Exchange Payment

How do exchange rates affect Cross-Border Payment ?

Exchange rates play a crucial role in cross-border payments, impacting the cost, speed, and feasibility of transactions. They can affect transfer fees, currency fluctuations, processing time, trade opportunities, and investment opportunities. Understanding exchange rates is essential for managing them effectively in international trade or finance.

What is Cross-Border Payment ?

Cross-border payment is the process of transferring money from one country to another, involving currency exchange and various payment methods. It is essential for businesses operating in multiple countries, allowing them to receive and make payments in different currencies. Key features include currency exchange, payment methods, regulations, fees, and timeframes. Benefits of cross-border payments include global expansion, increased sales, reduced costs, and improved cash flow.

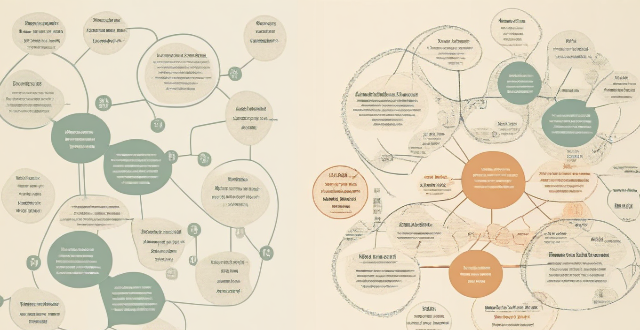

How can I optimize my Cross-Border Payment strategy ?

This guide discusses how to optimize cross-border payment strategy by researching and understanding regulations and compliance requirements, choosing the right payment method, using technology to streamline processes, and working with reliable partners.

How can I set up a Cross-Border Payment account ?

The text provides a detailed guide on how to set up a cross-border payment account, including steps such as researching and choosing a provider, checking compliance and regulations, opening an account, verifying the account, configuring payment settings, linking to a business account, testing the system, monitoring and maintaining the account, understanding fees and exchange rates, and optimizing for tax implications. It emphasizes the importance of complying with legal and regulatory requirements, maintaining detailed records, and working with a tax advisor.

What are the benefits of using Cross-Border Payment ?

Cross-border payments are essential for global commerce, offering benefits such as increased access to markets, improved efficiency, lower costs, greater flexibility, enhanced security, and scalability. These advantages help businesses expand globally, making cross-border payments a vital tool for modern commerce.

Are there any risks associated with Cross-Border Payment ?

Cross-border payments come with several risks, includingCross-border payments come with several risks, including risk, legal risk, and it's essential to use reputable payment providers and take steps to protect personal information.

What is the future of Cross-Border Payment ?

The future of cross-border payment is expected to be influenced by trends such as digitalization, regulatory changes, innovation in payment methods, and global economic integration. However, challenges like high fees, security risks, and lack of standardization need to be addressed for the industry to become more accessible, secure, and efficient.

Can I return or exchange items purchased through团购优惠 (tuan gou youhui) ?

This text discusses the concept of Tuan Gou Youhui, a popular online shopping method in China that allows customers to purchase products at discounted rates in large group sizes. It then explores the return and exchange policies for items purchased through this method, noting that these policies vary depending on the specific merchant and product but most merchants offer some form of return or exchange policy. The text provides general guidelines for understanding return and exchange policies and steps to return or exchange an item, emphasizing the importance of contacting customer service, providing necessary information, packaging the product carefully, shipping it according to instructions, waiting for refund or exchange, and confirming receipt of refund or exchanged product. Finally, it concludes that by understanding these policies and following appropriate steps, customers can ensure a smooth and hassle-free experience when shopping through Tuan Gou Youhui.

Can I use my credit card for currency exchange ?

Using a credit card for currency exchange is convenient but comes with potential fees and less favorable exchange rates. It involves dynamic currency conversion by your bank or credit card issuer, which may add a spread or margin to the rate. To use your credit card for currency exchange, ensure it's eligible for international use, notify your bank of travel plans, understand associated fees, choose to pay in local currency, and monitor transactions. While offering convenience and security, drawbacks include fees, potentially unfavorable rates, and the need to manage credit limits. Comparing cards based on fees and rewards can optimize benefits.

