Exchange Student

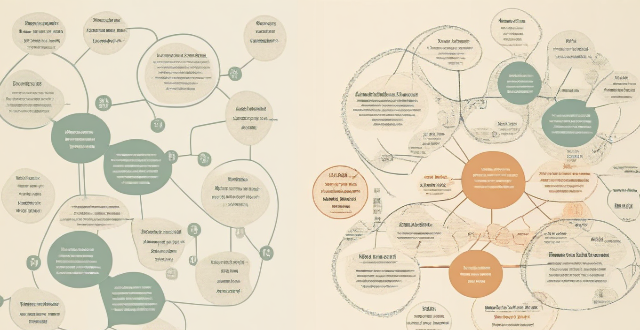

What are some successful examples of cultural exchange programs ?

The text discusses successful examples of cultural exchange programs, which are designed to promote understanding and appreciation for diverse cultures. The Fulbright Program provides grants for students, scholars, and professionals to study, teach, or conduct research abroad. The Peace Corps is a volunteer program that sends Americans to work on community development projects in developing countries. AFS Intercultural Programs offer intercultural learning experiences for high school students. International student exchange programs allow students from different countries to study abroad at universities or colleges in other countries. These programs provide opportunities for individuals to share their experiences, knowledge, and traditions with each other, promoting mutual understanding and fostering lasting connections between people from around the world.

What are the benefits of cultural exchange ?

Cultural exchange is the process of sharing and learning from each other's cultures, promoting understanding, tolerance, and appreciation for diversity. It offers benefits such as enhancing cultural awareness and sensitivity, promoting tolerance and acceptance, encouraging creativity and innovation, and building international relations and peace. Examples include traveling abroad, participating in international events, multicultural classrooms, interfaith dialogues, collaborative projects between artists, exchanging business practices, international cultural festivals, and international student exchange programs. Cultural exchange has the potential to create a more harmonious world where people appreciate and celebrate diversity while working together towards common goals.

What is the impact of cultural exchange on globalization ?

This essay explores the impact of cultural exchange on globalization. It states that cultural exchange plays a crucial role in enhancing mutual understanding and respect among nations, promoting economic growth and development, fostering international collaboration and cooperation, encouraging tourism and travel, and preserving cultural heritage and traditions. The essay concludes that as our world becomes increasingly interconnected, cultural exchange will continue to play a vital role in shaping our future together.

How can cultural exchange contribute to peace and harmony among nations ?

"Cultural Exchange: A Pathway to Peace and Harmony among Nations" explores the significance of cultural exchange in promoting peace and harmony globally. It outlines key benefits, including promoting mutual understanding, encouraging respect for diversity, building trust and friendships, facilitating dialogue and conflict resolution, supporting economic development and globalization, and fostering global citizenship. The article also provides practical examples of cultural exchange programs, emphasizing their role in creating a unified global community.

How do I compare exchange rates between different countries ?

Comparing exchange rates between different countries is crucial for travelers, investors, and businesses. To effectively compare exchange rates, gather information from various sources, convert currencies, create a table for easy comparison, analyze the results, consider other factors like transaction fees and commission charges, and use online tools for accurate conversions.

Can I exchange currency online ?

You can exchange currency online through banks, currency exchangeYou can exchange currency online through banks, currency exchange-peer platforms, mobile currency exchange websites, peer-to-peer platforms, mobile apps, and cryptocurrency exchanges. Each option has its own advantages and disadvantages in terms of convenience, fees, and exchange rates. It's important to research and compare different options to find the one that best suits your needs.

How often do exchange rates fluctuate ?

Exchange rates, which determine the value of one currency in relation to another, are subject to constant fluctuations influenced by various factors such as economic indicators, political events, market speculation, and central bank policies. These fluctuations occur at different frequencies ranging from intraday to yearly intervals and can significantly impact traders, investors, and businesses involved in international trade. It is crucial for these entities to stay informed about exchange rate movements to make well-informed financial decisions.

How can we overcome language barriers in cultural exchange ?

Strategies for overcoming language barriers in cultural exchange include learning basic phrases, using technology, being patient and respectful, practicing active listening, and seeking out cultural exchange opportunities.

