Expenses Advice

How do I manage debt effectively and pay it off quickly ?

Managing debt effectively and paying it off quickly requires a combination of discipline, strategy, and sometimes professional advice. Here are some steps you can take to get started: ### Assess Your Debt Situation - **Understand Your Debts**: List all your debts and identify high-interest debts. - **Determine Your Budget**: Calculate your monthly income and evaluate your expenses. ### Create a Debt Repayment Plan - **Choose a Repayment Method**: Avalanche or Snowball method. - **Make a Budget and Stick to It**: Allocate more funds to debt repayment and adjust as needed. - **Consider Refinancing Options**: Consolidate debts or negotiate with creditors. ### Implement Additional Strategies - **Increase Your Income**: Take on additional work or sell unwanted items. - **Reduce Your Expenses**: Cut out luxury spending and shop smarter. - **Improve Your Credit Score**: Pay on time and monitor your credit report. ### Seek Professional Advice if Needed - **Consult a Financial Advisor**: Personalized advice and debt management plans. - **Consider Debt Counseling**: Nonprofit credit counseling and beware of scams. Consistency and perseverance are key in paying off debt quickly.

What advice would successful businesswomen give to aspiring female entrepreneurs ?

Advice from successful businesswomen to aspiring female entrepreneurs includes believing in oneself, continuous learning and personal development, embracing risks and challenges, effective financial management, maintaining a work-life balance, collaboration and delegation, strong branding and marketing strategies, and upholding ethical practices and social responsibility. By following this advice, aspiring female entrepreneurs can navigate the challenges of starting and growing their own businesses while staying true to their values and goals.

How do I manage unexpected expenses within my budget ?

Unexpected expenses can be managed within your budget by establishing an emergency fund, reviewing and adjusting your budget, prioritizing expenses, considering short-term solutions, negotiating and seeking assistance, avoiding taking on debt, planning for future expenses, and staying vigilant with your budget. Start small with saving for emergencies, identify non-essential expenses to cut back on, prioritize essential expenses, consider side hustles or selling unused items for extra income, negotiate bills and seek assistance when needed, avoid high-interest loans, learn from past experiences to anticipate future expenses, and regularly review and adjust your budget as circumstances change.

Is it possible to lower my monthly utility expenses without sacrificing comfort ?

Yes, it is definitely possible to reduce your monthly utility expenses without compromising your comfort. Here are some tips and strategies that you can implement: - **Energy-efficient appliances**: Replace old appliances with energy-efficient models to save on electricity bills. - **Thermostat settings**: Adjust your thermostat settings to save money on heating and cooling. - **Lighting**: Use LED bulbs to use less energy and last longer than traditional incandescent bulbs. - **Water usage**: Fix leaks to save on your water bill. - **Insulation**: Improve insulation to keep your home warm in winter and cool in summer, reducing the need for heating and cooling. - **Unplug electronics**: Unplug electronics when not in use to save on your electricity bill. - **Shop around**: Shop around for better deals on your utilities. - **Be mindful of usage**: Be aware of how much water, gas, and electricity you're using to identify areas where you can cut back.

What are some tips for managing an education budget effectively ?

The article provides effective tips for managing an education budget, including creating a budget plan, tracking spending, looking for scholarships and grants, considering part-time work or freelancing, reducing unnecessary expenses, and planning ahead for future expenses. It emphasizes the importance of staying organized, prioritizing expenses, and seeking out funding opportunities to ensure that students have the resources they need to succeed in their academic pursuits.

How much does it cost to go to an idol concert ?

Attending an idol concert can be costly due to various factors such as ticket prices, travel expenses, merchandise costs, and additional fees. To manage these expenses, it's recommended to set a budget, compare prices, take advantage of group discounts, bring your own snacks, and consider the resale market for tickets.

How can I create an effective education budget plan ?

