Gin Growth

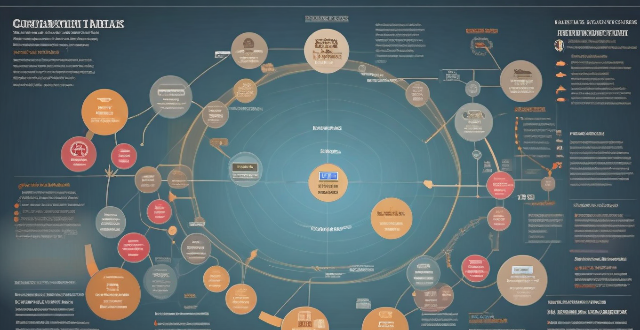

Can economic growth be compatible with sustainable development ?

Economic growth and sustainable development can coexist through strategies such as promoting green economies, inclusive growth, regulation and policy, technological innovation, and international collaboration.

What is the ideal temperature for indoor plant growth ?

Indoor plants generally thrive in temperatures between 65°F to 75°F during the day and slightly cooler at night, along with proper humidity and air circulation. Maintaining these conditions helps promote healthy growth and flowering. Use a thermometer, avoid drafts, and adjust heating or cooling as needed to keep plants comfortable.

How do changes in immigration policy influence economic growth ?

Changes in immigration policy can have a significant impact on economic growth by increasing the labor force, promoting diversity, increasing consumer spending, reducing wage inflation, and increasing tax revenue.

How does climate cooperation impact global economic growth ?

Climate cooperation has a positive impact on global economic growth by fostering new industries, promoting international trade and investment, stimulating innovation and research, enhancing resilience against climate impacts, and encouraging policy coherence and stability.

How have emerging markets been performing in recent years ?

Emerging markets have been performing well in recent years, with many countries experiencing strong economic growth and increased investment opportunities. Key points include GDP growth rates, foreign direct investment inflows, stock market performance, and challenges and risks such as political instability, currency volatility, and trade tensions. Investors should carefully consider these factors when investing in emerging markets.

What is the ideal percentage of income to save for wealth growth ?

This text discusses the importance of saving a portion of one's income for wealth growth and explores factors such as personal financial situation, financial goals, lifestyle choices, and income level that determine the ideal savings rate. It also provides general guidelines for saving, including starting small, increasing gradually, and aiming for at least 20% of income.

How do I invest my money wisely for long-term growth ?

Investing wisely for long-term growth involves setting financial goals, creating a diversified portfolio, considering risk tolerance, investing for the long-term, and monitoring investments regularly.

What is the relationship between energy prices and economic growth ?

The interplay between energy prices and economic growth is multifaceted, with each influencing the other in various ways. High energy prices can impede economic expansion by escalating production costs, diminishing consumer purchasing power, and fostering inflation. They might also spur investment in alternative energies and drive resource reallocation towards efficiency, counterbalancing some of their immediate negative impacts. Conversely, robust economic growth often amplifies energy demand, propelling prices upwards unless compensated by enhanced supply or technological advancements that boost efficiency. This intricate relationship underscores the importance of strategic policy interventions to manage energy pricing dynamics for sustainable economic development.

How do climate commitments impact economic growth and development ?

The impact of climate commitments on economic growth and development is multifaceted, with both positive and negative aspects. On the positive side, these commitments stimulate innovation in renewable energy sources and energy efficiency, create new markets for green products and services, improve public health by reducing air pollution, and enhance international cooperation. On the negative side, there are transition costs associated with shifting from fossil fuels to renewable energy sources, potential job displacement in traditional industries, trade-offs between environmental protection and economic growth, and unequal distribution of benefits and costs. Despite these challenges, prioritizing sustainability can lead to long-term economic growth while protecting the environment for future generations.

How do environmental subsidy policies impact economic growth ?

The text discusses the impact of environmental subsidy policies on economic growth, highlighting both positive and negative effects. Positive impacts include stimulating innovation and technology development, enhancing energy efficiency, creating job opportunities, and improving public health. Negative impacts encompass distorting market incentives, increasing government expenditures, potential for carbon lock-in, and global trade implications. It concludes that while environmental subsidies have the potential to foster economic growth, they must be carefully designed to avoid adverse effects and contribute positively to sustainable economic development.

How do regulations affect the growth of the commercial space industry ?

Regulations significantly influence the growth of the commercial space industry by providing a framework for innovation, ensuring safety and security, promoting competition, addressing environmental concerns, and adapting to rapid changes. Effective regulations can facilitate industry growth by reducing uncertainty and lowering barriers to entry, while also protecting public interest through strict safety standards and sustainable practices.