How do exchange rates affect Cross-Border Payment ?

Exchange rates play a crucial role in cross-border payments, impacting the cost, speed, and feasibility of transactions. They can affect transfer fees, currency fluctuations, processing time, trade opportunities, and investment opportunities. Understanding exchange rates is essential for managing them effectively in international trade or finance.

What is the importance of building a strong parent-teacher relationship in supporting student learning ?

The Importance of Building a Strong Parent-Teacher Relationship in Supporting Student Learning Building a strong parent-teacher relationship is crucial for supporting student learning. This partnership between parents and teachers can have a significant impact on a child's academic success, social development, and overall well-being. A strong parent-teacher relationship fosters open and effective communication channels, creates a supportive learning environment, promotes shared responsibility for a student's education, and cultivates positive attitudes toward education. By working together, parents and teachers can help students reach their full potential and prepare them for success in all aspects of life.

What are the pros and cons of taking out a student loan ?

Student loans can help students afford college, but also come with long-term debt and limited job opportunities.

How can educational technology enhance student engagement ?

The text discusses how educational technology can enhance student engagement. It outlines various methods such as personalized learning, interactive content, collaborative tools, real-time feedback, and flexible learning options that educators can use to improve student participation and performance in the classroom.

What are the most common scams in currency exchange ?

The most common scams in currency exchange include high fees and hidden charges, unfavorable exchange rates, phishing scams, and fake currency. To avoid these scams, it is important to read the fine print before agreeing to any transaction or service, check the current exchange rate before making a transaction, never give out personal information unless you are sure you are dealing with a legitimate source, and always inspect currency carefully before accepting it.

What is the best way to exchange currency ?

Exchanging currency is a common practice for travelers, businessmen, and investors. However, the process can be confusing and costly if not done correctly. In this article, we will discuss the best ways to exchange currency while minimizing fees and maximizing convenience. Understanding Currency Exchange Rates: Before diving into the best ways to exchange currency, it's essential to understand what affects currency exchange rates. These rates are influenced by various factors such as economic indicators, political stability, and market speculation. To get the best rate possible, keep an eye on these factors and plan your exchange accordingly. Researching Exchange Options: One of the most common ways to exchange currency is through banks and credit unions. While convenient, these institutions often have high fees and unfavorable exchange rates. It's important to compare rates and fees before choosing this option. Currency exchange offices are another popular choice for exchanging currency. They typically offer better rates than banks but may still charge high fees. It's crucial to research each office's policies and rates before making a transaction. Using an ATM to withdraw foreign currency can be a cost-effective option, especially for small amounts. However, be aware of any additional fees charged by your bank or the ATM operator. Prepaid currency cards allow you to load multiple currencies onto one card, making them a convenient option for travelers. They usually offer competitive exchange rates and low fees, but it's important to read the terms and conditions carefully. Online currency exchange services provide an easy and efficient way to exchange currency. They often offer competitive rates and low fees, but it's essential to research each service thoroughly before using them. Choosing the Best Option: The best way to exchange currency depends on several factors, including the amount of money being exchanged, the destination country, and personal preferences. Here are some general tips to help you choose the best option: Compare rates and fees: Always compare rates and fees across different options before making a decision. This will help you find the most cost-effective solution. Consider convenience: If you need access to cash quickly or frequently, consider using an ATM or prepaid currency card. These options allow you to withdraw money easily while traveling. Plan ahead: Don't wait until the last minute to exchange currency. Plan ahead and research your options to ensure you get the best rate possible. Be aware of scams: Unfortunately, there are many scams associated with currency exchange. Be wary of street vendors offering exceptionally good rates or other suspicious activities. Stick to reputable institutions and services to avoid potential fraud.

Do any restaurants offer student discounts ?

