Cap Trading

What is the carbon trading market ?

The carbon trading market is a financial mechanism that allows for the trading of emissions reductions to meet greenhouse gas emission targets. It is based on cap-and-trade, where a limit is set on total emissions and those who reduce their emissions below the cap can sell their surplus allowances. Key components include carbon credits, emissions caps, trading mechanisms, verification and certification, and regulation and governance. Benefits include cost-effectiveness, flexibility, innovation incentives, and global collaboration. Challenges and criticisms include equity concerns, market inefficiencies, environmental integrity, and political will. The carbon trading market serves as a crucial tool in the fight against climate change but requires ongoing attention and improvement to maximize its effectiveness.

How does the carbon trading market work ?

The carbon trading market is a mechanism designed to reduce greenhouse gas emissions by providing economic incentives for their reduction, operating on the principle of "cap and trade." It involves setting a cap on the total amount of greenhouse gases that can be emitted by regulated entities, who can then buy and sell allowances or credits for emissions. The process includes establishing the cap, allocating allowances, trading allowances, banking allowances, offsetting emissions through projects, verification and certification, regulation and oversight, and dealing with benefits and criticisms.

How do emission trading schemes work and are they effective ?

Emission trading schemes are market-based mechanisms designed to regulate the release of pollutants, especially greenhouse gases like CO2. These schemes operate on a "cap and trade" principle, whereby a regulatory body sets a limit on emissions, allocates emission allowances, and allows businesses to buy and sell these allowances in a marketplace. Companies must monitor and report their emissions, facing penalties for non-compliance. The effectiveness of such schemes varies but offers advantages like cost-efficiency, flexibility, and innovation incentives. However, challenges include complexity, political will, leakage, and equity concerns. Case studies like the EU ETS and California's Cap-and-Trade Program show mixed results, indicating that while emission trading schemes can be effective, their success depends on careful planning, robust implementation, and continuous evaluation.

How can I invest in the carbon trading market ?

The carbon trading market offers a lucrative investment opportunity for those interested in environmental sustainability and financial gain. To invest successfully, one should understand the basics of carbon trading, research different carbon markets, choose a broker or exchange, determine an investment strategy, and start trading while managing risk.

How do ecological taxes compare to other environmental policies, such as cap-and-trade systems ?

The text discusses the comparison of two environmental policies: ecological taxes and cap-and-trade systems. It explains what these policies are, their advantages, disadvantages, and concludes that the choice between them depends on political feasibility, administrative capacity, and public acceptance.

How does a carbon tax compare to other climate policies, such as cap-and-trade ?

**Comparison between Carbon Tax and Cap-and-Trade Climate Policies:** **Effectiveness:** - **Carbon Tax**: Depends on tax rate, revenue recycling, and international cooperation. Higher rates may reduce emissions but impact the economy negatively. - **Cap-and-Trade**: Depends on the stringency of the cap, market mechanisms, and offsetting mechanisms. A strict cap can lead to significant emissions reductions. **Economic Implications:** - **Carbon Tax**: Incentivizes innovation, impacts consumers (especially low-income households), and can stimulate economic growth through green technologies. - **Cap-and-Trade**: Introduces cost uncertainty, risks market manipulation, and can create jobs in new technologies and industries related to emissions reductions. **Implementation Challenges:** - **Carbon Tax**: Faces political opposition, equity concerns, and requires international coordination for maximum effectiveness. - **Cap-and-Trade**: Requires complex setup and management, strict enforcement, and may face public opposition if perceived as legitimizing pollution. **Conclusion:** Both policies have pros and cons in addressing climate change. The choice often depends on political feasibility, economic considerations, and public acceptance. What's crucial is taking effective action to reduce greenhouse gas emissions.

What are the potential benefits and drawbacks of using market-based mechanisms like carbon trading in global climate governance ?

