Portfolio Involve

What is the significance of rebalancing an investment portfolio ?

Rebalancing an investment portfolio is a crucial aspect of maintaining a well-diversified and risk-appropriate investment strategy. It involves periodically adjusting the asset allocation of your portfolio to align with your original investment goals and risk tolerance levels. The significance of rebalancing an investment portfolio includes maintaining diversification, controlling risk exposure, and staying disciplined. The frequency of rebalancing depends on various factors such as your investment goals, risk tolerance, and market conditions. Rebalancing an investment portfolio involves several steps, including determining your target allocation, evaluating your current allocation, selling off high-performing assets, reinvesting proceeds into underperforming assets, and reviewing and adjusting your portfolio regularly.

How can I diversify my portfolio with bond investments ?

Diversifying your portfolio with bond investments can reduce investment risk and provide a steady stream of income. There are several types of bonds, including government, corporate, municipal, and foreign bonds, each with its own characteristics and risks. Bond mutual funds and ETFs offer automatic diversification across multiple issuers and types of bonds. When investing in bonds, consider factors such as credit quality, interest rate risk, inflation risk, and liquidity. To effectively diversify your portfolio with bonds, allocate a portion of your portfolio to bonds, invest in different types of bonds, consider bond maturities, and rebalance regularly. Consulting with a financial advisor can help determine the best bond strategies for your individual financial goals and risk tolerance.

How do I create a diversified portfolio in the stock market ?

Creating a diversified portfolio is an essential strategy for mitigating risk and maximizing returns in the stock market. Here are some steps to help you create a diversified portfolio: 1. Determine your investment goals, including factors such as your risk tolerance, investment horizon, and financial objectives. 2. Allocate assets across different asset classes, such as stocks, bonds, cash, and other securities. 3. Select securities within each asset class that align with your investment goals and are not highly correlated with each other. 4. Rebalance your portfolio regularly to maintain your desired asset allocation. 5. Monitor the performance of your portfolio and make adjustments if necessary. By following these steps, you can create a well-diversified portfolio that aligns with your investment goals and helps you achieve long-term financial success.

How can we involve community members in climate adaptation planning ?

Community engagement is crucial for successful climate adaptation planning. To involve community members, identify and engage stakeholders, develop a stakeholder engagement plan, use multiple channels of communication, involve community members in decision making, provide training and education, foster partnerships and collaboration, and monitor and evaluate progress. By doing so, you can create a more resilient community that is better prepared for the impacts of climate change.

How does gold investment work ?

Gold investment is a popular way to diversify your portfolio and hedge against inflation, offering various forms such as physical gold, ETFs, mutual funds, mining company stocks, futures, and options. It provides benefits like hedging against inflation, portfolio diversification, and acting as a safe haven during crises but also involves risks including price volatility and storage costs. To start investing in gold, one should educate themselves, determine their investment goals, choose the right type of investment, allocate a budget, research vendors/brokers, and monitor their investment.

How do I diversify my cryptocurrency portfolio ?

Diversifying a cryptocurrency portfolio involves understanding the importance of spreading risk, setting clear investment goals, researching different cryptocurrencies, allocating based on risk tolerance, considering dollar-cost averaging, staying updated with market trends, rebalancing periodically, using a reliable crypto exchange, prioritizing security, and seeking professional advice when needed. This strategy helps to mitigate the impact of volatility and potentially maximize returns over the long term.

What role does real estate play in a retirement portfolio ?

The text discusses the role of real estate in a retirement portfolio, highlighting its potential benefits such as income generation through rental income and appreciation, serving as an inflation hedge by maintaining its value during inflationary periods and allowing rent adjustments, and providing diversification by being a non-correlated asset class and an alternative investment. It also outlines risks associated with real estate investments, including liquidity risk due to the illiquid nature of properties, market risk due to fluctuating property values influenced by local market conditions, and management responsibilities that come with owning rental property. The conclusion emphasizes the importance of considering these advantages and risks when incorporating real estate into a retirement strategy, along with the need for proper planning and consideration of personal circumstances.

How can I diversify my portfolio with different financial products ?

Diversifying your portfolio with different financial products is crucial for managing risk. Here's a summary of the key strategies: 1. **Stocks**: Invest in different industries, company sizes, and both growth and value stocks. 2. **Bonds**: Purchase bonds with varying maturities, including corporate, government, and municipal bonds. Consider bond funds or ETFs for broader exposure. 3. **Mutual Funds and ETFs**: Invest in funds focusing on different asset classes, geographical regions, or sectors like technology or healthcare. 4. **Real Estate**: Include options like direct ownership, REITs, or real estate syndications for potential rental income and as a hedge against inflation. 5. **Commodities and Precious Metals**: Add physical commodities, futures, options, or commodity-focused ETFs to serve as a store of value during inflationary periods. 6. **Alternative Investments**: Allocate a portion of your portfolio to assets like private equity, hedge funds, or collectibles for unique opportunities outside traditional markets. 7. **International Exposure**: Expand beyond domestic markets through foreign stock markets, international mutual funds or ETFs, and emerging market investments. Diversification requires a thoughtful approach to balancing risk and reward across various asset classes and markets, considering investment goals, risk tolerance, and time horizon.

