Project Bonds

How does the issuance of green bonds benefit environmental projects ?

Green bonds are financial instruments designed to fund environmentally friendly projects, offering benefits such as increased funding opportunities, improved project visibility, long-term financing, risk mitigation, market growth and innovation, policy and regulatory support, and community and environmental impact. These bonds not only benefit the specific environmental projects they aim to fund but also contribute to a broader shift towards sustainable finance and environmental stewardship.

How can green bonds help finance climate-friendly projects ?

Green bonds are financial instruments that raise capital specifically for climate and environmental projects. They offer increased funding opportunities by attracting a diverse investor base interested in sustainable investing, aligning with ESG criteria, and providing attractive returns. Transparency and accountability are ensured through rigorous certification processes, third-party reviews, and reporting requirements. Green bonds also catalyze climate action by incentivizing sustainable practices and supporting innovation in clean technology. Furthermore, they encourage wider market participation through investor education, public awareness campaigns, policy support, and international collaboration. Overall, green bonds are crucial for financing climate-friendly projects and accelerating the transition to a more sustainable economy.

What are the different types of bonds available for investment ?

This text discusses the different types of bonds available for investment. It explains the characteristics and subtypes of corporate, municipal, government, mortgage-backed securities, asset-backed securities, zero-coupon, floating rate, inflation-protected, perpetual, international, taxable vs. tax-exempt, secured vs. unsecured, callable vs. non-callable, registered vs. bearer, fixed rate vs. floating rate, strip, synthetic, private placement, structured, green, and supranational bonds.

What is the risk involved in investing in bonds ?

Investing in bonds carries risks such as interest rate, credit, inflation, liquidity, reinvestment, call, prepayment, foreign currency, and political/regulatory changes. Understanding and managing these risks is crucial for protecting your investment. Diversifying your portfolio across different types of bonds and monitoring market conditions can help mitigate these risks.

Are green bonds a profitable investment compared to traditional bonds ?

Green bonds are a type of fixed-income security designed to finance environmentally friendly projects. While their risk and return profile can be similar to traditional bonds, green bonds offer potential diversification benefits, alignment with sustainability goals, and possibly tax benefits. However, their long-term performance relative to traditional bonds depends on various factors such as interest rate changes and market sentiment. Green bonds often come with more rigorous reporting requirements to ensure the proceeds are used for environmentally friendly projects. Whether green bonds are more profitable than traditional bonds cannot be definitively answered without considering individual investment goals and market conditions.

What role do governments play in promoting the use of green bonds ?

Governments play a crucial role in promoting the use of green bonds by providing incentives for issuance, establishing regulations and disclosure requirements, issuing their own green bonds, and promoting education and awareness campaigns. These actions help accelerate the transition to a more sustainable economy and address pressing environmental challenges facing our planet.

Can green bonds help fight climate change effectively ?

Green bonds, a type of fixed-income instrument, are issued to fund environmentally friendly projects that aim to reduce greenhouse gas emissions and promote sustainable development. They can effectively contribute to the fight against climate change by incentivizing renewable energy projects, supporting energy efficiency and conservation, investing in low-carbon infrastructure, promoting sustainable agriculture and forestry, and advancing research and development. However, challenges such as ensuring transparency and accountability, achieving scale and impact, integrating with broader climate strategies, and engaging diverse investors must be addressed to fully realize their potential. As the market for green bonds grows, they remain an important tool in combating climate change effectively.

How do I choose the right brushless motor for my project ?

Choosing the right brushless motor for your project is crucial. Key factors to consider include the purpose of your project, power requirements, speed and torque needs, compatibility with your control system, efficiency and noise level, and researching different brands and models. By considering these factors, you can select the best option for your specific application.

Is it better to invest in stocks or bonds for retirement ?

The article discusses the advantages and disadvantages of investing in stocks and bonds for retirement. Stocks offer higher potential returns, diversification, and can serve as an inflation hedge, but come with higher risks and no guaranteed income. Bonds provide lower risk, predictable income streams, and diversification, but offer lower potential returns and are sensitive to interest rate changes. The key is finding the right balance between risk and reward based on individual circumstances and investment goals, and consulting with a financial advisor to create a customized retirement plan.

In what ways can mind mapping help with project management and planning ?

