Han Sector

How does Fintech drive innovation in the financial sector ?

Fintech is driving innovation in the financial sector by enhancing efficiency, democratizing access to services, improving customer experience, facilitating financial inclusion, enhancing security and compliance, and fostering innovation and collaboration.

Can private sector investments play a significant role in climate financing ?

The article discusses the potential of private sector investments in climate financing, highlighting their current involvement and potential impact on various aspects such as access to larger pools of capital, innovation, risk management, and scaling up successful approaches. It also addresses challenges and considerations like alignment with public goals, transparency, inclusivity, and regulatory frameworks. The conclusion emphasizes the importance of collaboration between public and private sectors for effective utilization of private capital in climate action.

What are some best practices for climate risk management in the agricultural sector ?

Climate risk management is critical for the agricultural sector, which faces significant vulnerabilities due to changing weather patterns and extreme events. Key practices include assessing climate risks, integrating climate information into decision-making, enhancing ecosystem resilience, building human capacity, and planning financially with insurance. By adopting these strategies, farmers can adapt to climate change and reduce their risks, ensuring a more resilient agricultural sector.

How can policymakers encourage private sector involvement in climate adaptation ?

To encourage private sector involvement in climate adaptation, policyTo encourage private sector involvement in climate adaptation, policy as creating incentives like tax policymakers can implement strategies such as creating incentives like tax breaks and subsidies, establishing clear regulations with compliance enforcement, facilitating information sharing through open data access and collaborative platforms, promoting public-private partnerships with joint projects and long-term commitments, enhancing capacity building via training programs and technical assistance, and recognizing and showcasing success stories through awards and media coverage. These steps will foster a collaborative environment where the private sector actively seeks opportunities to contribute to resilient and sustainable solutions for climate change challenges.

How can the energy sector reduce its water footprint through innovations in technology ?

The energy sector's substantial water consumption is a concern for sustainable development. Technological innovations, such as efficient cooling systems, advanced water treatment, renewable energy integration, smart water management, waste heat recovery, and improved desalination methods, can help reduce the sector's water footprint. These innovations offer benefits like resource conservation, cost efficiency, and reduced environmental impact, ultimately contributing to global water security.

How can climate financing be integrated into national policies ?

Climate financing is vital for addressing climate change challenges. Integrating it into national policies requires developing a climate change strategy, incorporating it into budgets, enhancing public-private partnerships, leveraging international finance, and promoting climate-resilient investments. This multifaceted approach ensures effective mobilization and allocation of resources towards reducing emissions, enhancing carbon sinks, and building resilience to climate impacts.

How can private sector participate in climate financing ?

Private sector participation in climate financing can take various forms, including direct investments in renewable energy projects, issuing green bonds or sustainable investment funds, carbon credit trading, R&D for innovative climate solutions, forming partnerships, adopting circular economy models, implementing eco-friendly business practices, maintaining transparency in environmental impact reporting, providing philanthropic support, and engaging employees in sustainability efforts. These actions not only mitigate climate change but also often improve corporate reputation and open new markets.

How do extreme weather events caused by climate change affect employment rates ?

This article explores the impact of extreme weather events caused by climate change on employment rates in various sectors, including agriculture, construction, and tourism. It highlights the vulnerability of these sectors to extreme weather events such as droughts, floods, heatwaves, hurricanes, tornadoes, wildfires, storms, rising sea levels, and reduced snowfall. The article also discusses potential mitigation strategies that can help reduce the impact of these events on employment rates in the affected sectors.

What are the major sources of climate finance and how are they allocated ?

The text discusses the main sources of climate finance, which include public sector funding, private sector investment, and multilateral institutions. Public sector funding is provided through government budgets, international climate funds, and domestic climate funds. Private sector investment comes from corporate sustainability initiatives, private climate funds, and impact investing. Multilateral institutions such as development banks, international financial institutions, and United Nations agencies also contribute to climate finance. These sources are crucial for supporting climate action globally, with allocations focused on reducing greenhouse gas emissions, adapting to the impacts of climate change, and promoting sustainable development.

How can we reduce greenhouse gas emissions from transportation sector ?

The transportation sector is a significant contributor to greenhouse gas emissions, and reducing these emissions is crucial for mitigating climate change. Strategies include encouraging public transportation, promoting electric vehicles, improving fuel economy and vehicle efficiency, developing alternative fuels, implementing policies and regulations, investing in sustainable urban planning, and raising awareness and education. By adopting these strategies, we can collectively work towards reducing greenhouse gas emissions from the transportation sector.

