Important Risk

Why is it important to conduct a climate risk assessment ?

Climate risk assessment is crucial for understanding the potential impacts of climate change on different sectors and systems, identifying vulnerabilities and risks, developing adaptation strategies and policies, enhancing resilience and reducing losses, and supporting decision making. It helps in building a more resilient and sustainable future for all.

Why is climate risk management important for businesses and organizations ?

Climate risk management is crucial for businesses and organizations due to its impact on operations, financial implications, reputational considerations, legal and compliance obligations, and ethical responsibilities. Supply chain disruptions, physical asset damage, regulatory changes, insurance costs, investor pressure, capital at risk, public perception, stakeholder engagement, leadership opportunities, compliance with laws, contractual obligations, sustainability goals, and intergenerational equity are all affected by climate change. Proactive climate risk management can protect assets, maintain investor confidence, uphold reputation, meet compliance requirements, and fulfill ethical responsibilities to current and future generations.

What is risk management and why is it important ?

Risk management is a systematic approach used by organizations to identify, assess, and prioritize potential risks that may impact their objectives. It involves implementing strategies to monitor and control these risks effectively. The goal of risk management is to minimize the probability and impact of negative events and maximize the opportunities for positive outcomes. The importance of risk management includes mitigating uncertainty, enhancing decision-making, compliance and regulatory requirements, protection of reputation, financial performance, and promoting innovation. Effective risk management is crucial for any organization looking to sustain its operations, protect its assets, enhance decision-making, maintain compliance, preserve its reputation, and improve its financial performance. It enables companies to navigate challenges proactively and capitalize on opportunities while minimizing the impact of potential threats.

What role do scientists play in climate risk assessments ?

Scientists are crucial in climate risk assessments, analyzing data, developing models, and providing recommendations for mitigating risks. They collect data from multiple sources and use statistical methods to identify trends, create computer models to predict impacts, develop strategies to mitigate risks, and communicate their findings to build support for policies and actions.

Are there any risks associated with aerobic exercise ?

Aerobic exercise, also known as cardio, is a popular form of physical activity that involves increasing your heart rate and breathing hard for an extended period of time. While aerobic exercise has numerous health benefits, it is important to be aware of the potential risks associated with this type of exercise. In this article, we will discuss some of the risks associated with aerobic exercise and how to minimize them. Overexertion is one of the most common risks associated with aerobic exercise. To avoid overexertion, it is essential to start slowly and gradually increase the intensity and duration of your workouts. Another risk associated with aerobic exercise is the potential for injuries. To reduce the risk of injury, it is important to wear appropriate footwear and clothing, warm up before exercising, and use proper form and technique when performing exercises. Dehydration is another risk associated with aerobic exercise. To prevent dehydration, it is important to drink plenty of water before, during, and after your workouts. While rare, cardiovascular events such as heart attacks and strokes can occur during aerobic exercise. To minimize the risk of cardiovascular events, it is important to undergo a thorough medical evaluation before starting an aerobic exercise program.

What is the risk involved in investing in bonds ?

Investing in bonds carries risks such as interest rate, credit, inflation, liquidity, reinvestment, call, prepayment, foreign currency, and political/regulatory changes. Understanding and managing these risks is crucial for protecting your investment. Diversifying your portfolio across different types of bonds and monitoring market conditions can help mitigate these risks.

Why is financial regulation important ?

Financial regulation plays a crucial role in maintaining the stability and integrity of the financial system. It protects investors by ensuring transparency and preventing fraudulent activities, maintains stability by preventing excessive risk-taking, encourages economic growth through competition and innovation, and prevents financial crime such as money laundering. Without adequate regulation, the risks associated with financial activities could lead to significant economic disruptions and harm to individuals and businesses alike.

What are the most important factors to consider when purchasing insurance ?

When purchasing insurance, important factors to consider include the type of coverage needed, deductibles, premium costs, insurer reputation, and policy terms and conditions. It's important to choose a policy that provides adequate coverage for your specific situation while also considering cost and provider reputation.

What are the key components of a successful disaster risk management plan ?

Key Components of a Successful Disaster Risk Management Plan include: 1. Risk Assessment 2. Prevention and Mitigation Strategies 3. Preparedness Activities 4. Response Mechanisms 5. Recovery and Rehabilitation 6. Continuous Improvement

Can physical activity reduce the risk of heart disease ?

