Nes Border

Can small businesses benefit from Cross-Border Payment ?

Cross-border payments are increasingly vital in the global economy, enabling businesses to tap into new markets. Small businesses can benefit from this trend by expanding market access, increasing revenue potential, improving customer experience, reducing costs, and gaining a competitive advantage. As technology continues to evolve, small businesses should consider taking advantage of cross-border payments to grow and succeed on a global scale.

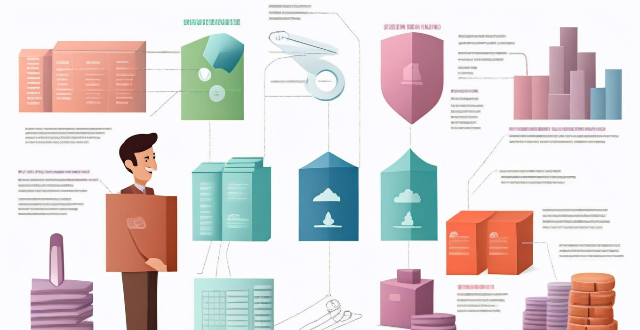

How does Cross-Border Payment work ?

Cross-border payments are transactions that involve transferring money between different countries. The process is complex and requires coordination among various parties, including banks, payment processors, and financial institutions. The steps involved in cross-border payments include initiation of the payment, verification and authorization, execution of the payment, and settlement and reconciliation. There are several methods available for cross-border payments, such as wire transfers, online payment platforms, and mobile wallets. Choosing the appropriate method ensures safe, secure, and efficient cross-border payments.

What is Cross-Border Payment ?

Cross-border payment is the process of transferring money from one country to another, involving currency exchange and various payment methods. It is essential for businesses operating in multiple countries, allowing them to receive and make payments in different currencies. Key features include currency exchange, payment methods, regulations, fees, and timeframes. Benefits of cross-border payments include global expansion, increased sales, reduced costs, and improved cash flow.

What are the benefits of using Cross-Border Payment ?

Cross-border payments are essential for global commerce, offering benefits such as increased access to markets, improved efficiency, lower costs, greater flexibility, enhanced security, and scalability. These advantages help businesses expand globally, making cross-border payments a vital tool for modern commerce.

How do exchange rates affect Cross-Border Payment ?

Exchange rates play a crucial role in cross-border payments, impacting the cost, speed, and feasibility of transactions. They can affect transfer fees, currency fluctuations, processing time, trade opportunities, and investment opportunities. Understanding exchange rates is essential for managing them effectively in international trade or finance.

Are there any risks associated with Cross-Border Payment ?

Cross-border payments come with several risks, includingCross-border payments come with several risks, including risk, legal risk, and it's essential to use reputable payment providers and take steps to protect personal information.

What currencies can be used for Cross-Border Payment ?

The currencies used for cross-border payments vary widely depending on numerous factors, including economic strength, political stability, and market acceptance. Major world currencies like the US Dollar, Euro, British Pound Sterling, and Japanese Yen are commonly used due to their global acceptance and role in international trade and financial markets. Other currencies such as the Chinese Yuan/Renminbi, Canadian Dollar, and Australian Dollar also play significant roles in cross-border payments, particularly in commodities trade and regional economies. Digital currencies, including Bitcoin and stablecoins, are increasingly being used for cross-border payments, offering decentralized transactions and the benefits of blockchain technology. Factors influencing currency choice include regulatory environment, cost considerations, market fluctuations, and business agreements.

How do I track my Cross-Border Payment transaction ?

Cross-border payments can be tracked using various methods such as obtaining key information, utilizing online banking services, contacting the bank directly, using third-party tracking services, staying informed with updates, understanding time frames, confirming receipt with the beneficiary, and monitoring for errors or fraud. It is essential to collect all necessary transaction details before initiating a transfer, including the transaction ID, beneficiary details, date of transfer, amount, and expected delivery date. Most banks provide online services that allow customers to track their transactions, while some financial service providers offer tracking tools specifically designed for cross-border payments. Staying informed with updates through email or SMS notifications is crucial, along with understanding typical time frames for different types of transactions. Confirming receipt with the beneficiary and monitoring for any errors or fraud throughout the process are also important steps to ensure a smooth and secure transaction.

