Credit Exchange

Can I use my credit card for currency exchange ?

Using a credit card for currency exchange is convenient but comes with potential fees and less favorable exchange rates. It involves dynamic currency conversion by your bank or credit card issuer, which may add a spread or margin to the rate. To use your credit card for currency exchange, ensure it's eligible for international use, notify your bank of travel plans, understand associated fees, choose to pay in local currency, and monitor transactions. While offering convenience and security, drawbacks include fees, potentially unfavorable rates, and the need to manage credit limits. Comparing cards based on fees and rewards can optimize benefits.

How can I ensure I get the best exchange rate ?

When exchanging currencies, it is important to ensure that you get the best possible exchange rate. This can help you save money and get the most value for your money. In this guide, we will discuss some tips and strategies that can help you achieve the best exchange rate possible. The first step in ensuring the best exchange rate is to research the current exchange rates online. There are many websites that provide real-time information on exchange rates, such as XE.com or OANDA. By checking these sites, you can get an idea of what the current exchange rate is and compare it to other providers. Once you have an idea of the current exchange rate, it's time to compare different providers. Look for banks, currency exchange offices, and even online services that offer competitive rates. Make a list of potential providers and compare their rates side by side. Using a credit card that doesn't charge foreign transaction fees can be a great way to get the best exchange rate. Some credit cards also offer rewards programs that give you cashback or points for using your card abroad. Look for cards that offer these benefits and make sure they don't charge any additional fees for foreign transactions. Prepaid currency cards are another option to consider when traveling abroad. These cards allow you to load them with foreign currency before your trip and use them like a debit card. They often come with lower fees than traditional bank accounts and may offer better exchange rates than exchanging cash at a currency exchange office. If you prefer to exchange cash, shop around at local currency exchange offices to find the best rates. Don't be afraid to walk away from an office if you feel like the rate they're offering isn't fair. Often, just by showing that you're willing to walk away, they may offer you a better rate. Getting the best exchange rate requires some research and planning ahead of time. By following these tips and strategies, you can ensure that you get the most value for your money when exchanging currencies.

What is the best way to exchange currency ?

Exchanging currency is a common practice for travelers, businessmen, and investors. However, the process can be confusing and costly if not done correctly. In this article, we will discuss the best ways to exchange currency while minimizing fees and maximizing convenience. Understanding Currency Exchange Rates: Before diving into the best ways to exchange currency, it's essential to understand what affects currency exchange rates. These rates are influenced by various factors such as economic indicators, political stability, and market speculation. To get the best rate possible, keep an eye on these factors and plan your exchange accordingly. Researching Exchange Options: One of the most common ways to exchange currency is through banks and credit unions. While convenient, these institutions often have high fees and unfavorable exchange rates. It's important to compare rates and fees before choosing this option. Currency exchange offices are another popular choice for exchanging currency. They typically offer better rates than banks but may still charge high fees. It's crucial to research each office's policies and rates before making a transaction. Using an ATM to withdraw foreign currency can be a cost-effective option, especially for small amounts. However, be aware of any additional fees charged by your bank or the ATM operator. Prepaid currency cards allow you to load multiple currencies onto one card, making them a convenient option for travelers. They usually offer competitive exchange rates and low fees, but it's important to read the terms and conditions carefully. Online currency exchange services provide an easy and efficient way to exchange currency. They often offer competitive rates and low fees, but it's essential to research each service thoroughly before using them. Choosing the Best Option: The best way to exchange currency depends on several factors, including the amount of money being exchanged, the destination country, and personal preferences. Here are some general tips to help you choose the best option: Compare rates and fees: Always compare rates and fees across different options before making a decision. This will help you find the most cost-effective solution. Consider convenience: If you need access to cash quickly or frequently, consider using an ATM or prepaid currency card. These options allow you to withdraw money easily while traveling. Plan ahead: Don't wait until the last minute to exchange currency. Plan ahead and research your options to ensure you get the best rate possible. Be aware of scams: Unfortunately, there are many scams associated with currency exchange. Be wary of street vendors offering exceptionally good rates or other suspicious activities. Stick to reputable institutions and services to avoid potential fraud.