How do global economic trends affect personal wealth growth strategies ?

Global economic trends significantly influence personal wealth growth strategies by affecting factors such as interest rates, inflation, economic growth, global trade, and political stability. Understanding these trends helps individuals make informed decisions about investments and financial planning.

What are the key factors driving the growth of the Chinese economy ?

The growth of the Chinese economy has been driven by several key factors, including government policies and reforms, demographic dividend, globalization and export-led growth, domestic demand and consumption, and environmental sustainability and green growth. These factors have collectively contributed to rapid economic development in China over the past few decades. However, ongoing challenges such as demographic changes, environmental concerns, and global economic uncertainties require continued adaptation and innovation to sustain future growth.

Can playing sports improve one's self-confidence and personal growth ?

Playing sports can contribute to self-confidence and personal growth by developing skills, overcoming challenges, fostering teamwork and support, promoting discipline and responsibility, encouraging goal setting and achievement, and enhancing social interaction and empathy. Incorporating sports into one's lifestyle can be highly beneficial for overall well-being and personal development.

How do tax laws impact my strategy for wealth growth ?

Tax laws play a significant role in shaping your wealth growth strategy. They can impact your investment decisions, retirement planning, and estate planning. Understanding how tax laws impact your wealth growth strategy is crucial for making informed financial decisions. By considering the tax implications of your investments, retirement planning, and estate planning, you can develop a comprehensive wealth growth strategy that maximizes your after-tax returns and helps you achieve your financial goals.

What are the key economic indicators to watch for global growth ?

Monitoring key economic indicators such as GDP, inflation rate, unemployment rate, interest rates, trade balance, current account balance, manufacturing and service sector indexes, stock market performance, and consumer confidence indices is crucial for policymakers, investors, and businesses to understand global economic growth. These indicators provide insights into the overall health of an economy, guide decision-making processes, and help predict future trends.

What's the secret to creating the perfect martini ?

The Secret to Creating the Perfect Martini is an art form that requires attention to detail, quality ingredients, and a touch of personal preference. Key elements to consider when making this iconic cocktail include high-quality gin or vodka, dry vermouth, ice cold water, and a garnish (traditionally a lemon twist or olives). Tools needed are a cocktail shaker or mixing glass, strainer, jigger for measuring, and chilled martini glass. Steps to make the perfect martini include measuring your ingredients, chilling your glassware, deciding whether to stir or shake the mixture, adding a splash of ice-cold water after stirring or shaking, straining and garnishing, and serving immediately. Personal touches such as experimenting with different types of gin or vodka, vermouth, and garnishes can add an exciting twist. By following these steps and paying attention to the details, you can create a martini that is perfectly tailored to your taste.

How does exercise affect muscle growth and repair at a cellular level ?

Exercise stimulates protein production for muscle growth and repair, increases satellite cells for new muscle fibers, boosts blood flow for nutrient delivery and waste removal, and promotes the release of growth factors like IGF-1.

How can sports help individuals develop leadership skills and personal growth ?

Participating in sports can help individuals develop leadership skills and foster personal growth by enhancing goal-setting, teamwork, resilience, decision-making under pressure, accountability, confidence building, discipline, physical health, emotional intelligence, and social interaction.

How have climate-related risks influenced the growth of impact investing ?

Climate-related risks have significantly influenced the growth of impact investing by making investors more aware of the potential financial risks associated with climate change. This has led to an increased demand for investments that not only generate financial returns but also address environmental and social issues. Impact investing, which focuses on creating positive social and environmental impact alongside a financial return, has emerged as a popular investment strategy in response to this trend. Key factors driving the growth of impact investing include increased awareness of climate change, regulatory pressure, consumer demand for sustainable products and services, financial opportunities in sustainable industries, and alignment with ethical values. As these trends continue to shape the global economy, we can expect impact investing to become an increasingly important part of mainstream finance.

Are there any books or resources you recommend on wealth growth strategies ?

The text recommends various books and resources on wealth growth strategies, including "The Total Money Makeover" by Dave Ramsey, "Rich Dad Poor Dad" by Robert Kiyosaki, "The Millionaire Next Door" by Thomas J. Stanley and William D. Danko, and "The Intelligent Investor" by Benjamin Graham. It also suggests online resources such as personal finance blogs, podcasts, and courses for learning about wealth growth strategies.

In what ways can investing in stocks contribute to my wealth growth ?

