Fraud Communications

Can I report telecommunications fraud to any authority ?

Telecommunications fraud is a serious issue that can have significant financial and personal consequences for victims. It is important to know where and how to report such incidents to ensure that appropriate action is taken. In this article, we will explore the various authorities to which you can report telecommunications fraud. The Federal Communications Commission (FCC) is the primary agency responsible for regulating interstate and international communications by radio, television, wire, satellite, and cable in the United States. The FBI is responsible for investigating federal crimes, including telecommunications fraud. Each state has an attorney general who is responsible for protecting consumers within their jurisdiction. Local law enforcement agencies also have the authority to investigate complaints and work with other agencies to pursue legal action against those responsible for fraudulent activities.

How can I educate my family about telecommunications fraud ?

Telecommunications fraud is a serious issue that can have devastating consequences for individuals and families. To protect themselves from becoming victims, it's important to educate loved ones about the risks and ways to avoid them. Here are some steps to follow: Understanding Telecommunications Fraud: Make sure everyone understands what telecommunications fraud entails and how it works. This includes phishing scams, vishing attacks, smishing schemes, and tech support scams. Recognizing Red Flags: Educate your family on the common signs of telecommunications fraud, such as urgency, unexpected requests, too good to be true offers, threats or intimidation. Prevention Tips: Share prevention tips with your family to help them avoid falling prey to scams. These include staying informed, verifying sources, securing devices, using anti-fraud tools, being cautious online, limiting personal exposure, and reporting suspected fraud. Action Plan: Create an action plan for your family in case they encounter a potential fraud attempt. This includes stopping and thinking before acting impulsively, consulting family members for a second opinion, contacting authorities if convinced it's a scam, and documenting everything related to the suspected fraud for future reference.

How can I protect myself from telecommunications fraud ?

Telecommunications fraud is a serious issue that can have devastating consequences for victims. It involves unauthorized access to personal and financial information through various communication channels such as phone calls, text messages, emails, and social media platforms. To protect yourself from telecommunications fraud, you should be wary of unsolicited calls and messages, use strong passwords and two-factor authentication, keep your devices and software up-to-date, be cautious with financial transactions, educate yourself and stay informed about the latest scams and fraudulent activities. By following these tips, you can significantly reduce your risk of falling victim to telecommunications fraud.

How can I prevent my personal information from being used in telecommunications fraud ?

To protect your personal information from telecommunications fraud, follow these steps: be cautious with personal information, use strong passwords and two-factor authentication, keep software and devices updated, be wary of suspicious emails and links, and educate yourself about common scams. By taking these precautions, you can reduce the risk of falling victim to telecommunications fraud.

What are the most common types of telecommunications fraud ?

Telecommunications fraud is a serious issue that affects millions of people worldwide. It involves using technology to deceive individuals or organizations for financial gain. Here are some of the most common types of telecommunications fraud: 1. Phishing Attacks: In this type of attack, cybercriminals send fraudulent emails or messages that appear to be from a legitimate source, such as a bank or a government agency. The message typically asks the recipient to click on a link or provide sensitive information, such as login credentials or credit card details. Once the victim provides the requested information, the attacker can use it to access their accounts and steal money or personal data. 2. Vishing Attacks: In this type of attack, cybercriminals use automated phone calls or live callers to trick victims into providing sensitive information over the phone. The attacker may pretend to be from a legitimate organization, such as a bank or a government agency, and ask for personal information or payment for a fake service. 3. Smishing Attacks: Smishing, or SMS phishing, is a relatively new form of telecommunications fraud that involves sending fraudulent text messages to victims' mobile devices. These messages often claim to be from a legitimate source, such as a bank or a government agency, and ask for sensitive information or payment for a fake service. Unlike traditional phishing attacks, which rely on email, smishing attacks use SMS messages to reach victims directly on their mobile devices.

What are some tips for avoiding telecommunications fraud ?

Telecommunications fraud can have serious consequences, but there are steps you can take to avoid becoming a victim. Be skeptical of unsolicited calls and messages, use strong passwords and two-factor authentication, keep software up-to-date, be cautious with public Wi-Fi networks, and educate yourself about common scams. By following these tips, you can protect your personal information and finances from potential fraud attempts.

