Currency Border

What is Cross-Border Payment ?

Cross-border payment is the process of transferring money from one country to another, involving currency exchange and various payment methods. It is essential for businesses operating in multiple countries, allowing them to receive and make payments in different currencies. Key features include currency exchange, payment methods, regulations, fees, and timeframes. Benefits of cross-border payments include global expansion, increased sales, reduced costs, and improved cash flow.

What currencies can be used for Cross-Border Payment ?

The currencies used for cross-border payments vary widely depending on numerous factors, including economic strength, political stability, and market acceptance. Major world currencies like the US Dollar, Euro, British Pound Sterling, and Japanese Yen are commonly used due to their global acceptance and role in international trade and financial markets. Other currencies such as the Chinese Yuan/Renminbi, Canadian Dollar, and Australian Dollar also play significant roles in cross-border payments, particularly in commodities trade and regional economies. Digital currencies, including Bitcoin and stablecoins, are increasingly being used for cross-border payments, offering decentralized transactions and the benefits of blockchain technology. Factors influencing currency choice include regulatory environment, cost considerations, market fluctuations, and business agreements.

How do exchange rates affect Cross-Border Payment ?

Exchange rates play a crucial role in cross-border payments, impacting the cost, speed, and feasibility of transactions. They can affect transfer fees, currency fluctuations, processing time, trade opportunities, and investment opportunities. Understanding exchange rates is essential for managing them effectively in international trade or finance.

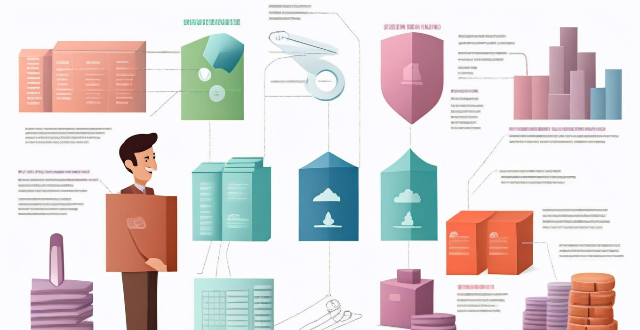

How does Cross-Border Payment work ?

Cross-border payments are transactions that involve transferring money between different countries. The process is complex and requires coordination among various parties, including banks, payment processors, and financial institutions. The steps involved in cross-border payments include initiation of the payment, verification and authorization, execution of the payment, and settlement and reconciliation. There are several methods available for cross-border payments, such as wire transfers, online payment platforms, and mobile wallets. Choosing the appropriate method ensures safe, secure, and efficient cross-border payments.

What are the most popular Cross-Border Payment platforms ?

The global economy heavily relies on cross-border payments, and several platforms have emerged to facilitate these transactions. PayPal is a widely used online payment system offering a secure way to send and receive money internationally. Stripe provides APIs for integrating payments into applications and supports multiple currencies. Adyen offers a one-stop platform for all payment methods, reducing transaction friction. TransferWise (now Wise) focuses on reducing transfer costs using a peer-to-peer model. WorldRemit specializes in remittances to mobile wallets and bank accounts in developing countries. Skrill is a digital wallet service with merchant services and a prepaid card option. Payoneer provides mass payments solutions and multi-currency accounts, particularly benefiting affiliate marketers. Each platform caters to different needs, from individual remittances to business solutions, ensuring options for various cross-border payment scenarios.

What are the benefits of using Cross-Border Payment ?

Cross-border payments are essential for global commerce, offering benefits such as increased access to markets, improved efficiency, lower costs, greater flexibility, enhanced security, and scalability. These advantages help businesses expand globally, making cross-border payments a vital tool for modern commerce.

Can small businesses benefit from Cross-Border Payment ?

Cross-border payments are increasingly vital in the global economy, enabling businesses to tap into new markets. Small businesses can benefit from this trend by expanding market access, increasing revenue potential, improving customer experience, reducing costs, and gaining a competitive advantage. As technology continues to evolve, small businesses should consider taking advantage of cross-border payments to grow and succeed on a global scale.

