Demand

Demand Price Demand Market Demand Busi Demand Source Demand Supply Demand Gold Demand Emission Demand Rate Demand Carbon Demand Ting Demand Power Demand Nuclear Demand Relationship Demand Credit Demand Consumer Demand Energy Demand Area Demand Product Demand Decision Demand Sports Demand Impact Demand Investment Demand Electricity Demand Employment Demand Economy Demand Analysis Demand Water Demand Factors Demand Investor Demand Service Demand Plant

How do sports economists analyze the demand for sports products and services, and what factors influence this demand ?

The demand for sports products and services is analyzed by sports economists using various methods such as market research, econometric models, surveys, historical data analysis, experimental designs, social media analytics, focus groups, case studies, cross-sectional analysis, and time series analysis. Factors influencing this demand include income levels, price, population demographics, health consciousness, technology, media coverage, fashion trends, celebrity endorsements, team performance, economic conditions, government policies, social trends, and the availability and price of substitutes or complements.

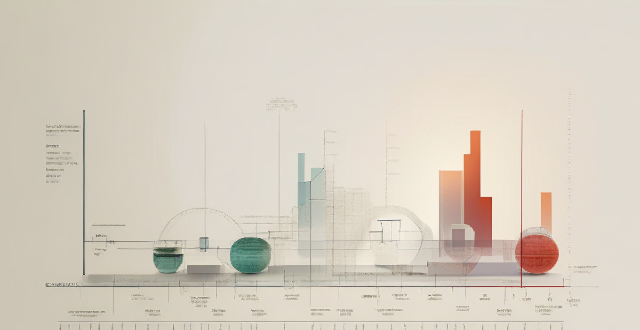

How is the demand for electricity affecting the energy market ?

The demand for electricity is a crucial factor that affects the energy market. As the world becomes more reliant on electricity, the demand for it continues to grow. This increased demand has significant implications for the energy market, including the types of energy sources used, the cost of electricity, and the environmental impact of energy production. The key points include population growth, economic development, technological advancements, diversification of energy sources, investment in infrastructure, cost of electricity, environmental impact, renewable energy sources, energy efficiency, smart grid technology, and electric vehicles. By considering sustainable energy solutions, we can work towards a more sustainable and equitable energy future.

What is the impact of fuel vehicles on global oil demand ?

The widespread use of fuel vehicles, especially those poweredThe widespread use of fuel vehicles, especially those powered engines, has significantly influenced global This increased consumption of petroleum-based fuels has led to economic implications such as price fluctuations and dependence on imports, as well as environmental challenges like greenhouse gas emissions and air pollution. Alternatives to fuel vehicles, including electric and hybrid vehicles, public transportation, and active mobility options, offer potential solutions to reduce our reliance on oil and mitigate these negative impacts.

What is the future outlook for gold investment ?

The future outlook for gold investment is influenced by various factors such as economic conditions, monetary policy, supply and demand dynamics, and investor sentiment. Economic uncertainty can drive up the demand for gold as a safe-haven asset, while periods of growth may decrease its value. Central banks' interest rate decisions and money supply changes can also impact gold prices. Supply and demand dynamics, including mining production and jewelry demand, play a role in determining gold availability and price. Finally, investor sentiment towards gold can be shaped by market trends, investment strategies, and overall risk appetite. By monitoring these key factors, investors can make informed decisions about the viability of gold as a portfolio addition in the coming years.

How is the price of carbon credits determined in the carbon trading market ?

The price of carbon credits in the carbon trading market is determined by various factors, including supply and demand, regulatory policies, and market dynamics. The balance between supply and demand significantly affects the price, with high demand increasing the price and oversupply decreasing it. Regulatory policies such as cap-and-trade systems and carbon taxes also play a crucial role in setting limits on emissions and creating incentives for companies to reduce their emissions or purchase carbon credits to offset them. Market dynamics such as speculation, liquidity, and transparency can also impact the price of carbon credits. As awareness of climate change grows, the demand for carbon credits is likely to increase, driving up their price. However, ensuring transparent and efficient operation of the carbon market is essential to maximize its potential benefits for both companies and the environment.

