Payment Data

What regulations govern Cross-Border Payment ?

Regulations governing cross-border payment include Anti-Money Laundering (AML) laws, Payment Card Industry Data Security Standard (PCI DSS), International Wire Transfer Regulations, and General Data Protection Regulation (GDPR). These regulations ensure the security, safety, and efficiency of the process by requiring financial institutions to verify customer identity, monitor transactions for suspicious activity, protect cardholder data, comply with US sanctions and embargoes, and protect personal data.

Is Cross-Border Payment secure ?

Cross-border payments are essential for international trade and business transactions but can pose security risks. Factors like regulatory compliance, technology, fraud prevention measures, and the reputation of the payment service provider affect the security of these payments. Risks include currency fluctuations, political instability, and cyber threats. To ensure security, choose a reputable provider, use secure payment methods, verify recipient details, and keep track of transactions.

What is the future of Cross-Border Payment ?

The future of cross-border payment is expected to be influenced by trends such as digitalization, regulatory changes, innovation in payment methods, and global economic integration. However, challenges like high fees, security risks, and lack of standardization need to be addressed for the industry to become more accessible, secure, and efficient.

How can I ensure safe and secure payment when shopping internationally ?

When shopping internationally, it's important to ensure safe and secure payment. Here are some tips on how to do so: - Use a reputable payment method such as credit cards, debit cards, or digital wallets. - Check for security features like HTTPS, a lock icon in the address bar, and a clear privacy policy. - Keep track of your purchases by saving receipts, order confirmations, and shipping information. - Be aware of scams and research the company or seller before making a purchase.

How can I optimize my Cross-Border Payment strategy ?

This guide discusses how to optimize cross-border payment strategy by researching and understanding regulations and compliance requirements, choosing the right payment method, using technology to streamline processes, and working with reliable partners.

How does Cross-Border Payment work ?

Cross-border payments are transactions that involve transferring money between different countries. The process is complex and requires coordination among various parties, including banks, payment processors, and financial institutions. The steps involved in cross-border payments include initiation of the payment, verification and authorization, execution of the payment, and settlement and reconciliation. There are several methods available for cross-border payments, such as wire transfers, online payment platforms, and mobile wallets. Choosing the appropriate method ensures safe, secure, and efficient cross-border payments.

What are the most popular Cross-Border Payment platforms ?

The global economy heavily relies on cross-border payments, and several platforms have emerged to facilitate these transactions. PayPal is a widely used online payment system offering a secure way to send and receive money internationally. Stripe provides APIs for integrating payments into applications and supports multiple currencies. Adyen offers a one-stop platform for all payment methods, reducing transaction friction. TransferWise (now Wise) focuses on reducing transfer costs using a peer-to-peer model. WorldRemit specializes in remittances to mobile wallets and bank accounts in developing countries. Skrill is a digital wallet service with merchant services and a prepaid card option. Payoneer provides mass payments solutions and multi-currency accounts, particularly benefiting affiliate marketers. Each platform caters to different needs, from individual remittances to business solutions, ensuring options for various cross-border payment scenarios.

Can I cancel a Cross-Border Payment transaction ?

Canceling a cross-border payment depends on factors like the payment method, bank policies, and timing of cancellation. Wire transfers and electronic platforms are common methods, with immediate requests having higher chances of success. Costs may apply for cancellation, and effective communication with banks or providers is crucial. Steps include acting quickly, verifying transaction status, contacting support, and understanding any fees. Prevention tips involve double-checking details and using reliable platforms.

How much down payment do I need to buy a house ?

This article discusses the factors affecting the down payment amount for buying a house, including credit score, type of mortgage, and price of the house. It also provides common down payment requirements for different types of mortgages and tips for saving for a down payment.

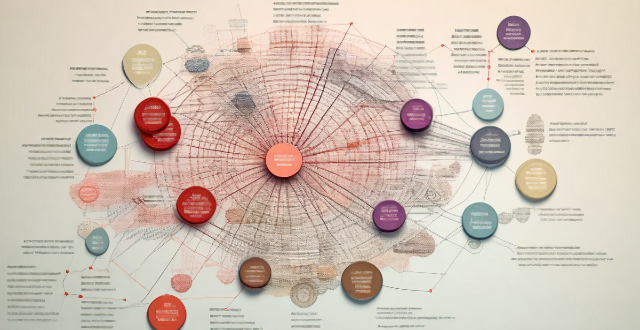

What is Cross-Border Payment ?

Cross-border payment is the process of transferring money from one country to another, involving currency exchange and various payment methods. It is essential for businesses operating in multiple countries, allowing them to receive and make payments in different currencies. Key features include currency exchange, payment methods, regulations, fees, and timeframes. Benefits of cross-border payments include global expansion, increased sales, reduced costs, and improved cash flow.

How can I set up a Cross-Border Payment account ?

The text provides a detailed guide on how to set up a cross-border payment account, including steps such as researching and choosing a provider, checking compliance and regulations, opening an account, verifying the account, configuring payment settings, linking to a business account, testing the system, monitoring and maintaining the account, understanding fees and exchange rates, and optimizing for tax implications. It emphasizes the importance of complying with legal and regulatory requirements, maintaining detailed records, and working with a tax advisor.

