Finance Tech

How does Fintech influence the job market in the finance industry ?

The influence of fintech on the job market in the finance industry has led to the creation of new roles and changes in the skillset required for existing positions. Fintech companies have increased demand for software developers, data scientists, and cybersecurity experts. Additionally, specialized financial roles like fintech startup founders, regulatory compliance officers, and customer experience managers have emerged. Traditional finance roles such as bankers, accountants, and investment advisors now require proficiency in digital tools and an understanding of automation and data analytics. As technology continues to advance, the finance industry workforce will need to adapt continuously to stay relevant in the changing job market.

What are the top holiday gifts for tech enthusiasts ?

This holiday season, surprise the tech enthusiasts in your life with top gifts ranging from the latest smartphones and tablets to immersive gaming experiences and smart home devices. Offer them the convenience of wearable technology and audiophile essentials for superior sound quality. Accessories like wireless chargers and mechanical keyboards enhance their tech experience, while gadgets such as drones and 3D printers bring innovation to their interests. Don't forget about software and subscription services for continuous entertainment and productivity. Choose wisely based on their preferences and existing devices for a personalized touch.

What role does innovation play in the success of tech stocks ?

Innovation is key to the success of tech stocks, impacting product development, market expansion, efficiency, disruption, and investor sentiment. Tech companies that prioritize innovation often outperform competitors and provide strong returns for shareholders.

What are some undervalued tech stocks worth considering ?

Tech stocks are popular but not all are equal; some may be undervalued, presenting a great opportunity for investors. This article discusses four such stocks: Cloudflare, Palo Alto Networks, Twilio, and Zscaler. These companies have seen strong growth and have large addressable markets, yet their stock prices have been relatively flat since their peaks in 2019-2021. They offer potential bargains for investors looking for value in the tech sector.

What is the outlook for tech stocks in 2022 ?

The outlook for tech stocks in 2022 is uncertain due to several factors that could impact their performance. Key factors affecting tech stocks in 2022 include the ongoing economic recovery from the COVID-19 pandemic, potential rising interest rates, regulatory risks, and innovation and disruption. While the economic recovery and continued innovation in the sector could drive growth, rising interest rates and regulatory risks could pose challenges for some companies. Investors should carefully consider these factors before making any investment decisions in the tech sector.

Which tech companies are leading the market ?

This article discusses the leading tech companies in the market, including Apple Inc., Microsoft Corporation, Amazon.com, Inc., Alphabet Inc. (Google), and Facebook, Inc. It highlights their key products and services, such as Apple's innovative devices, Microsoft's software and cloud services, Amazon's e-commerce platform and AWS, Google's search engine and Android OS, and Facebook's social media platforms and advertising revenue. The article also notes the competitive nature of the tech industry and the potential for new leaders to emerge in the future.

How does the pandemic affect the performance of tech stocks ?

The COVID-19 pandemic has significantly impacted tech stock performance through increased demand for technology, supply chain disruptions, changes in investor sentiment, and government stimulus and regulation. Remote work and learning have boosted tech sales, while e-commerce growth has further driven revenue. However, production delays and component shortages pose challenges. Investor behavior varies, with some seeking safety in tech stocks and others avoiding risk. Government support and regulatory changes also influence the sector's performance. The long-term effects on tech stocks remain uncertain.

How have tech stocks performed in the last year ?

In the last year, tech stocks have experienced significant fluctuations in performance, with major companies like Apple, Amazon, Google, and Microsoft leading the market. Emerging technologies such as artificial intelligence, cloud computing, and electric vehicles have shown strong growth potential. Factors influencing tech stocks include economic recovery, innovation, regulatory scrutiny, supply chain challenges, and interest rates. Top performers include Apple, Amazon, Microsoft, NVIDIA, and Tesla, while underperformers include Facebook (Meta Platforms), Twitter, and Snap Inc. Investors should consider both the potential rewards and risks associated with investing in this dynamic sector.

What is green finance ?

