Money Savings

How do I teach my children about saving money ?

Teaching children about saving money is a vital life skill that can benefit them throughout their lives. Here are some effective strategies to help your kids learn the value of saving: 1. Start early by introducing the concept of money and using visual aids like charts or piggy banks. 2. Set an example by demonstrating responsible financial behavior and sharing your own experiences with saving. 3. Make it fun by creating games that teach children about earning and saving money, and offering small rewards for reaching savings goals. 4. Encourage earning by encouraging part-time jobs or chores around the house, and teaching them about allowances. 5. Set goals together by establishing specific savings goals and tracking progress towards these goals. 6. Teach them about budgeting by explaining its importance and practicing budgeting together. 7. Introduce them to banking by opening a savings account for your child and explaining how interest works. 8. Discuss long-term goals like college tuition or car payments, and encourage long-term saving. 9. Teach them about credit by explaining what credit cards are and how they work, including the dangers of overspending. 10. Foster independence by encouraging financial independence and providing support as needed.

What are some common mistakes people make when trying to save money ?

Saving money is a crucial aspect of financial planning, but it's not always easy. Many people struggle with saving money and often make some common mistakes that can hinder their progress. Here are some of the most frequent errors people commit when trying to save money: Not having a clear savings goal, underestimating expenses or overestimating income, impulse buying, not taking advantage of discounts and deals, not automating savings, spending on depreciating assets, not reviewing banking and service providers, and ignoring the power of compound interest. By avoiding these common pitfalls, individuals can make substantial progress in their savings journey and achieve their financial goals more efficiently.

What are the best practices for teaching children about money management and savings ?

Teaching children about money management and savings is an essential life skill that can help them develop good financial habits. Here are some best practices for teaching children about money management: 1. Start early: Even toddlers can understand basic concepts like saving and spending. Use everyday opportunities to talk about money and its value. 2. Lead by example: Children learn by example, so it's important to model good financial habits yourself. Show them how you budget, save, and make decisions about spending. 3. Use allowances wisely: Giving your child an allowance is a great way to teach them about money management. Encourage saving, teach spending, and introduce giving as part of their allowance. 4. Play money games: Board games and online games can be fun and educational at the same time. Some popular ones include Monopoly, The Game of Life, and PiggyBot. 5. Involve them in family finances: Involving your children in family finances can help them understand the real-world implications of money management. Have them help you create a budget, go grocery shopping with you, and talk to them about bills and expenses. Remember to be patient, consistent, and positive when teaching children about money management and savings. With these best practices, your child will develop good financial habits that will serve them well throughout their life.

How can I maximize my savings during a shopping festival ?

Shopping festivals are a great opportunity to save money on your purchases. Here are some tips to help you maximize your savings: - Make a list of items you need before the festival starts to avoid impulse purchases. - Research prices beforehand to find the best deals. - Use coupons and promo codes to save money on your purchases. - Shop online for exclusive discounts and free shipping. - Buy in bulk if you know you will use an item frequently. - Take advantage of cashback offers from credit cards. - Don't forget to factor in taxes when calculating your savings.

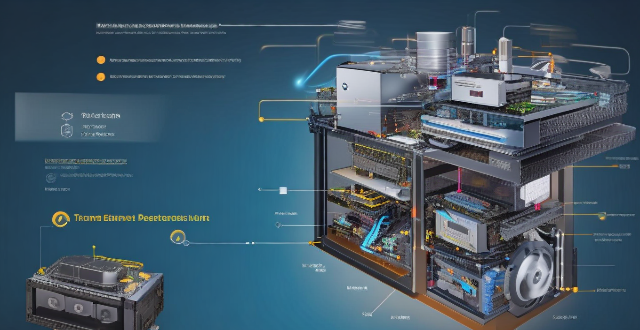

How do smart thermostats contribute to energy savings ?

Smart thermostats contribute to energy savings through automatic temperature control, energy-saving modes, learning capabilities, remote access and control, reporting and analytics, and integration with other smart devices. These features help reduce unnecessary energy usage and optimize HVAC system performance, leading to cost savings on utility bills without sacrificing comfort.

Can waste reduction lead to cost savings for individuals and companies ?

