Flow Spending

How often should I review and adjust my budget ?

Regular budget reviews are essential for maintaining financial health, helping to align spending with evolving goals, adjust for unexpected expenses, and account for inflation. Conduct monthly, quarterly, and annual reviews to monitor cash flow, analyze spending patterns, and make necessary adjustments. Focus on income vs. expenses, debt management, savings goals, emergency funds, subscription services, and bill negotiation. After each review, adjust spending, increase savings, revisit goals, improve cash flow, and seek professional advice as needed.

How do flow batteries compare to traditional chemical batteries ?

Flow batteries and traditional chemical batteries are both used for energy storage, but differ in aspects such as energy storage mechanism, power and energy density, lifespan and maintenance, and cost and scalability. Traditional chemical batteries store energy through chemical reactions within cells and have a fixed capacity, while flow batteries use external tanks of electrolyte solutions and have adjustable capacity. Traditional chemical batteries can deliver high power output per unit weight or volume and have moderate energy density, while flow batteries typically have lower power density but higher energy density. Traditional chemical batteries have a limited number of charge and discharge cycles before performance degrades and require regular maintenance, while flow batteries can undergo a larger number of cycles without significant degradation and require less maintenance. Traditional chemical batteries often have higher upfront costs and limited scalability, while flow batteries generally have lower upfront costs and offer more flexibility in scaling up. The choice between the two depends on the specific requirements of the energy storage application.

How do economic recessions and downturns affect consumer spending on sports-related activities and products ?

Economic recessions significantly impact consumer spending on sports-related activities and products, affecting various aspects of the industry. Reduced disposable income leads to budget cuts and prioritization of basic needs over leisure activities. Changes in consumer behavior include seeking value-oriented options and DIY approaches to sports participation. Decreased ticket sales, cancellations/rescheduling of events, reduced sales of sports goods, and bargain hunting are common during economic downturns. Gym memberships may be canceled in favor of free or lower-cost alternatives, and investment in fitness technology could suffer. Fewer trips for sports tourism and a rise in localized activities are also likely. Sponsorships and advertising revenue may decrease, leading to job losses and wage stagnation across the sports industry. Long-term effects include recovery time and shifting habits formed during recessions. As economies recover, the sports industry must adapt to these changes and find innovative ways to attract consumers back to their venues.

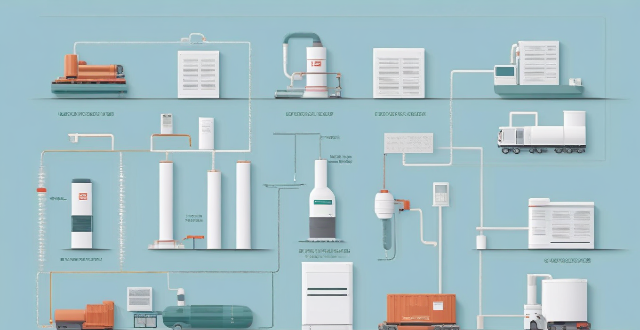

Can you explain the working principle of a flow battery for energy storage ?

Flow batteries are a type of rechargeable battery that store energy in two chemical solutions pumped past an ion-exchange membrane. Key components include electrolyte tanks, pumps, and the cell stack. During charging, electrical energy is converted into chemical energy by moving ions across the membrane, storing them as potential gradients. Discharging reverses this process to generate electricity. Flow batteries offer scalability, decoupling of power and energy, long lifespan, and good efficiency but face challenges like cost, maintenance, and size. They are suitable for large-scale energy storage applications.

What are the benefits of installing a low-flow toilet ?

Low-flow toilets offer water conservation, cost savings, and environmental protection. They also provide excellent performance and can increase home value.

How can I avoid impulse buying and stick to my budget ?

Impulse buying is a common problem for many people, but there are strategies you can use to avoid it and stick to your budget. Creating a budget, setting financial goals, using cash instead of credit cards, avoiding temptation, and practicing mindful spending are all effective ways to control your spending and achieve your financial objectives. By implementing these strategies, you can take control of your finances and make progress towards your long-term goals.