How can investors ensure that their portfolios align with global climate goals ?

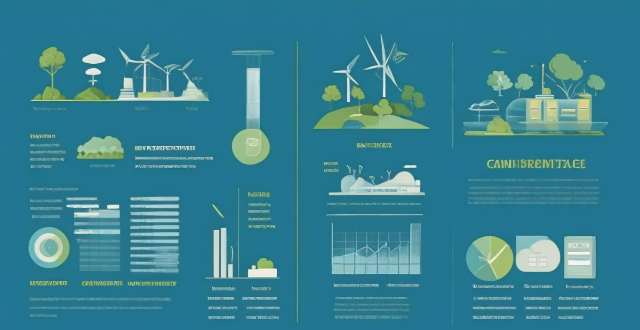

Investing in alignment with global climate goals is crucial for a sustainable future. Investors can ensure their portfolios reflect these objectives by understanding the Paris Agreement's goals, assessing current portfolio alignment, shifting investment strategies towards sustainable and impact investing while divesting from high-risk sectors, engaging with companies on sustainability issues, regularly monitoring and reporting on portfolio alignment, collaborating with other investors, and staying informed through continuous learning. This approach helps support a transition to a low-carbon economy while achieving competitive financial returns.

How can I protect my growing wealth from market fluctuations ?

Market fluctuations are a natural part of any investment journey. However, as your wealth grows, it becomes increasingly important to implement strategies that can help protect your assets from the ups and downs of the market. Here's how you can do it: - Diversify Your Portfolio - Use Hedging Strategies - Stay Updated on Economic Indicators - Regularly Review and Rebalance Your Portfolio - Work with Financial Advisors

How can women build a diversified portfolio to minimize risks and maximize returns ?

The article provides a comprehensive guide on how women can build a diversified portfolio to minimize risks and maximize returns in the stock market. It emphasizes the importance of education, starting early, setting clear goals, diversifying investments across different asset classes, industries, and geographic regions, rebalancing regularly, and considering professional advice when needed. By following these tips, women can create a strong foundation for long-term financial success.

How does sustainable investing work ?

Sustainable investing, also known as responsible or impact investing, involves making investment decisions based on environmental, social, and governance (ESG) criteria. The goal is to generate long-term financial returns while also considering the broader impact of investments on society and the environment. Here's how sustainable investing works: 1. Identify ESG Criteria: The first step in sustainable investing is to identify the ESG criteria that align with your values and risk tolerance. This could include factors such as carbon emissions, labor practices, diversity, board composition, and more. 2. Screen Investments: Once you have identified your ESG criteria, you can screen potential investments to ensure they meet your standards. This can be done through negative screening (excluding companies that don't meet certain criteria) or positive screening (selecting companies that exceed certain criteria). 3. Integrate ESG into Investment Process: Sustainable investing goes beyond simply screening investments; it involves integrating ESG considerations into the entire investment process. This includes researching companies' ESG performance, engaging with them to encourage improvements, and monitoring their progress over time. 4. Measure Performance: Like any investment strategy, it's important to measure the performance of your sustainable investments. This includes tracking financial returns as well as evaluating the impact of your investments on society and the environment. 5. Rebalance and Review: Finally, sustainable investing requires ongoing monitoring and rebalancing of your portfolio to ensure it continues to align with your ESG criteria and financial goals. This may involve selling off underperforming investments or reallocating funds to new opportunities that better meet your standards.

How do I get started with bond investing ?

Bond investing is a popular way to diversify your portfolio and earn a steady income. Here are some steps to help you get started: 1. Understand the basics of bonds. 2. Determine your investment objectives. 3. Choose the right type of bond for you. 4. Consider the duration of the bond. 5. Research and select brokers or intermediaries. 6. Diversify your portfolio by investing in various types of bonds issued by different entities. 7. Monitor your investments regularly and adjust your portfolio as needed based on changing market conditions or personal circumstances.

What is the role of asset allocation in an investment strategy ?

Asset allocation is a crucial component of any investment strategy, involving dividing your portfolio among different asset classes based on your financial goals, risk tolerance, and investment horizon. It plays a vital role in determining the overall performance of your portfolio by helping you manage risk and maximize returns through diversification. To determine your asset allocation, consider your financial goals, risk tolerance, investment horizon, and consult with a financial advisor. Review and adjust your asset allocation regularly as your circumstances change and new opportunities arise.