What should I do with leftover currency from my travels ?

When you return from a trip, you may find yourself with some leftover currency from the country you visited. Here are some options for what to do with it: keep it for future trips, exchange it back to your home currency, use it for online purchases, give it as a gift or souvenir, or donate it to charity. Consider your personal preferences and circumstances when deciding which option is best for you.

Can I exchange currency online ?

You can exchange currency online through banks, currency exchangeYou can exchange currency online through banks, currency exchange-peer platforms, mobile currency exchange websites, peer-to-peer platforms, mobile apps, and cryptocurrency exchanges. Each option has its own advantages and disadvantages in terms of convenience, fees, and exchange rates. It's important to research and compare different options to find the one that best suits your needs.

Is Cross-Border Payment secure ?

Cross-border payments are essential for international trade and business transactions but can pose security risks. Factors like regulatory compliance, technology, fraud prevention measures, and the reputation of the payment service provider affect the security of these payments. Risks include currency fluctuations, political instability, and cyber threats. To ensure security, choose a reputable provider, use secure payment methods, verify recipient details, and keep track of transactions.

How do economic indicators influence currency exchange rates ?

Economic indicators significantly influence currency exchange rates by reflecting the health and performance of an economy, affecting demand for its currency. Key indicators include Gross Domestic Product (GDP), interest rates, inflation rates, trade balance, political stability, employment data, and consumer confidence. A strong economy typically leads to an appreciation of its currency, while a weaker economy can result in depreciation. These indicators are closely monitored by investors and traders to make informed decisions about buying or selling currencies.

How does Cross-Border Payment impact global trade ?

Cross-border payment plays a crucial role in the global trade ecosystem by enabling businesses to buy and sell goods and services internationally. It reduces transaction costs, enhances transparency and efficiency, and promotes economic growth. However, challenges related to regulatory compliance, currency fluctuations, and technological barriers need to be addressed.

What are the most common scams in currency exchange ?

The most common scams in currency exchange include high fees and hidden charges, unfavorable exchange rates, phishing scams, and fake currency. To avoid these scams, it is important to read the fine print before agreeing to any transaction or service, check the current exchange rate before making a transaction, never give out personal information unless you are sure you are dealing with a legitimate source, and always inspect currency carefully before accepting it.

What is the best way to exchange currency ?

Exchanging currency is a common practice for travelers, businessmen, and investors. However, the process can be confusing and costly if not done correctly. In this article, we will discuss the best ways to exchange currency while minimizing fees and maximizing convenience. Understanding Currency Exchange Rates: Before diving into the best ways to exchange currency, it's essential to understand what affects currency exchange rates. These rates are influenced by various factors such as economic indicators, political stability, and market speculation. To get the best rate possible, keep an eye on these factors and plan your exchange accordingly. Researching Exchange Options: One of the most common ways to exchange currency is through banks and credit unions. While convenient, these institutions often have high fees and unfavorable exchange rates. It's important to compare rates and fees before choosing this option. Currency exchange offices are another popular choice for exchanging currency. They typically offer better rates than banks but may still charge high fees. It's crucial to research each office's policies and rates before making a transaction. Using an ATM to withdraw foreign currency can be a cost-effective option, especially for small amounts. However, be aware of any additional fees charged by your bank or the ATM operator. Prepaid currency cards allow you to load multiple currencies onto one card, making them a convenient option for travelers. They usually offer competitive exchange rates and low fees, but it's important to read the terms and conditions carefully. Online currency exchange services provide an easy and efficient way to exchange currency. They often offer competitive rates and low fees, but it's essential to research each service thoroughly before using them. Choosing the Best Option: The best way to exchange currency depends on several factors, including the amount of money being exchanged, the destination country, and personal preferences. Here are some general tips to help you choose the best option: Compare rates and fees: Always compare rates and fees across different options before making a decision. This will help you find the most cost-effective solution. Consider convenience: If you need access to cash quickly or frequently, consider using an ATM or prepaid currency card. These options allow you to withdraw money easily while traveling. Plan ahead: Don't wait until the last minute to exchange currency. Plan ahead and research your options to ensure you get the best rate possible. Be aware of scams: Unfortunately, there are many scams associated with currency exchange. Be wary of street vendors offering exceptionally good rates or other suspicious activities. Stick to reputable institutions and services to avoid potential fraud.