Creating an effective education budget plan involves identifying educational goals, determining expenses, evaluating financial resources, creating a budget timeline, tracking spending, and reviewing and revising the budget regularly. This process helps ensure that you have the necessary funds to cover your educational expenses while achieving your academic objectives responsibly.

How can I prioritize my educational expenses within my budget plan ?

To effectively prioritize educational expenses within a budget plan, start by identifying clear educational goals and assessing available resources such as scholarships and savings. Create a detailed budget outlining all expected costs, including tuition, books, and transportation. Evaluate each expense based on its cost versus the benefits it provides towards your goals. If necessary, set up a savings plan to cover any shortfalls in your budget. Regularly track your spending and adjust your budget as needed to stay on track financially while achieving your educational objectives.

What are the tax implications of receiving a scholarship ?

Receiving a scholarship can offset higher education costs, but understanding the tax implications is crucial. Scholarships for tuition, fees, and educational expenses are typically non-taxable, but those covering personal expenses may be taxed. Accurate record-keeping, separating expenses, consulting tax professionals, and planning ahead are key to managing these implications effectively.

Are there alternatives to taking out a student loan for college expenses ?

There are several alternatives to student loans for covering college expenses, including scholarships and grants, work-study programs, employer tuition assistance, military benefits, and crowdfunding and community support. Scholarships and grants are typically awarded based on academic merit or financial need, while work-study programs allow students to earn money through part-time jobs. Employer tuition assistance programs may cover all or a portion of tuition costs, and serving in the military can provide access to educational benefits like the GI Bill. Crowdfunding platforms and community organizations can also provide financial support for students in need.

How do I allocate funds for different educational needs in my budget plan ?

Education is crucial for personal growth, and budgeting for it is essential. Here's how to allocate funds effectively: determine goals, assess finances, create an education fund, prioritize expenses, use a budgeting tool, cut unnecessary expenses, seek financial aid, consider part-time work, and reevaluate regularly.

What are some common pitfalls when creating a household budget ?

When creating a household budget, people often fall intoWhen creating a household budget, people often fall into can lead to financial difficulties and people often fall into common pitfalls that can lead to financial difficulties and make it harder to achieve financial goals. These pitfalls include not tracking expenses, underestimating expenses, ignoring debt repayment, failing to plan for emergencies, and overspending on non-essentials. To avoid these mistakes, people should keep track of all expenses, be realistic when estimating expenses, prioritize paying off high-interest debt, set aside money for emergencies, and limit discretionary spending. By avoiding these pitfalls, people can create a budget that works for them and helps them achieve their financial goals.

How can I stick to my budget without feeling deprived ?

Sticking to a budget is easier when you don't feel deprived. Here's how to do it: 1. **Set Realistic Goals**: Break down your financial goals into smaller, more manageable ones and make them specific and measurable. 2. **Prioritize Your Expenses**: Categorize your expenses into essential and non-essential, and differentiate between needs and wants. 3. **Find Alternatives**: Consider DIY projects and buying used items instead of new ones to save money. 4. **Track Your Spending**: Use budgeting apps or visual aids to monitor your expenses and progress toward your financial goals. 5. **Reward Yourself**: Allow yourself small treats for sticking to your budget and plan larger rewards for achieving long-term financial goals. 6. **Stay Motivated**: Keep reminders of your financial goals visible and share your goals with friends or family members who can provide support.

How much money do I need to save for retirement ?

Planning for retirement is crucial to ensure a comfortable life after stopping work. The amount of money needed depends on factors like age, expected retirement age, lifestyle, and expenses. This guide helps calculate your retirement savings goal by determining your retirement age, assessing your financial situation, estimating retirement expenses, using retirement calculators, considering inflation and investment returns, and creating a savings plan. By doing so, you can work towards a comfortable and secure retirement.

What advice would a psychologist give for someone with severe exam anxiety ?