How can I recover from telecommunications fraud ?

In summary, to recover from telecommunications fraud, one should immediately report suspicious transactions to their bank or financial institution, file a police report, and consider alerting relevant agencies. It's essential to protect personal information, update security measures, and educate oneself and others about scams. Legal action may be necessary for significant losses, and strengthening online security is crucial for future protection.

How can women avoid falling victim to financial scams and fraud ?

Financial scams and fraud can target anyone, including women. To avoid falling victim to these schemes, it's crucial for women to educate themselves about common scams like phishing, romance, and investment frauds. Safe online habits, such as securing devices and being cautious with personal information, are also essential. Regularly monitoring finances, using credit cards wisely, building a support network of professionals and trusted friends or family, and reporting suspected fraud immediately are further protective measures. Staying informed and vigilant significantly reduces the risk of financial loss due to scams and fraud.

What impact has 5G technology had on the telecommunications industry ?

The advent of 5G technology has revolutionized the telecommunications industry, offering faster speeds, lower latency, and increased capacity. Key impacts include enhanced mobile broadband, ultra-reliable low-latency communications, and massive Internet of Things connectivity. These advancements have led to changes in network infrastructure, service innovation, economic growth, and social development. However, challenges such as coverage limitations, compatibility issues, spectrum allocation, and security concerns need to be addressed. The full potential of 5G is yet to be realized but holds immense promise for positive change across various sectors.

What is credit monitoring and why is it important in credit management ?

Credit monitoring is the process of tracking and analyzing a borrower's credit history, including payment behavior, outstanding debts, and changes in credit scores. It is important for early warning signals of potential default or delinquency, accurate risk assessment, fraud prevention, customer relationship management, and compliance with regulations. By continuously monitoring a borrower's credit history, lenders can update their risk assessments, prevent fraud, tailor their products and services to better meet their customers' requirements, and ensure they are meeting regulatory requirements.

What are some signs that I may be a victim of telecommunications fraud ?

Telecommunications fraud is a serious issue with significant financial and emotional consequences. It's important to be aware of the signs that you may be a victim, such as unrecognized charges on your phone bill, unfamiliar phone calls or messages, changes to your service settings, suspicious account activity, and new accounts opened in your name. To protect yourself, contact your service provider immediately if you notice any suspicious activity, change your passwords regularly, monitor your accounts closely, and consider additional security measures such as two-factor authentication.

How do communication satellites impact the field of telecommunications ?

Communication satellites have revolutionized telecommunications by providing global connectivity, increasing bandwidth, and improving reliability. They allow for communication across vast distances, connecting remote areas with the rest of the world and providing access to telecom services in regions lacking terrestrial infrastructure. Modern satellite systems offer high data rates for faster internet speeds and better voice/video transmissions, supporting multiple services like voice, data, and video conferencing. Satellites also enhance reliability and redundancy as critical backups during disasters and emergencies, creating diverse communication pathways. With rapid deployment capabilities, satellites are ideal for temporary situations like military operations or emergency responses and enable mobile applications. Economically, advancing technology reduces costs, opens new markets, and fosters job creation. Technological advancements include improved modulation techniques and antenna designs for better performance. Environmental considerations involve space debris mitigation and energy efficiency. Overall, satellites significantly impact telecommunications by extending reach, increasing capacity, ensuring reliability, offering flexibility, driving economic growth, and fostering technological advancements while considering environmental implications.

What is online privacy and why is it important ?

The text discusses the definition and importance of online privacy, which is the ability to control personal information when using the internet. Online privacy protects sensitive data such as browsing history, location, communications, and personal details from being accessed, collected, or used without consent. It is important for protecting personal information, allowing control over personal data, enabling freedom of expression, building trust in digital services, and ensuring economic benefits. Best practices for online privacy include using strong passwords, keeping software up-to-date, being cautious on social media, avoiding public Wi-Fi, reviewing privacy policies, and monitoring financial statements for signs of fraud or identity theft.

Can solar flares cause communication interference ?

Solar flares, intense bursts of radiation from the sun's atmosphere, can disrupt communication systems on Earth. This includes shortwave radio signals, satellite communications, and other terrestrial networks. The effects range from signal quality disruption and frequency deviation to satellite link disruptions, GPS accuracy issues, and even physical damage to satellite hardware. While these impacts vary, organizations involved in critical communication operations must be aware of the risks and implement mitigation strategies to minimize potential disruptions.

