Project Invest

How do I invest in wind energy projects ?

Investing in wind energy projects can be a lucrative opportunity, but requires careful consideration and planning. To ensure success, it is crucial to understand the industry, research potential projects, evaluate their feasibility and financial viability, conduct due diligence, choose a suitable investment strategy, secure financing, form partnerships, negotiate terms, monitor progress, and diversify your portfolio. By following these steps, you can make informed investment decisions and contribute to a sustainable future for generations to come.

How can individuals invest in clean energy projects ?

Investing in clean energy projects is a way to support sustainable development and fight climate change. Individuals can invest through renewable energy mutual funds, green bonds, direct investment in clean energy companies, community solar projects, and sustainable real estate investments. Examples include iShares Global Clean Energy ETF (ICLN), Toyota Green Bond, and Eco-friendly apartment complexes.

How do I choose the right brushless motor for my project ?

Choosing the right brushless motor for your project is crucial. Key factors to consider include the purpose of your project, power requirements, speed and torque needs, compatibility with your control system, efficiency and noise level, and researching different brands and models. By considering these factors, you can select the best option for your specific application.

In what ways can mind mapping help with project management and planning ?

Mind mapping is a valuable tool for project management and planning, offering benefits such as clarifying objectives, enhancing brainstorming sessions, facilitating task breakdown, tracking progress, managing risks, and improving communication. By providing a visual representation of information, mind maps enable clearer understanding and more effective collaboration among team members, ultimately contributing to the success of projects.

How does poor project management contribute to construction hazards ?

This text discusses the impact of poor project management on construction hazards, including inadequate planning, communication breakdown, ineffective risk management, unrealistic timelines and budgets, and inadequate supervision and training. It emphasizes the importance of effective project management practices for ensuring safety and success in construction projects.

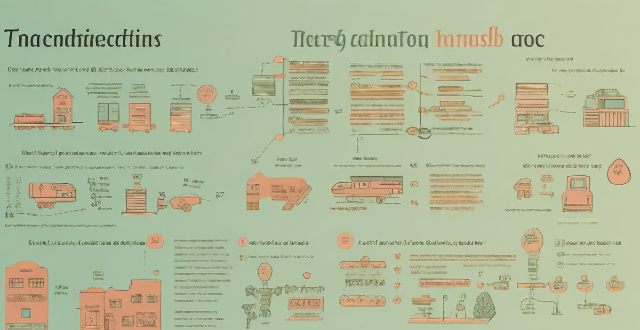

How do I create a budget for a special project at work ?

Creating a budget for a special project at work requires careful planning and consideration of various factors. Here are some steps to help you create an effective budget: 1. Define the project scope, including goals, objectives, and deliverables. 2. Identify all resources needed, such as personnel, equipment, software, and materials. 3. Estimate costs associated with each resource, including direct and indirect costs. 4. Determine funding sources and how much funding is available. 5. Create a timeline with key milestones and deadlines. 6. Assign responsibilities for managing different aspects of the budget. 7. Regularly monitor progress and adjust the budget as needed.

What are the challenges faced during a network expansion project ?

When expanding a network, organizations may face various challenges that can impact the success of the project. These challenges include budget constraints, technical difficulties, security concerns, downtime and disruptions, training and support requirements, integration with existing systems, regulatory compliance, project management issues, change management, and future-proofing considerations. By proactively addressing these challenges, organizations can successfully complete network expansion projects while minimizing disruptions and maximizing the benefits of the expanded network.

What role does risk management play in project planning and execution ?

Risk management is a crucial aspect of project planning and execution that involves identifying, assessing, and prioritizing potential risks to minimize their impact on the project's objectives, timeline, budget, and quality. The process includes identifying technical, financial, operational, and legal/regulatory risks; assessing their likelihood and potential impact; developing response plans for avoidance, mitigation, transference, or acceptance; monitoring and controlling risks throughout the project lifecycle; and effectively communicating about risks to all stakeholders. By managing risks proactively, projects can navigate uncertainties more effectively, leading to improved outcomes and success rates.

How long does it take to complete a network expansion project ?

Completing a network expansion project involves several stages, including planning and design, procurement, installation and configuration, testing and troubleshooting, and deployment and training. The duration of each stage can vary depending on factors such as project size, resource availability, and team efficiency. A general timeline for completing a network expansion project is 6 months to a year.

What are the key factors to consider when planning an energy-efficient building project ?

The text provides a summary of key factors that should be considered when planning an energy-efficient building project. These factors include site selection and orientation, building design and construction, and energy sources and consumption. The location and orientation of the building on the site can have a significant impact on its energy efficiency, as well as the design and construction of the building itself. Consideration should also be given to the sources of energy used by the building and how that energy is consumed. By considering these key factors during the planning stages of an energy-efficient building project, it is possible to create a building that is comfortable, functional, environmentally responsible, and economically sustainable over its lifetime.

How do project-based learning and problem-solving activities fit into innovative teaching methodologies ?