Exam anxiety is a common issue that can impact performance. A psychologist offers advice on recognizing symptoms, identifying triggers, coping strategies (time management, study techniques, relaxation techniques, positive self-talk, seeking support), preparing for the exam day (sleep, healthy meal, arriving early), during the exam (reading instructions carefully, staying calm and confident, managing time wisely), and after the exam (reflecting on performance, taking care of yourself). By understanding exam anxiety and adopting effective strategies, individuals can overcome their fears and perform to the best of their abilities.

How can I track and monitor my education budget plan effectively ?

Effectively tracking and monitoring your education budget plan is crucial for managing finances and achieving academic goals without unnecessary debt. Strategies include setting clear goals, creating a comprehensive budget, using financial tools, regularly tracking expenses, making adjustments as needed, and seeking professional advice when necessary. Following these steps can help you stay on track financially while pursuing your academic objectives.

What advice would you give to women who struggle with managing relationships ?

Managing relationships can be challenging, especially for women juggling multiple roles. Effective strategies include open communication, setting healthy boundaries, practicing empathy, maintaining independence, resolving conflicts constructively, and continuous mutual growth. By adopting these approaches, women can enhance their relationship management skills and foster more fulfilling connections.

How long does it take to achieve financial freedom ?

Achieving financial freedom is a goal many people strive for, but the time it takes varies based on individual circumstances, habits, and market conditions. Factors influencing the journey include initial financial standing, income level and consistency, lifestyle and expenses, investment choices and returns, and economic and market conditions. Strategies to potentially shorten the timeline include increasing income, reducing expenses, investing wisely, managing debt, and planning for retirement. The path to financial freedom is unique for each person, but understanding the factors and using effective strategies can help anyone work towards achieving financial independence more efficiently.

How can women effectively manage their wealth ?

Managing wealth is crucial for women to achieve financial security. Tips include setting SMART financial goals, creating a budget, building an emergency fund, investing wisely, prioritizing retirement savings, and seeking professional advice. By following these steps, women can effectively manage their wealth and achieve their financial goals.

Can I retire early without jeopardizing my financial security ?

Retiring early is a goal for many, but it requires careful planning to ensure financial security. Key steps include assessing your current finances, setting clear retirement goals, creating a comprehensive plan, and seeking professional advice. By following these strategies, you can achieve early retirement without jeopardizing your financial well-being.

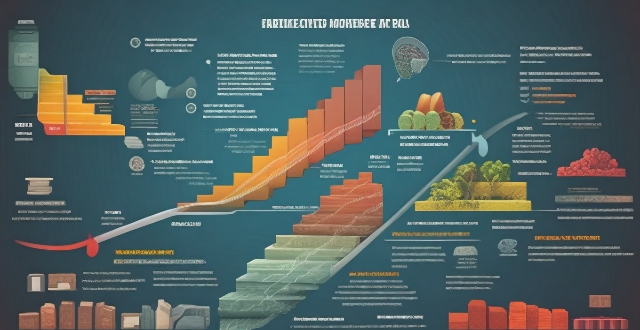

What are the key factors to consider when designing an energy storage system for a specific application ?

When designing an energy storage system (ESS) for a specific application, key factors to consider include capacity (power and energy requirements, discharge rate), efficiency (round-trip efficiency, self-discharge rate), reliability (cycle life, safety), cost (capital expenses, operating expenses), environmental impact (sustainability, emissions), and scalability (modular design, flexibility). These considerations will ensure the ESS meets application needs while operating efficiently, reliably, and sustainably.

What are the closing costs associated with a mortgage ?

Closing costs are fees and expenses associated with finalizing a real estate transaction. These costs vary based on location, property type, and lender requirements. Common closing costs for buyers include loan origination fees, appraisal fees, credit report fees, title search and insurance fees, attorney fees, recording fees, prepaid interest, homeowner's insurance premium, property taxes, and other miscellaneous fees. It is important to budget for these expenses in advance and review all closing documents carefully to avoid any financial surprises during the home-buying process.

