to make durable iPhone cases and discuss their benefits and drawbacks.

What are the most common materials used in the production of protective clothing ?

Protective clothing is designed to safeguard individuals from hazardous environments or conditions. The materials used for such garments play a crucial role in providing the necessary protection while ensuring comfort and functionality. In this article, we will explore the most common materials used in the production of protective clothing: Polyester, Cotton, Nylon, Neoprene, and Gore-Tex.

What currencies can be used for Cross-Border Payment ?

The currencies used for cross-border payments vary widely depending on numerous factors, including economic strength, political stability, and market acceptance. Major world currencies like the US Dollar, Euro, British Pound Sterling, and Japanese Yen are commonly used due to their global acceptance and role in international trade and financial markets. Other currencies such as the Chinese Yuan/Renminbi, Canadian Dollar, and Australian Dollar also play significant roles in cross-border payments, particularly in commodities trade and regional economies. Digital currencies, including Bitcoin and stablecoins, are increasingly being used for cross-border payments, offering decentralized transactions and the benefits of blockchain technology. Factors influencing currency choice include regulatory environment, cost considerations, market fluctuations, and business agreements.

What are the basic techniques used in Chinese cooking ?

Chinese cuisine is known for its diverse flavors and cooking techniques. Here are some of the basic techniques used in Chinese cooking: 1. Stir-frying involves quickly frying small pieces of food in a wok or frying pan over high heat. The key to successful stir-frying is to use hot oil, fresh ingredients, and constant motion to prevent burning. 2. Steaming involves placing food in a steamer basket over boiling water and allowing it to cook through steam. This method is often used for dumplings, buns, fish, and vegetables. 3. Braising is a slow-cooking method that involves simmering meat or vegetables in liquid until they become tender and flavorful. This technique is often used for stews, soups, and braises. 4. Deep-frying involves submerging food in hot oil until it becomes crispy and golden brown. This technique is often used for fried rice, spring rolls, and tempura dishes. 5. Roasting involves cooking food in an oven at high temperatures until it becomes caramelized and tender. This technique is often used for roasted meats, vegetables, and baked goods like mooncakes and egg tarts.

Are there any famous duos or groups of celebrities who are known for their strong bond and friendship ?

The text discusses several famous pairs or groups of celebrities known for their strong friendships and bonds. These include The Beatles (John Lennon and Paul McCartney), Tom Hanks and Rita Wilson, Tina Fey and Amy Poehler, Taylor Swift and Selena Gomez, Jay-Z and Kanye West, Oprah Winfrey and Gayle King, Lady Gaga and Bradley Cooper, and Chris Hemsworth and Chris Pratt.

Can an electronic speed controller be used in a car engine ?

The question of whether an electronic speed controller (ESC) can be used in a car engine depends on the type of engine. In traditional internal combustion engines (ICE), which use gasoline or diesel as fuel, an ESC cannot be used because these engines rely on mechanical systems for speed control. However, in electric cars, which use electric motors as their primary source of propulsion, an ESC is essential for controlling the speed of the motor and protecting it from damage. Therefore, while an ESC cannot be used in ICE vehicles, it plays a crucial role in electric vehicles.

Can you still get a good deal on a used hybrid car ?

The text discusses whether it is still possible to get a good deal on a used hybrid car, considering factors such as depreciation rates, technological advancements, fuel prices, and environmental concerns. It outlines the pros and cons of buying a used hybrid car and provides tips for getting a good deal. The conclusion states that while the market is subject to various dynamics, it is still possible to find a good deal on a used hybrid car by employing smart buying strategies.

Has religion ever been used to justify discrimination in sports ?

Religion has been used to justify discrimination in sports, including apartheid in South Africa, Islamic veiling and swimming, and caste-based discrimination in India. Contemporary issues include Sikh turbans and safety regulations, and Jewish holidays and scheduling conflicts. Addressing these issues requires a balance between respect for religious freedom and principles of equality and fairness in sports.

What new materials are being used in the production of sports equipment ?

The sports industry is constantly evolving, and with that evolution comes the introduction of new materials used in the production of sports equipment. These materials are designed to enhance performance, increase durability, and improve safety for athletes. Some of the latest materials being used in sports equipment production include carbon fiber, titanium, aerogel, Kevlar, and polyurethane foam. Carbon fiber is lightweight yet incredibly strong, making it ideal for use in items such as bicycle frames, tennis rackets, and golf clubs. Titanium is lightweight, corrosion-resistant, and extremely durable. Aerogel is incredibly light yet strong enough to support significant weight. Kevlar is known for its exceptional strength and heat resistance. Polyurethane foam provides excellent cushioning and shock absorption properties. As technology advances and athletes demand better performance from their gear, we can expect to see even more innovative materials being developed and incorporated into sports equipment production.

How is artificial intelligence being used to create new forms of entertainment ?

