Month Introduction

Are there specific days of the week or times of the month when sales are most common ?

This text discusses common patterns and trends in sales throughout the week and month. It suggests that there are certain days of the week and times of the month when sales tend to be higher or lower, depending on the industry, product, and target audience. The text provides general insights for each day of the week and different times of the month, such as Monday being a slower start to the week with people getting back into their routines after the weekend, Tuesday showing an uptick in sales as the workweek progresses, Wednesday offering midweek deals, Thursday seeing increased sales in certain categories as customers plan for the weekend, Friday experiencing a spike in sales due to weekend excitement, Saturday being a busy retail day due to more free time, and Sunday having tapering off sales as people prepare for the upcoming week. The text also suggests that there are certain times of the month when sales are most common, such as the beginning of the month when many consumers receive their paychecks and have more spending power, mid-month when people adjust their budgets and look for deals or necessities they've run out of, and the end of the month when businesses aim to meet monthly targets and offer promotions to boost numbers before the month ends. However, the text emphasizes that these trends are general and that it's important to analyze one's own business data and customer behavior to determine the best timing for sales and promotions. Additionally, external factors such as holidays, seasonality, and economic conditions can also significantly influence sales patterns.

What are the key elements of a baby's nutrition during the first year ?

Infant nutrition is crucial for growth and development during the first year. Key elements include breast milk or formula as the primary source of nutrition, the introduction of solid foods around six months, iron supplementation for breastfed babies, vitamin D supplementation, limited fluid intake in the first six months, the introduction of allergens one at a time, and no evidence that early gluten introduction prevents celiac disease. Consulting with a healthcare professional is recommended for specific dietary needs or concerns.

How much should I be saving each month ?

Saving money is crucial for financial planning, but determining how much to save monthly can be challenging. Factors to consider include income, expenses, debts, goals, and lifestyle preferences. It's generally recommended to save at least 20% of your income, prioritize paying off debts, allocate savings towards short-term and long-term goals, and adjust based on lifestyle choices. By creating a personalized savings plan, you can work towards achieving your financial objectives and securing your future.

**What is the pricing for iCloud+ plans compared to the free iCloud service ?

iCloud is a cloud storage service provided by Apple Inc. that allows users to store their photos, documents, and other data on remote servers for access from multiple devices. While the basic features of iCloud are available for free, Apple also offers paid plans with additional storage capacity and enhanced features under the name iCloud+. The pricing of iCloud+ plans offers good value for the additional storage capacity and features provided, making them a worthwhile investment for many users.

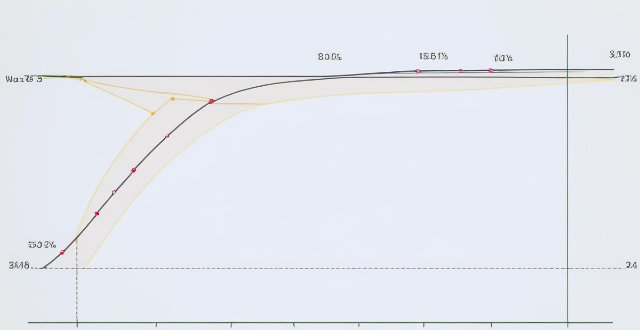

How long does it take to see results from critical thinking training ?

The time it takes to see results from critical thinking training depends on factors such as individual differences, quality of training, frequency and intensity of practice, and feedback mechanisms. Short-term outcomes can be seen within 1-3 months, mid-term outcomes within 3-6 months, and long-term outcomes after 6 months or more. Consistent effort and practice are key to achieving lasting improvements in critical thinking abilities.

**Will my iCloud storage be affected if I downgrade my iCloud plan ?

The text provides a summary of the potential impacts on iCloud storage when downgrading an iCloud plan. It explains that downgrading reduces the available storage space to the new plan's capacity and emphasizes the importance of data management before making any changes. The text also mentions the effects on backups and Family Sharing arrangements and advises discussing the change with family members before proceeding with the downgrade.

How much does it cost to upgrade to 5G network ?

The cost of upgrading to a 5G network varies depending on several factors, including your current plan, the carrier you are using, and the device you have. If you want to take advantage of 5G speeds, you will need a 5G-compatible device which can range from $200 to over $1000. The cost of upgrading to a 5G plan also depends on your carrier, with some offering unlimited data plans starting at around $70 per month. In addition to a new device and plan, you may also need to purchase accessories such as cases or screen protectors that are compatible with your new device. Finally, if you are installing a 5G network in your home or office, there may be additional costs associated with installation fees or equipment rental fees.

How much does an unlimited data plan usually cost ?