How can I ensure that my education budget plan is sustainable in the long term ?

Proper planning and management of an education budget are crucial for ensuring its long-term sustainability. Here's how you can achieve that: * Establish clear goals that are specific, measurable, achievable, relevant, and time-bound (SMART). * Conduct a thorough analysis of your current financial situation, projected costs, and sources of funding. * Create a comprehensive plan that includes budget allocation, revenue streams, and expense tracking. * Review and adjust the plan periodically to adapt to changes in personal circumstances, market conditions, or educational requirements. * Seek professional advice from financial advisors and education counselors to ensure the best outcomes.

How much would it cost to implement geoengineering on a large scale ?

The text discusses the financial implications of implementing large-scale geoengineering projects to counteract global warming. Key points include research and development costs, initial implementation expenses, ongoing operational costs, uncertainty and risk management expenses, and legal and regulatory compliance costs. The analysis suggests that large-scale geoengineering would require significant funding and resources.

What are some effective personal finance management strategies ?

Managing personal finances effectively is crucial for achieving financial stability and long-term success. Here are some effective personal finance management strategies: 1. Create a budget that tracks income, expenses, savings, and adjustments. 2. Build an emergency fund with at least 3-6 months' worth of living expenses in a high-yield savings account or money market fund. 3. Pay off high-interest debt using the snowball or avalanche method. 4. Invest for long-term goals by starting early, diversifying, and staying consistent. 5. Protect your finances with health insurance, disability insurance, and life insurance. 6. Plan for retirement by starting early, maximizing contributions, and investing wisely. 7. Educate yourself through reading books, taking courses, and seeking professional advice.

What advice would you give to families new to homeschooling ?

Homeschooling requires careful planning, dedication, and patience. To create a successful and enjoyable learning environment for children while maintaining their own well-being, families new to homeschooling should: 1. Set clear goals and expectations by establishing a vision, defining objectives, and communicating expectations. 2. Create a structured schedule with a consistent routine, flexibility, and balance. 3. Utilize resources and support systems such as online resources, local groups, and professional help. 4. Foster an enjoyable learning environment through positive reinforcement, incorporating interests, and hands-on activities. 5. Maintain open communication with regular check-ins, active listening, and adapting teaching styles based on feedback. 6. Prioritize self-care for parents by taking breaks, seeking support, and maintaining hobbies.

How can I create a successful savings plan ?

Creating a successful savings plan is essential for achieving financial goals, such as saving for a down payment, retirement, or an emergency fund. The steps to create a successful savings plan include setting clear financial goals, analyzing the current financial situation, establishing a budget, automating savings, choosing the right tools, monitoring and adjusting the plan, and seeking professional advice. Consistency and perseverance are key to success in sticking to the plan.

How often should I review and adjust my budget ?

Regular budget reviews are essential for maintaining financial health, helping to align spending with evolving goals, adjust for unexpected expenses, and account for inflation. Conduct monthly, quarterly, and annual reviews to monitor cash flow, analyze spending patterns, and make necessary adjustments. Focus on income vs. expenses, debt management, savings goals, emergency funds, subscription services, and bill negotiation. After each review, adjust spending, increase savings, revisit goals, improve cash flow, and seek professional advice as needed.

How do I create a budget plan for my small business ?

This guide provides a step-by-step approach to creating a budget plan for small businesses, emphasizing the importance of defining business goals, analyzing financial data, categorizing expenses, setting realistic revenue projections, determining break-even points, and allocating funds accordingly. It also stresses the need for regular monitoring and adjustments to the budget, along with tips for effective budget management such as staying flexible, using budgeting tools, seeking professional advice, communicating with the team, and reviewing past budgets.

How can women balance their personal financial goals with family responsibilities ?

The article discusses strategies for women to balance their personal financial goals with family responsibilities, such as prioritizing goals, creating a budget, planning for emergencies, investing wisely, and seeking professional advice.