Investing in stocks is a well-known strategy for wealth growth, offering several advantages that can contribute to your financial prosperity. Here's a detailed look at the ways stock market investments can boost your wealth: 1\. **Capital Appreciation**: Over time, the value of stocks can increase as the company grows and becomes more profitable. This growth translates into capital appreciation for investors, potentially leading to significant returns on investment. Some companies offer dividends, which are payments made to shareholders from the company's profits. When these dividends are reinvested back into the stock, it can lead to compounded growth, further enhancing your investment's value. 2\. **Compound Interest**: By reinvesting dividends and capital gains, you leverage the power of compound interest, where your earnings generate their own earnings over time. The longer you stay invested, the more pronounced the effects of compounding become, making early and consistent investments a key factor in achieving substantial wealth growth. 3\. **Diversification**: Diversifying your portfolio across different stocks and sectors can help mitigate risks associated with any single investment. This strategy allows for stable growth by offsetting losses in some areas with gains in others. By investing in a variety of sectors, you can take advantage of cyclical trends and shifts in the economy, potentially maximizing returns by being in the right sector at the right time. 4\. **Liquidity**: Stocks are generally liquid assets, meaning they can be converted into cash quickly without significant loss in value. This liquidity provides flexibility for investors who may need access to their funds at short notice. Publicly traded stocks have a ready market, ensuring that there's usually someone willing to buy or sell, maintaining an active and efficient market environment. 5\. **Ownership Stake**: Owning stocks means having a piece of the company you invest in. This ownership stake gives you voting rights and a say in company matters, depending on the number of shares you hold. Dividends provide a regular income stream that can supplement other sources of revenue, especially beneficial for retirees or those seeking passive income. 6\. **Inflation Hedge**: Stocks represent tangible assets and real businesses that can adjust their prices in response to inflation. This ability makes them a potential hedge against inflationary pressures. Over time, as companies raise prices to combat inflation, their profits (and consequently, stock values) can increase, helping to preserve or even grow your purchasing power. 7\. **Leverage Potential**: Some investors use margin trading to leverage their investments, essentially borrowing money to buy more stocks. While this increases risk, it can also amplify returns when the market is favorable. Options allow investors to control a larger number of shares with a smaller initial investment, providing another layer of leverage for those who understand the complexities and risks involved. Overall, investing in stocks offers numerous avenues for wealth growth, from capital appreciation and compound interest to diversification and liquidity benefits. By strategically selecting stocks and managing your portfolio wisely, you can position yourself for long-term financial success. However, it's essential to conduct thorough research, consider your risk tolerance, and possibly consult with a financial advisor to make well-informed investment decisions.

How does real estate investing compare to other methods of wealth growth ?

This text compares real estate investing with other wealth growth methods. It outlines the advantages and disadvantages of real estate investing, such as appreciation, cash flow, tax benefits, leverage, and diversification, but also mentions liquidity issues, management responsibilities, market risks, high upfront costs, and the risk of tenant damage. The text then explores alternative wealth growth methods, including stock market investing, bond investing, cryptocurrency investing, art and antiques investing, and gold and precious metals investing. It highlights the pros and cons of each method, such as liquidity, diversification, stability, fixed income, high risk/high reward, technology exposure, aesthetic value, scarcity, subjectivity, storage and maintenance, hedge against inflation, physical asset, limited upside, storage and insurance costs, and no cash flow. Finally, the text emphasizes the importance of understanding the risks and rewards associated with each option and choosing the one that aligns with your financial goals and risk tolerance.

Are there any low-risk investment options that still offer wealth growth potential ?

Investing always comes with a certain level of risk, but there are some investment options that are considered to be relatively low-risk while still offering the potential for wealth growth. These include savings accounts and certificates of deposit (CDs), bonds, mutual funds and exchange-traded funds (ETFs), and real estate investment trusts (REITs). It's important to do your research and understand the risks involved before making any investment decisions.

How does technology contribute to the growth and development of a multicultural society ?

Technology has played a pivotal role in the growth and development of multicultural societies. It has facilitated communication, understanding, and collaboration across diverse cultural backgrounds, leading to a more inclusive and interconnected world. The article explores how technology contributes to the growth and development of a multicultural society through enhanced communication, access to information, collaboration and partnership, and cultural preservation and promotion.

What's the best way to infuse alcohol with fruits or spices ?