Unlimited data plans vary in cost from $60 to $105/month for one line, depending on the provider and included features. Factors affecting the final cost include the number of lines, device payment plans, taxes and fees, autopay discounts, and promotions. It's important to compare plans and consider any additional costs before choosing an unlimited data plan.

How often should I get a physical checkup to monitor my personal health ?

Regular physical checkups are important for maintaining good health and preventing potential illnesses. The frequency of these checkups depends on various factors, including age, gender, family history, and overall health status. Age-specific guidelines suggest that children should have well-child visits according to the American Academy of Pediatrics schedule, adults aged 19 to 64 should have checkups every 2-3 years if in good health, and older adults aged 65 and above should have annual checkups. Gender-specific guidelines recommend women to have regular gynecological checkups and men over 50 to discuss prostate health with their doctor. Family history and overall health status may also influence the frequency of physical checkups. It is essential to consult with a healthcare provider to determine an appropriate schedule for regular checkups tailored to individual needs.

How do I maximize my credit card rewards ?

Maximizing Credit Card Rewards: Tips for Earning More Credit card rewards can be a valuable way to save money and earn cash back, travel points, or other perks. To maximize your rewards, it's important to choose the right credit card, use it regularly, take advantage of bonus categories, and track your rewards. You should also combine rewards with other discounts, consider a card with an annual fee, avoid unnecessary fees, monitor your credit score, and don't overspend. By following these tips, you can make the most of your credit card rewards while using them responsibly.

How does Apple Music compare to other music streaming services like Spotify or Tidal ?

This text compares Apple Music, Spotify, and Tidal in terms of their user interfaces, music libraries, audio quality, pricing, and additional features. Apple Music integrates seamlessly with Apple devices and offers personalized recommendations, while Spotify emphasizes social sharing and collaboration. Tidal focuses on high-quality audio and exclusive content from artists. The choice between these services depends on personal preferences and priorities when it comes to music streaming.

**Are there any limitations to the number of photos and videos I can store in iCloud ?

The amount of storage space you have in iCloud depends on your iCloud+ plan. There are different plans with varying storage limits, ranging from 50GB to 4TB. If you exceed your storage limit, Apple will alert you and give you the option to upgrade or free up space by deleting files.

What is Apple Music ?

Apple Music is a music and video streaming service developed by Apple Inc. It offers access to millions of songs and videos from the iTunes Store, exclusive content, and personalized recommendations. Features include a library, personalized recommendations, radio stations, and artist connections through Connect. The service is available in over 100 countries and regions with various pricing options. It competes with other music streaming services like Spotify and Amazon Music.

What are the best mobile operators in my area ?

Choosing the best mobile operator in your area requires careful consideration of several factors, including coverage, data speeds, pricing, customer service, and network reliability. Some of the best options based on these criteria are Verizon, AT&T, and T-Mobile. Each operator has its own strengths and weaknesses, so it's important to do your research and choose the one that best meets your needs and budget.

How much does Apple Music cost ?

Apple Music offers several pricing plans, including individual, family, and student options, with varying costs and features.

Can you explain the concept of dollar-cost averaging in investing ?

Dollar-cost averaging is an investment method where a fixed amount of money is invested at regular intervals, regardless of the asset's current price. This approach aims to reduce the impact of market volatility and timing on the overall investment portfolio. Key principles include regular investments, a fixed dollar amount, and a long-term focus. Advantages include less volatility, reduced market timing risk, and disciplined convenience. Disadvantages may include opportunity cost, transaction costs, and potential underperformance in a steadily rising market. The strategy works by selecting an investment, determining the investment amount, setting up automatic purchases, and staying disciplined. Dollar-cost averaging offers a straightforward method for building an investment portfolio over time but should be considered alongside individual circumstances and financial advice.

What are the best practices for setting a personal budget ?

The article outlines best practices for setting a personal budget to achieve financial stability and success. It suggests determining income, listing expenses, setting financial goals, creating a budget plan, tracking spending, and adjusting the budget as needed.

What are some common pitfalls when creating a household budget ?

When creating a household budget, people often fall intoWhen creating a household budget, people often fall into can lead to financial difficulties and people often fall into common pitfalls that can lead to financial difficulties and make it harder to achieve financial goals. These pitfalls include not tracking expenses, underestimating expenses, ignoring debt repayment, failing to plan for emergencies, and overspending on non-essentials. To avoid these mistakes, people should keep track of all expenses, be realistic when estimating expenses, prioritize paying off high-interest debt, set aside money for emergencies, and limit discretionary spending. By avoiding these pitfalls, people can create a budget that works for them and helps them achieve their financial goals.