Artificial intelligence (AI) is revolutionizing the entertainment industry by creating new forms of entertainment that were not possible before. AI has enabled the development of personalized and interactive experiences that engage audiences in ways never seen before. Here are some examples of how AI is being used to create new forms of entertainment: 1. Personalization: AI algorithms are being used to personalize entertainment content for individual users. For example, streaming services like Netflix and Amazon Prime use AI to recommend movies and TV shows based on a user's viewing history and preferences. 2. Interactive Experiences: AI-powered virtual assistants and chatbots are being used to create interactive experiences that allow users to engage with entertainment content in new ways. For example, the game "Detroit: Become Human" uses an AI-powered system to allow players to interact with characters in the game in a natural and realistic way. 3. Content Creation: AI is also being used to create new forms of entertainment content. For example, AI-generated music and art are becoming increasingly popular. AI algorithms can analyze existing music and art to create new pieces that are unique and original. 4. Gaming: AI is being used to enhance gaming experiences by creating more realistic and challenging gameplay. For example, AI-powered non-player characters (NPCs) can behave more realistically and adapt to a player's actions, making the game more engaging and challenging. 5. Virtual Reality and Augmented Reality: AI is being used to create more immersive virtual reality (VR) and augmented reality (AR) experiences. For example, AI algorithms can track a user's movements and adjust the VR or AR environment in real-time to create a more realistic and engaging experience. In conclusion, AI is being used to create new forms of entertainment that are more personalized, interactive, and engaging than ever before. From personalized recommendations to AI-generated content, the possibilities for AI in the entertainment industry are endless. As AI technology continues to evolve, we can expect even more innovative and exciting forms of entertainment to emerge.

What are the most effective anti-aging products used by celebrities ?

The most effective anti-aging products used by celebrities include retinol, hyaluronic acid, vitamin C, and sunscreen. Retinol reduces the appearance of fine lines and wrinkles, while hyaluronic acid provides intense hydration and plumps up the skin. Vitamin C brightens skin tone and protects against environmental damage, and sunscreen is essential for preventing premature aging caused by sun damage. By incorporating these products into your skincare routine, you can enjoy younger-looking skin like celebrities do.

Can carbon capture technology be used in conjunction with other renewable energy sources ?

Carbon capture technology can be used with renewable energy sources to reduce greenhouse gas emissions and mitigate climate change. There are several ways that this technology can be used, including post-combustion capture, pre-combustion capture, oxy-fuel combustion, and chemical looping combustion. However, there are also challenges and considerations that must be taken into account, such as cost, energy requirements, and storage.

How can individuals invest in clean energy projects ?

Investing in clean energy projects is a way to support sustainable development and fight climate change. Individuals can invest through renewable energy mutual funds, green bonds, direct investment in clean energy companies, community solar projects, and sustainable real estate investments. Examples include iShares Global Clean Energy ETF (ICLN), Toyota Green Bond, and Eco-friendly apartment complexes.

Can you share any inspiring stories of famous people who became friends despite their differences ?

Friendship is a powerful bond that can transcend personal differences, cultural backgrounds, and historical conflicts. The inspiring friendships of Frederick Douglass and William Lloyd Garrison, Nelson Mandela and Desmond Tutu, and Helen Keller and Anne Sullivan are examples of how understanding, respect, and shared goals can bridge divides. These relationships highlight the importance of open dialogue, mutual support, and collaboration in achieving common visions.

Are there any risks associated with investing in green bonds that investors should be aware of ?

Investing in green bonds comes with certain risks that investors should be aware of, including credit risk, interest rate risk, inflation risk, liquidity risk, reputational risk, legal and regulatory risk, project risk, climate risk, and ESG (environmental, social, and governance) risk. These risks can impact the returns on investment and the overall success of the investment strategy. It is important to carefully evaluate each green bond investment opportunity and consult with financial advisors before making any investment decisions.

What is the risk involved in investing in bonds ?

Investing in bonds carries risks such as interest rate, credit, inflation, liquidity, reinvestment, call, prepayment, foreign currency, and political/regulatory changes. Understanding and managing these risks is crucial for protecting your investment. Diversifying your portfolio across different types of bonds and monitoring market conditions can help mitigate these risks.

Are green bonds a profitable investment compared to traditional bonds ?

Green bonds are a type of fixed-income security designed to finance environmentally friendly projects. While their risk and return profile can be similar to traditional bonds, green bonds offer potential diversification benefits, alignment with sustainability goals, and possibly tax benefits. However, their long-term performance relative to traditional bonds depends on various factors such as interest rate changes and market sentiment. Green bonds often come with more rigorous reporting requirements to ensure the proceeds are used for environmentally friendly projects. Whether green bonds are more profitable than traditional bonds cannot be definitively answered without considering individual investment goals and market conditions.

What are some real-world applications of blockchain technology ?

Blockchain technology is being used in various industries to provide secure, decentralized, and transparent solutions. In finance and banking, it is used for cryptocurrencies, payment processing, and smart contracts. In supply chain management, it is used for tracking and traceability, inventory management, and logistics optimization. In healthcare, it is used for medical records management, drug traceability and anti-counterfeiting, and research data sharing. In government and public sector, it is used for voting systems, digital identity management, and land registry. In energy and utilities, it is used for renewable energy trading and smart grid management.