How can blockchain technology revolutionize the healthcare sector ?

Blockchain technology has the potential to revolutionize the healthcare sector by addressing key challenges such as data privacy, security, interoperability, and efficiency. Key features of blockchain include decentralization, transparency, immutability, and security. Applications of blockchain in healthcare include electronic health records management, drug supply chain management, clinical trials and research, health insurance claims processing, and telemedicine and remote monitoring. As more healthcare organizations adopt blockchain, we can expect significant improvements in patient care, research, and overall healthcare delivery.

What are the potential benefits of using blockchain technology in the education sector ?

Blockchain technology can transform the education sector by providing immutable records, decentralized networks, enhanced collaboration through smart contracts, and improved communication. These benefits include maintaining accurate academic records, ensuring research data integrity, automating administrative tasks, and fostering teacher-student interaction. As the technology advances, it is expected to have a significant impact on the future of education.

What are the potential risks of climate change for the insurance sector ?

Climate change poses significant threats to the insurance sector, including increased natural disasters, changes in liability exposures, property value fluctuations, and regulatory/legal changes. Insurers must adapt by assessing risks, updating policies, and collaborating with governments to create effective strategies.

How has the COVID-19 pandemic affected the financial markets ?

The COVID-19 pandemic caused significant disruptions in financial markets, including increased volatility, sector-specific impacts, and central bank interventions. Stock markets experienced sharp declines initially, with travel and retail sectors hit hard, while healthcare and technology sectors generally fared well. Central banks cut interest rates and injected liquidity to stabilize markets. Bond markets saw increased activity, and oil prices experienced dramatic swings. Investor behavior shifted towards defensive investing, and economic indicators showed negative trends. The long-term implications of these changes are still unfolding but are likely to shape the financial landscape for years to come.

How does economic recovery affect different industries differently ?

Economic recovery affects industries differently based on their reliance on consumer spending, investment, government policies, and global markets. Consumer discretionary sectors like retail and hospitality are highly sensitive to economic fluctuations but can rebound quickly with increased consumer confidence. The technology sector often remains resilient during downturns, with continued growth in segments like software and online services. Manufacturing may face challenges due to supply chain disruptions but can rapidly expand with demand recovery. Financial services benefit from improved credit conditions and increased lending activities. Healthcare is generally less affected by economic cycles and can grow with aging populations. Energy sector recovery depends on global demand and policy shifts towards renewable energy. Understanding these differential impacts is crucial for investors, policymakers, and businesses to navigate the changing landscape effectively.

How has the involvement of the private sector influenced the strategies for global climate governance ?

The influence of the private sector on global climate governance strategies is evident in innovation, finance, and policy-making. Private companies invest in research and development of new technologies that can reduce greenhouse gas emissions and commercialize these technologies for widespread use. They lead the way in developing renewable energy sources and improving energy efficiency. In terms of finance, private companies issue green bonds and venture capitalists invest in startups focused on climate solutions. They also participate in carbon markets and create carbon offset programs. In policy-making, private companies engage in advocacy and lobbying efforts to shape government policies related to climate change and integrate corporate social responsibility into their business models. They collaborate with governments and international organizations in public-private partnerships and multi-stakeholder initiatives. Overall, the involvement of the private sector has significantly influenced global climate governance strategies by driving innovation, providing financial resources, and shaping policy decisions.

What are the economic implications of climate change for the agricultural sector ?

The text discusses the economic implications of climate change for the agricultural sector, including changes in crop yields, increased costs of production, shifts in trade patterns, and the need for adaptation strategies. Climate change can lead to a decrease in crop productivity due to extreme weather events, changes in temperature and rainfall patterns, and pests and diseases. The unpredictability of weather patterns makes it difficult for farmers to plan their crops and manage resources effectively, resulting in higher risk and reduced investment. Climate change can also increase the costs of agricultural production through adaptation measures, input costs, and insurance. As some regions become more favorable for certain crops while others become less so, there could be significant shifts in global trade patterns, leading to new market opportunities and loss of competitiveness. To mitigate the negative impacts of climate change on agriculture, there is a need for adaptation strategies such as research and development, policy interventions, and education and training.

What is the impact of financial regulation on innovation in the financial sector ?

Financial regulation plays a critical role in the innovation landscape of the financial sector, with both positive and negative impacts. Positively, it promotes transparency and trust, encourages responsible innovation, and facilitates access to capital. However, it can also slow down the pace of innovation, restrict experimentation, and stifle international competitiveness. To mitigate these negative effects, adaptive regulation, collaborative approaches, and education and training are recommended. Striking a balance between fostering innovation and ensuring safety is crucial.