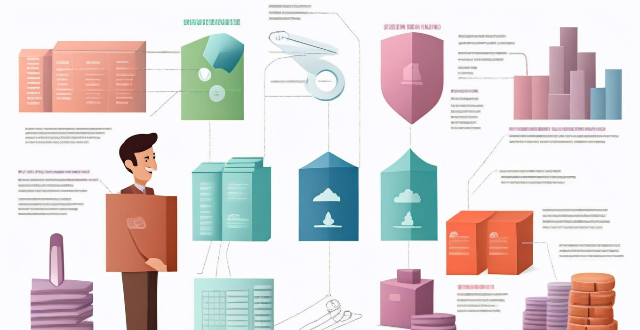

How does Cross-Border Payment work ?

Cross-border payments are transactions that involve transferring money between different countries. The process is complex and requires coordination among various parties, including banks, payment processors, and financial institutions. The steps involved in cross-border payments include initiation of the payment, verification and authorization, execution of the payment, and settlement and reconciliation. There are several methods available for cross-border payments, such as wire transfers, online payment platforms, and mobile wallets. Choosing the appropriate method ensures safe, secure, and efficient cross-border payments.

Is Cross-Border Payment secure ?

Cross-border payments are essential for international trade and business transactions but can pose security risks. Factors like regulatory compliance, technology, fraud prevention measures, and the reputation of the payment service provider affect the security of these payments. Risks include currency fluctuations, political instability, and cyber threats. To ensure security, choose a reputable provider, use secure payment methods, verify recipient details, and keep track of transactions.

What currencies can be used for Cross-Border Payment ?

The currencies used for cross-border payments vary widely depending on numerous factors, including economic strength, political stability, and market acceptance. Major world currencies like the US Dollar, Euro, British Pound Sterling, and Japanese Yen are commonly used due to their global acceptance and role in international trade and financial markets. Other currencies such as the Chinese Yuan/Renminbi, Canadian Dollar, and Australian Dollar also play significant roles in cross-border payments, particularly in commodities trade and regional economies. Digital currencies, including Bitcoin and stablecoins, are increasingly being used for cross-border payments, offering decentralized transactions and the benefits of blockchain technology. Factors influencing currency choice include regulatory environment, cost considerations, market fluctuations, and business agreements.

Can I cancel a Cross-Border Payment transaction ?

Canceling a cross-border payment depends on factors like the payment method, bank policies, and timing of cancellation. Wire transfers and electronic platforms are common methods, with immediate requests having higher chances of success. Costs may apply for cancellation, and effective communication with banks or providers is crucial. Steps include acting quickly, verifying transaction status, contacting support, and understanding any fees. Prevention tips involve double-checking details and using reliable platforms.

How can I ensure safe and secure payment when shopping internationally ?

When shopping internationally, it's important to ensure safe and secure payment. Here are some tips on how to do so: - Use a reputable payment method such as credit cards, debit cards, or digital wallets. - Check for security features like HTTPS, a lock icon in the address bar, and a clear privacy policy. - Keep track of your purchases by saving receipts, order confirmations, and shipping information. - Be aware of scams and research the company or seller before making a purchase.

How do I compare exchange rates between different countries ?

Comparing exchange rates between different countries is crucial for travelers, investors, and businesses. To effectively compare exchange rates, gather information from various sources, convert currencies, create a table for easy comparison, analyze the results, consider other factors like transaction fees and commission charges, and use online tools for accurate conversions.

Can I exchange currency online ?

You can exchange currency online through banks, currency exchangeYou can exchange currency online through banks, currency exchange-peer platforms, mobile currency exchange websites, peer-to-peer platforms, mobile apps, and cryptocurrency exchanges. Each option has its own advantages and disadvantages in terms of convenience, fees, and exchange rates. It's important to research and compare different options to find the one that best suits your needs.

How often do exchange rates fluctuate ?