How can we involve vulnerable communities in climate action planning and implementation ?

Involving vulnerable communities in climate action planning and implementation is crucial for creating effective, equitable, and sustainable solutions to the climate crisis. Here's how we can ensure their involvement: 1. Identify and engage with vulnerable communities through community meetings, workshops, and consultations. 2. Build trust and capacity within these communities by involving them in decision-making processes, providing regular updates on progress, demonstrating transparency and accountability, and offering training programs on climate change science, policy advocacy, and project management skills. 3. Collaborate with vulnerable communities to develop solutions that address their specific needs and priorities while being culturally sensitive and respectful of local traditions and practices. 4. Regularly monitor progress towards climate action goals and evaluate the impact of initiatives on vulnerable communities by collecting data on changes in environmental conditions, economic opportunities, and social wellbeing, as well as seeking feedback from community members.

What role do governments play in addressing climate vulnerability ?

The essay discusses the various ways governments can address climate vulnerability, including mitigation, adaptation, and resilience building. Mitigation involves reducing greenhouse gas emissions to slow down the rate of climate change, while adaptation involves adjusting to the impacts of climate change that cannot be avoided. Resilience building involves enhancing the ability of systems and populations to cope with climate change impacts. The essay emphasizes the crucial role of governments in implementing policies and programs that reduce the risks associated with climate change.

How can parents involve their children in household chores in a fun and educational way ?

Household chores can be made fun and educational for children by creating a chore chart, turning chores into games, involving them in meal planning and preparation, assigning age-appropriate chores, and offering praise and rewards. These methods help teach valuable skills and promote family bonding.

In what situations is it important to involve a financial advisor in budget planning ?

Involving a financial advisor in budget planning is crucial during significant life events, large investments, debt management, retirement planning, and tax planning. A professional can help develop a budget that meets short-term needs while achieving long-term goals.

How do I determine the appropriate level of risk for my investment strategy ?

Investing is a crucial step towards achieving financial goals, but it's essential to determine the appropriate level of risk that aligns with your investment strategy and objectives. The first step is understanding your risk tolerance by assessing your comfort level with potential losses and volatility. Your investment objectives play a crucial role in determining your risk tolerance. Once you have a clear understanding of your risk tolerance and investment objectives, evaluate different investment options such as stocks, bonds, mutual funds, ETFs, and real estate. Finally, monitor your portfolio regularly and make adjustments as needed to maintain your desired asset allocation and manage risks effectively.

How do private equity firms make money ?

Private equity firms generate profits through various strategies, includingPrivate equity firms generate profits through various strategies, includingLBOs), growth capital including leveraged buyouts (LBOs), growth capital investments, and venture capital investments. LBOs involve acquiring companies with debt and equity financing to improve their value for a higher sale price or public offering. Growth capital investments provide funding to established companies with growth potential but not ready for an LBO or public offering. Venture capital investments target early-stage startups with high growth potential but limited track records. Private equity firms manage risk by diversifying across industries and geographies, conducting thorough due diligence, actively involving portfolio company management, and monitoring financial performance metrics. By balancing risk and reward, they can achieve consistent returns over time while minimizing losses from individual investments.

How can companies implement effective risk management strategies ?

Effective Risk Management Strategies for Companies Risk management is a critical aspect of any business operation. It involves identifying, assessing, and prioritizing potential risks that could impact the company's objectives. Here are some effective risk management strategies that companies can implement: 1. Identify Potential Risks: The first step in implementing effective risk management is to identify potential risks. This involves analyzing the company's operations and processes to determine what could go wrong. Some common types of risks include financial risks, operational risks, strategic risks, and compliance risks. 2. Assess and Prioritize Risks: Once potential risks have been identified, they need to be assessed and prioritized based on their likelihood and potential impact. This involves assigning each risk a score based on its severity and probability of occurrence. The risks can then be ranked in order of priority, with the most significant risks being addressed first. 3. Develop Risk Mitigation Plans: For each identified risk, a mitigation plan should be developed. This plan should outline the steps that will be taken to reduce or eliminate the risk. Mitigation plans can include avoidance, reduction, transfer, or acceptance. 4. Monitor and Review Risks Regularly: Risk management is an ongoing process, and companies should regularly monitor and review their risks. This involves tracking changes in the business environment and updating risk assessments accordingly. It also involves evaluating the effectiveness of risk mitigation plans and making adjustments as needed. In conclusion, effective risk management strategies involve identifying potential risks, assessing and prioritizing them, developing mitigation plans, and regularly monitoring and reviewing them. By implementing these strategies, companies can reduce their exposure to risks and protect their operations and bottom line.

How can we involve marginalized communities in climate decision-making processes ?

Involving marginalized communities in climate decision-making is crucial for equitable solutions. Identify and engage these communities, build trust, provide info & resources, incorporate local knowledge, ensure participation, address power imbalances, and monitor progress.