How to manage payment methods for my Apple account ?

Apple offers multiple payment methods for users, including creditApple offers multiple payment methods for users, including credit Apple Pay, and gift cardsManaging your payment methods ensures a smooth experience when making purchases on Apple services like the App Store and iTunes Store.

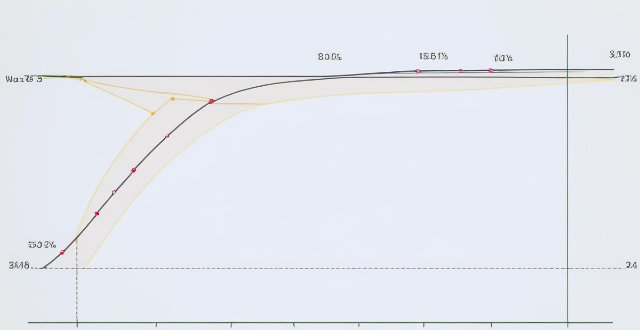

How do exchange rates affect Cross-Border Payment ?

Exchange rates play a crucial role in cross-border payments, impacting the cost, speed, and feasibility of transactions. They can affect transfer fees, currency fluctuations, processing time, trade opportunities, and investment opportunities. Understanding exchange rates is essential for managing them effectively in international trade or finance.

How long does it take for a Cross-Border Payment to process ?

The processing time for cross-border payments can vary depending on several factors, including the payment method used, the countries involved, and the banks or financial institutions handling the transaction. Wire transfers typically take 1 to 5 business days, credit cards can take 3 to 7 business days, and digital wallet transactions are usually completed within 24 hours. However, these are just general guidelines and the actual processing time can vary based on the specific circumstances of each transaction.

Can you consolidate multiple student loans into one payment ?

Consolidating multiple student loans into one payment simplifies monthly expenses and can reduce overall interest rates. The process involves taking out a new loan to pay off existing ones, resulting in a single fixed interest rate and monthly payment. Benefits include lower monthly payments and easier management, but potential drawbacks such as longer repayment periods and loss of lender benefits should be considered. Successful consolidation requires evaluating current loans, comparing offers, and understanding all terms before committing.

What are the benefits of using Cross-Border Payment ?

Cross-border payments are essential for global commerce, offering benefits such as increased access to markets, improved efficiency, lower costs, greater flexibility, enhanced security, and scalability. These advantages help businesses expand globally, making cross-border payments a vital tool for modern commerce.

Can small businesses benefit from Cross-Border Payment ?

Cross-border payments are increasingly vital in the global economy, enabling businesses to tap into new markets. Small businesses can benefit from this trend by expanding market access, increasing revenue potential, improving customer experience, reducing costs, and gaining a competitive advantage. As technology continues to evolve, small businesses should consider taking advantage of cross-border payments to grow and succeed on a global scale.

Are there any risks associated with Cross-Border Payment ?

Cross-border payments come with several risks, includingCross-border payments come with several risks, including risk, legal risk, and it's essential to use reputable payment providers and take steps to protect personal information.

How much does an unlimited data plan usually cost ?

Unlimited data plans vary in cost from $60 to $105/month for one line, depending on the provider and included features. Factors affecting the final cost include the number of lines, device payment plans, taxes and fees, autopay discounts, and promotions. It's important to compare plans and consider any additional costs before choosing an unlimited data plan.

How do I track my Cross-Border Payment transaction ?

Cross-border payments can be tracked using various methods such as obtaining key information, utilizing online banking services, contacting the bank directly, using third-party tracking services, staying informed with updates, understanding time frames, confirming receipt with the beneficiary, and monitoring for errors or fraud. It is essential to collect all necessary transaction details before initiating a transfer, including the transaction ID, beneficiary details, date of transfer, amount, and expected delivery date. Most banks provide online services that allow customers to track their transactions, while some financial service providers offer tracking tools specifically designed for cross-border payments. Staying informed with updates through email or SMS notifications is crucial, along with understanding typical time frames for different types of transactions. Confirming receipt with the beneficiary and monitoring for any errors or fraud throughout the process are also important steps to ensure a smooth and secure transaction.

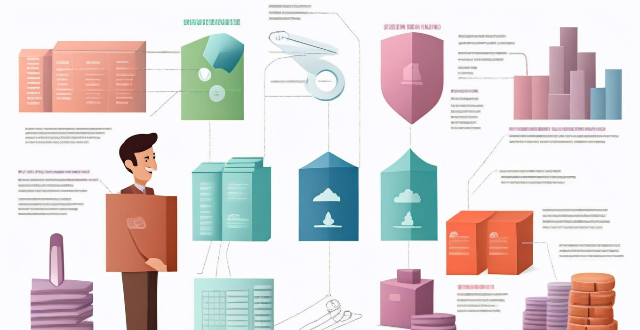

How does Fintech enable faster and more secure payments ?