Students often look for ways to save money, and one such way is by utilizing student discounts offered by various establishments, including restaurants. In this response, we will explore if there are any restaurants that offer student discounts and what benefits they provide. Yes, there are several restaurants that offer student discounts, which can vary from place to place and may not be advertised openly. Therefore, it is important to ask the staff or check their website before visiting. The benefits of student discounts at restaurants include saving money, trying new places, socializing, and convenience. To find out if a restaurant offers student discounts, you can check their website, ask the staff, or search online. Examples of restaurants that offer student discounts include McDonald's, Subway, Pizza Hut, Dairy Queen, and Burger King. In conclusion, there are several restaurants that offer student discounts, which can help students save money while enjoying a meal out with friends or family. By checking the restaurant's website, asking the staff, or searching online, you can find out if a restaurant offers student discounts and take advantage of them.

How does educational psychology impact student learning ?

Educational psychology plays a crucial role in understanding and enhancing student learning. It helps educators understand cognitive development, enhance motivation and engagement, promote social-emotional learning, address diverse learning needs, and evaluate teaching strategies and interventions. By incorporating insights from educational psychology into their practice, teachers can create a more effective and supportive learning environment for all students.

How do student loans impact credit scores ?

Student loans can significantly impact credit scores, positively throughStudent loans can significantly impact credit scores, positively through diversified credit mix, and Best practices for managing student loans include making payments on time, keeping balances low, and exploring forgiveness or repayment options to protect and enhance financial standing.

Can I use my credit card for currency exchange ?

Using a credit card for currency exchange is convenient but comes with potential fees and less favorable exchange rates. It involves dynamic currency conversion by your bank or credit card issuer, which may add a spread or margin to the rate. To use your credit card for currency exchange, ensure it's eligible for international use, notify your bank of travel plans, understand associated fees, choose to pay in local currency, and monitor transactions. While offering convenience and security, drawbacks include fees, potentially unfavorable rates, and the need to manage credit limits. Comparing cards based on fees and rewards can optimize benefits.

Should I use a bank or a currency exchange service ?

When it comes to exchanging currencies, you have two main options: banks and currency exchange services. Both have their advantages and disadvantages, so it's important to consider your specific needs before making a decision. Advantages of Using a Bank: - Security: Banks are generally considered more secure than currency exchange services because they are regulated by government agencies. Your money is protected by insurance policies, such as the Federal Deposit Insurance Corporation (FDIC) in the United States. - Convenience: Many banks offer online and mobile banking services, allowing you to easily manage your account and make transactions from anywhere. You can also withdraw cash from ATMs worldwide without additional fees. - Fees: Banks typically charge lower fees for currency exchange compared to currency exchange services. Some banks even offer fee-free currency exchange if you have an account with them. Advantages of Using a Currency Exchange Service: - Better Exchange Rates: Currency exchange services often offer better exchange rates than banks because they specialize in foreign currency exchange. This means you can get more money for your currency than if you were to use a bank. - No Fees: Many currency exchange services do not charge any fees for exchanging currencies. However, some may still charge a small commission or service fee. - Speed: Currency exchange services are usually faster than banks when it comes to exchanging currencies. They often have shorter processing times and can provide you with the currency you need quickly. Disadvantages of Using a Bank: - Limited Availability: Not all banks offer foreign currency exchange services, especially smaller local banks. You may need to visit multiple banks to find one that offers this service. - Higher Fees: As mentioned earlier, banks typically charge higher fees for currency exchange compared to currency exchange services. This can add up quickly if you need to exchange large amounts of currency. Disadvantages of Using a Currency Exchange Service: - Security Risks: Currency exchange services are not regulated by government agencies like banks are. This means there is a higher risk of fraud or theft when using these services. - Limited Locations: Currency exchange services may not be available in all locations, especially in rural areas or smaller towns. You may need to travel to a larger city or airport to find one. - Limited Services: Currency exchange services typically only offer foreign currency exchange and do not provide other banking services like checking accounts or loans. If you need additional financial services, you will need to use a separate bank.

How can I ensure I get the best exchange rate ?