The text discusses the potential benefits and drawbacks of using market-based mechanisms like carbon trading in global climate governance. The benefits include cost-effectiveness, flexibility and innovation, economic incentives, and global cooperation. However, there are also drawbacks such as equity concerns, complexity, uncertainty, and lack of public acceptance. It is important to consider these factors carefully when designing a carbon trading system to ensure that it is equitable, transparent, and effective in reducing carbon emissions.

What are the benefits of participating in the carbon trading market ?

Participating in the carbon trading market offers a multitude of benefits, which can be categorized into environmental, economic, and social aspects. Here are some of the key advantages: 1. **Environmental Benefits**: - Reduction in Greenhouse Gas Emissions: The primary goal of carbon trading is to reduce greenhouse gas emissions by creating financial incentives for companies to adopt cleaner technologies and practices. This helps to mitigate climate change and its associated impacts on ecosystems and biodiversity. - Promotion of Renewable Energy Sources: As companies strive to reduce their carbon footprint, they are more likely to invest in renewable energy sources such as solar, wind, and hydroelectric power. This shift towards green energy promotes sustainable development and reduces reliance on fossil fuels. - Enhanced Energy Efficiency: Carbon trading encourages businesses to improve their energy efficiency, leading to reduced energy consumption and lower operating costs. This results in fewer resources being used and less waste generated. 2. **Economic Benefits**: - Creation of New Industries and Jobs: The growth of the carbon trading market has led to the emergence of new industries focused on developing and implementing low-carbon technologies. These industries create job opportunities and contribute to economic growth. - Potential for Profitability: Companies that effectively manage their carbon emissions can generate additional revenue by selling excess emission allowances or credits. This provides an incentive for businesses to become more environmentally friendly while also increasing their profitability. - Access to International Markets: Participation in the carbon trading market allows companies to access global markets and take advantage of international trade opportunities related to low-carbon products and services. 3. **Social Benefits**: - Improved Public Health: By reducing air pollution caused by greenhouse gas emissions, carbon trading can lead to improved public health outcomes. This includes reductions in respiratory illnesses, heart disease, and other health issues associated with poor air quality. - Increased Awareness and Education: The existence of a carbon trading market raises public awareness about climate change and its implications. This increased understanding can drive behavioral changes among consumers, leading to more sustainable choices and lifestyles. - Community Engagement: Carbon trading projects often involve local communities, providing opportunities for community engagement and empowerment. This can lead to improved infrastructure, enhanced educational programs, and increased social cohesion within affected areas.

What are the risks associated with investing in the carbon trading market ?

The carbon trading market offers lucrative investment opportunities but also carries significant risks, including price volatility, lack of transparency, legal and regulatory changes, and environmental impacts. To mitigate these risks, investors should diversify their portfolios, conduct thorough research, stay updated on regulatory changes, and consider the environmental impact of their investments. By taking these steps, investors can potentially reduce their exposure to risks while still benefiting from the profitability of the carbon trading market.

How is the price of carbon credits determined in the carbon trading market ?

The price of carbon credits in the carbon trading market is determined by various factors, including supply and demand, regulatory policies, and market dynamics. The balance between supply and demand significantly affects the price, with high demand increasing the price and oversupply decreasing it. Regulatory policies such as cap-and-trade systems and carbon taxes also play a crucial role in setting limits on emissions and creating incentives for companies to reduce their emissions or purchase carbon credits to offset them. Market dynamics such as speculation, liquidity, and transparency can also impact the price of carbon credits. As awareness of climate change grows, the demand for carbon credits is likely to increase, driving up their price. However, ensuring transparent and efficient operation of the carbon market is essential to maximize its potential benefits for both companies and the environment.

How does the carbon trading market contribute to reducing greenhouse gas emissions ?

