Payment Apple

How to manage payment methods for my Apple account ?

Apple offers multiple payment methods for users, including creditApple offers multiple payment methods for users, including credit Apple Pay, and gift cardsManaging your payment methods ensures a smooth experience when making purchases on Apple services like the App Store and iTunes Store.

Can I use Apple Pay internationally ?

Apple Pay is available in over 20 countries and regions worldwide, allowing users to make convenient and secure payments using their iPhone, Apple Watch, or iPad. To use Apple Pay internationally, users need to ensure their device supports it and set up a payment method accepted in the country they are visiting. Using Apple Pay offers benefits such as convenience, security, speed, and compatibility with popular apps and services around the world.

Is Apple Pay safe to use ?

Apple Pay is a secure payment technology that employs multiple security layers to protect user information. Its safety features include device-specific numbers, unique transaction codes, and secure element chips. Apple Pay also emphasizes privacy protection by abstracting actual payment information from transactions. The service supports a wide range of devices and is easy to set up. It is widely accepted in both physical and online locations. Additionally, Apple Pay collaborates with numerous financial institutions worldwide, further enhancing its accessibility and security. Overall, Apple Pay is a reliable and secure digital payment solution.

Can I use Apple Pay for online purchases ?

Apple Pay is a mobile payment and digital wallet service that allows users to make secure and convenient payments using their Apple devices. It works by transmitting payment information between the user's device and the merchant's payment terminal using near-field communication (NFC) technology. Using Apple Pay for online purchases offers several benefits, including convenience, security, speed, and integration with other Apple services. To set up Apple Pay for online purchases, users must add their credit or debit card details to the Wallet app on their iPhone or iPad, choose a default card, look for the Apple Pay button at checkout when shopping online, confirm their payment using Touch ID or Face ID, and wait for confirmation from the merchant. If issues arise while using Apple Pay for online purchases, users can check their device compatibility, update their billing and shipping information, or contact customer support for assistance.

Where can I use Apple Pay ?

Apple Pay is a mobile payment and digital wallet service by Apple Inc. that allows users to make secure purchases in person, in iOS apps, and on the web using Safari. It is designed to replace physical credit and debit cards by provisioning their information on Apple Pay-compatible devices. You can use Apple Pay for in-person transactions at any store or merchant that accepts contactless payments. Look for the NFC payment symbol or the Apple Pay logo to ensure that your transaction will be processed smoothly. You can also use Apple Pay within iOS apps during checkout, which saves you the trouble of entering your card details each time you make a purchase. Additionally, if you're shopping on the web using Safari on your iPhone or iPad, you can complete purchases with Apple Pay on participating websites.

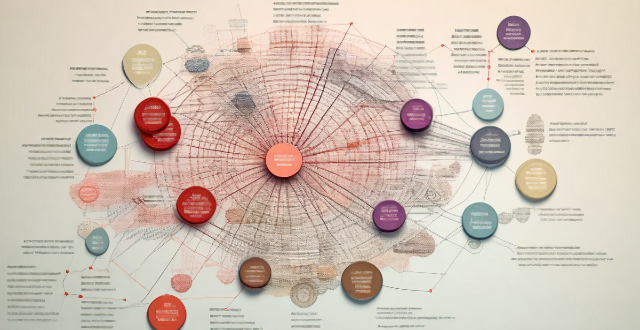

How does Cross-Border Payment work ?

Cross-border payments are transactions that involve transferring money between different countries. The process is complex and requires coordination among various parties, including banks, payment processors, and financial institutions. The steps involved in cross-border payments include initiation of the payment, verification and authorization, execution of the payment, and settlement and reconciliation. There are several methods available for cross-border payments, such as wire transfers, online payment platforms, and mobile wallets. Choosing the appropriate method ensures safe, secure, and efficient cross-border payments.

Are there any fees associated with using Apple Pay ?

There are no fees associated with using Apple Pay for purchases, transfers, or international transactions. Apple Pay offers robust security features and can be used conveniently in-person and online without additional costs.

How does Apple Pay work ?

Apple Pay is a mobile payment and digital wallet service that allows users to make secure purchases using their Apple devices. To set up Apple Pay, users add their credit or debit cards to the Wallet app on their iPhone and verify their identity with their bank or card issuer. When using Apple Pay in stores, users can hold their iPhone or iPad near the contactless reader and confirm the payment using Touch ID or Face ID. With Apple Watch, users double-click the side button and bring their watch close to the contactless reader. Within apps and on the web, users can select Apple Pay as their payment method during checkout and confirm their purchase using Touch ID or Face ID. Apple Pay ensures security and privacy by using a device-specific number and unique transaction code for each payment, and transactions are authorized with Face ID or Touch ID. Apple Pay is compatible with various Apple devices, including iPhone models with Face ID and Touch ID, Apple Watch models, iPad Pro, iPad Air, iPad, and iPad mini models with Touch ID or Face ID, and Mac models with Touch ID.