What is the relationship between economic recovery and employment rates ?

The relationship between economic recovery and employment rates is influenced by various factors such as increased aggregate demand, investment in the economy, government policies, and global factors. As the economy recovers, businesses start hiring more workers to meet the growing demand for goods and services, leading to an increase in employment rates. However, this relationship is complex and requires a deeper understanding of the different aspects involved.

What skills will be in demand for jobs related to climate change adaptation and mitigation ?

The fight against climate change requires a diverse set of skills, including data analysis and modeling, sustainable design, renewable energy, environmental science, urban planning, risk management, communication, education and training, and project management. These competencies are in high demand for jobs related to climate change adaptation and mitigation.

How can businesses adapt to changing climate conditions and still meet consumer demands ?

Businesses face the challenge of adapting to climate change while meeting consumer demands. Key strategies include embracing sustainable practices, innovating products and services, enhancing resilience, engaging stakeholders, and continuous learning and adaptation. By implementing these strategies, businesses can differentiate themselves as responsible corporate citizens while ensuring they continue to meet consumer demands.

How is the value of carbon credits determined ?

Carbon credits are a valuable tool in the fight against climate change. Their value is determined by supply and demand, quality of the project used to generate them, and market conditions. Supply and demand can be influenced by government regulations, public opinion, and technological advancements. The quality of a carbon offset project can be influenced by verification and certification, additionality, and permanence. Market conditions such as economic growth, political stability, and global events can also impact the value of carbon credits.

How has the pandemic impacted the energy market ?

The COVID-19 pandemic has significantly impacted the energy market by decreasing demand, causing price fluctuations, and accelerating the shift towards renewable energy sources. With businesses and schools closed, people staying home more often, and reduced commuting and travel, there has been less need for energy consumption, leading to a reduction in electricity usage during peak hours. Industrial sources have seen lower energy consumption due to factory shutdowns or reduced production, while transportation sectors have experienced decreased demand for gasoline, diesel fuel, and jet fuel. Residential energy demand has also decreased as people adopted more energy-efficient habits. Energy prices have fluctuated, particularly in the oil and gas industry, with crude oil prices falling sharply at the beginning of the pandemic but recovering somewhat since then. Natural gas prices have also experienced volatility due to declines in demand. However, as economies begin to recover and restrictions ease, energy prices may increase again. The pandemic has accelerated the transition towards renewable energy sources as governments and businesses seek to reduce their carbon footprint and mitigate climate change. Governments have implemented policies aimed at promoting renewable energy development, such as tax incentives for solar and wind projects or bans on new fossil fuel infrastructure. Companies across various industries have set ambitious sustainability goals, including reducing their greenhouse gas emissions and increasing their use of renewable energy sources. This trend is expected to drive further growth in the renewable energy sector even after the pandemic subsides.

What is the impact of climate change on the energy market ?

Climate change impacts the energy market by increasing demand for cooling, causing unpredictable weather patterns, rising sea levels, and shifting energy sources towards renewables.

What role do pumped hydro storage systems play in renewable energy integration ?

Pumped hydro storage systems are crucial for renewable energy integration by offering reliable and efficient energy storage, balancing supply and demand, enhancing grid stability and reliability, facilitating higher penetration of renewables, providing ancillary services, and delivering economic benefits.

How do immigration policies affect the real estate market ?

Immigration policies have a significant impact on the real estate market, affecting demand for housing, property prices, rental markets, and long-term urban development patterns. Open immigration policies can lead to an influx of new residents, increasing demand for housing and contributing to a diversification of the housing market. This can result in higher property values and rental rates, as well as more construction projects to accommodate the growing population. However, changes in immigration policies can also affect the availability of financing options for potential homebuyers, further influencing property prices. In addition, immigration policies can have long-term effects on urban development patterns, creating new opportunities for investment and development. Understanding these relationships is crucial for anyone involved in the real estate industry or considering investing in property within regions affected by changing immigration policies.

