Return Management

What is the average return on investment for private equity ?

Private equity (PE) investments can offer attractive returns, but these are influenced by several factors. The success of the companies in which PE firms invest, market conditions, investment strategy, and timing all play a role. Historically, PE has delivered average annualized returns of 12-15%, though these can be volatile. It's important for investors to understand the J-curve effect, fees, and the benefits of diversification when considering PE investments.

Which financial product offers the highest return on investment ?

Investing in financial products is a popular way to grow wealth, but with many options, it's hard to determine which offers the highest return on investment (ROI). This article explores popular financial products and their potential returns. The stock market offers high potential returns but also significant risks. Real estate can provide rental income and property appreciation, but comes with its own set of risks. Mutual funds offer professional management and diversification, but fees and expenses can impact returns. Cryptocurrencies have gained popularity as an alternative investment option, but are highly volatile and speculative, making them unsuitable for most investors seeking stable returns. Determining which financial product offers the highest return on investment depends on various factors, including risk tolerance, investment goals, and market conditions. Diversification across different asset classes and investment vehicles can help minimize risks and maximize returns over time.

How do bond yields affect my investment returns ?

Bond yields significantly impact investment returns, particularly for bond and bond-related security investors. Yields represent the interest rate paid by bond issuers to holders and are crucial for expected returns. Higher yields generally result in increased interest income but can also cause price volatility. Inflation affects real returns, and lower yields may increase opportunity costs. Strategies like diversification, duration management, active management, and staying informed can help maximize returns amidst changing bond yield environments.

How often do I need to file my personal income tax return ?

Filing personal income tax returns is a crucial financial responsibility for individuals. The frequency of filing depends on various factors such as your residency, employment status, and income level. In this article, we will discuss the different scenarios that determine how often you need to file your personal income tax return. Personal income tax returns are filed annually in most countries. However, there are certain situations where you may need to file more frequently or less frequently. Your residency status plays a significant role in determining how often you need to file your personal income tax return. If you are a resident of a country, you are required to file your tax return annually, regardless of your employment status or income level. If you are employed and receive a regular salary, your employer is responsible for withholding taxes from your paycheck and remitting them to the government. In this case, you are still required to file your personal income tax return annually to report your total income and ensure that the correct amount of taxes has been withheld. The frequency of filing your personal income tax return also depends on your income level. If you have a low income and do not exceed the minimum threshold set by the government, you may not be required to file a tax return. However, it is always advisable to check with the tax authorities to confirm if you are exempt from filing. Self-employed individuals who earn an income from their business activities are required to file their personal income tax return annually. This is because self-employed individuals are responsible for paying their own taxes and reporting their income to the government. Freelance workers who earn an income from providing services to clients are also required to file their personal income tax return annually. This ensures that they report their earnings accurately and pay the appropriate taxes. If you own rental properties and earn rental income, you are required to file your personal income tax return annually. This is because rental income is considered part of your overall income and must be reported to the government. Retirees who receive pensions or other forms of retirement income are generally required to file their personal income tax return annually. However, if their income falls below the minimum threshold set by the government, they may be exempt from filing. In conclusion, the frequency of filing your personal income tax return depends on various factors such as your residency status, employment status, and income level. It is important to understand these factors and consult with the tax authorities to ensure that you comply with the requirements for filing your tax return. By doing so, you can avoid penalties and ensure that you pay the correct amount of taxes.

What is the return policy for items purchased during a limited-time promotion ?

When you purchase items during a limited-time promotion, it is important to understand the return policy associated with those purchases. The return policy for items purchased during a limited-time promotion may vary depending on the retailer or brand. Most retailers have a specified time limit for returns, which is usually stated in their return policy. The item must be returned in its original condition, including any packaging and accessories that were included with the purchase. Refunds are typically issued using the same method of payment as the original purchase. There are some exceptions to the general return policy for items purchased during a limited-time promotion, such as final sale items, customized items, and shipping and handling fees. To ensure a smooth return process, keep receipts and packaging, check the return policy before purchasing, and contact customer service if unsure.