Mind mapping is a valuable tool for project management and planning, offering benefits such as clarifying objectives, enhancing brainstorming sessions, facilitating task breakdown, tracking progress, managing risks, and improving communication. By providing a visual representation of information, mind maps enable clearer understanding and more effective collaboration among team members, ultimately contributing to the success of projects.

How does poor project management contribute to construction hazards ?

This text discusses the impact of poor project management on construction hazards, including inadequate planning, communication breakdown, ineffective risk management, unrealistic timelines and budgets, and inadequate supervision and training. It emphasizes the importance of effective project management practices for ensuring safety and success in construction projects.

How do I create a budget for a special project at work ?

Creating a budget for a special project at work requires careful planning and consideration of various factors. Here are some steps to help you create an effective budget: 1. Define the project scope, including goals, objectives, and deliverables. 2. Identify all resources needed, such as personnel, equipment, software, and materials. 3. Estimate costs associated with each resource, including direct and indirect costs. 4. Determine funding sources and how much funding is available. 5. Create a timeline with key milestones and deadlines. 6. Assign responsibilities for managing different aspects of the budget. 7. Regularly monitor progress and adjust the budget as needed.

What are the challenges faced during a network expansion project ?

When expanding a network, organizations may face various challenges that can impact the success of the project. These challenges include budget constraints, technical difficulties, security concerns, downtime and disruptions, training and support requirements, integration with existing systems, regulatory compliance, project management issues, change management, and future-proofing considerations. By proactively addressing these challenges, organizations can successfully complete network expansion projects while minimizing disruptions and maximizing the benefits of the expanded network.

Are there any risks associated with investing in green bonds that investors should be aware of ?

Investing in green bonds comes with certain risks that investors should be aware of, including credit risk, interest rate risk, inflation risk, liquidity risk, reputational risk, legal and regulatory risk, project risk, climate risk, and ESG (environmental, social, and governance) risk. These risks can impact the returns on investment and the overall success of the investment strategy. It is important to carefully evaluate each green bond investment opportunity and consult with financial advisors before making any investment decisions.

How can green bonds help finance environmentally friendly projects ?

Green bonds are a type of financial instrument designed to raise capital for environmentally friendly projects. They offer dedicated funding sources, attract sustainability-focused investors, enhance corporate reputation, and potentially lower borrowing costs. Examples of projects funded by green bonds include renewable energy development, energy efficiency upgrades, sustainable water management, clean transportation, and waste management. As awareness of climate change grows, the use of green bonds is expected to expand, driving progress towards a more sustainable future.

What role does risk management play in project planning and execution ?

Risk management is a crucial aspect of project planning and execution that involves identifying, assessing, and prioritizing potential risks to minimize their impact on the project's objectives, timeline, budget, and quality. The process includes identifying technical, financial, operational, and legal/regulatory risks; assessing their likelihood and potential impact; developing response plans for avoidance, mitigation, transference, or acceptance; monitoring and controlling risks throughout the project lifecycle; and effectively communicating about risks to all stakeholders. By managing risks proactively, projects can navigate uncertainties more effectively, leading to improved outcomes and success rates.

How long does it take to complete a network expansion project ?

Completing a network expansion project involves several stages, including planning and design, procurement, installation and configuration, testing and troubleshooting, and deployment and training. The duration of each stage can vary depending on factors such as project size, resource availability, and team efficiency. A general timeline for completing a network expansion project is 6 months to a year.

What role do green bonds and other financial products play in climate financing ?

Green bonds and other financial products are crucial for climate financing, enabling investors to support environmentally friendly projects. These instruments fund renewable energy, energy efficiency, waste management, biodiversity conservation, and other eco-friendly initiatives, contributing to climate change mitigation and sustainable development. Key features of green bonds include transparency and verification, offering benefits such as attracting capital and pricing advantages but facing challenges like standardization and secondary market liquidity. Other financial products include climate-themed investment funds, CERs, green loans, and credit facilities, which directly finance green projects and stimulate innovation in sustainable practices. By aligning financial returns with environmental benefits, these instruments play a vital role in mobilizing private capital towards climate action, helping to bridge the funding gap for sustainable projects and mitigate climate change.