Green finance is the use of financial instruments and strategies to support environmentally friendly projects. It includes sustainable investing, green bonds, green banks, carbon credits, impact investing, climate-related disclosures, ESG criteria, green indexes, green funds, green insurance, green tax incentives, green microfinance, green real estate, green technology, and green partnerships. The goal of green finance is to promote economic growth while minimizing negative impacts on the environment.

What is the function of thermoregulation in high-tech sportswear ?

The text discusses the function of thermoregulation in high-tech sportswear. It explains that thermoregulation is crucial for athletes to maintain their optimal body temperature during physical activities, as overheating or being too cold can affect their performance and increase the risk of injury. High-tech sportswear uses advanced materials and technologies to regulate temperature and manage moisture, including insulation, ventilation, moisture-wicking capabilities, and quick drying. These garments also adapt to different environments through layering systems and seasonal variants. Overall, the function of thermoregulation in high-tech sportswear is essential for athletes to stay comfortable, focused, and efficient during their activities.

How secure is decentralized finance compared to traditional finance ?

The text provides a comparative analysis of the security aspects of decentralized finance (DeFi) and traditional finance (TradFi). DeFi relies on blockchain technology for peer-to-peer transactions, while TradFi operates through centralized institutions. Both systems have unique security features and risks, with DeFi offering transparency and automated contract execution but facing smart contract vulnerabilities and lack of regulatory clarity. TradFi benefits from regulatory oversight and physical security measures but is susceptible to systemic risks and cybersecurity threats. The choice between DeFi and TradFi depends on individual preferences and risk tolerance, and it's crucial to stay informed about new developments in the evolving financial landscape.

What are the risks associated with green finance investments ?

The article discusses the various risks associated with green finance investments, including market risk, credit risk, operational risk, environmental risk, reputational risk, and legal and regulatory risk. It emphasizes the importance of understanding these risks before making investment decisions in order to achieve desired levels of risk and return.

How do I invest in tech stocks as a beginner ?

Investing in tech stocks can be a profitable venture, but it's important to approach it with caution and knowledge. Here are some steps to help you get started: 1. Educate yourself on the basics of the stock market and the technology sector. 2. Set investment goals based on your risk tolerance and desired returns. 3. Choose a reputable brokerage firm that offers access to the stock market. 4. Research individual tech stocks by looking at financial statements, earnings reports, and news articles. 5. Diversify your portfolio by investing in multiple tech stocks across different industries and companies. 6. Monitor your investments and stay informed about industry developments and company news. 7. Remember that investing in stocks involves risks, including the possibility of losing money. Do your own research and consult with a financial advisor before making any investment decisions.

How do high-tech training facilities contribute to athlete development and recovery ?

High-tech training facilities contribute to athlete development and recovery by providing advanced equipment, technologies, and personalized programs. These resources help improve performance, prevent injuries, and facilitate efficient recovery.

What are the most popular tech gifts for this holiday season ?

The holiday season is a time for giving and receiving gifts, and technology has become an increasingly popular category of gift items. From smartphones to smart home devices, there are plenty of options to choose from. Here are some of the most popular tech gifts for this holiday season: 1. Smartphones: iPhone 13, Samsung Galaxy S21, Google Pixel 6 2. Smart Home Devices: Amazon Echo Show 10, Google Nest Hub, Philips Hue Lightstrip 3. Laptops and Tablets: MacBook Air M1, Dell XPS 13, iPad Pro 4. Wearables: Apple Watch Series 7, Fitbit Charge 5, Samsung Galaxy Watch 4 5. Gaming Consoles: PlayStation 5, Xbox Series X, Nintendo Switch OLED These are just a few examples of the many tech gifts available this holiday season. Whether you're looking for something practical or fun, there's sure to be something on this list that will make a great gift for any tech enthusiast on your list!

What are the ethical considerations in the allocation and use of climate finance ?

The article discusses the key ethical considerations that must be addressed in the allocation and use of climate finance to ensure its effectiveness and equity. These considerations include transparency, accountability, equity, justice, sustainability, long-term goals, inclusivity, participation, innovation, and learning. By prioritizing these factors, climate finance can contribute more effectively to global efforts to tackle climate change and create a more just and resilient world for current and future generations.

What are the benefits of investing in green finance ?

