Force Operational

How does climate change influence the operational environments for defense forces ?

Climate change is significantly impacting the operational environments for defense forces, affecting military planning, strategy, and tactics. Extreme weather events are becoming more frequent, requiring defense forces to manage or support disaster response operations. Changes in terrain and landscape due to melting ice caps and rising sea levels can affect military operations. Climate change can exacerbate social tensions and conflicts over resources, leading to internal displacement and potential security threats. Health risks and disease spread can expand due to changes in temperature and rainfall patterns. Energy requirements and logistics may need adjustments in operational environments affected by climate change.

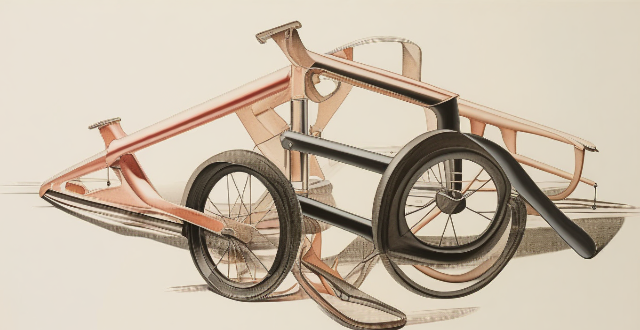

How do force vectors influence an athlete's movement in sports biomechanics ?

Force vectors play a crucial role in sports biomechanics. The magnitude and direction of force vectors determine an athlete's acceleration, deceleration, and direction of motion. There are several types of force vectors, including internal, external, contact, frictional, and elastic forces. Understanding how these force vectors influence an athlete's movement is essential for improving performance and preventing injuries in sports. Coaches and athletes can use this knowledge to optimize their training programs and techniques.

How do immigration policies affect the labor force participation of immigrants ?

Immigration policies significantly impact the labor force participation of immigrants by determining their legal status, access to services, family reunification, economic opportunities, and protection from discrimination. Policies that provide work permits, authorization to work, language training, education and training programs, healthcare, social safety nets, family support, childcare options, business opportunities, self-employment regulations, equal employment opportunities, and protection from exploitation can all contribute to successful integration of immigrants into the workforce. This benefits both the immigrants and the host country's economic growth and development.

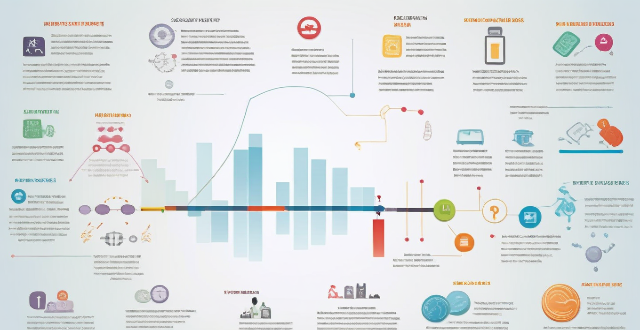

What is the TCFD (Task Force on Climate-related Financial Disclosures) ?

The Task Force on Climate-related Financial Disclosures (TCFD) is an initiative by the Financial Stability Board aimed at standardizing how companies report climate-related financial impacts. It covers four main areas: governance, strategy, risks and opportunities, and metrics and targets. By adhering to TCFD guidelines, companies can enhance transparency, improve risk management, align with sustainable development goals, and boost their reputation among stakeholders.

How does understanding joint mechanics contribute to improving athletic performance through sports biomechanics ?

Understanding joint mechanics is crucial for improving athletic performance in sports biomechanics. By optimizing movement patterns, preventing injuries, enhancing force production, and improving stability, athletes can achieve greater success in their chosen sports. Sports biomechanists analyze an athlete's joint mechanics to develop targeted training programs that improve joint function and overall performance. Advances in sports technology provide real-time feedback on joint mechanics during training and competition, allowing athletes to fine-tune their technique and make adjustments to their training program as needed.

Which economic indicators are used to measure the health of the labor market ?

The health of the labor market is crucial for any economy, and several economic indicators are used to measure it. These include the unemployment rate, employment growth, labor force participation rate, wage growth, and job openings and vacancies. The unemployment rate measures the percentage of the labor force that is unemployed but actively seeking work, while employment growth refers to the number of new jobs created over a specific period. The labor force participation rate measures the percentage of working-age individuals who are either employed or actively seeking employment, and wage growth reflects the earning power of workers. Job openings and vacancies provide insight into the demand for labor within the economy. By monitoring these indicators regularly, stakeholders can identify trends and potential issues early on, allowing them to take proactive steps to address any challenges and promote a healthy labor market.