Innovative teaching methodologies emphasize project-based learning (PBL) and problem-solving activities to engage students, foster critical thinking, and develop practical skills. PBL involves students in complex, meaningful projects that connect classroom learning with real-world scenarios, promoting deeper understanding, skill development, and motivation. Problem-solving activities challenge students to identify issues and find effective solutions, enhancing their critical thinking, decision-making, and resilience. Integrating PBL and problem-solving into innovative teaching involves identifying key concepts, designing relevant projects, incorporating problem-solving elements, providing resources, facilitating collaboration, scaffolding instruction, reflecting and evaluating, and assessing holistic performance. This approach creates a dynamic learning environment that prepares students for future challenges and fosters a love of lifelong learning.

What is the best way to invest in gold ?

This article explores the best way to invest in gold, discussing why one might want to consider adding gold to their portfolio and outlining different ways to invest in gold, such as physical gold, gold stocks and mutual funds, gold ETFs, and gold futures and options. The advantages and disadvantages of each method are discussed, and it is emphasized that the best way to invest in gold depends on individual investment goals, risk tolerance, and personal preferences.

How much money should I invest in cryptocurrencies ?

Investing in cryptocurrencies has become a popular trend, but determining how much money to invest can be challenging. Factors such as risk tolerance, investment goals, market conditions, and the need for diversification should be considered before making any investment decisions. It is important to carefully consider these factors and only invest what you are comfortable losing, as investing in cryptocurrencies carries risks.

How do I invest my money wisely for long-term growth ?

Investing wisely for long-term growth involves setting financial goals, creating a diversified portfolio, considering risk tolerance, investing for the long-term, and monitoring investments regularly.

How can I invest in stocks with a minimal risk ?

How to Invest in Stocks with Minimal Risk Investing in stocks can be risky, but there are strategies to minimize these risks. Diversification across stocks, sectors, and asset classes is crucial. Dollar-cost averaging helps smooth market fluctuations. Stop-loss orders limit potential losses. Long-term investing allows for market recoveries. Understanding the companies you invest in reduces unknown risks. Start small and learn as you go, staying informed about financial news. Working with a financial advisor can provide personalized guidance. Remember, no investment is completely risk-free, so assess your comfort level before making decisions.

What is the best cryptocurrency to invest in ?

The article provides a summary of the best cryptocurrencies to invest in, including Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), and Cardano (ADA). It highlights the pros and cons of each cryptocurrency, such as high liquidity and widespread adoption for Bitcoin, smart contract functionality and a large developer community for Ethereum, usefulness on the Binance exchange and a burn mechanism for Binance Coin, and a strong academic foundation and focus on security and sustainability for Cardano. The conclusion emphasizes the importance of considering factors such as liquidity, adoption, and potential for growth when choosing a cryptocurrency to invest in, and encourages readers to do their own research before making an investment decision.

How do I invest in the stock market ?

The text provides a step-by-step guide on how to invest in the stock market. It emphasizes the importance of education, determining investment goals, choosing a strategy, opening a brokerage account, selecting investments, monitoring them, and maintaining patience and discipline. The process involves learning about different types of stocks, understanding risks, diversification, and risk management. It also includes researching brokerage firms, funding an account, choosing individual stocks or mutual funds based on company performance, and staying informed about market changes. Overall, the text encourages potential investors to approach stock market investing with careful planning and research to achieve their financial goals over time.

Is it safe to invest in cryptocurrency as a financial product ?

Is it safe to invest in cryptocurrency as a financial product? The answer is not straightforward, as there are both risks and potential benefits associated with this type of investment. On the one hand, cryptocurrencies are known for their high volatility, lack of regulation, and security risks, which can make them a risky investment. On the other hand, investing in cryptocurrency can potentially yield high returns, offer decentralization, and be accessible to investors. Ultimately, it is important to carefully consider the risks involved before making any investment decisions and to only invest what you are willing to lose. As with any investment, it is recommended to do your own research and consult with a financial advisor before making any decisions regarding cryptocurrency investments.

Can I invest in financial products with a small amount of money ?

Investing in financial products with a small amount of money is possible and can be beneficial for long-term wealth growth. Minimum investment requirements vary among different financial products, but options like robo-advisors, micro-investing apps, online brokerages, ETFs, and direct stock purchases allow for low minimum investments. Starting small helps manage risk, build discipline, and take advantage of compound interest. Tips for investing small include setting clear goals, educating oneself, diversifying the portfolio, considering fees and taxes, and staying patient and disciplined.

How do I invest in real estate without buying property ?

Real estate investment offers wealth growth opportunities without buying physical property through options like REITs, crowdfunding, syndication, online platforms, and mutual funds/ETFs. These methods provide liquidity, diversification, and passive income potential while avoiding typical challenges of direct property ownership.

Is it better to save or invest money for wealth growth purposes ?

The age-old debate of whether to save or invest money for wealth growth purposes largely depends on individual circumstances, risk tolerance, and financial goals. Saving offers security and stability but low returns, while investing carries more risk but has the potential for higher rewards. The best approach for most individuals is a balance between saving and investing, with strategies such as establishing an emergency fund, allocating for short-term goals, investing for long-term goals, and regularly re-evaluating financial plans.

How does the issuance of green bonds benefit environmental projects ?