Regular physical activity can significantly reduce the risk of heart disease by improving blood circulation, strengthening heart muscles, and reducing major risk factors such as high blood pressure, high cholesterol, and diabetes. Recommended types of exercise include aerobic activities and strength training. Following guidelines from health organizations like the WHO can help maintain cardiovascular health.

How does participating in extreme sports affect mental toughness and risk-taking behavior ?

Extreme sports can positively affect mental toughness and risk-taking behavior, helping individuals build resilience and manage risks effectively. However, it is crucial to prioritize safety and recognize personal limitations.

How can governments implement climate risk management policies to protect their citizens and infrastructure ?

Governments can implement climate risk management policies by assessing the risks, developing a comprehensive plan, investing in resilience and adaptation measures, engaging stakeholders and building public awareness, and monitoring and evaluating progress.

Are there any low-risk investment options that still offer wealth growth potential ?

Investing always comes with a certain level of risk, but there are some investment options that are considered to be relatively low-risk while still offering the potential for wealth growth. These include savings accounts and certificates of deposit (CDs), bonds, mutual funds and exchange-traded funds (ETFs), and real estate investment trusts (REITs). It's important to do your research and understand the risks involved before making any investment decisions.

What are some best practices for integrating climate risk into investment decision-making processes ?

As climate change continues to affect financial markets, integrAs climate change continues to affect financial markets, integr decision-making processes is becoming integrating climate risk into investment decision-making processes is becoming increasingly important. Best practices for doing so include assessing climate risk in the investment process, incorporating climate risk into investment analysis, monitoring and reporting on climate risk exposure, and collaborating with other stakeholders. These practices help investors manage climate risk effectively and make informed investment decisions that align with sustainability goals.

What is disaster risk management ?

Disaster risk management (DRM) is a comprehensive approach aimed at reducing the impact of natural and human-made disasters on communities. It involves understanding, assessing, and reducing risks through prevention, preparedness, response, and recovery strategies. The goal is to ensure that people's lives and livelihoods are not compromised by disaster events. Key components include risk assessment, hazard mitigation, early warning systems, emergency planning, community education, immediate action, coordination, rehabilitation, reconstruction, and sustainable development. Best practices involve multi-stakeholder collaboration, gender sensitivity, use of technology, inclusive planning, and regular review and updating. Challenges include limited resources, political will, information gaps, and cultural differences. Effective DRM requires a multifaceted approach that considers social, economic, and environmental factors.

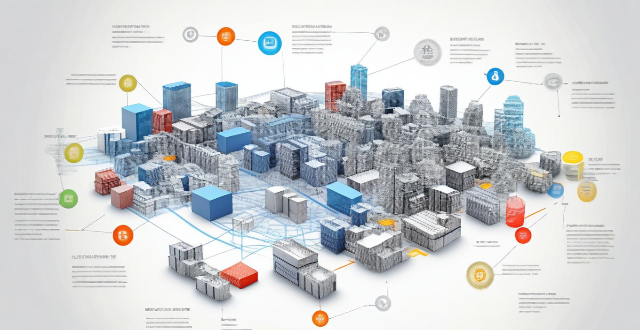

What is climate risk assessment ?

Climate risk assessment is a systematic process that identifies, evaluates, and prioritizes the potential impacts of climate change on a specific region or sector. It involves analyzing the likelihood and severity of various climate-related risks, such as extreme weather events, sea level rise, and changes in temperature and precipitation patterns. The goal of climate risk assessment is to inform decision-makers about the risks associated with climate change and help them develop strategies to manage and adapt to these risks. Key components of climate risk assessment include identifying potential risks, evaluating their potential impacts, prioritizing them based on severity and likelihood of occurrence, and developing adaptation strategies to reduce potential impacts. By implementing these strategies, decision-makers can help ensure that their communities are better prepared for the challenges posed by climate change.

How can communities be better prepared for disasters through effective risk management ?

Communities can be better prepared for disasters through effective risk management strategies, which include risk assessment, mitigation, transfer, and acceptance. Risk assessment involves identifying hazards, evaluating vulnerabilities, and assessing consequences. Risk mitigation includes structural and non-structural measures. Risk transfer can be achieved through insurance and government aid. Finally, risk acceptance focuses on emergency response plans and community resilience.