Fintech has revolutionized payment systems by making them faster and more secure. Instant transfers, mobile payments, and automated options have streamlined the process, while encryption, tokenization, two-factor authentication, and fraud detection systems have enhanced security. These advancements benefit both individuals and businesses.

How do I ensure I'm getting the best deal when shopping online ?

When shopping online, it's important to take steps to ensure you're getting the best deal possible. Here are some tips: 1. Research before buying to compare prices and read reviews. 2. Look for coupons and discounts. 3. Be wary of scams and only shop from reputable retailers. 4. Use secure payment methods and avoid storing payment information on websites. 5. Keep track of your purchases and monitor your accounts for suspicious activity.

Can you explain the concept of 'data minimization' in data protection laws ?

Data minimization is a crucial principle in data protection laws that requires organizations to collect and process only the minimum amount of personal data necessary for specified, explicit, and legitimate purposes. This concept aims to protect individuals' privacy by limiting the potential harm that can result from the misuse or breach of their personal information. Key aspects of data minimization include collection limitation, purpose specification, data retention, data security, and accountability and transparency. Implementing robust security measures is crucial to ensure the confidentiality, integrity, and availability of personal data. Adhering to data minimization principles helps organizations comply with various data protection laws, fosters trust between individuals and organizations, reduces the risk of privacy breaches and violations, mitigates potential damage caused by cyberattacks or data breaches, and leads to cost savings for organizations due to reduced storage requirements and associated management costs.

**What happens to my data if I stop paying for iCloud storage ?

When you stop paying for iCloud storage, Apple will downgrade your account to the free 5GB storage plan. This means that any data exceeding the 5GB limit will no longer be accessible from iCloud. However, there are a few things you should know about what happens to your data: - Your data remains on your device - You can download your data - You won't be able to access newer backups - Some apps may stop working properly In conclusion, while stopping payment for iCloud storage will result in losing access to data stored in iCloud beyond the free 5GB limit, it does not mean that all of your data is lost forever. It's important to take steps to download and save any important data before cancelling your subscription and understand how certain apps may be affected by the change.

What is the role of encryption in securing data transmission ?

Encryption is crucial for securing data transmission by converting plain text into unreadable ciphertext, ensuring confidentiality, integrity, and authentication. It protects sensitive information, prevents data tampering, enhances trust, complies with regulations, and reduces the risk of data breaches. Two main types of encryption are symmetric and asymmetric encryption, each using different keys for encryption and decryption.

What are the benefits of using data encryption in business ?

Data encryption in business offers protection of sensitive information, compliance with legal requirements, enhanced customer trust, defense against cyber threats, and controlled data access. It ensures confidentiality and integrity of communications, helps meet regulatory standards, safeguards personal data, builds customer confidence, mitigates risks of data breaches, guards against malware and ransomware, provides role-based access control, and simplifies key management. This makes encryption an essential tool for securing digital assets and strengthening a company's market position.

What currencies can be used for Cross-Border Payment ?

The currencies used for cross-border payments vary widely depending on numerous factors, including economic strength, political stability, and market acceptance. Major world currencies like the US Dollar, Euro, British Pound Sterling, and Japanese Yen are commonly used due to their global acceptance and role in international trade and financial markets. Other currencies such as the Chinese Yuan/Renminbi, Canadian Dollar, and Australian Dollar also play significant roles in cross-border payments, particularly in commodities trade and regional economies. Digital currencies, including Bitcoin and stablecoins, are increasingly being used for cross-border payments, offering decentralized transactions and the benefits of blockchain technology. Factors influencing currency choice include regulatory environment, cost considerations, market fluctuations, and business agreements.

What are some examples of data breaches and how do they affect individuals ?

Data breaches have become a pervasive issue in the digital age, affecting millions of individuals worldwide. These incidents can compromise sensitive information and have far-reaching consequences for those affected. In this discussion, we will explore some notable examples of data breaches and examine how they impact individuals.

Is data encryption necessary for all types of businesses and industries ?

The Importance of Data Encryption in Modern Business Operations Data encryption is a crucial aspect of modern business operations, ensuring confidentiality, integrity, and availability of sensitive information. Different types of businesses and industries handle varying degrees of sensitive data, requiring robust security measures. Healthcare, finance, e-commerce, and legal sectors are examples where encryption is necessary due to the nature of the data they handle or regulatory requirements. However, the necessity of implementing encryption can depend on factors such as the type and amount of sensitive data, risk assessment, and compliance with legal requirements. To implement data encryption, businesses must assess their needs, develop a data protection policy, choose appropriate technologies, integrate them into systems and processes, and regularly monitor and maintain these measures. While not always necessary for every business, data encryption is often a wise investment that can protect sensitive information and ensure business continuity.

What is data privacy ?

Data privacy is the protection of personal information from unauthorized use. It's important for individual rights, building trust, legal compliance, and risk mitigation. Principles include data minimization, anonymization, encryption, transparency, consent, access control, retention, integrity, and accountability. Best practices involve regular audits, employee training, updating policies, secure systems, and response plans for data breaches.