How does tax planning affect a country's economy ?

Tax planning is a crucial component of any country's fiscal policy, as it affects various aspects of the economy, including government spending, investment decisions, and consumer behavior. Increased tax revenue can lead to higher government spending in critical sectors like healthcare and education, which can improve living standards and stimulate economic growth. Tax incentives can encourage businesses to invest in areas aligned with economic objectives, leading to job creation and technological advancements. Additionally, tax planning can influence consumer behavior by affecting prices, discouraging consumption of certain products, and promoting responsible spending habits. Overall, effective tax planning is essential for fostering economic growth, enhancing living standards, and promoting sustainable development.

How can I avoid overspending during the discount season ?

During the discount season, it's important to avoid overspending. Here are some tips: set a budget, make a list of desired items, research prices, use cash or debit cards, avoid impulse buys, and shop online for better deals. By following these steps, you can enjoy discounts without overspending.

How can companies use credit management to improve cash flow ?

Credit management is crucial for companies extending credit to customers. Strategies include implementing a credit policy, conducting credit checks, monitoring receivables, offering multiple payment options, incentivizing timely payments, using automated tools, and periodically reviewing and adjusting processes. These steps can help reduce bad debts and improve cash flow.

What are the best practices for teaching children about money management and savings ?

Teaching children about money management and savings is an essential life skill that can help them develop good financial habits. Here are some best practices for teaching children about money management: 1. Start early: Even toddlers can understand basic concepts like saving and spending. Use everyday opportunities to talk about money and its value. 2. Lead by example: Children learn by example, so it's important to model good financial habits yourself. Show them how you budget, save, and make decisions about spending. 3. Use allowances wisely: Giving your child an allowance is a great way to teach them about money management. Encourage saving, teach spending, and introduce giving as part of their allowance. 4. Play money games: Board games and online games can be fun and educational at the same time. Some popular ones include Monopoly, The Game of Life, and PiggyBot. 5. Involve them in family finances: Involving your children in family finances can help them understand the real-world implications of money management. Have them help you create a budget, go grocery shopping with you, and talk to them about bills and expenses. Remember to be patient, consistent, and positive when teaching children about money management and savings. With these best practices, your child will develop good financial habits that will serve them well throughout their life.

How do I make restaurant-quality meals at home without spending too much ?

To make restaurant-quality meals at home without spending too much, start by planning your meals and shopping smart. Prep ingredients in advance and master basic cooking techniques. Invest in good kitchen tools and create the right ambiance to enhance the dining experience. Remember that practice makes perfect, so keep trying new recipes and learning from mistakes. By following these steps, you can enjoy delicious, affordable meals at home.

What are the benefits of effective credit management for businesses ?

Effective credit management is crucial for businesses to maintain a healthy cash flow, reduce financial risks, and ensure long-term success. Key benefits include improved cash flow through reduced payment delays, prevention of bad debts, and better negotiation power; increased financial stability with lower interest expenses, improved access to financing, and enhanced investor confidence; greater competitive advantage through stronger customer relationships, higher market share, and improved reputation; and risk mitigation via reduced fraud risk, compliance with regulations, and risk assessment.

What role does budgeting play in financial planning ?

Budgeting is crucial for financial planning, helpingBudgeting is crucial for financial planning, helping-term goals by tracking income helping individuals and businesses achieve long-term goals by tracking income, expenses, and savings. It aids in setting goals, tracking expenses to cut back on spending, allocating resources effectively, managing cash flow, and reducing financial stress. By creating a realistic budget and sticking to it, individuals and businesses can maintain a healthy financial status and achieve their short-term and long-term objectives.

What are the most effective energy storage solutions currently available ?

The text discusses the crucial role of energy storage in modern energy systems, enabling the utilization of excess energy during low demand periods for peak demand. It presents a summary of various effective energy storage solutions, including pumped hydro storage, battery storage, compressed air energy storage (CAES), flywheels, flow batteries, superconducting magnetic energy storage (SMES), and thermal energy storage. Each solution has unique features and applications, such as high capacity for pumped hydro, fast response times for batteries and flywheels, and flexible design for flow batteries. The choice among these solutions depends on factors like application, cost, geography, and desired duration and scale of storage.