Carbon trading markets are a key tool in the global fight against climate change by offering economic incentives for reducing greenhouse gas emissions. They set a price on carbon, encouraging businesses to invest in cleaner technologies and practices. These markets also promote innovation, international cooperation, and the implementation of robust regulatory frameworks. Additionally, they raise public awareness about the importance of combating climate change. Overall, carbon trading markets play a crucial role in mitigating the effects of climate change by creating a structured approach to reducing GHG emissions.

What are the most popular platforms for second-hand trading ?

The text discusses various popular platforms for second-hand trading, which are categorized into online marketplaces, specialty websites, auction houses, and consignment stores. The online marketplaces include eBay, Craigslist, and Facebook Marketplace, with their pros and cons highlighted. Specialty websites such as Poshmark, Reverb, and OfferUp cater to specific interests or industries. Auction houses like Sotheby's and Heritage Auctions offer high-end items but come with higher fees. Consignment stores including Buffalo Exchange and Plato's Closet provide an in-person shopping experience with a focus on sustainability. These platforms cater to different needs and preferences when it comes to second-hand trading, allowing users to find unique items at a lower cost or declutter their homes.

Can you explain the concept of market capitalization and its significance in stock analysis ?

Market capitalization is a crucial financial metric that reflects the total dollar value of a company's outstanding shares. It is calculated by multiplying the current market price per share by the total number of outstanding shares. Market cap helps investors and analysts assess a company's size and potential growth opportunities, serving as a fundamental tool in stock analysis. Large-cap stocks represent well-established companies, while mid-cap and small-cap stocks indicate potential for growth but come with higher risks. Market cap also influences investment strategies, such as diversification and index fund investing, and is used in valuation metrics like P/B and P/E ratios. Understanding market cap allows for informed decisions on portfolio construction, risk management, and valuation assessments.

Who are the main participants in the carbon trading market ?

The carbon trading market is a complex ecosystem involving various stakeholders who play crucial roles in reducing greenhouse gas emissions and promoting sustainable development. These participants include governments and regulatory bodies, companies and businesses, investors and financial institutions, project developers and consulting firms, and NGOs and environmental groups. Governments establish the legal framework and policies that govern the market, while companies are required to hold sufficient allowances to cover their emissions or purchase additional allowances if needed. Investors provide liquidity by buying and selling allowances based on their expectations of future price movements. Project developers design and implement projects that generate credits for sale on the carbon market, working closely with governments, companies, and investors. NGOs and environmental groups advocate for stronger climate policies and support initiatives that promote sustainable development.

How do I choose a reliable cryptocurrency exchange platform ?

This guide offers a comprehensive checklist for selecting a trustworthy cryptocurrency exchange platform, emphasizing security measures, user interface, trading volume and liquidity, fees, coin support, regulation compliance, and reputation. It encourages potential users to consider factors such as two-factor authentication, cold storage, encrypted data, regular audits, clean layout, mobile accessibility, customer support, high trading volume, liquid markets, transparent fee structures, available coins, trading pairs, licensed operations, AML and KYC compliance, as well as online reviews and community feedback to make an informed decision.

How are carbon credits traded and what is their market value ?

The article discusses the trading of carbon credits, which are tradable permits allowing holders to emit certain amounts of greenhouse gases. It explains how carbon credits are traded and their market value, outlining steps in their creation, verification, issuance, trading, and retirement. It also notes that the market value of carbon credits varies based on project type, location, and demand for offsets.

What are the challenges and opportunities for developing countries in the carbon trading market ?

Challenges and opportunities for developing countries in the carbon trading market include lack of infrastructure, legal and regulatory hurdles, market access and information asymmetry, capacity building needs, economic growth and investment, technology transfer and innovation, environmental sustainability, policy influence and leadership.

In what industries is blockchain being explored currently ?