How do banks manage credit risk ?

Banks manage credit risk through a variety of methods and strategies to ensure the stability of their operations and protect against potential losses. They identify and assess credit risk using credit scoring models, financial analysis, and credit reports. They mitigate credit risk through diversification, collateral and guarantees, and credit derivatives. Banks monitor and control credit risk by ongoing monitoring, loan loss reserves, and regulatory compliance. In case of credit risk events, banks recover through workout agreements, legal recourse, and communication with stakeholders. By employing these strategies, banks aim to minimize credit risk while still providing essential lending services to support economic growth and individual prosperity.

What role does credit scoring play in credit management ?

This article discusses the importance of credit scoring in credit management. It explains what credit scoring is, its role in risk assessment, fairness and objectivity, efficiency and accuracy, customization, and compliance with regulations. The article emphasizes that credit scoring is a crucial tool for lenders to evaluate borrowers' creditworthiness and make informed decisions about approving loans.

How do interest rates affect credit management strategies ?

Interest rates significantly influence credit management strategies by affecting the cost of borrowing, returns on savings, and serving as a tool for monetary policy. To mitigate their impact, individuals and businesses can diversify their portfolios, consider short-term loans, refinance debt, and maintain good credit history.

How do I compare exchange rates between different countries ?

Comparing exchange rates between different countries is crucial for travelers, investors, and businesses. To effectively compare exchange rates, gather information from various sources, convert currencies, create a table for easy comparison, analyze the results, consider other factors like transaction fees and commission charges, and use online tools for accurate conversions.

Can I exchange currency online ?

You can exchange currency online through banks, currency exchangeYou can exchange currency online through banks, currency exchange-peer platforms, mobile currency exchange websites, peer-to-peer platforms, mobile apps, and cryptocurrency exchanges. Each option has its own advantages and disadvantages in terms of convenience, fees, and exchange rates. It's important to research and compare different options to find the one that best suits your needs.

How often do exchange rates fluctuate ?

Exchange rates, which determine the value of one currency in relation to another, are subject to constant fluctuations influenced by various factors such as economic indicators, political events, market speculation, and central bank policies. These fluctuations occur at different frequencies ranging from intraday to yearly intervals and can significantly impact traders, investors, and businesses involved in international trade. It is crucial for these entities to stay informed about exchange rate movements to make well-informed financial decisions.

Can I get a mortgage with bad credit ?

Getting a mortgage with bad credit is possible but may be more challenging and come with less favorable loan terms. To increase your chances, check your credit score, work on improving it, shop around for lenders, consider alternative options like FHA or VA loans, and be prepared to make a larger down payment.

What is the impact of cultural exchange on globalization ?

This essay explores the impact of cultural exchange on globalization. It states that cultural exchange plays a crucial role in enhancing mutual understanding and respect among nations, promoting economic growth and development, fostering international collaboration and cooperation, encouraging tourism and travel, and preserving cultural heritage and traditions. The essay concludes that as our world becomes increasingly interconnected, cultural exchange will continue to play a vital role in shaping our future together.

How are carbon credits traded and monitored ?

Carbon credits are a crucial component in the global fight against climate change. They represent a certificate indicating that one tonne of CO2 (or its equivalent in other greenhouse gases) has been either reduced, avoided, or sequestered from the atmosphere. The trading and monitoring of carbon credits involve several key steps and players, ensuring that the reductions are real, measurable, and verifiable. Trading platforms include centralized exchanges like the European Energy Exchange (EEX) and Chicago Climate Exchange (CCX), over-the-counter (OTC) markets for direct transactions between two parties, and brokers who facilitate buying and selling by matching buyers with sellers. Monitoring and verification processes include project registration and approval, third-party audits, issuance of credits, transaction recording, and retirement of credits. Key players involved in the process include governments, project developers, verifiers, registrars, brokers and traders, and compliance entities. Challenges and considerations include standardization, double-counting, persistence, transparency, and environmental integrity.