Exchange rates, which determine the value of one currency in relation to another, are subject to constant fluctuations influenced by various factors such as economic indicators, political events, market speculation, and central bank policies. These fluctuations occur at different frequencies ranging from intraday to yearly intervals and can significantly impact traders, investors, and businesses involved in international trade. It is crucial for these entities to stay informed about exchange rate movements to make well-informed financial decisions.

How much down payment do I need to buy a house ?

This article discusses the factors affecting the down payment amount for buying a house, including credit score, type of mortgage, and price of the house. It also provides common down payment requirements for different types of mortgages and tips for saving for a down payment.

What regulations govern Cross-Border Payment ?

Regulations governing cross-border payment include Anti-Money Laundering (AML) laws, Payment Card Industry Data Security Standard (PCI DSS), International Wire Transfer Regulations, and General Data Protection Regulation (GDPR). These regulations ensure the security, safety, and efficiency of the process by requiring financial institutions to verify customer identity, monitor transactions for suspicious activity, protect cardholder data, comply with US sanctions and embargoes, and protect personal data.

How do I sell my cryptocurrency ?

This guide provides a step-by-step process for selling cryptocurrency, emphasizing the importance of security, fees, user interface, and supported currencies. It outlines steps such as choosing a reputable exchange or trading platform, creating an account, verifying identity, linking a payment method, transferring crypto to the exchange, placing a sell order, confirming the trade, and securing assets. The text also includes tips on tax implications and consulting a financial advisor.

What is the impact of cultural exchange on globalization ?

This essay explores the impact of cultural exchange on globalization. It states that cultural exchange plays a crucial role in enhancing mutual understanding and respect among nations, promoting economic growth and development, fostering international collaboration and cooperation, encouraging tourism and travel, and preserving cultural heritage and traditions. The essay concludes that as our world becomes increasingly interconnected, cultural exchange will continue to play a vital role in shaping our future together.

Can I use Cross-Border Payment for personal transactions ?

Cross-border payment systems are designed to facilitate international transactions, allowing individuals and businesses to send and receive money across borders. These systems can be used for various purposes, including personal transactions. In this article, we will discuss the use of cross-border payment systems for personal transactions and provide some tips on how to make the most of them. Cross-border payment refers to the process of transferring money from one country to another. This can be done through various methods, such as wire transfers, credit cards, or digital wallets. The main purpose of cross-border payment systems is to simplify the process of sending and receiving money internationally, making it easier for people to conduct business or personal transactions with others around the world. While cross-border payment systems are primarily used for business transactions, they can also be used for personal transactions. Here are some examples of when you might use a cross-border payment system for personal transactions: Sending Money to Friends and Family Abroad: If you have friends or family members living in another country, you may need to send them money occasionally. Cross-border payment systems allow you to do this quickly and easily, without having to worry about exchange rates or bank fees. Paying for Online Shopping: Many online retailers offer international shipping, allowing you to purchase goods from other countries. When paying for these purchases, you can use a cross-border payment system to ensure that your payment is processed securely and efficiently. Travel Expenses: When traveling abroad, you may need to pay for expenses such as accommodation, transportation, or food. Cross-border payment systems can be useful in these situations, as they allow you to make payments in local currencies without having to carry large amounts of cash. To make the most of cross-border payment systems for personal transactions, consider the following tips: Choose the Right Provider: Not all cross-border payment systems are created equal. Some may offer better exchange rates or lower fees than others. Research different providers before choosing one to ensure that you get the best deal possible. Understand Fees and Exchange Rates: Before making any cross-border payment, be sure to understand the fees and exchange rates involved. Some providers may charge additional fees for certain types of transactions, so it's important to know what you're getting into before sending money. Keep Track of Your Transactions: When using cross-border payment systems for personal transactions, it's important to keep track of your transactions. This will help you stay organized and ensure that you don't overspend or lose track of your finances. Be Aware of Scams: Unfortunately, there are scammers who target people using cross-border payment systems. Be cautious when sharing personal information or sending money to someone you don't know well. If something seems suspicious, trust your instincts and report it to the appropriate authorities. In conclusion, cross-border payment systems can be a convenient and efficient way to handle personal transactions with people in other countries. By choosing the right provider, understanding fees and exchange rates, keeping track of your transactions, and being aware of potential scams, you can make the most of these systems and enjoy smoother international financial interactions.