How do I set up Apple Pay on my iPhone or Apple Watch ?

Apple Pay is a mobile payment service that allows users to make secure purchases in person, in iOS apps, and on the web. To set up Apple Pay on an iPhone, open the Wallet app, tap the plus sign, choose "Continue" and follow the prompts to add a credit or debit card. After verifying your information with your bank or card issuer, you can start using Apple Pay for contactless payments at supported merchants and within apps. For the Apple Watch, open the Apple Watch app on your iPhone, tap "My Watch," then tap "Wallet & Apple Pay," tap "Add Card," and follow the prompts to add a card. After setting up Apple Pay, enjoy the convenience of quick and secure payments wherever Apple Pay is accepted.

How can I ensure safe and secure payment when shopping internationally ?

When shopping internationally, it's important to ensure safe and secure payment. Here are some tips on how to do so: - Use a reputable payment method such as credit cards, debit cards, or digital wallets. - Check for security features like HTTPS, a lock icon in the address bar, and a clear privacy policy. - Keep track of your purchases by saving receipts, order confirmations, and shipping information. - Be aware of scams and research the company or seller before making a purchase.

How do I use Apple Pay in stores ?

Apple Pay is a convenient and secure way to make purchases using your Apple device. Here's how you can use it in stores: 1. Set up Apple Pay on your device by opening the Wallet app, tapping the plus sign, and following the prompts to add a new card. 2. Use Apple Pay at the checkout by double-clicking the side button on your iPhone, holding it near the contactless reader until you see Done and a checkmark, and entering your PIN or signing your name if prompted. 3. Confirm your payment by looking for a confirmation on your device. 4. Keep your receipt in case you need to return or exchange an item.

How to change the email address associated with my Apple ID ?

This is a step-by-step guide on how to change the email address associated with your Apple ID. The steps include signing in to your Apple ID account page, choosing a new email address, verifying the new email address, signing out of all devices using the old email address, updating payment information if necessary, and updating contact information if desired. It is important to remember to update any other services or apps that may still be using the old email address as well.

Does Apple Music have a free trial period ?

Apple Music offers a three-month free trial for new users, allowing them to explore its vast library and personalized recommendations without any charges. To sign up, users need to open the Music app or iTunes, click on the "Try it free" button, create an Apple ID (if needed), enter payment information, and start enjoying the service. It's important to cancel the subscription before the trial ends to avoid being charged.

How long does it take for a Cross-Border Payment to process ?

The processing time for cross-border payments can vary depending on several factors, including the payment method used, the countries involved, and the banks or financial institutions handling the transaction. Wire transfers typically take 1 to 5 business days, credit cards can take 3 to 7 business days, and digital wallet transactions are usually completed within 24 hours. However, these are just general guidelines and the actual processing time can vary based on the specific circumstances of each transaction.

What is the future of Cross-Border Payment ?

The future of cross-border payment is expected to be influenced by trends such as digitalization, regulatory changes, innovation in payment methods, and global economic integration. However, challenges like high fees, security risks, and lack of standardization need to be addressed for the industry to become more accessible, secure, and efficient.

Can I use Apple Pay to send money to friends or family ?

The article provides a summary of how to use Apple Pay to send money to friends or family through the Apple Cash feature. It outlines the steps to set up Apple Cash, send money using Apple Pay, and receive money through Apple Pay. Additionally, it mentions other ways to use Apple Pay for transactions such as making purchases, paying for services, splitting bills, and donating to charities.

What banks and credit card providers support Apple Pay ?

Apple Pay is a mobile payment and digital wallet service that works with Apple devices. It allows users to make secure purchases in person, in iOS apps, and on the web using Safari. Many banks and credit card providers support Apple Pay, including Bank of America, Capital One, Chase, Citi, Wells Fargo, American Express, Discover, MasterCard, and Visa. Adding your card to Apple Pay is a straightforward process involving opening the Wallet app, tapping the plus sign, and following the steps to add a new card. The availability of Apple Pay and the specific cards it supports may vary by country or region, so it's important to check with your bank or card issuer to confirm compatibility and get any necessary instructions.

How can I optimize my Cross-Border Payment strategy ?

This guide discusses how to optimize cross-border payment strategy by researching and understanding regulations and compliance requirements, choosing the right payment method, using technology to streamline processes, and working with reliable partners.

Does Apple Pay offer any rewards or cashback programs ?