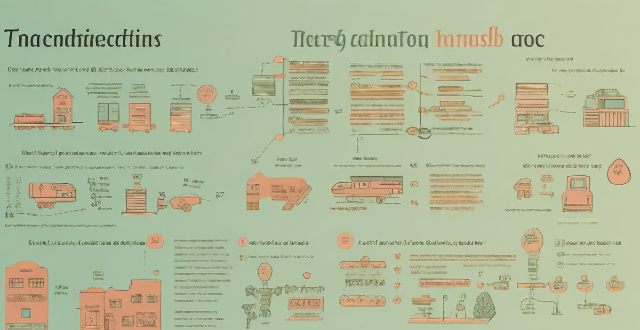

What are the key factors to consider when planning an energy-efficient building project ?

The text provides a summary of key factors that should be considered when planning an energy-efficient building project. These factors include site selection and orientation, building design and construction, and energy sources and consumption. The location and orientation of the building on the site can have a significant impact on its energy efficiency, as well as the design and construction of the building itself. Consideration should also be given to the sources of energy used by the building and how that energy is consumed. By considering these key factors during the planning stages of an energy-efficient building project, it is possible to create a building that is comfortable, functional, environmentally responsible, and economically sustainable over its lifetime.

How do project-based learning and problem-solving activities fit into innovative teaching methodologies ?

Innovative teaching methodologies emphasize project-based learning (PBL) and problem-solving activities to engage students, foster critical thinking, and develop practical skills. PBL involves students in complex, meaningful projects that connect classroom learning with real-world scenarios, promoting deeper understanding, skill development, and motivation. Problem-solving activities challenge students to identify issues and find effective solutions, enhancing their critical thinking, decision-making, and resilience. Integrating PBL and problem-solving into innovative teaching involves identifying key concepts, designing relevant projects, incorporating problem-solving elements, providing resources, facilitating collaboration, scaffolding instruction, reflecting and evaluating, and assessing holistic performance. This approach creates a dynamic learning environment that prepares students for future challenges and fosters a love of lifelong learning.

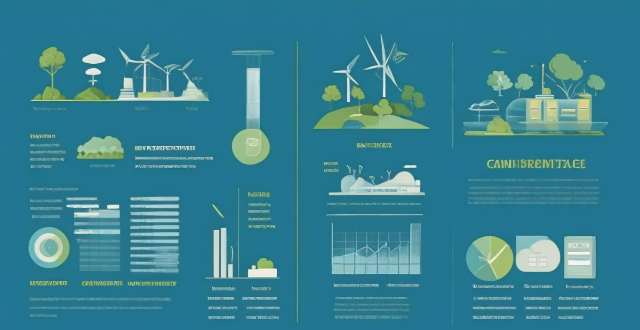

How can climate finance be leveraged to support renewable energy projects ?

Climate finance plays a crucial role in supporting renewable energy projects. Here are some ways to leverage it: 1. Public-Private Partnerships (PPPs) can be used to attract private investment into renewable energy projects. 2. Green Bonds can be issued to fund environmentally friendly projects such as solar and wind farms. 3. Carbon Pricing Mechanisms can generate revenue that can be invested in renewable energy projects. 4. International Climate Finance Initiatives can provide funding for renewable energy projects in developing countries. 5. Crowdfunding Platforms offer another way to raise funds for renewable energy projects. By using a combination of these strategies, we can accelerate the transition towards a more sustainable future.

Why are green bonds important for sustainable development ?

Green bonds are crucial for sustainable development as they provide funding for environmental projects, broaden investor base, support environmental standards, stimulate innovation, advance global SDGs, and raise awareness about sustainability in finance.

How can I diversify my portfolio with bond investments ?

Diversifying your portfolio with bond investments can reduce investment risk and provide a steady stream of income. There are several types of bonds, including government, corporate, municipal, and foreign bonds, each with its own characteristics and risks. Bond mutual funds and ETFs offer automatic diversification across multiple issuers and types of bonds. When investing in bonds, consider factors such as credit quality, interest rate risk, inflation risk, and liquidity. To effectively diversify your portfolio with bonds, allocate a portion of your portfolio to bonds, invest in different types of bonds, consider bond maturities, and rebalance regularly. Consulting with a financial advisor can help determine the best bond strategies for your individual financial goals and risk tolerance.

How do I get started with bond investing ?

Bond investing is a popular way to diversify your portfolio and earn a steady income. Here are some steps to help you get started: 1. Understand the basics of bonds. 2. Determine your investment objectives. 3. Choose the right type of bond for you. 4. Consider the duration of the bond. 5. Research and select brokers or intermediaries. 6. Diversify your portfolio by investing in various types of bonds issued by different entities. 7. Monitor your investments regularly and adjust your portfolio as needed based on changing market conditions or personal circumstances.