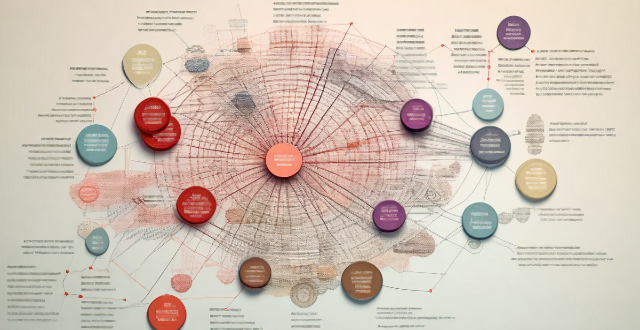

What are the most popular Cross-Border Payment platforms ?

The global economy heavily relies on cross-border payments, and several platforms have emerged to facilitate these transactions. PayPal is a widely used online payment system offering a secure way to send and receive money internationally. Stripe provides APIs for integrating payments into applications and supports multiple currencies. Adyen offers a one-stop platform for all payment methods, reducing transaction friction. TransferWise (now Wise) focuses on reducing transfer costs using a peer-to-peer model. WorldRemit specializes in remittances to mobile wallets and bank accounts in developing countries. Skrill is a digital wallet service with merchant services and a prepaid card option. Payoneer provides mass payments solutions and multi-currency accounts, particularly benefiting affiliate marketers. Each platform caters to different needs, from individual remittances to business solutions, ensuring options for various cross-border payment scenarios.

Is Cross-Border Payment secure ?

Cross-border payments are essential for international trade and business transactions but can pose security risks. Factors like regulatory compliance, technology, fraud prevention measures, and the reputation of the payment service provider affect the security of these payments. Risks include currency fluctuations, political instability, and cyber threats. To ensure security, choose a reputable provider, use secure payment methods, verify recipient details, and keep track of transactions.

What regulations govern Cross-Border Payment ?

Regulations governing cross-border payment include Anti-Money Laundering (AML) laws, Payment Card Industry Data Security Standard (PCI DSS), International Wire Transfer Regulations, and General Data Protection Regulation (GDPR). These regulations ensure the security, safety, and efficiency of the process by requiring financial institutions to verify customer identity, monitor transactions for suspicious activity, protect cardholder data, comply with US sanctions and embargoes, and protect personal data.

What is the future of Cross-Border Payment ?

The future of cross-border payment is expected to be influenced by trends such as digitalization, regulatory changes, innovation in payment methods, and global economic integration. However, challenges like high fees, security risks, and lack of standardization need to be addressed for the industry to become more accessible, secure, and efficient.

How does Cross-Border Payment impact global trade ?

Cross-border payment plays a crucial role in the global trade ecosystem by enabling businesses to buy and sell goods and services internationally. It reduces transaction costs, enhances transparency and efficiency, and promotes economic growth. However, challenges related to regulatory compliance, currency fluctuations, and technological barriers need to be addressed.

Can I use Cross-Border Payment for personal transactions ?

Cross-border payment systems are designed to facilitate international transactions, allowing individuals and businesses to send and receive money across borders. These systems can be used for various purposes, including personal transactions. In this article, we will discuss the use of cross-border payment systems for personal transactions and provide some tips on how to make the most of them. Cross-border payment refers to the process of transferring money from one country to another. This can be done through various methods, such as wire transfers, credit cards, or digital wallets. The main purpose of cross-border payment systems is to simplify the process of sending and receiving money internationally, making it easier for people to conduct business or personal transactions with others around the world. While cross-border payment systems are primarily used for business transactions, they can also be used for personal transactions. Here are some examples of when you might use a cross-border payment system for personal transactions: Sending Money to Friends and Family Abroad: If you have friends or family members living in another country, you may need to send them money occasionally. Cross-border payment systems allow you to do this quickly and easily, without having to worry about exchange rates or bank fees. Paying for Online Shopping: Many online retailers offer international shipping, allowing you to purchase goods from other countries. When paying for these purchases, you can use a cross-border payment system to ensure that your payment is processed securely and efficiently. Travel Expenses: When traveling abroad, you may need to pay for expenses such as accommodation, transportation, or food. Cross-border payment systems can be useful in these situations, as they allow you to make payments in local currencies without having to carry large amounts of cash. To make the most of cross-border payment systems for personal transactions, consider the following tips: Choose the Right Provider: Not all cross-border payment systems are created equal. Some may offer better exchange rates or lower fees than others. Research different providers before choosing one to ensure that you get the best deal possible. Understand Fees and Exchange Rates: Before making any cross-border payment, be sure to understand the fees and exchange rates involved. Some providers may charge additional fees for certain types of transactions, so it's important to know what you're getting into before sending money. Keep Track of Your Transactions: When using cross-border payment systems for personal transactions, it's important to keep track of your transactions. This will help you stay organized and ensure that you don't overspend or lose track of your finances. Be Aware of Scams: Unfortunately, there are scammers who target people using cross-border payment systems. Be cautious when sharing personal information or sending money to someone you don't know well. If something seems suspicious, trust your instincts and report it to the appropriate authorities. In conclusion, cross-border payment systems can be a convenient and efficient way to handle personal transactions with people in other countries. By choosing the right provider, understanding fees and exchange rates, keeping track of your transactions, and being aware of potential scams, you can make the most of these systems and enjoy smoother international financial interactions.