What factors influence vaccine distribution ?

Vaccine distribution is a complex process influenced by various factors, including production, logistics, and demand. Key factors include the availability of raw materials, manufacturing capacity, quality control measures, transportation infrastructure, cold chain maintenance, staff training, population size, geographic location, and public perception and trust. Addressing these factors is crucial for ensuring effective and efficient vaccine distribution to those who need it most.

How does economic recovery affect different industries differently ?

Economic recovery affects industries differently based on their reliance on consumer spending, investment, government policies, and global markets. Consumer discretionary sectors like retail and hospitality are highly sensitive to economic fluctuations but can rebound quickly with increased consumer confidence. The technology sector often remains resilient during downturns, with continued growth in segments like software and online services. Manufacturing may face challenges due to supply chain disruptions but can rapidly expand with demand recovery. Financial services benefit from improved credit conditions and increased lending activities. Healthcare is generally less affected by economic cycles and can grow with aging populations. Energy sector recovery depends on global demand and policy shifts towards renewable energy. Understanding these differential impacts is crucial for investors, policymakers, and businesses to navigate the changing landscape effectively.

How do changes in economic indicators affect small business operations ?

Economic indicators such as GDP, inflation rates, unemployment, interest rates, and consumer confidence can significantly affect small businesses. These changes impact financing costs, labor availability, consumer demand, and operational expenses. Small business owners should monitor these factors to adjust their strategies effectively.

How does the pandemic affect the performance of tech stocks ?

The COVID-19 pandemic has significantly impacted tech stock performance through increased demand for technology, supply chain disruptions, changes in investor sentiment, and government stimulus and regulation. Remote work and learning have boosted tech sales, while e-commerce growth has further driven revenue. However, production delays and component shortages pose challenges. Investor behavior varies, with some seeking safety in tech stocks and others avoiding risk. Government support and regulatory changes also influence the sector's performance. The long-term effects on tech stocks remain uncertain.

How can Smart Grid Technology improve energy efficiency ?

Smart grid technology is transforming the energy sector by integrating advanced communication technologies, automated controls, and innovative sensors to create a more efficient, reliable, and sustainable energy system. Key features of smart grid technology include Advanced Metering Infrastructure (AMI), Distributed Energy Resources (DERs), Demand Response (DR) Programs, and Electric Vehicles (EVs). The benefits of smart grid technology on energy efficiency include improved load management through peak shaving, demand side management, and dynamic pricing; increased renewable energy integration through microgrids, grid balancing, and energy storage systems; optimized transmission and distribution through self-healing networks, predictive maintenance, and reduced transmission losses; and enhanced customer engagement and participation through consumer education, incentives for energy efficiency, and community solar programs. Overall, smart grid technology offers numerous opportunities to improve energy efficiency across various sectors of the energy industry while transitioning towards a more sustainable future with reliable and efficient energy delivery for all consumers.

Is it a good time to invest in gold ?

Investing in gold is a popular choice for many investors, but whether it is a good time to invest depends on various factors such as market conditions, economic indicators, and personal financial goals. Market conditions are influenced by supply and demand, geopolitical events, and monetary policies. Economic indicators like inflation rates, interest rates, and economic growth can also impact the appeal of gold as an investment. Personal financial goals should also be considered, including diversification, long-term investment, and risk tolerance. It is important to assess individual circumstances and risk tolerance before making any investment decisions, and consulting with a financial advisor can provide valuable guidance tailored to specific needs and objectives.

How much should I expect to pay for a second-hand iPhone ?

When purchasing a second-hand iPhone, factors suchWhen purchasing a second-hand iPhone, factors such and demand can impact the price Researching online and local listings, negotiating with sellers, and considering warranty and return policies are tips for finding a good deal.