Blockchain technology is being explored across various industries to improve transparency, security, and efficiency. Here's a summary of its applications in different sectors: 1. **Finance and Banking**: Secure and efficient financial operations like international money transfers, smart contracts, trading, clearing, and loyalty rewards programs. 2. **Healthcare**: Secure patient data management, clinical trials, drug traceability, and insurance claims processing. 3. **Supply Chain Management**: End-to-end traceability for food safety, pharmaceutical supply chain, luxury goods authentication, and carbon credit trading. 4. **Real Estate**: Efficient property transactions, ownership records, rent collection, and dispute resolution. 5. **Education**: Verification and secure storage of academic credentials, lifelong learning records, and scholarship disbursements. 6. **Governance**: Transparent voting systems, public records management, and identity verification. 7. **Art and Entertainment**: Creation of unique digital assets like NFTs for artwork, music, films, ensuring authenticity and provenance.

Are there any international standards for carbon credit systems ?

There are several international standards and protocols that govern carbon credit systems, including the Climate Action Reserve (CAR), the International Carbon Reduction and Offset Alliance (ICROA), and regional and national standards such as the European Union Emissions Trading System (EU ETS) and the North American Carbon Programme (NACP). These standards ensure the credibility, transparency, and integrity of carbon offset projects by setting rigorous guidelines for project developers to follow. By adhering to these standards, organizations can demonstrate their commitment to combating climate change and contribute to a more sustainable future.

What are the legal obligations for companies regarding their carbon footprint ?

Companies face various legal obligations concerning their carbon footprint aimed at reducing greenhouse gas emissions and mitigating climate change. These include mandatory and voluntary emissions reporting, regulatory compliance through emissions caps and permitting, corporate governance measures like board oversight and stakeholder engagement, financial responsibilities such as carbon taxes and trading schemes, commitments under international agreements, and potential civil liabilities for negligence or human rights violations related to pollution. Companies must take proactive steps to reduce emissions, engage stakeholders, and contribute positively to global climate action, with specific requirements depending on the jurisdiction, industry, and individual company's commitments.

What is the relationship between the greenhouse effect and ice caps melting ?

The greenhouse effect, amplified by human activities, leads to global warming which causes ice caps to melt, leading to sea level rise, climate change, and ecosystem disruption.

How can climate and environmental policies be designed to promote sustainable economic growth ?

This text discusses the integration of environmental considerations into economic planning, promoting renewable energy sources, encouraging energy efficiency, supporting green infrastructure, promoting circular economy practices, strengthening environmental regulations, and fostering international cooperation to promote sustainable economic growth.

What impact does climate awareness have on global policies and decisions ?

Climate awareness has led to the implementation of various environmental, economic, and social policies at national and international levels. These policies aim to reduce greenhouse gas emissions, promote renewable energy sources, protect forests, and raise public awareness about climate change. Some examples include carbon taxes, renewable energy targets, forest protection laws, the Paris Agreement, the Kyoto Protocol, cap-and-trade systems, feed-in tariffs, tax credits for renewable energy projects, building codes, appliance standards, school curricula on climate change, and community workshops.

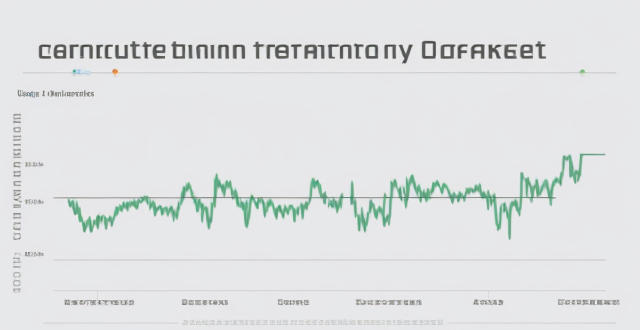

How have greenhouse gas emissions changed over the past decade ?