Can I use my credit card for currency exchange ?

Using a credit card for currency exchange is convenient but comes with potential fees and less favorable exchange rates. It involves dynamic currency conversion by your bank or credit card issuer, which may add a spread or margin to the rate. To use your credit card for currency exchange, ensure it's eligible for international use, notify your bank of travel plans, understand associated fees, choose to pay in local currency, and monitor transactions. While offering convenience and security, drawbacks include fees, potentially unfavorable rates, and the need to manage credit limits. Comparing cards based on fees and rewards can optimize benefits.

Should I use a bank or a currency exchange service ?

When it comes to exchanging currencies, you have two main options: banks and currency exchange services. Both have their advantages and disadvantages, so it's important to consider your specific needs before making a decision. Advantages of Using a Bank: - Security: Banks are generally considered more secure than currency exchange services because they are regulated by government agencies. Your money is protected by insurance policies, such as the Federal Deposit Insurance Corporation (FDIC) in the United States. - Convenience: Many banks offer online and mobile banking services, allowing you to easily manage your account and make transactions from anywhere. You can also withdraw cash from ATMs worldwide without additional fees. - Fees: Banks typically charge lower fees for currency exchange compared to currency exchange services. Some banks even offer fee-free currency exchange if you have an account with them. Advantages of Using a Currency Exchange Service: - Better Exchange Rates: Currency exchange services often offer better exchange rates than banks because they specialize in foreign currency exchange. This means you can get more money for your currency than if you were to use a bank. - No Fees: Many currency exchange services do not charge any fees for exchanging currencies. However, some may still charge a small commission or service fee. - Speed: Currency exchange services are usually faster than banks when it comes to exchanging currencies. They often have shorter processing times and can provide you with the currency you need quickly. Disadvantages of Using a Bank: - Limited Availability: Not all banks offer foreign currency exchange services, especially smaller local banks. You may need to visit multiple banks to find one that offers this service. - Higher Fees: As mentioned earlier, banks typically charge higher fees for currency exchange compared to currency exchange services. This can add up quickly if you need to exchange large amounts of currency. Disadvantages of Using a Currency Exchange Service: - Security Risks: Currency exchange services are not regulated by government agencies like banks are. This means there is a higher risk of fraud or theft when using these services. - Limited Locations: Currency exchange services may not be available in all locations, especially in rural areas or smaller towns. You may need to travel to a larger city or airport to find one. - Limited Services: Currency exchange services typically only offer foreign currency exchange and do not provide other banking services like checking accounts or loans. If you need additional financial services, you will need to use a separate bank.

Are there any risks associated with Cross-Border Payment ?

Cross-border payments come with several risks, includingCross-border payments come with several risks, including risk, legal risk, and it's essential to use reputable payment providers and take steps to protect personal information.

Is it better to exchange currency before or after arriving at my destination ?

Exchanging currency is an important aspect of international travel. Depending on your travel plans, it may be more advantageous to exchange currency before or after arriving at your destination. Here are some factors to consider: ## Pros of exchanging currency before arrival: - Convenience - Better rates - Security ## Cons of exchanging currency before arrival: - Higher fees - Risk of loss/theft - Limited flexibility ## Pros of exchanging currency after arrival: - Better rates - More options - Flexibility ## Cons of exchanging currency after arrival: - Time constraints - Lack of availability - Language barriers In conclusion, whether it's better to exchange currency before or after arriving at your destination depends on various factors such as convenience, safety, and cost. It's essential to weigh these factors carefully and choose the option that best suits your needs and travel plans.