How do DNS resolution times influence network optimization ?

The speed at which DNS resolution occurs can have a significant impact on network performance and optimization. Slow DNS resolution times can cause delays in the start of network communications, while fast DNS resolution times can significantly improve network performance. Strategies for optimizing DNS resolution times include using a reliable DNS server, implementing caching, and using a CDN.

How does Fintech enable faster and more secure payments ?

Fintech has revolutionized payment systems by making them faster and more secure. Instant transfers, mobile payments, and automated options have streamlined the process, while encryption, tokenization, two-factor authentication, and fraud detection systems have enhanced security. These advancements benefit both individuals and businesses.

What is the role of frequency bands in wireless communication standards ?

In wireless communication, frequency bands dictate signal propagation, spectrum allocation, and interference management. These bands are critical for establishing reliable connections in technologies like Wi-Fi, Bluetooth, cellular networks, and satellite communications. The choice of band influences the range, data rate, and potential interference of a wireless system. Spectrum scarcity and regulatory compliance present challenges that drive innovations in spectrum sharing and cognitive radio technologies. Overall, the role of frequency bands is crucial for efficient and effective wireless communication standards.

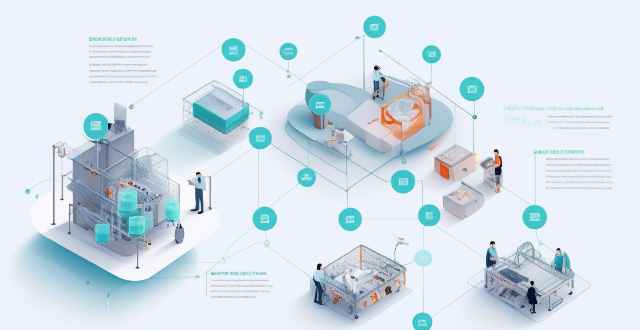

How can smart contracts improve supply chain management ?

Smart contracts can revolutionize supply chain management by automating transactions, enhancing transparency, improving efficiency, enabling real-time tracking, and reducing risks. This decentralized and automated approach can save time, reduce costs, prevent fraud, and improve overall trust between parties in the supply chain.

How can businesses benefit from implementing digital identity solutions ?

Digital identity solutions offer businesses enhanced security, improved customer experiences, increased efficiency, and scalability. They reduce fraud risks, protect data, streamline onboarding, personalize services, automate processes, and provide reliable data for better decision-making. These benefits help businesses stay compliant with regulations, save costs, and adapt to evolving technology.

What is 5G technology and how does it differ from 4G ?

5G technology, the fifth generation of wireless networks, is set to revolutionize mobile networking by offering faster speeds, lower latency, and increased capacity compared to 4G. Key differences between 5G and 4G include improvements in speed (up to 20 Gbps for 5G vs. 10-30 Mbps for 4G), latency (as low as 1 millisecond for 5G vs. 50 milliseconds for 4G), and network capacity (supporting up to a million devices per square kilometer for 5G). 5G also utilizes advanced network architecture and a wider bandwidth, incorporating both sub-6 GHz and millimeter-wave spectrum. The advantages of 5G over 4G include enhanced mobile broadband, ultra-reliable low latency communications, and massive machine type communications, making it suitable for applications like remote surgery, autonomous vehicles, and smart cities. The potential impact of 5G spans various sectors such as industrial automation, healthcare, transportation, entertainment, and smart city development, promising to connect people and machines in unprecedented ways and open doors to numerous opportunities and advancements.

How does digital identity verification work in online transactions ?

Digital Identity Verification in Online Transactions: A Comprehensive Guide Digital identity verification is a crucial aspect of online transactions, ensuring the authenticity and security of users. This process involves collecting personal information, verifying it against reliable sources, employing multi-factor authentication, using encryption techniques, and implementing monitoring systems to detect fraudulent activities. By following these steps, businesses can protect their customers' sensitive data and maintain trust in the digital marketplace.

What happens if my Cross-Border Payment transaction fails ?