What role does kinetics play in the study of sports biomechanics ?

Kinetics is a key aspect of sports biomechanics, focusing on forces and motions in physical activity. It aids in understanding how athletes generate power, control movements, and enhance performance. Key points include force analysis (internal and external), energy considerations (potential, kinetic, work, and power), movement efficiency (mechanical advantage, joint reaction forces, ground reaction forces), injury prevention and rehabilitation (overuse and traumatic injuries, rehab programs), and performance optimization (technique analysis, equipment design, training methods). Overall, kinetics helps coaches, athletes, and researchers make informed decisions about training, equipment, and technique to achieve safe and effective goals.

How do the principles of sports biomechanics differ between individual and team sports ?

This text discusses the principles of sports biomechanics in individual and team sports. It highlights the differences in kinematics, kinetics, and coordination between the two types of sports. In individual sports, there is a focus on precision, technique optimization, and personal performance, while team sports emphasize strategic interactions, group coordination, and adaptability to complex game situations. The text concludes by emphasizing the importance of understanding these distinctions for coaches and athletes to tailor their training approaches to best suit the specific demands of their chosen sport.

How do changes in economic indicators affect small business operations ?

Economic indicators such as GDP, inflation rates, unemployment, interest rates, and consumer confidence can significantly affect small businesses. These changes impact financing costs, labor availability, consumer demand, and operational expenses. Small business owners should monitor these factors to adjust their strategies effectively.

What is sports biomechanics and how does it apply to athletic performance ?

Sports biomechanics is a subdiscipline that applies mechanics principles to study human movement in sports and exercise. It focuses on how forces and motion affect the body during physical activity, combining knowledge from physics, biology, engineering, and other areas for understanding and improving athletic performance. Key concepts include kinematics, kinetics, and dynamics. Applications of sports biomechanics include injury prevention through gait analysis and movement optimization; technique improvement via motion analysis and force plates; equipment design considering ergonomics and material science; training programs that incorporate resistance, flexibility, and stability training; performance analysis using data analysis and feedback systems; and recovery strategies like physical therapy and rest-activity balance.

How does TCFD affect corporate reporting ?

The Task Force on Climate-related Financial Disclosures (TCFD) has significantly impacted corporate reporting by requiring enhanced disclosure of climate-related risks and opportunities. Companies must identify, assess, and manage these risks, including through scenario analysis and governance processes. They also need to disclose how climate change affects their business model and strategy, as well as the alignment of their portfolio with a low-carbon transition. Operational performance metrics such as emissions data and energy use must be reported, along with information on positive impacts and innovation related to climate action. Overall, the TCFD guidelines aim to promote transparency and encourage companies to integrate sustainability into their financial decision-making processes.

What are the challenges faced by the insurance industry in addressing climate change ?

The insurance industry faces several challenges in addressing climate change, including data-related issues, regulatory and legal concerns, and operational difficulties. These challenges can be broadly classified into three categories: data-related challenges, regulatory and legal challenges, and operational challenges. Data-related challenges include insufficient historical data and lack of standardization in collecting and analyzing climate-related data across the insurance industry. Regulatory and legal challenges involve lack of clarity in regulations governing how insurers should account for climate change in their risk assessments and pricing strategies, as well as liability concerns due to increased natural disasters and extreme weather events. Operational challenges include limited capacity to model climate risks, inadequate infrastructure for disaster response, and difficulty in pricing policies accurately. To overcome these challenges, insurers need to work together and invest in research and development to develop more sophisticated models and hire experts who can help them understand and manage climate risks effectively. They also need to continuously monitor climate trends and adjust their pricing strategies accordingly. By doing so, the insurance industry can play a vital role in managing the risks associated with climate change.

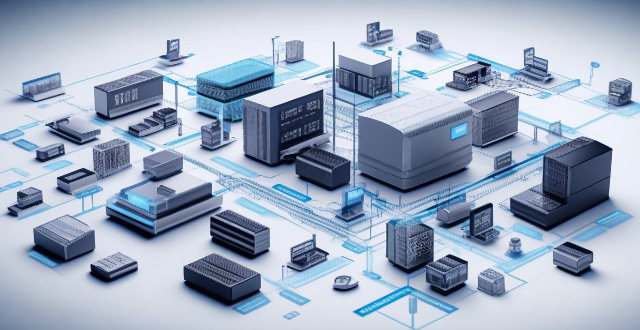

What is the Internet of Things (IoT) ?