What is the difference between a bond and a stock ?

Bonds and stocks are two different types of financial instruments that companies use to raise capital. While both are used for funding, they have distinct differences in terms of ownership, returns, risks, and other factors. Here are some key differences between bonds and stocks: - Bonds represent debt and provide regular interest payments with a fixed maturity date, while stocks represent equity and offer potential dividends and capital appreciation without a set maturity date. - When you buy a bond, you are essentially lending money to the issuer (usually a company or government). In return, you receive a bond certificate that represents your loan. You do not own any part of the company; you are simply a creditor. - When you buy a stock, you become a part owner of the company. This means you have a claim on the company's assets and earnings, as well as a say in how the company is run through voting at shareholder meetings. - The primary return from owning a bond comes from interest payments made by the issuer. These payments are usually fixed and paid at regular intervals until the bond matures, at which point the principal amount is repaid. - The return on stocks comes from dividends (if the company chooses to pay them) and capital gains (the increase in the stock price over time). Stock prices can be volatile, so the potential for high returns is greater than with bonds, but so is the risk. - Generally considered less risky than stocks because they offer a fixed rate of return and have priority over stockholders in the event of bankruptcy. However, there is still risk involved, especially if the issuer defaults on its payments. - More risky than bonds because their value fluctuates with market conditions and the performance of the underlying company. If the company does poorly, the stock price may fall significantly, and investors could lose part or all of their investment. - Have a defined maturity date when the principal amount must be repaid by the issuer. This provides a clear timeline for investors. - Do not have a maturity date; they exist as long as the company remains in business. Investors can sell their shares at any time in the open market. - Interest income from bonds is typically taxed as ordinary income. - Long-term capital gains from stock sales may be taxed at a lower rate than ordinary income, depending on the tax laws of the jurisdiction.

How do I adjust my investment strategy during economic downturns ?

Adjusting Investment Strategy During Economic Downturns: - **Diversify Your Portfolio**: Allocate across stocks, bonds, and cash equivalents; invest in different sectors and international markets. - **Rebalance Your Portfolio**: Monitor performance and composition regularly; rebalance to maintain diversification. - **Focus on Quality Stocks**: Choose companies with strong financials, stable earnings, and resilient business models. - **Consider Bonds and Other Fixed Income Securities**: Invest in government, corporate, or municipal bonds for stability and potential returns. - **Stay Disciplined and Avoid Emotional Decisions**: Stay calm, focus on long-term goals, and avoid herd mentality.

How do I invest in wind energy projects ?

Investing in wind energy projects can be a lucrative opportunity, but requires careful consideration and planning. To ensure success, it is crucial to understand the industry, research potential projects, evaluate their feasibility and financial viability, conduct due diligence, choose a suitable investment strategy, secure financing, form partnerships, negotiate terms, monitor progress, and diversify your portfolio. By following these steps, you can make informed investment decisions and contribute to a sustainable future for generations to come.

How do carbon offset projects get verified ?

The verification process for carbon offset projects involves multiple stages, including project registration, preparation of a Project Design Document (PDD), review and approval by third-party auditors, ongoing Monitoring, Reporting, and Verification (MRV), certification, issuance of credits, continuous improvement, and re-verification. This process ensures the genuineness, effectiveness, and sustainability of these projects in mitigating climate change. Key points to remember include the importance of transparency, independent verification, continuous monitoring, and adaptability.

How do you choose the right AC stepping motor for your project ?

Choosing the right AC stepping motor requires understanding project needs, selecting the appropriate motor type, ensuring compatibility with control systems, considering physical constraints, evaluating performance characteristics, accounting for environmental factors, managing budgetary considerations, relying on supplier support and reputation, and conducting thorough testing.

In what ways can retirement communities incorporate physical activities that foster social bonds ?

Retirement communities can foster social bonds among older adults by incorporating a variety of physical activities that cater to different interests and abilities. These include group fitness classes, outdoor adventures, sports and games, mind-body activities, special events, and ensuring accessibility and inclusivity for all residents. By doing so, retirement communities can create an environment where residents maintain their health while developing strong social connections through shared experiences.