How can I create an effective education budget plan ?

Creating an effective education budget plan involves identifying educational goals, determining expenses, evaluating financial resources, creating a budget timeline, tracking spending, and reviewing and revising the budget regularly. This process helps ensure that you have the necessary funds to cover your educational expenses while achieving your academic objectives responsibly.

What are the steps to achieving financial freedom ?

Achieving financial freedom is a multi-step process that involves defining personal goals, creating a budget, paying off debt, building an emergency fund, investing wisely, increasing income streams, living below one's means, and continuously educating oneself about personal finance strategies. This journey requires patience, persistence, and a commitment to long-term growth rather than short-term gains. By following these steps, individuals can work towards achieving the lifestyle they desire without relying on traditional forms of income such as a job.

How can I maintain my financial freedom once I achieve it ?

The text discusses strategies for maintaining financial freedom, including creating a budget and sticking to it, building an emergency fund, investing wisely, living below one's means, and continuously learning and growing. It emphasizes the importance of discipline, planning, and effort in sustaining financial independence.

Can waste reduction lead to cost savings for individuals and companies ?

Waste reduction can lead to cost savings for both individuals and companies by minimizing waste in various aspects of daily life and business operations. For individuals, reducing food waste through meal planning and proper storage, minimizing energy consumption with energy-efficient appliances and water conservation, and reducing unnecessary spending through secondhand shopping and repairing instead of replacing can result in significant cost savings. Companies can also benefit from waste reduction by optimizing production processes with lean manufacturing techniques and resource recovery, improving logistics and supply chain management through just-in-time inventory and efficient packaging, and enhancing energy efficiency with green building design and employee training. Overall, waste reduction is a crucial aspect of sustainable living and business practices that can lead to cost savings while contributing to environmental sustainability.

How does a sedentary lifestyle affect job productivity and overall health ?

This article discusses the negative impacts of a sedentary lifestyle on job productivity and overall health. It outlines how prolonged periods of sitting can lead to decreased energy levels, impaired cognitive function, and increased stress and anxiety in the workplace. It also highlights the increased risk of chronic diseases such as heart disease, diabetes, and obesity, as well as musculoskeletal issues and poor mental health associated with a sedentary lifestyle. The article concludes by emphasizing the importance of incorporating regular physical activity into daily routines and maintaining a healthy work-life balance to improve job performance and overall well-being.

How do I create a budget plan for my small business ?

This guide provides a step-by-step approach to creating a budget plan for small businesses, emphasizing the importance of defining business goals, analyzing financial data, categorizing expenses, setting realistic revenue projections, determining break-even points, and allocating funds accordingly. It also stresses the need for regular monitoring and adjustments to the budget, along with tips for effective budget management such as staying flexible, using budgeting tools, seeking professional advice, communicating with the team, and reviewing past budgets.

Are there any lifestyle changes that can boost female fertility ?

Female fertility can be influenced by various lifestyle factors, including weight, diet, exercise, stress levels, smoking, and alcohol intake. Making changes in these areas can boost fertility. Maintaining a healthy weight, eating a balanced diet, getting regular exercise, managing stress levels, quitting smoking, limiting alcohol intake, and considering alternative treatments like herbal supplements and acupuncture can all contribute to improving female fertility. It's essential to work closely with a healthcare provider to determine which lifestyle changes are best suited for individual needs and circumstances.

How do economists evaluate the effectiveness of a particular economic stimulus plan ?

Economists evaluate the effectiveness of economic stimulus plans by considering factors such as GDP growth rate, inflation rate, unemployment rate, job creation, government spending, deficit and debt levels, personal consumption expenditures, consumer confidence, sectoral analysis, regional impact, sustainability, and legacy. These evaluations help determine whether the plan has achieved its intended goals and guide future policy decisions.

In what ways does financial literacy affect personal finance management ?