How does risk management relate to compliance and regulatory requirements ?

Risk management and compliance are interconnected aspects of organizational operations, aimed at safeguarding against potential losses and legal issues. Risk management identifies and prioritizes risks impacting objectives, while compliance ensures adherence to laws and regulations. An integrated approach enhances efficiency, and collaboration between departments is key for success. Regulatory requirements significantly influence risk management and compliance strategies, with direct rules and indirect environmental changes. Understanding these dynamics is vital for maintaining reputation and avoiding compliance breaches.

How do banks manage credit risk ?

Banks manage credit risk through a variety of methods and strategies to ensure the stability of their operations and protect against potential losses. They identify and assess credit risk using credit scoring models, financial analysis, and credit reports. They mitigate credit risk through diversification, collateral and guarantees, and credit derivatives. Banks monitor and control credit risk by ongoing monitoring, loan loss reserves, and regulatory compliance. In case of credit risk events, banks recover through workout agreements, legal recourse, and communication with stakeholders. By employing these strategies, banks aim to minimize credit risk while still providing essential lending services to support economic growth and individual prosperity.

How important is public awareness and education in the context of disaster risk management ?

Public awareness and education are vital in disaster risk management, enhancing community preparedness, reducing vulnerabilities, promoting resilience, and encouraging community engagement. Examples like Hurricane Katrina and the Japan Earthquake and Tsunami highlight the importance of these initiatives in saving lives and minimizing damages during disasters.

Why is it important to warm up before exercise ?

Warming up before exercise is crucial for preparing the body, preventing injuries, and improving performance. Benefits include increased blood flow, raised body temperature, loosened joints, prepared nervous system, reduced cardiovascular risk, and enhanced workout results.

How can organizations create a culture of risk awareness among employees ?

Organizations can create a culture of risk awareness among employees by implementing strategies such as leadership buy-in, training and education, open communication channels, integrating risk management into daily operations, recognizing and rewarding risk awareness, and continuous improvement. These efforts will help employees proactively identify, assess, and manage risks more effectively.

How can I optimize storage space on my iPhone without deleting important files ?

Managing storage space on your iPhone is crucial for maintaining its performance and ensuring that you have enough room for new apps, photos, and other files. However, deleting important files is not always the best solution. In this guide, we will explore some effective ways to optimize storage space on your iPhone without compromising your important data. Clearing app cache can free up storage space without affecting your important files. Reviewing large files such as old videos or music tracks and deleting the ones you don't need can also help free up space. Optimizing photo storage by selecting "Optimize iPhone Storage" in the Photos settings can save space without deleting any important memories. Managing messages by selecting a shorter duration for keeping messages can free up space without affecting recent conversations. Offloading unused apps can help free up space without deleting any important data associated with those apps. By implementing these strategies, you can ensure that your iPhone runs smoothly and has enough space for new content while keeping your important data safe and accessible.

How can companies implement effective risk management strategies ?

Effective Risk Management Strategies for Companies Risk management is a critical aspect of any business operation. It involves identifying, assessing, and prioritizing potential risks that could impact the company's objectives. Here are some effective risk management strategies that companies can implement: 1. Identify Potential Risks: The first step in implementing effective risk management is to identify potential risks. This involves analyzing the company's operations and processes to determine what could go wrong. Some common types of risks include financial risks, operational risks, strategic risks, and compliance risks. 2. Assess and Prioritize Risks: Once potential risks have been identified, they need to be assessed and prioritized based on their likelihood and potential impact. This involves assigning each risk a score based on its severity and probability of occurrence. The risks can then be ranked in order of priority, with the most significant risks being addressed first. 3. Develop Risk Mitigation Plans: For each identified risk, a mitigation plan should be developed. This plan should outline the steps that will be taken to reduce or eliminate the risk. Mitigation plans can include avoidance, reduction, transfer, or acceptance. 4. Monitor and Review Risks Regularly: Risk management is an ongoing process, and companies should regularly monitor and review their risks. This involves tracking changes in the business environment and updating risk assessments accordingly. It also involves evaluating the effectiveness of risk mitigation plans and making adjustments as needed. In conclusion, effective risk management strategies involve identifying potential risks, assessing and prioritizing them, developing mitigation plans, and regularly monitoring and reviewing them. By implementing these strategies, companies can reduce their exposure to risks and protect their operations and bottom line.