What are some local experience activities that involve food and drink ?

The text provides a summary of various local experience activities involving food and drink. These include cooking classes, food market tours, brewery and winery visits, culinary walking tours, farm-to-table dinners, food festivals, ethnic cuisine experiences, private dining experiences, gourmet safaris, and interactive restaurant concepts. Each activity offers a unique way to explore local cuisine and culture, providing insights into the daily life of locals and their eating habits.

What services do sports rehabilitation centers offer ?

Sports rehabilitation centers offer a variety of services to help athletes recover from injuries and improve their overall performance. These services include physical therapy, athletic training, strength and conditioning programs, sport-specific training, and recovery strategies. Physical therapy involves manual therapy, therapeutic exercise, and functional training to regain strength, flexibility, and mobility in injured areas. Athletic trainers assess injuries, develop personalized rehabilitation plans, and implement prevention strategies to reduce the risk of future injuries. Strength and conditioning programs focus on building muscle strength, increasing endurance, and improving flexibility through resistance training, cardiovascular training, and stretching exercises. Sport-specific training involves developing skills and techniques required for success in a particular sport, as well as mental preparation for competition. Recovery strategies such as cryotherapy, massage therapy, and proper hydration and nutrition help athletes recover from intense training sessions or competitions more quickly and efficiently.

What are some of the most effective methods for carbon sequestration ?

Carbon sequestration refers to the process of capturing and storing carbon dioxide (CO2) from the atmosphere to mitigate its effects on climate change. There are several effective methods for carbon sequestration, including afforestation and reforestation, soil carbon sequestration, biochar production, ocean fertilization, and direct air capture (DAC). Afforestation and reforestation involve planting new trees or replacing existing ones in deforested areas, while soil carbon sequestration involves increasing the amount of organic matter in soil by adding compost, manure, or other organic materials. Biochar production involves creating a type of charcoal made from plant materials that is added to soil to improve its fertility and water-holding capacity. Ocean fertilization involves adding iron or other nutrients to the ocean to stimulate the growth of phytoplankton, which absorb CO2 through photosynthesis. Direct air capture involves using machines to capture CO2 directly from the atmosphere and then store it underground or in other long-term storage solutions.

What are the potential drawbacks or challenges associated with climate action initiatives ?

Climate action initiatives are essential for mitigating the impacts of climate change, but they come with potential drawbacks and challenges. These can range from economic to social and political implications. Economic implications include job displacement in traditional fossil fuel industries, the cost of implementing renewable energy infrastructure, and economic inequality. Social and cultural implications involve changes in lifestyle and consumption patterns, as well as equity in access to clean energy solutions. Political and policy challenges include legislative hurdles, international cooperation, public perception, and misinformation. Environmental trade-offs involve impact on other ecosystems and sustainability of solutions. Addressing these challenges through comprehensive planning, stakeholder engagement, and continuous improvement is crucial for a just and effective transition to a low-carbon future.

What are the challenges in developing and implementing tidal power as an alternative energy source ?

Tidal power is a promising alternative energy source that harnesses the energy of ocean tides to generate electricity. However, its development and implementation face several challenges, including technical, environmental, economic, and social aspects. Technical challenges involve efficiency and reliability issues with turbine design, maintenance, and power transmission. Environmental challenges include potential impacts on marine life and water quality. Economic challenges involve high upfront costs and market competitiveness. Social challenges encompass community acceptance, legal and regulatory hurdles, and local economy impacts. Addressing these multifaceted challenges is crucial for the successful development and implementation of tidal power on a larger scale.

What role does investing play in achieving financial freedom ?

Investing plays a crucial role in achieving financial freedom by growing wealth, diversifying portfolios, and protecting against inflation. Strategies include starting early, making consistent contributions, adopting a long-term perspective, and managing risk effectively.

What policies have been successful in promoting economic recovery in the past ?

Economic recovery refers to the process of restoring a nation's economy to its pre-recession level or even improving it. Various policies have been implemented in the past to promote economic recovery, and some of them have proven successful. Fiscal stimulus involves increasing government spending or reducing taxes to boost economic activity. Monetary policy involves adjusting interest rates and money supply to influence inflation, unemployment, and economic growth. Structural reforms involve changing the way an economy operates to improve its efficiency and competitiveness. In conclusion, various policies have been successful in promoting economic recovery in the past.

How do I invest in wind energy projects ?

Investing in wind energy projects can be a lucrative opportunity, but requires careful consideration and planning. To ensure success, it is crucial to understand the industry, research potential projects, evaluate their feasibility and financial viability, conduct due diligence, choose a suitable investment strategy, secure financing, form partnerships, negotiate terms, monitor progress, and diversify your portfolio. By following these steps, you can make informed investment decisions and contribute to a sustainable future for generations to come.