How often do Outlet Stores have sales ?

Outlet stores are known for their discounted prices on brand-name merchandise. The frequency of sales at outlet stores can vary depending on location, season, and demand. Factors affecting sales frequency include location, seasonality, demand, and inventory turnover. Typical sales frequency patterns include weekly sales, monthly sales, seasonal sales, and special promotions. Tips for shopping at outlet stores include being flexible, following social media accounts, joining loyalty programs, and shopping off-peak hours.

What is the future outlook for green jobs ?

The future outlook for green jobs is promising, asThe future outlook for green jobs is promising, as eco-friendly practices continues to The key factors driving this growth include government policies, consumer demand, technological advancements, corporate social responsibility, and international collaboration. Examples of green jobs include renewable energy technicians, sustainability managers, green building designers, waste management professionals, conservation scientists, and environmental lawyers.

How can data analytics help identify areas for energy efficiency improvements in industry ?

Data analytics is crucial for identifying opportunities for energy efficiency improvements in industry. It enables real-time and historical monitoring, benchmarking, process optimization, predictive maintenance, and demand response management. These insights help companies reduce energy waste, cut costs, and minimize environmental impact.

What are the latest trends in smart grid technology to integrate renewable energy sources more effectively ?

The article discusses the latest trends in smart grid technology that are facilitating the integration of renewable energy sources into power systems. These trends include distributed energy resource management through microgrids and virtual power plants, advanced predictive analytics and machine learning for weather and load forecasting, various energy storage technologies like battery storage, pumped hydro storage, and flow batteries, smart infrastructure and automation involving smart meters and grid automation, electric vehicles participating in demand response programs and vehicle-to-grid technology, and blockchain applications for peer-to-peer trading and transactive energy systems. Collectively, these advancements aim to create a cleaner, more sustainable, and resilient energy system.

Can we expect any music videos for the songs in the new album ?

The text discusses the possibility of music videos accompanying a new album, considering factors such as the artist's history, label support, fan demand, budget and resources, and creative vision. The author expresses their hope for visual representations of the music to enhance the listening experience.

How will climate change influence future job markets ?

The article discusses how climate change will influence future job markets. It highlights the increased demand for green jobs, a shift toward resilient industries, and potential declines in certain sectors that contribute to greenhouse gas emissions or rely heavily on fossil fuels. Additionally, remote work opportunities may rise due to extreme weather events and environmental concerns. The article concludes by emphasizing the need for individuals and organizations to adapt to these changes in the job market.

How can energy storage be integrated with smart grid technologies ?

Energy storage plays a pivotal role in the development and operation of smart grids. It provides flexibility to the system, enabling it to manage variable renewable energy sources, enhance reliability, and improve efficiency. The benefits of energy storage in smart grids include balancing supply and demand, integrating renewable energy, improving grid stability and reliability, enhancing efficiency, and saving costs. Methods of integration include distributed energy resource management (DERMS), advanced metering infrastructure (AMI), grid optimization software, and energy management systems (EMS). However, challenges such as interoperability, cybersecurity, regulation and standardization, and cost must be addressed. Integrating energy storage with smart grid technologies is crucial for achieving a modernized, efficient, and sustainable electrical grid.

Are organic foods more expensive than non-organic foods ?

Organic foods are generally more expensive than non-organic options due to higher production costs, certification fees, and market demand. Factors such as labor intensity, lower yields, longer production time, accreditation costs, and ongoing inspections contribute to these increased costs. Despite the price difference, many consumers choose organic foods for health, environmental, and animal welfare reasons. The decision to purchase organic or non-organic often depends on individual priorities and budget.

What is the future of nuclear energy in the energy market ?

The future of nuclear energy is promising, as it has advantages such as low carbon emissions, high energy density and baseload power. However, challenges like safety concerns, waste disposal, and high costs must be addressed. Increasing demand for clean energy, advances in technology, and integration with renewable sources can drive the growth of nuclear energy in the future.