Waste reduction can lead to cost savings for both individuals and companies by minimizing waste in various aspects of daily life and business operations. For individuals, reducing food waste through meal planning and proper storage, minimizing energy consumption with energy-efficient appliances and water conservation, and reducing unnecessary spending through secondhand shopping and repairing instead of replacing can result in significant cost savings. Companies can also benefit from waste reduction by optimizing production processes with lean manufacturing techniques and resource recovery, improving logistics and supply chain management through just-in-time inventory and efficient packaging, and enhancing energy efficiency with green building design and employee training. Overall, waste reduction is a crucial aspect of sustainable living and business practices that can lead to cost savings while contributing to environmental sustainability.

How can I protect my retirement savings from inflation ?

Inflation can significantly erode the value of retirement savings over time. To protect your nest egg, consider diversifying your portfolio with stocks, real estate, and commodities. Investing in inflation-protected securities (TIPS) and fixed index annuities can also help maintain purchasing power. Global diversification, particularly in emerging markets, offers growth opportunities and hedges against local economic conditions. Maintaining a cash reserve for liquidity and short-term needs is crucial, as is regularly rebalancing your portfolio to stay on track with your goals. Delaying Social Security benefits can lead to higher monthly payments, acting as longevity insurance. Increasing contributions, especially if matched by employers, and working with a financial advisor for personalized guidance are other effective strategies. By employing these tactics, you can safeguard your retirement savings from inflation and ensure a comfortable retirement.

How much money do I need to save for retirement ?

Planning for retirement is crucial to ensure a comfortable life after stopping work. The amount of money needed depends on factors like age, expected retirement age, lifestyle, and expenses. This guide helps calculate your retirement savings goal by determining your retirement age, assessing your financial situation, estimating retirement expenses, using retirement calculators, considering inflation and investment returns, and creating a savings plan. By doing so, you can work towards a comfortable and secure retirement.

How can we save money on food during a family vacation ?

Saving money on food during a family vacation is crucial for budgeting. To achieve this, one should plan ahead by researching local restaurants and checking online reviews. Cooking your own meals in a vacation rental with a kitchen or bringing a portable stove can significantly reduce expenses. Packing healthy snacks like fruits and nuts can prevent expensive snack purchases at tourist attractions. Utilizing hotel amenities such as free breakfasts or dinners can also save money. Sharing meals by ordering larger portions and splitting them among family members is another effective strategy. Lastly, using discounts and coupons for local restaurants can further cut costs. By following these tips, one can enjoy delicious meals without overspending.

How can I create a successful savings plan ?

Creating a successful savings plan is essential for achieving financial goals, such as saving for a down payment, retirement, or an emergency fund. The steps to create a successful savings plan include setting clear financial goals, analyzing the current financial situation, establishing a budget, automating savings, choosing the right tools, monitoring and adjusting the plan, and seeking professional advice. Consistency and perseverance are key to success in sticking to the plan.

What is the relationship between energy-efficient appliances and overall energy savings ?

The text discusses the connection between energy-efficient appliances and overall energy savings, defining such appliances as those engineered to meet specific efficiency standards. These devices reduce direct energy consumption through lower power requirements and advanced technology, leading to long-term cost benefits and environmental advantages like reduced greenhouse gas emissions. To maximize savings, consumers should research and maintain these appliances properly and replace older models. The relationship underscores the importance of energy-efficient appliances in achieving energy savings for a more sustainable future.

Is it worth buying electronics at duty-free shops ?

When considering buying electronics at duty-free shops, one must weigh the pros and cons. Tax benefits can save money, but price comparison is crucial to ensure real savings. Product availability may be limited, and warranty and support validity in your home country should be checked. Return policies are stricter, and additional costs like baggage fees and customs charges may apply. Convenience is a significant advantage for immediate needs, but currency exchange rates can impact savings. Evaluate all these factors before deciding to buy.

What are the advantages of using a cashback website for shopping ?

Cashback websites offer several advantages to shoppers, including savings, convenience, flexibility, user-friendly interface, security, and extra perks like sign-up bonuses and loyalty programs. These benefits can result in significant savings over time while providing a convenient and secure shopping experience.

What are some effective saving techniques for beginners ?