How can we overcome language barriers in cultural exchange ?

Strategies for overcoming language barriers in cultural exchange include learning basic phrases, using technology, being patient and respectful, practicing active listening, and seeking out cultural exchange opportunities.

How to manage payment methods for my Apple account ?

Apple offers multiple payment methods for users, including creditApple offers multiple payment methods for users, including credit Apple Pay, and gift cardsManaging your payment methods ensures a smooth experience when making purchases on Apple services like the App Store and iTunes Store.

How long does it take for a Cross-Border Payment to process ?

The processing time for cross-border payments can vary depending on several factors, including the payment method used, the countries involved, and the banks or financial institutions handling the transaction. Wire transfers typically take 1 to 5 business days, credit cards can take 3 to 7 business days, and digital wallet transactions are usually completed within 24 hours. However, these are just general guidelines and the actual processing time can vary based on the specific circumstances of each transaction.

Can you consolidate multiple student loans into one payment ?

Consolidating multiple student loans into one payment simplifies monthly expenses and can reduce overall interest rates. The process involves taking out a new loan to pay off existing ones, resulting in a single fixed interest rate and monthly payment. Benefits include lower monthly payments and easier management, but potential drawbacks such as longer repayment periods and loss of lender benefits should be considered. Successful consolidation requires evaluating current loans, comparing offers, and understanding all terms before committing.

What fees are associated with Cross-Border Payment ?

Cross-border payments are subject to various fees, including transfer fees, exchange rate markups, receiving fees, and intermediary bank fees. Understanding these fees is crucial for cost-effective international money transfers.

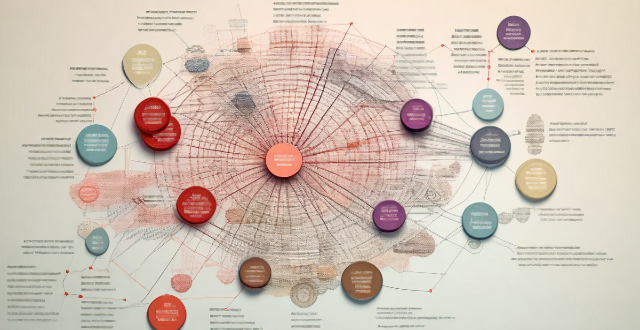

What are the most popular Cross-Border Payment platforms ?

The global economy heavily relies on cross-border payments, and several platforms have emerged to facilitate these transactions. PayPal is a widely used online payment system offering a secure way to send and receive money internationally. Stripe provides APIs for integrating payments into applications and supports multiple currencies. Adyen offers a one-stop platform for all payment methods, reducing transaction friction. TransferWise (now Wise) focuses on reducing transfer costs using a peer-to-peer model. WorldRemit specializes in remittances to mobile wallets and bank accounts in developing countries. Skrill is a digital wallet service with merchant services and a prepaid card option. Payoneer provides mass payments solutions and multi-currency accounts, particularly benefiting affiliate marketers. Each platform caters to different needs, from individual remittances to business solutions, ensuring options for various cross-border payment scenarios.

Can small businesses benefit from Cross-Border Payment ?

Cross-border payments are increasingly vital in the global economy, enabling businesses to tap into new markets. Small businesses can benefit from this trend by expanding market access, increasing revenue potential, improving customer experience, reducing costs, and gaining a competitive advantage. As technology continues to evolve, small businesses should consider taking advantage of cross-border payments to grow and succeed on a global scale.

What are the benefits of cultural exchange ?

Cultural exchange is the process of sharing and learning from each other's cultures, promoting understanding, tolerance, and appreciation for diversity. It offers benefits such as enhancing cultural awareness and sensitivity, promoting tolerance and acceptance, encouraging creativity and innovation, and building international relations and peace. Examples include traveling abroad, participating in international events, multicultural classrooms, interfaith dialogues, collaborative projects between artists, exchanging business practices, international cultural festivals, and international student exchange programs. Cultural exchange has the potential to create a more harmonious world where people appreciate and celebrate diversity while working together towards common goals.