The article discusses changes in greenhouse gas emissions over the past decade, focusing on carbon dioxide (CO2), methane (CH4), and nitrous oxide (N2O). It highlights global trends such as an increase in CO2 emissions from transportation and energy production, a decrease in CH4 emissions from agriculture and waste management, and stable N2O emissions from agricultural activities and industrial processes. Regional differences are also noted, with Europe and North America making progress in adopting renewable energy sources and implementing emissions trading systems, while Asia faces challenges due to rapid industrialization and growth in vehicle use. Africa and South America struggle with deforestation and lack of infrastructure. The future outlook suggests potential for reduction through renewable energy and efficiency improvements but also highlights challenges such as population growth and economic development priorities. Overall, the article emphasizes the importance of collaborative efforts to address greenhouse gas emissions and mitigate climate change.

How does climate change legislation influence corporate sustainability practices ?

Climate change legislation significantly influences corporate sustainability practices by setting standards for environmental responsibility. It compels companies to report on their environmental impact, use market-based mechanisms like cap-and-trade systems, and consider tax incentives or penalties in their operations. This legislation also creates investor pressure through ESG criteria and shareholder resolutions, leading companies to enhance their sustainability practices to meet investor expectations. Additionally, it opens market opportunities for green products and services and encourages renewable energy adoption. Companies that comply with climate legislation can improve their brand image and stakeholder engagement. Furthermore, such legislation aids in risk management by requiring companies to assess physical and transition risks associated with climate change. Overall, climate change legislation is a driving force behind corporations adopting more sustainable practices.

What are the current trends in renewable energy policies globally ?

The global community is increasingly prioritizing renewable energy policies as part of efforts to combat climate change and reduce carbon emissions. Governments are offering financial incentives, setting ambitious targets for renewable energy consumption, promoting energy efficiency, and encouraging private sector investment in clean energy projects. These trends reflect a worldwide commitment to creating a more sustainable future through the adoption of renewable energy sources.

What is the best cryptocurrency to invest in ?

The article provides a summary of the best cryptocurrencies to invest in, including Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), and Cardano (ADA). It highlights the pros and cons of each cryptocurrency, such as high liquidity and widespread adoption for Bitcoin, smart contract functionality and a large developer community for Ethereum, usefulness on the Binance exchange and a burn mechanism for Binance Coin, and a strong academic foundation and focus on security and sustainability for Cardano. The conclusion emphasizes the importance of considering factors such as liquidity, adoption, and potential for growth when choosing a cryptocurrency to invest in, and encourages readers to do their own research before making an investment decision.

How can we ensure energy security while reducing greenhouse gas emissions ?

The text discusses a comprehensive strategy to ensure energy security while reducing greenhouse gas emissions. It outlines four main strategies: transitioning to renewable energy sources, implementing carbon pricing mechanisms, fostering international cooperation, and encouraging sustainable practices at all levels. The transition to renewable energy sources includes investing in infrastructure for solar, wind, hydroelectric, and geothermal power, promoting energy efficiency in buildings, transportation, and industries, and increasing research and development in clean energy technologies such as battery storage, nuclear fusion, and carbon capture and storage. Implementing carbon pricing mechanisms involves imposing taxes on fossil fuels and establishing cap-and-trade systems to limit greenhouse gas emissions from industries. Fostering international cooperation includes supporting global agreements like the Paris Agreement and sharing technology and resources with developing nations. Encouraging sustainable practices at all levels involves government policies and regulations, corporate social responsibility, and public awareness and education about the importance of energy conservation and reducing emissions. The text concludes that achieving energy security and reducing greenhouse gas emissions requires technological innovation, policy implementation, international cooperation, and cultural shifts towards sustainability.

What are the top tech stocks to invest in right now ?

This text is a summary of the top tech stocks to invest in right now. It provides an overview of 10 companies, including their market cap, sector, and recent news. The companies listed are Apple Inc., Microsoft Corporation, Amazon.com, Inc., Alphabet Inc., Facebook, Inc., NVIDIA Corporation, Tesla, Inc., Advanced Micro Devices, Inc., Zoom Video Communications, Inc., and Salesforce.com, Inc.