Green bonds are financial instruments designed to fund environmentally friendly projects, offering benefits such as increased funding opportunities, improved project visibility, long-term financing, risk mitigation, market growth and innovation, policy and regulatory support, and community and environmental impact. These bonds not only benefit the specific environmental projects they aim to fund but also contribute to a broader shift towards sustainable finance and environmental stewardship.

How do I invest in tech stocks as a beginner ?

Investing in tech stocks can be a profitable venture, but it's important to approach it with caution and knowledge. Here are some steps to help you get started: 1. Educate yourself on the basics of the stock market and the technology sector. 2. Set investment goals based on your risk tolerance and desired returns. 3. Choose a reputable brokerage firm that offers access to the stock market. 4. Research individual tech stocks by looking at financial statements, earnings reports, and news articles. 5. Diversify your portfolio by investing in multiple tech stocks across different industries and companies. 6. Monitor your investments and stay informed about industry developments and company news. 7. Remember that investing in stocks involves risks, including the possibility of losing money. Do your own research and consult with a financial advisor before making any investment decisions.

How do carbon offset projects get verified ?

The verification process for carbon offset projects involves multiple stages, including project registration, preparation of a Project Design Document (PDD), review and approval by third-party auditors, ongoing Monitoring, Reporting, and Verification (MRV), certification, issuance of credits, continuous improvement, and re-verification. This process ensures the genuineness, effectiveness, and sustainability of these projects in mitigating climate change. Key points to remember include the importance of transparency, independent verification, continuous monitoring, and adaptability.

Is carbon offsetting effective in reducing greenhouse gas emissions ?

Carbon offsetting is a strategy to compensate for CO2 emissions by investing in projects that reduce, avoid, or absorb an equivalent amount of CO2 elsewhere. While it can provide immediate action and support clean projects, there's a lack of standardization and potential for perverse incentives. Effectiveness depends on project quality and organizational integrity. It should be part of a broader strategy, not seen as a silver bullet.

How do you choose the right AC stepping motor for your project ?

Choosing the right AC stepping motor requires understanding project needs, selecting the appropriate motor type, ensuring compatibility with control systems, considering physical constraints, evaluating performance characteristics, accounting for environmental factors, managing budgetary considerations, relying on supplier support and reputation, and conducting thorough testing.

What are the best practices for setting up a women's empowerment project in a rural area ?

Best practices for setting up a women's empowerment project in rural areas include understanding the local context, involving local stakeholders, designing a holistic program, ensuring accessibility and inclusivity, promoting economic opportunities, enhancing health and well-being, building leadership and decision-making skills, and monitoring progress and evaluating impact.

How can I stay focused and motivated when working on long-term projects ?

Working on long-term projects can be challenging, especially when it comes to maintaining focus and motivation. However, with the right strategies and mindset, you can ensure that you stay on track and achieve your goals. In this guide, we will discuss some effective techniques to help you stay focused and motivated throughout your long-term project. Setting clear goals is crucial for staying focused and motivated. Start by defining your vision for the project and breaking it down into specific, measurable objectives using the SMART criteria (Specific, Measurable, Achievable, Relevant, Time-bound). Create a timeline that outlines when you want to achieve each objective and use a calendar or project management tool to track your progress. Maintaining consistency is also important for staying focused and motivated. Establish a daily routine that includes dedicated time for working on your project and stick to it as much as possible. Track your progress regularly and celebrate small milestones along the way to stay motivated and recognize your achievements. Prioritize tasks based on their importance and use tools like to-do lists or task management apps to stay organized and focused. Staying motivated is key to completing a long-term project. Find your why by reflecting on why this project is important to you and what motivates you to see it through to completion. Write down your reasons and refer back to them when you need a boost of motivation. Surround yourself with sources of inspiration, such as books, podcasts, or videos related to your project, and connect with others who share your interests or are working on similar projects. Finally, set up rewards for reaching specific milestones or completing certain tasks to provide an extra incentive to keep pushing forward. By setting clear goals, maintaining consistency, and staying motivated throughout your long-term project, you can increase your chances of success and achieve your desired outcomes. Remember to stay focused on your vision, prioritize tasks, and celebrate your progress along the way. With these strategies in place, you'll be well on your way to completing your long-term project with confidence and dedication.

Are there any risks associated with investing in DeFi ?

Investing in DeFi comes with risks such as smart contract vulnerabilities, impermanent loss, regulatory uncertainty, and lack of transparency. It is important for investors to carefully evaluate these risks before investing in any DeFi project.

How can climate finance be leveraged to support renewable energy projects ?

Climate finance plays a crucial role in supporting renewable energy projects. Here are some ways to leverage it: 1. Public-Private Partnerships (PPPs) can be used to attract private investment into renewable energy projects. 2. Green Bonds can be issued to fund environmentally friendly projects such as solar and wind farms. 3. Carbon Pricing Mechanisms can generate revenue that can be invested in renewable energy projects. 4. International Climate Finance Initiatives can provide funding for renewable energy projects in developing countries. 5. Crowdfunding Platforms offer another way to raise funds for renewable energy projects. By using a combination of these strategies, we can accelerate the transition towards a more sustainable future.