In what ways can bad credit management lead to financial difficulties for a company ?

Poor credit management can lead to cash flow issues, increased costs, damage to supplier relationships, negative impact on business reputation, and legal implications. To mitigate these risks, companies should establish clear credit policies, conduct regular credit checks, maintain open communication with customers, leverage technology for payment tracking, and consider third-party services or credit insurance.

How can we overcome language barriers in cultural exchange ?

Strategies for overcoming language barriers in cultural exchange include learning basic phrases, using technology, being patient and respectful, practicing active listening, and seeking out cultural exchange opportunities.

How do exchange rates affect Cross-Border Payment ?

Exchange rates play a crucial role in cross-border payments, impacting the cost, speed, and feasibility of transactions. They can affect transfer fees, currency fluctuations, processing time, trade opportunities, and investment opportunities. Understanding exchange rates is essential for managing them effectively in international trade or finance.

How can companies use credit management to improve cash flow ?

Credit management is crucial for companies extending credit to customers. Strategies include implementing a credit policy, conducting credit checks, monitoring receivables, offering multiple payment options, incentivizing timely payments, using automated tools, and periodically reviewing and adjusting processes. These steps can help reduce bad debts and improve cash flow.

Can you explain the process of credit analysis in credit management ?

Credit analysis is a crucial process in credit management that involves evaluating the creditworthiness of a borrower or a counterparty. The process includes gathering information on personal data, financial data, and credit history, analyzing this information through credit score analysis, financial statement analysis, and industry analysis, and determining creditworthiness based on capacity to repay, collateral, and covenant analysis. Finally, a decision is made on whether to extend credit to the borrower or not.

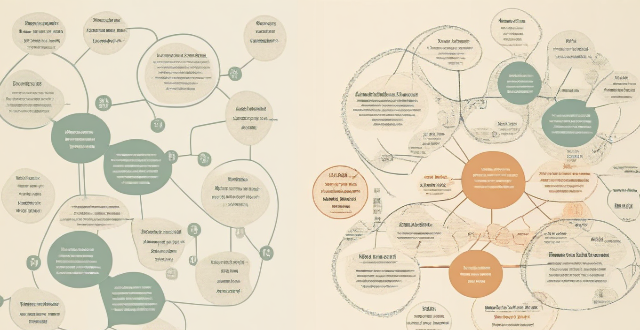

What is credit management ?

Credit management is the process of managing and controlling the use of credit by individuals or businesses. It involves evaluating borrowers' creditworthiness, determining the amount of credit to extend, monitoring loan repayment, and taking action for late payments. Key components include credit analysis, evaluation, loan monitoring, collections management, risk management, and customer relationship management. Effective credit management benefits include reduced default risk, improved cash flow, increased customer satisfaction, and enhanced reputation.

How often do credit card rewards expire ?

This text provides an in-depth analysis of credit card rewards expiry. It explains the various types of rewards and their typical expiration timelines, including cashback rewards, travel points, and other benefits. The article also offers tips on how to maximize the value of these rewards before they expire, such as staying organized, planning ahead, redeeming early, exploring redemption options, and negotiating with your credit card issuer if necessary. Overall, it emphasizes the importance of understanding the terms and conditions of credit card rewards to make the most of them.

How can I improve my credit score and maintain good credit history ?