Financial literacy is crucial for managing personal finances effectively, as it helps individuals understand basic financial concepts, promotes prudent budgeting and spending habits, shapes savvy saving and investing strategies, and facilitates efficient debt management.

How can governments fund economic stimulus plans effectively ?

Governments can fund economic stimulus plans through increased government spending, tax cuts, issuing bonds, monetary policy measures, privatizing assets, international aid and loans, and budget reallocation.

Are there any apps that can help me improve my saving habits ?

The article discusses various apps that can help improve saving habits. These include Mint, Acorns, Goodbudget, and Digit. Mint is a free budgeting and personal finance app that helps track spending, create a budget, and set financial goals. Acorns is a micro-investing app that rounds up purchases to the nearest dollar and invests the difference in low-cost index funds. Goodbudget is a simple yet powerful budgeting tool that uses the envelope method to manage money effectively. Digit is a smart savings app that automatically transfers small amounts of money from checking accounts into separate savings accounts based on spending patterns. By using these apps, one can develop better saving habits and work towards achieving financial goals more efficiently.

In what circumstances is an economic stimulus plan most necessary ?

An economic stimulus plan is most necessary during times of recession, slow economic growth, high unemployment rates, or financial crisis. These plans can help to boost economic activity, create jobs, and stabilize the financial system by implementing policies such as increasing government spending, reducing taxes, providing subsidies to businesses, encouraging investment in new technologies, expanding access to credit, investing in infrastructure projects, offering tax incentives for hiring new employees, and implementing regulatory reforms.

How can I create a budget that works for me ?

Creating a budget that works for you is crucial to achieving your financial goals. Here are some steps to help you create a budget that suits your needs: Step 1: Determine Your Income The first step in creating a budget is to determine your income, including your salary, bonuses or commissions, and any other sources of income. Step 2: List Your Expenses Next, make a list of all your expenses, including fixed expenses such as rent/mortgage, car payments, insurance premiums, and utilities, as well as variable expenses such as groceries, entertainment, and clothing. Step 3: Categorize Your Expenses Once you have listed all your expenses, categorize them into different categories such as housing, transportation, food, entertainment, etc. This will help you see where your money is going and identify areas where you can cut back on spending. Step 4: Set Financial Goals Before creating a budget, it's important to set financial goals. These goals could be short-term, such as saving for a vacation, or long-term, such as saving for retirement. Having clear financial goals will help you prioritize your spending and stay motivated to stick to your budget. Step 5: Allocate Your Money Now that you have determined your income, listed your expenses, categorized them, and set financial goals, it's time to allocate your money. Start by subtracting your total monthly expenses from your total monthly income. The remaining amount is what you have left to save or spend on discretionary items. Make sure to allocate money towards your financial goals first, then prioritize your other expenses based on their importance. Step 6: Track Your Spending Finally, tracking your spending is essential to making sure you stick to your budget. Use a budgeting app or spreadsheet to track your income and expenses each month. This will help you see where you may be overspending and adjust your budget accordingly. Remember, creating a budget that works for you takes time and effort. Be patient and persistent, and don't be afraid to adjust your budget as needed to achieve your financial goals.

What is an economic stimulus plan ?

An economic stimulus plan is a government policy aimed at boosting a country's economy during times of slow growth or recession. The primary goal of such plans is to increase consumer spending, encourage business investments, and create jobs, thereby stimulating economic activity and promoting overall growth. Key features of an economic stimulus plan include tax cuts and rebates, government spending on infrastructure projects, monetary policy adjustments, direct assistance to businesses and individuals, and incentives for investment. Benefits of an economic stimulus plan include increased economic growth, job creation, long-term gains, and reduced poverty rates. However, potential downsides of an economic stimulus plan include national debt, inflation risks, crowding out effect, and short-term vs long-term effects. In conclusion, an economic stimulus plan is a multifaceted approach employed by governments to revive flagging economies. While these plans can have significant positive impacts on growth, employment, and overall well-being, they must be carefully designed and implemented to minimize potential drawbacks such as increased national debt and inflation risks.