Infusing alcohol with fruits or spices is a great way to add flavor and complexity to your drinks. Here are the steps to do it right: Materials Needed: - Alcohol of your choice (vodka, rum, gin, etc.) - Fresh or dried fruits/spices - Clean glass jar or bottle with a tight-fitting lid - Fine mesh strainer or cheesecloth - Funnel (optional) Steps to Infuse Alcohol: 1. Choose Your Ingredients: Pick high-quality fruits and spices that complement the flavor profile of your chosen alcohol. Popular combinations include vodka with citrus fruits or jalapeño, rum with tropical fruits or cinnamon, and gin with juniper berries or lavender. 2. Prepare Your Ingredients: Wash and chop fresh fruits into small pieces. For spices, use whole spices like cinnamon sticks or crush them slightly to release more flavor. Dried fruits can be used as they are. 3. Infusion Process: Fill your clean glass jar or bottle with the prepared fruits/spices, leaving about 1/4 of the container empty at the top. Pour in the alcohol until the fruits/spices are fully submerged. 4. Seal and Shake: Close the jar tightly and shake well. Store it in a cool, dark place, shaking it occasionally over the next few days to help release the flavors. 5. Taste Testing: After about 3-5 days, taste your infusion. If it's not strong enough, reseal and let it sit for a few more days. The longer it sits, the more intense the flavor will become. 6. Straining and Bottling: When you're satisfied with the flavor, strain the mixture through a fine mesh strainer or cheesecloth into a clean jar or bottle. Use a funnel to transfer it without spilling. 7. Enjoy! Your homemade infused alcohol is now ready to be enjoyed in various cocktails or served neat over ice. Remember, the quality of your ingredients matters greatly. Always use fresh fruits and high-quality alcohol for the best results. Cheers!

What role do international aid and foreign investments play in the economic growth of low-income countries ?

The text discusses the crucial role of international aid and foreign investments in promoting economic growth in low-income countries. It highlights how these two factors contribute to development by providing financial resources, technical expertise, and market access. The text also emphasizes the need for effective and transparent use of these resources to maximize their impact on sustainable economic growth.

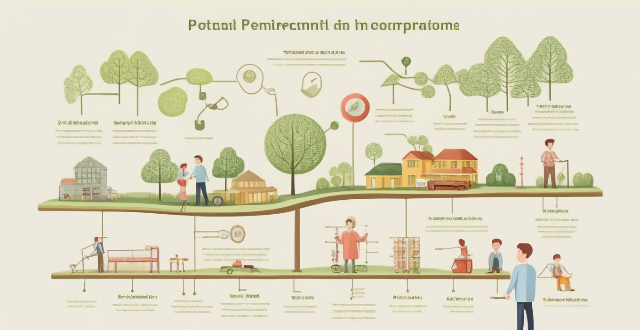

How do green jobs impact economic growth ?

Green jobs can stimulate economic growth by creating new employment opportunities, driving innovation and technological advancements, reducing costs and improving efficiency, enhancing environmental quality and public health, and attracting investment and tourism dollars.

What should I look for in a school's extracurricular activities program ?

When considering a school's extracurricular activities program, look for diversity of options, quality leadership, opportunities for growth and development, and inclusivity and accessibility. A well-rounded program will foster personal growth, leadership skills, and community among participants.

How do I pair cocktails with food for optimal taste experiences ?

Pairing cocktails with food can elevate your dining experience to a whole new level. Here are some tips on how to do it right: 1. Consider the flavor profile of your food. For bold and spicy dishes, you might want to consider cocktails that can stand up to the strong flavors, such as Margarita or Mojito. For lighter dishes, opt for a cocktail that won't overpower the subtleties of the food, like Champagne Cocktail or Whiskey Sour. 2. Match intensity. If you're having light bites or snacks, opt for lower-alcohol cocktails that won't weigh you down, such as Sherry Cobbler or Gin Fizz. For more substantial meals, you might want something with a bit more oomph, like Old Fashioned or Negroni. 3. Think about sweetness. For dessert courses, you'll want a cocktail that can match the sweetness, such as Pina Colada or White Russian. For savory dishes, avoid overly sweet cocktails that might clash, like Daiquiri or Cosmopolitan. 4. Don't forget about acidity. For dishes with a lot of acidity, like lemon-based sauces or vinegar dressings, you might want a cocktail that can stand up to it, such as Woo Woo or Kir Royale. For rich, creamy dishes, a touch of acidity in your cocktail can help cut through the heaviness, like Martini or Bramble. 5. Experiment and have fun! The most important thing is to find what you enjoy. There are no hard-and-fast rules, so don't be afraid to try something new. The best pairing is the one that brings you the most pleasure!