When exchanging currencies, it is important to ensure that you get the best possible exchange rate. This can help you save money and get the most value for your money. In this guide, we will discuss some tips and strategies that can help you achieve the best exchange rate possible. The first step in ensuring the best exchange rate is to research the current exchange rates online. There are many websites that provide real-time information on exchange rates, such as XE.com or OANDA. By checking these sites, you can get an idea of what the current exchange rate is and compare it to other providers. Once you have an idea of the current exchange rate, it's time to compare different providers. Look for banks, currency exchange offices, and even online services that offer competitive rates. Make a list of potential providers and compare their rates side by side. Using a credit card that doesn't charge foreign transaction fees can be a great way to get the best exchange rate. Some credit cards also offer rewards programs that give you cashback or points for using your card abroad. Look for cards that offer these benefits and make sure they don't charge any additional fees for foreign transactions. Prepaid currency cards are another option to consider when traveling abroad. These cards allow you to load them with foreign currency before your trip and use them like a debit card. They often come with lower fees than traditional bank accounts and may offer better exchange rates than exchanging cash at a currency exchange office. If you prefer to exchange cash, shop around at local currency exchange offices to find the best rates. Don't be afraid to walk away from an office if you feel like the rate they're offering isn't fair. Often, just by showing that you're willing to walk away, they may offer you a better rate. Getting the best exchange rate requires some research and planning ahead of time. By following these tips and strategies, you can ensure that you get the most value for your money when exchanging currencies.

How can educational psychology improve teacher-student relationships ?

Educational psychology can enhance teacher-student relationships by promoting empathy, clear communication, effective classroom management, emotional intelligence, cultural competence, personalized instruction, and collaboration. Understanding diverse student needs, active listening, consistent messaging, feedback, clear boundaries, fair discipline, self-awareness, managing emotions, inclusivity, adaptability, tailored instruction, personalized attention, parental involvement, and peer support are all strategies that contribute to a positive learning environment.

How do interest rates on student loans work ?

Interest rates on student loans are the percentage of the loan amount that borrowers must pay in addition to the principal balance. The interest rate is determined by the lender and can vary based on factors such as creditworthiness, type of loan, and repayment term. There are two main types of student loans: federal and private. Federal student loans have fixed interest rates that are set by Congress each year, while private student loans have variable or fixed interest rates that are determined by the lender. Interest on student loans begins to accrue as soon as the loan is disbursed, and there are several repayment options available for student loans. By choosing the right type of loan and repayment plan, you can minimize your interest costs and pay off your student loans more efficiently.

What role does art play in cultural exchange ?

Art is a powerful medium for cultural exchange, promoting understanding and empathy between different societies. It transcends language barriers and connects people on a deeper level. Art can facilitate mutual understanding by exposing individuals to diverse perspectives and experiences. Visual arts provide a visual representation of culture, while performing arts offer a dynamic form of cultural exchange. Literary arts explore the inner workings of a culture through its stories and narratives. Art also promotes creativity and innovation within cultures, encouraging experimentation with new ideas. Artistic collaborations between artists from different cultures can result in groundbreaking works that blend traditional elements with modern influences. Art serves as a means of preserving cultural heritage, documenting the history, traditions, and customs of a society. Museums and galleries showcase art from different cultures, promoting cultural awareness and appreciation among the public. Cultural festivals celebrate the artistic achievements of different cultures through various forms of performance. Overall, art plays a vital role in cultural exchange by enhancing mutual understanding, promoting creativity and innovation, and preserving cultural heritage.

How do online learning platforms enhance student engagement and performance ?

The article discusses how online learning platforms enhance student engagement and performance. It mentions personalized learning experiences, interactive content and multimedia, collaboration and communication tools, gamification and rewards, flexibility and convenience, and immediate feedback and support as key features of these platforms that contribute to improved student outcomes.

How can educational institutions use data analytics to improve student outcomes ?

Educational institutions can use data analytics to improve student outcomes by identifying areas of focus such as performance tracking, curriculum analysis, and student engagement. Implementing data-driven strategies like personalized learning, predictive analytics, and resource allocation can further enhance student success. Continuous evaluation and collaboration are key to measuring success and making necessary adjustments.

What happens if I can't repay my student loans ?