Apple Pay is a digital wallet and payment system developed by Apple Inc. It allows users to make payments using their iPhone, iPad, Apple Watch, and Mac. While Apple Pay itself does not offer any specific rewards or cashback programs, there are several ways to earn rewards and cashback when using Apple Pay for purchases. Many credit cards offer rewards and cashback programs that can be used with Apple Pay. Some banks also offer rewards and cashback programs for using Apple Pay. In addition to credit card and bank-sponsored offers, some retailers and merchants also offer rewards and cashback programs for using Apple Pay. By taking advantage of these programs, users can maximize their savings and enjoy additional benefits when paying with Apple Pay.

How do I add a new card to Apple Pay ?

Adding a new card to Apple Pay is a simple process that involves opening the Wallet app on your iPhone or iPad, selecting the card type, adding card details, verifying your information, agreeing to terms and conditions, setting up contactless payment options, and completing the process. On Apple Watch, you need to open the Apple Watch app, add a card to Apple Pay, enter card details, verify your information, agree to terms and conditions, and complete the process. The steps may vary depending on your card issuer, but once completed, your new card will be added to Apple Pay and ready for use.

Is Cross-Border Payment secure ?

Cross-border payments are essential for international trade and business transactions but can pose security risks. Factors like regulatory compliance, technology, fraud prevention measures, and the reputation of the payment service provider affect the security of these payments. Risks include currency fluctuations, political instability, and cyber threats. To ensure security, choose a reputable provider, use secure payment methods, verify recipient details, and keep track of transactions.

Can I cancel a Cross-Border Payment transaction ?

Canceling a cross-border payment depends on factors like the payment method, bank policies, and timing of cancellation. Wire transfers and electronic platforms are common methods, with immediate requests having higher chances of success. Costs may apply for cancellation, and effective communication with banks or providers is crucial. Steps include acting quickly, verifying transaction status, contacting support, and understanding any fees. Prevention tips involve double-checking details and using reliable platforms.

How do I troubleshoot issues with Apple Pay ?

Troubleshooting issues with Apple Pay involves checking device compatibility, updating software, adding a new card, verifying bank support, and contacting Apple Support. Compatible devices include iPhone 8 or later, iPad Pro (all models), Apple Watch Series 1 or later, and Mac with Touch ID or T2 Security Chip. Updating software can be done through Settings > General > Software Update on iPhone or iPad, or System Preferences > Software Update on Mac. To add a new card, open the Wallet app, tap the plus sign, follow prompts, and call the bank if needed. Not all banks support Apple Pay, so check with your bank or visit Apple's website for a list of supported banks. If issues persist, contact Apple Support via phone, email, or chat on their website for further assistance.

How much down payment do I need to buy a house ?

This article discusses the factors affecting the down payment amount for buying a house, including credit score, type of mortgage, and price of the house. It also provides common down payment requirements for different types of mortgages and tips for saving for a down payment.

What is Cross-Border Payment ?

Cross-border payment is the process of transferring money from one country to another, involving currency exchange and various payment methods. It is essential for businesses operating in multiple countries, allowing them to receive and make payments in different currencies. Key features include currency exchange, payment methods, regulations, fees, and timeframes. Benefits of cross-border payments include global expansion, increased sales, reduced costs, and improved cash flow.

What regulations govern Cross-Border Payment ?

Regulations governing cross-border payment include Anti-Money Laundering (AML) laws, Payment Card Industry Data Security Standard (PCI DSS), International Wire Transfer Regulations, and General Data Protection Regulation (GDPR). These regulations ensure the security, safety, and efficiency of the process by requiring financial institutions to verify customer identity, monitor transactions for suspicious activity, protect cardholder data, comply with US sanctions and embargoes, and protect personal data.

How do I unsubscribe from an app purchased with my Apple ID ?

Unsubscribing from an app purchased with your Apple ID involves understanding the cancellation process, accessing your Apple ID account, managing subscriptions, and confirming cancellation. After unsubscribing, you can continue using the service until the end of the current billing cycle. If issues arise, check your Apple ID or contact support for assistance.

How can I set up a Cross-Border Payment account ?

The text provides a detailed guide on how to set up a cross-border payment account, including steps such as researching and choosing a provider, checking compliance and regulations, opening an account, verifying the account, configuring payment settings, linking to a business account, testing the system, monitoring and maintaining the account, understanding fees and exchange rates, and optimizing for tax implications. It emphasizes the importance of complying with legal and regulatory requirements, maintaining detailed records, and working with a tax advisor.

How do exchange rates affect Cross-Border Payment ?

Exchange rates play a crucial role in cross-border payments, impacting the cost, speed, and feasibility of transactions. They can affect transfer fees, currency fluctuations, processing time, trade opportunities, and investment opportunities. Understanding exchange rates is essential for managing them effectively in international trade or finance.

Can I use Apple Music without an Apple device ?

The text discusses the availability of Apple Music across various platforms, including Windows, Android devices, web players, and smart TVs and streaming devices. It highlights the key features available on each platform and concludes that users don't need an Apple device to enjoy Apple Music.