Maintaining a good credit score is vital for securing loans, mortgages, and even some jobs. To improve your credit score and maintain good credit history, consider the following tips: 1. Pay bills on time to avoid late payments that can significantly impact your credit score. 2. Avoid defaulting on loans by contacting the lender to discuss options if you're struggling to make payments. 3. Keep balances low and increase credit limits to lower your utilization rate. 4. Keep old accounts open and space out applications for new credit to maintain a healthy length of credit history. 5. Diversify your types of accounts to show that you can handle different types of credit responsibly. 6. Limit hard inquiries and apply for credit only when necessary. 7. Check your credit report regularly to ensure there are no errors or fraudulent activity dragging down your score. 8. Use credit wisely and monitor your credit score to keep an eye on progress. 9. Educate yourself on how FICO scores work and the factors that influence them to make more informed financial decisions. By following these guidelines, you can establish and maintain a strong credit profile that will serve you well in your financial life.

What is credit monitoring and why is it important in credit management ?

Credit monitoring is the process of tracking and analyzing a borrower's credit history, including payment behavior, outstanding debts, and changes in credit scores. It is important for early warning signals of potential default or delinquency, accurate risk assessment, fraud prevention, customer relationship management, and compliance with regulations. By continuously monitoring a borrower's credit history, lenders can update their risk assessments, prevent fraud, tailor their products and services to better meet their customers' requirements, and ensure they are meeting regulatory requirements.

What are the benefits of cultural exchange ?

Cultural exchange is the process of sharing and learning from each other's cultures, promoting understanding, tolerance, and appreciation for diversity. It offers benefits such as enhancing cultural awareness and sensitivity, promoting tolerance and acceptance, encouraging creativity and innovation, and building international relations and peace. Examples include traveling abroad, participating in international events, multicultural classrooms, interfaith dialogues, collaborative projects between artists, exchanging business practices, international cultural festivals, and international student exchange programs. Cultural exchange has the potential to create a more harmonious world where people appreciate and celebrate diversity while working together towards common goals.

What are the most common scams in currency exchange ?

The most common scams in currency exchange include high fees and hidden charges, unfavorable exchange rates, phishing scams, and fake currency. To avoid these scams, it is important to read the fine print before agreeing to any transaction or service, check the current exchange rate before making a transaction, never give out personal information unless you are sure you are dealing with a legitimate source, and always inspect currency carefully before accepting it.

How do student loans impact credit scores ?

Student loans can significantly impact credit scores, positively throughStudent loans can significantly impact credit scores, positively through diversified credit mix, and Best practices for managing student loans include making payments on time, keeping balances low, and exploring forgiveness or repayment options to protect and enhance financial standing.

How do I maximize my credit card rewards ?

Maximizing Credit Card Rewards: Tips for Earning More Credit card rewards can be a valuable way to save money and earn cash back, travel points, or other perks. To maximize your rewards, it's important to choose the right credit card, use it regularly, take advantage of bonus categories, and track your rewards. You should also combine rewards with other discounts, consider a card with an annual fee, avoid unnecessary fees, monitor your credit score, and don't overspend. By following these tips, you can make the most of your credit card rewards while using them responsibly.

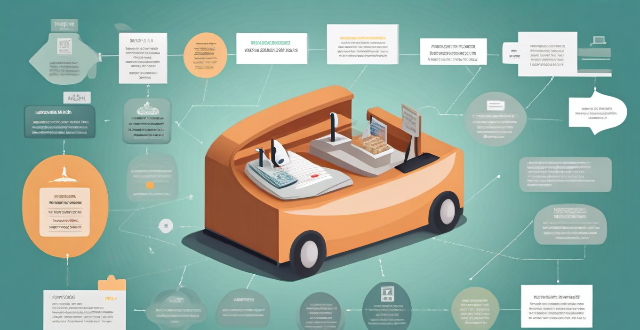

How does credit management work in a bank ?

Credit management is a crucial function of banks that involves assessing and managing the risks associated with lending money to individuals and businesses. The process includes evaluating borrowers' creditworthiness, using credit scoring models to determine risk, making loan decisions, servicing and monitoring loans, and managing credit risk through diversification and risk management strategies.

How does credit history influence insurance rates ?