How is the tourism industry adapting to climate change-related risks and opportunities ?

The tourism industry, a significant contributor to the global economy, has been profoundly affected by climate change. The sector is now compelled to adapt to the associated risks and opportunities in various ways, including developing disaster management plans, building more resilient infrastructure, promoting sustainable tourism practices, diversifying offerings to attract tourists throughout the year, adopting green initiatives, developing nature-based tourism activities, creating wellness retreats, and providing educational programs about the connection between climate change and health. By implementing innovative solutions and embracing sustainability, the sector aims to mitigate the negative impacts of climate change and ensure its long-term viability.

What measures can be taken to reduce the carbon footprint of the tourism sector ?

The text discusses measures to reduce the carbon footprint in the tourism sector, including promoting sustainable transportation, green accommodations, responsible tourism, carbon offsetting programs, renewable energy sources, and proper waste management. These steps aim to minimize the environmental impact of tourism while still allowing people to enjoy traveling and exploring new places.

How do energy-efficient buildings contribute to reducing carbon emissions in the construction sector ?

Energy-efficient buildings are crucial in the construction sector for reducing carbon emissions, which contribute significantly to global warming and climate change. The importance of urgent action is emphasized by the IPCC's warning about the limited timeframe to limit global warming to 1.5°C above pre-industrial levels. Energy-efficient buildings can reduce energy consumption, lower energy bills, improve comfort and health, and contribute to long-term sustainability. Strategies for achieving energy efficiency include passive design strategies, high-performance building envelopes, advanced HVAC systems, retrofitting existing buildings with energy audits and renewable energy sources. Collective action from various stakeholders is necessary to make significant progress towards a sustainable future.

In what ways do extreme weather events, such as hurricanes and typhoons, impact the fishing sector ?

This text discusses the various impacts that extreme weather events, such as hurricanes and typhoons, have on the fishing sector. It outlines direct damage to fishing infrastructure like vessels, ports, and processing facilities, disruption of fishing operations due to safety concerns and loss of gear, environmental changes affecting fish populations, economic impact on fishermen and communities including loss of income, market disruptions, and recovery costs, and long-term implications for the industry such as shifting fishing patterns, policy changes, and sustainability efforts. It concludes by highlighting the importance of understanding these impacts and working together to develop strategies that can build resilience against future extreme weather events.

What is the importance of market trends in stock analysis ?

Market trends play a crucial role in stock analysis by providing insights into the overall direction and momentum of the market. There are three types of market trends: uptrends, downtrends, and sideways trends. Understanding market trends is essential for making informed investment decisions. By analyzing market trends, investors can identify potential opportunities and risks associated with specific stocks or sectors. To effectively use market trends in stock analysis, investors should first identify the current market trend and then analyze individual stocks or sectors relative to the overall market. Make informed investment decisions based on your analysis of market trends and individual stocks or sectors. Monitor changes in market trends and adjust your investment strategy accordingly.

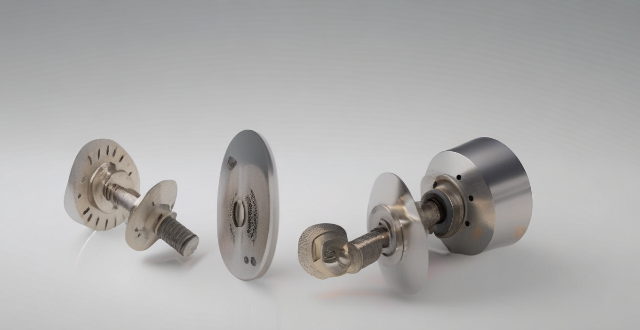

In which industries are permanent magnet motors most commonly used ?

Permanent magnet motors are utilized across a wide range of industries due to their efficiency and reliability. Key sectors include the automotive industry, where they power electric and hybrid vehicles and are used in automated manufacturing. In aerospace and defense, PM motors are crucial for aircraft systems and military applications. Appliance manufacturing benefits from PM motors in household and commercial equipment. The medical sector employs them in imaging equipment and surgical tools. Manufacturing and process control use PM motors in CNC machinery and pumps/valves. Renewable energy sectors such as wind turbines and solar tracking systems also rely on these motors. Consumer electronics, including audio and visual equipment as well as toys and hobbyist products, make use of permanent magnet motors for various functions.