Can I cancel a Cross-Border Payment transaction ?

Canceling a cross-border payment depends on factors like the payment method, bank policies, and timing of cancellation. Wire transfers and electronic platforms are common methods, with immediate requests having higher chances of success. Costs may apply for cancellation, and effective communication with banks or providers is crucial. Steps include acting quickly, verifying transaction status, contacting support, and understanding any fees. Prevention tips involve double-checking details and using reliable platforms.

What fees are associated with Cross-Border Payment ?

Cross-border payments are subject to various fees, including transfer fees, exchange rate markups, receiving fees, and intermediary bank fees. Understanding these fees is crucial for cost-effective international money transfers.

How can I optimize my Cross-Border Payment strategy ?

This guide discusses how to optimize cross-border payment strategy by researching and understanding regulations and compliance requirements, choosing the right payment method, using technology to streamline processes, and working with reliable partners.

How long does it take for a Cross-Border Payment to process ?

The processing time for cross-border payments can vary depending on several factors, including the payment method used, the countries involved, and the banks or financial institutions handling the transaction. Wire transfers typically take 1 to 5 business days, credit cards can take 3 to 7 business days, and digital wallet transactions are usually completed within 24 hours. However, these are just general guidelines and the actual processing time can vary based on the specific circumstances of each transaction.

What happens if my Cross-Border Payment transaction fails ?

If your cross-border payment transaction fails, itIf your cross-border payment transaction fails, it reasons such as insufficient funds it can be due to several reasons such as insufficient funds, invalid recipient information, transfer limit exceeded, technical issues, or fraud detection. It is important to identify the reason behind it and take appropriate action to resolve the issue and complete the transaction successfully.

How can I set up a Cross-Border Payment account ?

The text provides a detailed guide on how to set up a cross-border payment account, including steps such as researching and choosing a provider, checking compliance and regulations, opening an account, verifying the account, configuring payment settings, linking to a business account, testing the system, monitoring and maintaining the account, understanding fees and exchange rates, and optimizing for tax implications. It emphasizes the importance of complying with legal and regulatory requirements, maintaining detailed records, and working with a tax advisor.

How does global shopping contribute to economy ?

Global shopping, or cross-border e-commerce, has become a crucial aspect of the global economy. It involves buying and selling goods and services across national borders through online platforms. This phenomenon has not only revolutionized shopping but also significantly contributed to economic growth worldwide. Here are some ways global shopping boosts the global economy: 1. Increased consumer spending: Global shopping provides consumers with access to a wide range of products from around the world, leading to higher consumer spending, which is a key driver of economic growth. 2. Benefits for sellers: Businesses can reach new customers and expand their market share by tapping into international markets, increasing revenue and profitability. 3. Job creation and employment opportunities: The rise of global shopping has given birth to numerous jobs in various sectors such as logistics, customer service, marketing, and technology. 4. Boosting local economies: Local businesses can reach customers beyond their geographical boundaries by exporting their products globally, generating revenue that helps sustain their operations and contribute to the local economy. 5. Encouraging innovation and competition: The global marketplace created by cross-border e-commerce encourages businesses to innovate and improve their products to stay competitive, benefiting consumers by providing them with high-quality products at competitive prices. 6. Fostering international trade relations: Global shopping promotes cooperation between nations by facilitating trade agreements and reducing barriers to entry for businesses looking to expand internationally.

What role does biometrics play in establishing a digital identity ?