Student loans are a common way for individuals to finance their education. However, what happens if you are unable to repay your student loans? This article will explore the consequences of not being able to repay your student loans and provide some suggestions on how to avoid these consequences. If you fail to make payments on your student loans, you will eventually default on your loans. This means that you have failed to make payments for a certain period of time, usually 270 days. Once you default on your loans, the following consequences may occur: - Damage to Your Credit Score: Your credit score will be negatively impacted, which can affect your ability to obtain credit in the future. - Wage Garnishment: The government or your lender may take legal action against you to garnish your wages, which means taking a portion of your paycheck to cover the debt. - Tax Refund Offset: The government may also take a portion of your tax refund to cover the debt. - Loss of Eligibility for Future Financial Aid: You may lose eligibility for future financial aid, including grants and scholarships. In addition to the above consequences, the government or your lender may take legal action against you to recover the debt. This can result in additional fees and court costs, as well as potential damage to your reputation and career prospects. Failing to repay your student loans can have a negative impact on your future opportunities, including difficulty renting an apartment, getting hired, or starting a business. To avoid the consequences of not repaying your student loans, consider the following suggestions: - Create a Budget: Create a budget that includes your monthly expenses and income, and prioritize paying off your student loans as soon as possible. - Explore Repayment Options: Talk to your lender about different repayment options that may be available to you, such as income-driven repayment plans or deferment/forbearance options. - Seek Professional Help: If you are struggling with repayment, seek professional help from a financial advisor or credit counselor who can provide guidance on managing your debt. - Stay in Touch with Your Lender: Keep in touch with your lender and communicate any changes in your financial situation that may affect your ability to repay your loans. - Consider Consolidation or Refinancing: If you have multiple loans with different interest rates and terms, consider consolidating or refinancing them into one loan with a lower interest rate and more manageable repayment terms.

How do I apply for a student loan ?

This text provides a comprehensive guide on how to apply for a student loan. It outlines nine steps, including determining needs, researching loan options, checking eligibility requirements, gathering documents, completing and submitting the application form, waiting for approval, signing promissory notes and loan agreements, and receiving disbursement of loan funds. The guide emphasizes the importance of understanding different loan options and their terms and conditions before applying. It also highlights the need to gather all necessary documents and provide accurate information in the application form. Overall, this text is an essential resource for students seeking financial assistance for their education.

How do sports exchange programs contribute to cultural awareness and appreciation among youth ?

Sports exchange programs offer young athletes a platform to engage in cultural exchanges and foster cultural awareness and appreciation. These programs expose youth to different cultures, promote language learning, and include cultural exchange activities that break down cultural barriers. Additionally, sports exchange programs celebrate diversity, build lasting friendships, and encourage the embrace of cultural differences, contributing to a more harmonious global community.

What factors determine the amount of a student loan ?

The amount of a student loan is determined by several key factors, including eligibility criteria set by the lender, the cost of attendance at the chosen school, the student's financial need, and the type of loan (federal or private). Other influential factors include repayment options, school choice, and the availability of other financial aid. Students should consider all these elements and explore all possible funding options before taking out a loan.

How can I manage my student loan repayment after graduation ?

## Summary of Managing Student Loan Repayment After Graduation After graduation, managing student loan repayment can be a significant challenge. However, by following these steps, you can effectively manage your loans and avoid unnecessary fees or damage to your credit score: 1. **Understand Your Loan Terms**: Before starting any repayment plan, it's crucial to understand the terms of your student loans, including interest rates, monthly payments, and grace periods. 2. **Create a Budget**: A budget helps prioritize expenses and determine how much money can be allocated towards student loan repayment each month. Include all necessary expenses in your budget. 3. **Make Payments On Time**: Late payments can lead to fees and negatively impact your credit score. Set up automatic payments or make manual payments on time to avoid penalties. 4. **Consider Consolidation or Refinancing**: If you have multiple loans with different terms, consolidating them into one payment or refinancing at a lower rate may simplify repayment and save money. 5. **Explore Repayment Options**: Federal student loans offer various repayment plans, such as income-driven plans that adjust your payments based on your income and family size. Discuss the best plan with your loan servicer. 6. **Seek Help if Needed**: If struggling to make payments, don't hesitate to reach out for assistance. Many loan servicers offer forbearance or deferment options, and there are also government programs that can provide support for student loan repayment.