Saving money is a crucial skill that everyone should learn, especially beginners. Here are some effective saving techniques for beginners: setting clear goals, creating a budget, automating savings, cutting unnecessary expenses, and increasing income. By following these steps, you can start saving money and achieving your financial goals.

How can I make sure I'm getting the best value for my money when shopping ?

When it comes to shopping, ensuring you're getting the best value for your money is crucial. Here are some tips to help you make informed decisions and get the most out of your purchases: 1. Research Before You Buy: Read reviews, compare prices, and check for sales and discounts. 2. Set a Budget: Determine your needs, prioritize items, and allocate funds accordingly. 3. Choose Quality Over Quantity: Invest in durable items and consider warranties and guarantees. 4. Take Advantage of Loyalty Programs: Join reward programs and use credit card rewards wisely. 5. Don't Forget About Return Policies: Understand store policies and keep receipts organized. By following these tips, you can ensure that you're getting the best value for your money when shopping. Remember to take your time, do your research, and make well-informed decisions to get the most out of your purchases.

Is it worth subscribing to a membership program for additional savings at a particular store ?

This article explores the pros and cons of joining a membership program at a particular store, including additional savings, early access to sales and products, loyalty rewards, annual fees, limited selection, and privacy concerns. It concludes that while subscribing to a membership program can provide benefits, it's important to weigh the pros and cons before making a decision.

What are some tips for saving money while shopping ?

Saving Money While Shopping: Tips for Smarter Spending Shopping can be both enjoyable and costly. To save money while shopping, consider these tips: make a list before shopping, compare prices across different stores and online retailers, use coupons and discounts, buy in bulk (if applicable), avoid impulse purchases, and shop around holidays for sales. By following these strategies, you can stick to your budget, avoid overspending, and get the best deals possible.

What are some tips for maximizing savings with online shopping coupons ?

Maximizing Savings with Online Shopping Coupons: Tips and Strategies Online shopping has become an integral part of our lives, and using coupons can help us save a significant amount of money. Here are some tips for maximizing savings with online shopping coupons: 1. Sign up for Newsletters: Many online stores offer exclusive discounts and coupon codes to their newsletter subscribers. Sign up for the newsletters of your favorite stores to receive updates on the latest deals and promotions. 2. Use Multiple Coupon Codes: Some online stores allow you to use multiple coupon codes in a single transaction. Try combining different coupon codes to maximize your savings. For example, you can use a discount code for a percentage off your purchase and another code for free shipping. 3. Check for Store-Specific Discounts: Some online stores offer store-specific discounts that can be applied to your purchase. Check the store's website or contact customer support to find out if there are any available discounts. 4. Shop During Sales and Promotions: Keep an eye out for sales and promotions offered by online stores. Many stores offer discounts during holidays, special events, or seasonal changes. You can also check websites like RetailMeNot or Honey to find current promotions and coupon codes. 5. Use Price Comparison Websites: Before making a purchase, use price comparison websites like PriceGrabber or Google Shopping to compare prices across different retailers. This can help you find the best deal and potentially save you money. 6. Look for Free Shipping Offers: Free shipping offers can save you money on your purchase. Look for online stores that offer free shipping or have a minimum purchase requirement for free shipping. You can also try using a coupon code for free shipping if it's available. 7. Stack Coupons with Cashback Offers: Some cashback websites like Rakuten or TopCashback offer additional cashback when you shop through their website. You can stack these cashback offers with coupon codes to maximize your savings. 8. Follow Social Media Accounts: Follow the social media accounts of your favorite online stores to stay updated on their latest deals and promotions. Many stores announce exclusive discounts and coupon codes on their social media platforms. 9. Join Loyalty Programs: Joining loyalty programs of online stores can provide you with exclusive discounts and rewards. These programs often offer points or rewards for every purchase made, which can be redeemed for future purchases or discounts. 10. Be Patient: Sometimes, waiting for the right moment to make a purchase can lead to bigger savings. Keep an eye out for upcoming sales or promotions, and hold off on making a purchase until you find the best deal.

How can I maximize my savings with store loyalty programs ?