How do I track my Cross-Border Payment transaction ?

Cross-border payments can be tracked using various methods such as obtaining key information, utilizing online banking services, contacting the bank directly, using third-party tracking services, staying informed with updates, understanding time frames, confirming receipt with the beneficiary, and monitoring for errors or fraud. It is essential to collect all necessary transaction details before initiating a transfer, including the transaction ID, beneficiary details, date of transfer, amount, and expected delivery date. Most banks provide online services that allow customers to track their transactions, while some financial service providers offer tracking tools specifically designed for cross-border payments. Staying informed with updates through email or SMS notifications is crucial, along with understanding typical time frames for different types of transactions. Confirming receipt with the beneficiary and monitoring for any errors or fraud throughout the process are also important steps to ensure a smooth and secure transaction.

How can I set up a Cross-Border Payment account ?

The text provides a detailed guide on how to set up a cross-border payment account, including steps such as researching and choosing a provider, checking compliance and regulations, opening an account, verifying the account, configuring payment settings, linking to a business account, testing the system, monitoring and maintaining the account, understanding fees and exchange rates, and optimizing for tax implications. It emphasizes the importance of complying with legal and regulatory requirements, maintaining detailed records, and working with a tax advisor.

What fees are associated with Cross-Border Payment ?

Cross-border payments are subject to various fees, including transfer fees, exchange rate markups, receiving fees, and intermediary bank fees. Understanding these fees is crucial for cost-effective international money transfers.

What documents do I need to exchange currency ?

Exchanging currency at Bank of China or any other financial institution requires presenting valid personal identification documents and relevant materials proving the necessity for the exchange, including proof of need and a usage declaration. The process adheres to specific regulations set by the State Administration of Foreign Exchange, such as annual total amount management and verification and approval procedures. It is crucial to understand these requirements and check with your bank beforehand to ensure a smooth currency exchange experience.

What regulations govern Cross-Border Payment ?

Regulations governing cross-border payment include Anti-Money Laundering (AML) laws, Payment Card Industry Data Security Standard (PCI DSS), International Wire Transfer Regulations, and General Data Protection Regulation (GDPR). These regulations ensure the security, safety, and efficiency of the process by requiring financial institutions to verify customer identity, monitor transactions for suspicious activity, protect cardholder data, comply with US sanctions and embargoes, and protect personal data.

What is the future of Cross-Border Payment ?

The future of cross-border payment is expected to be influenced by trends such as digitalization, regulatory changes, innovation in payment methods, and global economic integration. However, challenges like high fees, security risks, and lack of standardization need to be addressed for the industry to become more accessible, secure, and efficient.

Can I use Cross-Border Payment for personal transactions ?