The Internet of Things (IoT) is a network of interconnected devices with sensors, software, and connectivity that can communicate autonomously to perform tasks. IoT components include sensors, software, and network connectivity, enabling applications in smart homes, wearables, industrial machinery, transportation, and agriculture. The technology improves efficiency for businesses by reducing costs and enhancing operational insights. Overall, IoT is a transformative force across industries, reshaping our world and daily interactions.

How does Fintech drive innovation in the financial sector ?

Fintech is driving innovation in the financial sector by enhancing efficiency, democratizing access to services, improving customer experience, facilitating financial inclusion, enhancing security and compliance, and fostering innovation and collaboration.

How can companies implement TCFD disclosures effectively ?

Effective implementation of TCFD disclosures in companies involves establishing a governance framework, assessing climate-related risks and opportunities, developing scenario analysis, reporting and disclosing information, and ongoing management and updates. This process helps companies meet the requirements of the TCFD and prepare for a low-carbon future.

What are the economic impacts of floods and how can they be minimized ?

Floods have significant economic impacts on communities, affecting various sectors of the economy. Direct impacts include property damage, crop loss, and business disruption, while indirect impacts encompass job losses, population displacement, and economic downturns. To minimize these effects, strategies such as flood defense infrastructure, early warning systems, emergency plans, flood insurance, microfinance, land-use planning, building codes, public awareness campaigns, and capacity building are recommended. By adopting a comprehensive approach, communities can enhance their resilience and reduce the economic repercussions of flooding.

What is private equity ?

Private equity (PE) is an investment strategy where funds pool capital from institutional investors to directly invest in companies. This involves buying out existing shareholders or providing growth capital, with the aim of improving operations and selling at a profit. Key features include long-term investments, active ownership, diverse strategies, and a clear exit strategy. Types of PE include leveraged buyouts, venture capital, growth equity, mezzanine financing, and secondaries. Private equity firms play roles in due diligence, deal structuring, operational improvement, financial management, and exit planning. Benefits of PE include economic growth, job creation, and operational expertise, while criticisms include high debt loads, short-term focus, and potential negative labor impacts.

What is the role of a private equity firm in a company's growth ?

Private equity firms contribute to a company's growth by providing capital, strategic expertise, and operational support. They invest significant amounts of capital into companies for expansion, refinance debt, offer industry experience and management consulting services, assist in talent acquisition, and help integrate new technologies. This collaboration helps companies navigate challenges, seize opportunities, and achieve success.

How do military strategies need to adapt to address the consequences of climate change ?

The text discusses the challenges and adaptations necessary for military strategies to account for the consequences of climate change. It emphasizes the need for impact assessments, operational planning, training and preparation, technology and innovation, cooperation and diplomacy, and readiness and response. Key points include understanding how climate change affects specific regions, developing resilient supply chains and adaptive infrastructure, incorporating climate change into training scenarios, utilizing advanced predictive tools, working with allies and international organizations, and establishing rapid response capabilities. By integrating these elements into defense policy, militaries can remain effective and resilient in the face of a changing climate.

How does clean energy investment compare to traditional energy investment ?

Investing in energy sources is crucial for the development and growth of any economy. However, the choice between clean energy investment and traditional energy investment has become a significant topic of discussion in recent years. This comparison will explore the differences between these two types of investments, focusing on their costs, benefits, and potential impacts on the environment and society.

What are the risks associated with green finance investments ?

The article discusses the various risks associated with green finance investments, including market risk, credit risk, operational risk, environmental risk, reputational risk, and legal and regulatory risk. It emphasizes the importance of understanding these risks before making investment decisions in order to achieve desired levels of risk and return.

What are the potential consequences of poor risk management practices ?

Risk management is a crucial component of any organization's strategy, and poor practices can lead to financial losses, legal issues, reputational damage, operational disruptions, and negative impacts on employee morale and productivity. It is essential for organizations to implement effective strategies to mitigate these potential consequences and ensure their long-term success and sustainability.

How much would it cost to implement geoengineering on a large scale ?

The text discusses the financial implications of implementing large-scale geoengineering projects to counteract global warming. Key points include research and development costs, initial implementation expenses, ongoing operational costs, uncertainty and risk management expenses, and legal and regulatory compliance costs. The analysis suggests that large-scale geoengineering would require significant funding and resources.

How does the cost of building a charging network compare to traditional gas stations ?

Building a charging network for electric vehicles and traditional gas stations involve different costs and considerations. The initial investment may be higher for a charging network due to the need for electrical infrastructure, while operational costs may be lower due to lower electricity costs compared to fuel procurement. Additionally, the scalability and growth potential of a charging network may be higher as the market share of EVs continues to increase.