Biometrics are vital for establishing a digital identity, offering security, convenience, accuracy, and scalability. They are used in various applications like mobile devices, online banking, border control, and healthcare.

What are the benefits of shopping through global online platforms ?

The text summarizes the benefits of shopping through global online platforms. The key advantages include increased access to products, competitive pricing, convenience, variety of payment options, easy price comparison, reviews and ratings, direct shipping, cross-border shopping, and environmental friendliness. These benefits make online shopping an attractive option for consumers around the world.

Can you provide examples of international tax planning strategies ?

Here is a summary of the topic: The text discusses various international tax planning strategies that companies can use to reduce their tax liability. These include: 1\. Tax Treaty Shopping: Using provisions in tax treaties between two countries to lower taxes. 2\. Transfer Pricing: Manipulating transfer prices for transactions between related companies in different countries to shift profits to lower-tax jurisdictions. 3\. Deferral of Taxes on Foreign Income: Delaying payment of taxes on income earned in a foreign country until it is repatriated to the home country. 4\. Use of Offshore Companies: Setting up a company in a low-tax jurisdiction to conduct business activities and avoid high taxes in other countries. 5\. Cross-Border Inversions: Acquiring a company in a low-tax jurisdiction and moving the headquarters of the combined entity to that jurisdiction to reduce tax liability in the home country.

Can you provide examples of cultural fusion in different parts of the world ?

Cultural fusion, also known as cultural integration or hybridity, is a phenomenon that occurs when two or more distinct cultures interact and blend to create a new, unique culture. This process can be observed in various parts of the world, where different cultures have come together to form new traditions, languages, cuisines, art forms, and lifestyles. Some examples of cultural fusion include Korea-Japan cultural exchange, India-Pakistan cultural influence, Spain-Morocco cross-cultural interaction, France-England historical interactions, Mexico-United States border culture, and Caribbean-African diasporic cultures. These examples illustrate how cultural fusion can lead to the creation of new and exciting forms of expression across different aspects of society.

What measures can be taken to prevent the spread of infectious diseases across borders ?

The text discusses measures to prevent the spread of infectious diseases across borders, including surveillance and early warning systems, travel restrictions and border controls, vaccination programs, public health infrastructure and preparedness, collaboration and information sharing, and education and public awareness. The Global Health Security Agenda (GHSA) promotes robust surveillance systems for early detection of outbreaks, while the International Health Regulations (IHR) require countries to develop core public health capacities. Travel restrictions such as entry/exit screening and quarantine policies can help prevent introduction of diseases into new regions. Vaccination programs, including routine immunization and vaccination requirements for travelers, reduce the risk of disease spread. Strong public health infrastructure and emergency response plans are crucial for containing outbreaks. Collaboration and information sharing through global health security initiatives and open access to data enable quicker identification of patterns and trends. Education and public awareness campaigns can reduce transmission rates and discourage travel to high-risk areas. By implementing these measures, countries can work together to protect public health globally.

What are the latest immigration policies in the United States ?

The latest immigration policies in the United States have been evolving and changing rapidly. Key updates include the public charge rule, asylum policy changes, DACA renewal fees, visa restrictions for pregnant women, travel ban expansion, and migrant children at the border. These policies reflect a trend towards stricter enforcement and restrictions on both legal and illegal immigration. Advocates argue that these policies harm vulnerable populations and undermine America's historical reputation as a nation of immigrants.

How does GDPR affect international businesses ?

The General Data Protection Regulation (GDPR) has significant implications for international businesses, affecting everything from data collection and processing to customer communication. Key aspects include its territorial scope, consent requirements, appointment of Data Protection Officers (DPOs), Data Subject Access Rights (DSAR), cross-border data transfers, and potential fines and penalties for non-compliance. Companies must take proactive steps to ensure compliance with GDPR to avoid costly fines and penalties while building trust with customers and partners.

Are duty-free goods genuine or are they often counterfeit ?

Duty-free goods are often seen as a way to save money on luxury items, but the question of their authenticity arises for many travelers. Most duty-free shops operate under strict government regulations and have reputational incentives to sell genuine products. However, instances of counterfeit goods have been reported, often due to supply chain issues or fraudulent practices. To ensure you are purchasing genuine items, it's important to research before traveling, purchase from reputable sources, inspect the product carefully, and beware of unusually low prices. By exercising caution and remaining vigilant, you can enjoy the benefits of duty-free shopping with peace of mind.