The text discusses how credit history influences insurance rates. Insurers use credit history as a predictor of future claims and risk, with studies showing that individuals with poor credit histories are more likely to file claims and cost insurers more money than those with good credit histories. Several factors can affect insurance rates based on credit history, including payment history, amount owed, length of credit history, and types of credit used. Maintaining a strong credit history can potentially save money on insurance premiums and demonstrate financial responsibility to insurers.

Should I use a bank or a currency exchange service ?

When it comes to exchanging currencies, you have two main options: banks and currency exchange services. Both have their advantages and disadvantages, so it's important to consider your specific needs before making a decision. Advantages of Using a Bank: - Security: Banks are generally considered more secure than currency exchange services because they are regulated by government agencies. Your money is protected by insurance policies, such as the Federal Deposit Insurance Corporation (FDIC) in the United States. - Convenience: Many banks offer online and mobile banking services, allowing you to easily manage your account and make transactions from anywhere. You can also withdraw cash from ATMs worldwide without additional fees. - Fees: Banks typically charge lower fees for currency exchange compared to currency exchange services. Some banks even offer fee-free currency exchange if you have an account with them. Advantages of Using a Currency Exchange Service: - Better Exchange Rates: Currency exchange services often offer better exchange rates than banks because they specialize in foreign currency exchange. This means you can get more money for your currency than if you were to use a bank. - No Fees: Many currency exchange services do not charge any fees for exchanging currencies. However, some may still charge a small commission or service fee. - Speed: Currency exchange services are usually faster than banks when it comes to exchanging currencies. They often have shorter processing times and can provide you with the currency you need quickly. Disadvantages of Using a Bank: - Limited Availability: Not all banks offer foreign currency exchange services, especially smaller local banks. You may need to visit multiple banks to find one that offers this service. - Higher Fees: As mentioned earlier, banks typically charge higher fees for currency exchange compared to currency exchange services. This can add up quickly if you need to exchange large amounts of currency. Disadvantages of Using a Currency Exchange Service: - Security Risks: Currency exchange services are not regulated by government agencies like banks are. This means there is a higher risk of fraud or theft when using these services. - Limited Locations: Currency exchange services may not be available in all locations, especially in rural areas or smaller towns. You may need to travel to a larger city or airport to find one. - Limited Services: Currency exchange services typically only offer foreign currency exchange and do not provide other banking services like checking accounts or loans. If you need additional financial services, you will need to use a separate bank.

How does technology impact credit management practices ?

Technology has revolutionized credit management practices by automating processes, enhancing data analysis capabilities, and streamlining communication channels. Automated credit scoring systems save time and reduce human error, while accounts receivable management software helps businesses track outstanding invoices and initiate collections actions if necessary. Technology also enables businesses to monitor changes in a borrower's creditworthiness in real-time, allowing them to make informed decisions about extending credit or adjusting terms. Enhanced data analysis tools like artificial intelligence and machine learning help businesses gain insights into customer behavior and make better-informed decisions about extending credit. Predictive analytics can identify potential risks, sentiment analysis gauges customer sentiment towards products or services, and fraud detection technology reduces the risk of financial losses due to credit card fraud or identity theft. Streamlined communication channels such as online portals, mobile apps, and chatbots powered by AI improve customer service and efficiency in credit management practices. Overall, technology has had a profound impact on credit management practices and will continue to do so as it evolves.

What are some successful examples of cultural exchange programs ?

The text discusses successful examples of cultural exchange programs, which are designed to promote understanding and appreciation for diverse cultures. The Fulbright Program provides grants for students, scholars, and professionals to study, teach, or conduct research abroad. The Peace Corps is a volunteer program that sends Americans to work on community development projects in developing countries. AFS Intercultural Programs offer intercultural learning experiences for high school students. International student exchange programs allow students from different countries to study abroad at universities or colleges in other countries. These programs provide opportunities for individuals to share their experiences, knowledge, and traditions with each other, promoting mutual understanding and fostering lasting connections between people from around the world.