The text discusses the benefits of investing in green finance, which supports environmentally friendly projects. It highlights three main categories of benefits: environmental, economic, and social. Environmental benefits include reducing carbon emissions, conserving natural resources, and protecting biodiversity. Economic benefits encompass job creation, innovation stimulation, and reduced energy costs. Social benefits involve improving public health, promoting social equity, and enhancing the quality of life. The article emphasizes that investing in green finance contributes to sustainable development and a better future for all.

What is the status of climate finance commitments made during climate change negotiations ?

This text discusses the status of climate finance commitments made during climate change negotiations, highlighting their importance in mitigating and adapting to climate change. It outlines key points regarding financial commitments, progress towards targets, channels for finance, and the need for improved monitoring and reporting mechanisms. The text also explores the involvement of both the public and private sectors in climate finance, as well as the challenges and opportunities that exist in this area. Finally, it emphasizes the significance of increasing transparency, improving accountability, and exploring innovative financing solutions to ensure that these commitments result in meaningful actions to address climate change.

What are the benefits of using decentralized finance ?

Decentralized finance (DeFi) is a sector within the cryptocurrency space that aims to create an open-source, permission-less, and transparent financial service ecosystem using blockchain technology. It offers several benefits over traditional financial systems, including increased accessibility, lower costs, greater transparency, enhanced security, programmable money, improved efficiency, and financial inclusion. By eliminating intermediaries and reducing overhead costs, DeFi makes financial services more affordable and accessible to a wider audience. Its transparent ledger system reduces fraud and increases trust among participants, while its secure blockchain networks protect user funds. DeFi also enables programmable money, allowing for customized financial products and services, and improves efficiency by streamlining transaction processing. Ultimately, DeFi has the potential to revolutionize finance by democratizing access to essential financial services for underbanked populations and bridging the gap between developed and developing countries in terms of financial access.

In what ways does financial literacy affect personal finance management ?

Financial literacy is crucial for managing personal finances effectively, as it helps individuals understand basic financial concepts, promotes prudent budgeting and spending habits, shapes savvy saving and investing strategies, and facilitates efficient debt management.

What are the key challenges facing the growth of green finance ?

Green finance is facing several key challenges, including lackGreen finance is facing several key challenges, including lack data availability, inadequ there needs to be greater harmonization and standardization of definitions and reporting requirements for green finance, increased efforts to collect and share data on environmental impacts and risks, stronger regulatory frameworks that encourage transparency and accountability, greater education and outreach efforts aimed at increasing awareness and understanding of green finance among investors, and greater emphasis on highlighting the potential economic benefits of green finance.

What is the relationship between climate finance and disaster risk reduction ?

Climate finance and disaster risk reduction are interconnected concepts that address the impacts of climate change. Climate finance provides funding for projects aimed at reducing greenhouse gas emissions and adapting to climate change, while disaster risk reduction involves strategies to minimize the potential impacts of natural disasters on communities and infrastructure. The relationship between the two lies in their shared goal of addressing climate change, with climate finance supporting disaster risk reduction through funding for adaptation measures, investments in vulnerable communities, promoting sustainable development, encouraging innovation, and strengthening institutional capacity.

What innovations in financial instruments are being used to mobilize climate finance ?

Innovations in financial instruments for mobilizing climate finance include green bonds, climate derivatives, sustainable investment funds, impact investment funds, and microfinance for climate action. These tools aim to support projects that reduce greenhouse gas emissions, adapt to climate change, and promote sustainable development while offering investors potential returns and risk management options.

What role does technology play in modern finance and banking ?

Technology has revolutionized the finance and banking industry by enhancing efficiency, improving customer experience, and driving innovation. Automation, streamlined processes, and cost reduction have made financial services more efficient. Personalization, accessibility, and advanced cybersecurity measures have improved customer experiences. Fintech startups, blockchain technology, and cryptocurrencies are driving innovation in the industry. As technology continues to evolve, it will play an even greater role in shaping the future of finance and banking.

How can climate finance be integrated with national development plans and strategies ?