What is credit monitoring and why is it important in credit management ?

Credit monitoring is the process of tracking and analyzing a borrower's credit history, including payment behavior, outstanding debts, and changes in credit scores. It is important for early warning signals of potential default or delinquency, accurate risk assessment, fraud prevention, customer relationship management, and compliance with regulations. By continuously monitoring a borrower's credit history, lenders can update their risk assessments, prevent fraud, tailor their products and services to better meet their customers' requirements, and ensure they are meeting regulatory requirements.

Is there a link between exercise and reduced risk of depression ?

**Link Between Exercise and Reduced Risk of Depression: A Comprehensive Overview** Depression is a prevalent mental disorder that affects millions globally. While its exact cause remains unclear, various factors, including lifestyle choices like exercise, have been studied for their potential to reduce the risk. This article delves into the evidence supporting the link between exercise and reduced risk of depression, exploring studies on animals and humans, potential mechanisms underlying this relationship, and practical tips for incorporating exercise into one's routine. **Studies on Animals:** Research has shown that regular exercise in rats can increase BDNF levels, a protein linked to the development and treatment of depression. This suggests that exercise may help reduce depression risk by boosting BDNF levels. **Studies on Humans:** Numerous studies have investigated the human connection between exercise and depression. A meta-analysis found exercise significantly reduces depressive symptoms compared to no treatment or placebo interventions. Another longitudinal study showed that regular physical activity lowers the likelihood of developing depression compared to sedentary behavior. **Potential Mechanisms:** Several mechanisms could explain how exercise reduces depression risk: * **Neurobiological Changes:** Exercise increases BDNF levels, promoting neuronal growth and improving mood. It also alters neurotransmitter levels involved in mood regulation. * **Endocrine Response:** Exercise stimulates endorphin release, producing pleasure and reducing pain perception, contributing to improved mood. * **Psychosocial Benefits:** Regular physical activity provides social interaction opportunities, enhancing mental health. It also improves self-esteem and body image. * **Stress Reduction:** Exercise reduces stress by decreasing cortisol secretion and promoting relaxation, which helps prevent depression since stress is a known risk factor. **Practical Tips:** To reduce your depression risk through exercise, start slowly with low-intensity activities, find enjoyable exercises, set realistic goals, make it social, and monitor your progress. In conclusion, ample evidence supports a link between exercise and reduced risk of depression. Both animal and human studies demonstrate the mood-enhancing effects of regular physical activity. By understanding the potential mechanisms and incorporating exercise into your routine, you can potentially lower your risk of developing depression and improve your overall well-being.

Why is it important to have a basic understanding of finance ?

Having a basic understanding of finance is crucial for making informed decisions about money, planning for the future, and managing financial risks effectively. It helps individuals evaluate investment options, manage debt wisely, create a budget, save for retirement and education expenses, build wealth over time, protect against unexpected events with insurance, plan estates, and minimize investment risks through diversification. Overall, financial literacy improves financial well-being and peace of mind.

What are some common tools and techniques used in risk management ?

Risk management is a process that involves identifying, assessing, and prioritizing potential risks. There are various tools and techniques used in risk management, including brainstorming, Delphi method, checklists, qualitative and quantitative assessment, risk matrix, cost-benefit analysis, avoidance, reduction, transference, acceptance, continuous monitoring, and audits. These tools and techniques help organizations and individuals manage risks effectively and make informed decisions.

How can climate risk management help reduce the impact of climate change on the environment ?

Climate risk management is a multi-step approach that helps mitigate the effects of climate change on the environment. It involves identifying and assessing risks, prioritizing them, developing adaptation strategies, implementing mitigation efforts, fostering collaboration, and continuously monitoring outcomes. This proactive method aims to protect natural systems from adverse climate impacts, promote sustainable practices, and reduce greenhouse gas emissions. By adopting these measures, we can build resilience against climate-related risks and contribute to a more sustainable future for all.

Is there a link between sedentary lifestyle and increased risk of mental health disorders ?

This article explores the link between sedentary lifestyle and increased risk of mental health disorders such as depression, anxiety, and stress-related disorders. It suggests that lack of exercise can contribute to these issues due to decreased endorphin release and higher cortisol levels. The article recommends increasing physical activity, taking frequent breaks from sitting, and practicing mindfulness and stress-reduction techniques to reduce these risks.