Maximizing Savings with Store Loyalty Programs: - Sign up for the program to earn points, get exclusive discounts, and personalized offers. - Use the program every time you shop to accumulate points faster. - Understand the rewards system, including point expiration and reward restrictions. - Take advantage of bonus offers to earn additional rewards. - Stack promotions and discounts to save more money. - Track your rewards and their expiration dates to ensure you use them before they expire.

What tips can help me save money while shopping for groceries ?

Saving money while shopping for groceries requires planning, discipline, and creativity. Making a shopping list, using coupons and discounts, buying in bulk, shopping seasonally, and cooking at home are some of the tips and tricks that can help you save money on groceries. By following these tips, you can significantly reduce your grocery bill without sacrificing quality or variety.

How much should I be saving each month ?

Saving money is crucial for financial planning, but determining how much to save monthly can be challenging. Factors to consider include income, expenses, debts, goals, and lifestyle preferences. It's generally recommended to save at least 20% of your income, prioritize paying off debts, allocate savings towards short-term and long-term goals, and adjust based on lifestyle choices. By creating a personalized savings plan, you can work towards achieving your financial objectives and securing your future.

What are the benefits of shopping during the discount season ?

Shopping during the discount season offers numerous benefits for consumers, including saving money, getting more value for your money, trying new products, clearing out inventory, avoiding crowds, and taking advantage of promotions. By taking advantage of these opportunities, you can maximize your savings and enjoy a more enjoyable shopping experience.

How do I avoid high fees when exchanging money ?

Exchanging money can be costly, but there are ways to avoid high fees. Use your bank or credit card for transactions, consider a prepaid travel card, look for no-fee ATMs, use online currency exchange services, and negotiate with local currency exchange offices. By being aware of your options and doing research ahead of time, you can save money and make your travels more enjoyable.

How can one save money while shopping globally ?

Shopping globally can be an exciting experience, but it can also be costly. Here are some tips on how to save money while shopping internationally: 1. Research the best deals by comparing prices, checking for discounts and coupons, and signing up for newsletters from favorite retailers. 2. Consider shipping costs by looking for retailers that offer free or flat rate shipping and group shipping with friends or family members who live in the same country. 3. Use currency exchange services to compare rates and avoid airport exchange desks, and consider prepaid cards to load money onto a card in your home currency and use it abroad without incurring additional fees. 4. Be aware of taxes and duties by understanding tax regulations of the country you are shopping in, checking for tax-free options for tourists, and calculating duty fees before making a purchase. 5. Shop locally when possible by supporting small businesses, looking for handmade items, and bargaining with street vendors in countries where it is common practice.

Can I use Apple Pay to send money to friends or family ?

The article provides a summary of how to use Apple Pay to send money to friends or family through the Apple Cash feature. It outlines the steps to set up Apple Cash, send money using Apple Pay, and receive money through Apple Pay. Additionally, it mentions other ways to use Apple Pay for transactions such as making purchases, paying for services, splitting bills, and donating to charities.

What are some ways to save money on food while traveling ?

Here are ten ways to save money on food while traveling: 1. Eat local street food for affordable and delicious options. 2. Cook your own meals if you have access to a kitchen or cooking facilities. 3. Pack snacks from home to avoid expensive airport or convenience store prices. 4. Avoid tourist traps and look for places where locals eat for authentic and affordable cuisine. 5. Use discount apps and coupons to save money on food and drink at local establishments. 6. Share meals with friends or family members to enjoy a variety of dishes without spending too much money. 7. Drink tap water instead of buying bottled water to save money. 8. Take advantage of hotel breakfasts to save money on breakfast costs. 9. Visit local markets for fresh produce, meats, and other ingredients that are cheaper than grocery stores or restaurants. 10. Choose budget-friendly restaurants that cater to locals rather than tourists for good food at reasonable prices.

Is it better to save or invest money for wealth growth purposes ?

The age-old debate of whether to save or invest money for wealth growth purposes largely depends on individual circumstances, risk tolerance, and financial goals. Saving offers security and stability but low returns, while investing carries more risk but has the potential for higher rewards. The best approach for most individuals is a balance between saving and investing, with strategies such as establishing an emergency fund, allocating for short-term goals, investing for long-term goals, and regularly re-evaluating financial plans.