Cross-border payment systems are designed to facilitate international transactions, allowing individuals and businesses to send and receive money across borders. These systems can be used for various purposes, including personal transactions. In this article, we will discuss the use of cross-border payment systems for personal transactions and provide some tips on how to make the most of them. Cross-border payment refers to the process of transferring money from one country to another. This can be done through various methods, such as wire transfers, credit cards, or digital wallets. The main purpose of cross-border payment systems is to simplify the process of sending and receiving money internationally, making it easier for people to conduct business or personal transactions with others around the world. While cross-border payment systems are primarily used for business transactions, they can also be used for personal transactions. Here are some examples of when you might use a cross-border payment system for personal transactions: Sending Money to Friends and Family Abroad: If you have friends or family members living in another country, you may need to send them money occasionally. Cross-border payment systems allow you to do this quickly and easily, without having to worry about exchange rates or bank fees. Paying for Online Shopping: Many online retailers offer international shipping, allowing you to purchase goods from other countries. When paying for these purchases, you can use a cross-border payment system to ensure that your payment is processed securely and efficiently. Travel Expenses: When traveling abroad, you may need to pay for expenses such as accommodation, transportation, or food. Cross-border payment systems can be useful in these situations, as they allow you to make payments in local currencies without having to carry large amounts of cash. To make the most of cross-border payment systems for personal transactions, consider the following tips: Choose the Right Provider: Not all cross-border payment systems are created equal. Some may offer better exchange rates or lower fees than others. Research different providers before choosing one to ensure that you get the best deal possible. Understand Fees and Exchange Rates: Before making any cross-border payment, be sure to understand the fees and exchange rates involved. Some providers may charge additional fees for certain types of transactions, so it's important to know what you're getting into before sending money. Keep Track of Your Transactions: When using cross-border payment systems for personal transactions, it's important to keep track of your transactions. This will help you stay organized and ensure that you don't overspend or lose track of your finances. Be Aware of Scams: Unfortunately, there are scammers who target people using cross-border payment systems. Be cautious when sharing personal information or sending money to someone you don't know well. If something seems suspicious, trust your instincts and report it to the appropriate authorities. In conclusion, cross-border payment systems can be a convenient and efficient way to handle personal transactions with people in other countries. By choosing the right provider, understanding fees and exchange rates, keeping track of your transactions, and being aware of potential scams, you can make the most of these systems and enjoy smoother international financial interactions.

Can I cancel a Cross-Border Payment transaction ?

Canceling a cross-border payment depends on factors like the payment method, bank policies, and timing of cancellation. Wire transfers and electronic platforms are common methods, with immediate requests having higher chances of success. Costs may apply for cancellation, and effective communication with banks or providers is crucial. Steps include acting quickly, verifying transaction status, contacting support, and understanding any fees. Prevention tips involve double-checking details and using reliable platforms.

How can I optimize my Cross-Border Payment strategy ?

This guide discusses how to optimize cross-border payment strategy by researching and understanding regulations and compliance requirements, choosing the right payment method, using technology to streamline processes, and working with reliable partners.

How long does it take for a Cross-Border Payment to process ?

The processing time for cross-border payments can vary depending on several factors, including the payment method used, the countries involved, and the banks or financial institutions handling the transaction. Wire transfers typically take 1 to 5 business days, credit cards can take 3 to 7 business days, and digital wallet transactions are usually completed within 24 hours. However, these are just general guidelines and the actual processing time can vary based on the specific circumstances of each transaction.

How can I ensure I get the best exchange rate ?

When exchanging currencies, it is important to ensure that you get the best possible exchange rate. This can help you save money and get the most value for your money. In this guide, we will discuss some tips and strategies that can help you achieve the best exchange rate possible. The first step in ensuring the best exchange rate is to research the current exchange rates online. There are many websites that provide real-time information on exchange rates, such as XE.com or OANDA. By checking these sites, you can get an idea of what the current exchange rate is and compare it to other providers. Once you have an idea of the current exchange rate, it's time to compare different providers. Look for banks, currency exchange offices, and even online services that offer competitive rates. Make a list of potential providers and compare their rates side by side. Using a credit card that doesn't charge foreign transaction fees can be a great way to get the best exchange rate. Some credit cards also offer rewards programs that give you cashback or points for using your card abroad. Look for cards that offer these benefits and make sure they don't charge any additional fees for foreign transactions. Prepaid currency cards are another option to consider when traveling abroad. These cards allow you to load them with foreign currency before your trip and use them like a debit card. They often come with lower fees than traditional bank accounts and may offer better exchange rates than exchanging cash at a currency exchange office. If you prefer to exchange cash, shop around at local currency exchange offices to find the best rates. Don't be afraid to walk away from an office if you feel like the rate they're offering isn't fair. Often, just by showing that you're willing to walk away, they may offer you a better rate. Getting the best exchange rate requires some research and planning ahead of time. By following these tips and strategies, you can ensure that you get the most value for your money when exchanging currencies.