If your cross-border payment transaction fails, itIf your cross-border payment transaction fails, it reasons such as insufficient funds it can be due to several reasons such as insufficient funds, invalid recipient information, transfer limit exceeded, technical issues, or fraud detection. It is important to identify the reason behind it and take appropriate action to resolve the issue and complete the transaction successfully.

Are there any potential drawbacks or challenges with implementing network slicing ?

Network slicing is a promising technology that allows multiple virtual networks to coexist on a shared physical infrastructure. It enables operators to provide tailored network services for different use cases, such as enhanced mobile broadband (eMBB), ultra-reliable low-latency communications (URLLC), and massive machine-type communications (mMTC). However, there are potential drawbacks and challenges associated with implementing network slicing, including the complexity of management and orchestration, significant infrastructure investment required, standardization and interoperability issues, skill gap within organizations, and regulatory and legal aspects to consider.

How do communication satellites contribute to disaster response and relief efforts ?

Communication satellites are vital for disaster response and relief efforts, providing real-time information, surveillance, coordination, emergency communications, and aiding search and rescue operations. They enable quick decision-making and efficient resource allocation during emergencies.

Are there any international laws or treaties related to privacy rights ?

The text discusses several international laws and treaties related to privacy rights, including the European Convention on Human Rights (ECHR), the General Data Protection Regulation (GDPR), the Charter of Fundamental Rights of the European Union (CFR), and the International Covenant on Civil and Political Rights (ICCPR). These documents provide individuals with protection against unlawful interference with their private lives, homes, and communications.

What is the future of blockchain beyond cryptocurrency ?

This article explores the potential applications of blockchain technology beyond cryptocurrency, highlighting key areas such as decentralized finance (DeFi), supply chain management, healthcare, government services, and intellectual property rights management. It emphasizes how blockchain can improve transparency, security, efficiency, and accessibility in these sectors through features like peer-to-peer transactions, smart contracts, tokenization, traceability, interoperability, data privacy, identity management, public records storage, voting systems, proof of ownership, streamlined licensing, and fraud prevention. The article concludes by stating that the future prospects of blockchain technology are vast and promising, offering numerous opportunities for innovation and transformation across various industries.

How do communication satellites support military operations and intelligence gathering ?

This text discusses how communication satellites support military operations and intelligence gathering, highlighting their role in secure communication channels, wide area coverage, high-speed data transmission, surveillance and reconnaissance, coordination and command, resilience and redundancy.

How is AI changing the field of finance and banking ?

AI is revolutionizing the finance and banking industry by improving efficiency, accuracy, and customer experience while streamlining risk management processes. AI-powered algorithms can analyze vast amounts of data quickly and accurately, leading to faster and more informed decisions. Automated processes save time and reduce human error. Fraud detection is enhanced by analyzing patterns in customer behavior and transactions. Personalized customer experience is provided through detailed profiling and predictive analytics. Risk management is streamlined with credit risk assessment and market risk analysis.

What should I do if I receive a suspicious call or message ?

Receiving a suspicious call or message can be unsettling and potentially dangerous. It is important to take appropriate measures to protect yourself and your personal information. The steps you should take when you encounter such situations are: 1. Remain calm and assess the situation objectively. 2. Do not share any personal information with the caller or sender of the message. 3. End the call or delete the message without engaging in any conversation. 4. Block the number or email address that contacted you. 5. Report the incident to the appropriate authorities, such as your local police department or the Federal Trade Commission (FTC). 6. Be vigilant and educate others about the risks of sharing personal information over the phone or through messages. By following these steps, you can minimize the risk of falling victim to scams and fraud attempts.

How secure is decentralized finance compared to traditional finance ?

The text provides a comparative analysis of the security aspects of decentralized finance (DeFi) and traditional finance (TradFi). DeFi relies on blockchain technology for peer-to-peer transactions, while TradFi operates through centralized institutions. Both systems have unique security features and risks, with DeFi offering transparency and automated contract execution but facing smart contract vulnerabilities and lack of regulatory clarity. TradFi benefits from regulatory oversight and physical security measures but is susceptible to systemic risks and cybersecurity threats. The choice between DeFi and TradFi depends on individual preferences and risk tolerance, and it's crucial to stay informed about new developments in the evolving financial landscape.