Integrating Climate Finance with National Development Plans and Strategies emphasizes the importance of aligning climate finance with national priorities, ensuring policy coherence, participatory planning, resource mobilization, risk management, monitoring and evaluation, capacity building, transparency and accountability. Key implementation steps include assessment and diagnosis, formulation of integrated strategies, financing mechanisms, implementation and disbursement, and reporting and learning. By integrating climate finance, countries can address climate change while promoting sustained economic growth and social well-being.

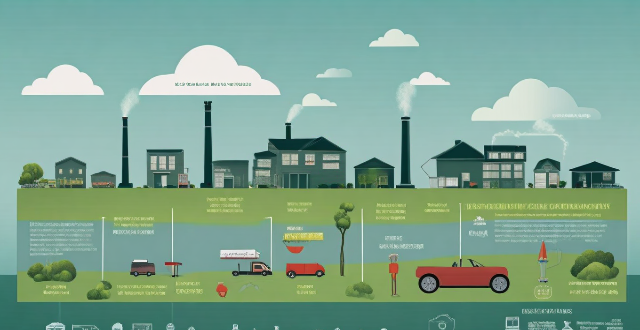

What is green finance and how does it relate to climate change ?

Green finance is the financing of projects that have environmentally friendly impacts, such as reducing carbon emissions or conserving natural resources. It involves investing in renewable energy sources, clean technologies, and sustainable infrastructure projects that aim to mitigate climate change and promote a greener economy. The relationship between green finance and climate change includes impact on carbon emissions, promotion of sustainable practices, innovation and technology development, risk management and resilience, market incentives and policy support, stakeholder engagement, and international cooperation. Green finance plays a crucial role in addressing climate change by directing capital towards environmentally beneficial projects and practices.

How can green finance be integrated into mainstream financial markets and products ?

Green finance is the integration of environmental considerations into financial decision-making processes. It involves using financial mechanisms to support sustainable development and promote environmentally friendly investments. Integrating green finance into mainstream financial markets and products is crucial for addressing climate change and promoting sustainable economic growth. This response discusses various ways in which green finance can be integrated into mainstream financial markets and products, including promoting green bonds, stocks, mutual funds, ETFs, and banking products; establishing supportive regulations; and raising awareness about sustainable investments.

What are some effective personal finance management strategies ?

Managing personal finances effectively is crucial for achieving financial stability and long-term success. Here are some effective personal finance management strategies: 1. Create a budget that tracks income, expenses, savings, and adjustments. 2. Build an emergency fund with at least 3-6 months' worth of living expenses in a high-yield savings account or money market fund. 3. Pay off high-interest debt using the snowball or avalanche method. 4. Invest for long-term goals by starting early, diversifying, and staying consistent. 5. Protect your finances with health insurance, disability insurance, and life insurance. 6. Plan for retirement by starting early, maximizing contributions, and investing wisely. 7. Educate yourself through reading books, taking courses, and seeking professional advice.

How can climate finance be leveraged to support renewable energy projects ?

Climate finance plays a crucial role in supporting renewable energy projects. Here are some ways to leverage it: 1. Public-Private Partnerships (PPPs) can be used to attract private investment into renewable energy projects. 2. Green Bonds can be issued to fund environmentally friendly projects such as solar and wind farms. 3. Carbon Pricing Mechanisms can generate revenue that can be invested in renewable energy projects. 4. International Climate Finance Initiatives can provide funding for renewable energy projects in developing countries. 5. Crowdfunding Platforms offer another way to raise funds for renewable energy projects. By using a combination of these strategies, we can accelerate the transition towards a more sustainable future.

How effective has international climate finance been in reducing greenhouse gas emissions ?

The text discusses the effectiveness of international climate finance in reducing greenhouse gas emissions. It states that such a financial mechanism is vital for supporting developing countries to reduce their GHG emissions and adapt to climate change impacts, but it falls short of global climate action needs. The key points include the total funds committed and disbursed, allocation across sectors and regions, direct and indirect emission reductions achieved, and challenges related to funding adequacy, allocation, and monitoring. The conclusion emphasizes the importance of addressing these challenges to enhance the effectiveness of international climate finance in the future.