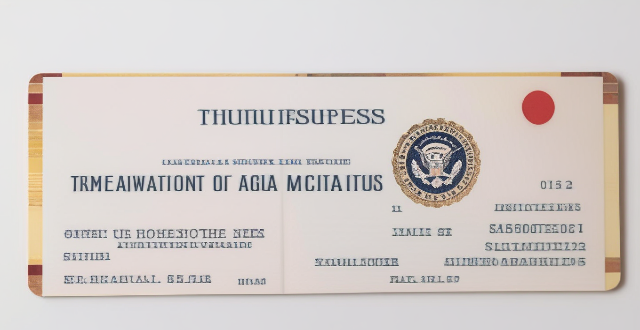

Is it necessary to have a return ticket for a tourist visa application ?

The text discusses the importance of a return ticket for a tourist visa application. It states that a return ticket is necessary to ensure the traveler has plans to return to their home country after the completion of their trip. Other documents required for a tourist visa application include a valid passport, hotel reservation, travel itinerary, financial evidence, invitation letter, travel insurance, application form, and photo. The return ticket is considered important as it shows the embassy or consulate that the traveler plans to return to their home country after their trip, reduces the chances of overstaying their visa period, assures the authorities of departure arrangements, and maintains the integrity of visa policies. If a traveler cannot provide a return ticket at the time of application, there is a high probability of visa rejection. However, an onward journey ticket can be provided as an alternative. Alternatives to a return ticket include one-way tickets, open-ended tickets, refundable tickets, and onward journey tickets. To ensure the availability of a return ticket, travelers should book in advance, choose flexible dates, opt for refundable tickets, and check with airlines about their policies. Not providing a return ticket can lead to visa rejection, blacklisting, impact future applications, and financial losses. Travel agents can assist in getting a return ticket or suggesting alternatives but may charge additional fees.

Can I return or exchange items purchased through团购优惠 (tuan gou youhui) ?

This text discusses the concept of Tuan Gou Youhui, a popular online shopping method in China that allows customers to purchase products at discounted rates in large group sizes. It then explores the return and exchange policies for items purchased through this method, noting that these policies vary depending on the specific merchant and product but most merchants offer some form of return or exchange policy. The text provides general guidelines for understanding return and exchange policies and steps to return or exchange an item, emphasizing the importance of contacting customer service, providing necessary information, packaging the product carefully, shipping it according to instructions, waiting for refund or exchange, and confirming receipt of refund or exchanged product. Finally, it concludes that by understanding these policies and following appropriate steps, customers can ensure a smooth and hassle-free experience when shopping through Tuan Gou Youhui.

What are the key elements of successful sports career management ?

Managing a successful sports career involves various elements that work together to ensure the athlete's success. Key elements include goal setting, time management, skill development, mental preparation, nutrition and hydration, injury prevention and recovery, networking and relationship building, and financial management. Athletes must set both short-term and long-term goals, manage their time effectively, develop physical and technical skills, prepare mentally for competitions, maintain proper nutrition and hydration, prevent and recover from injuries, build strong relationships with coaches and teammates, and manage their finances wisely.

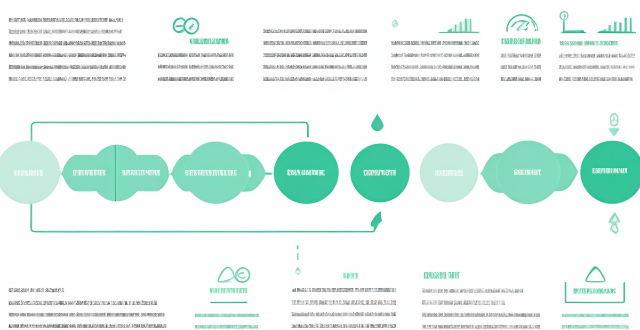

What is the process of returning a product in global shopping ?

### Summary: Returning a product purchased through global shopping involves several steps, including checking the return policy, initiating the return process, preparing and shipping the item back, monitoring your refund, documenting the process, and considering international factors such as customs and currency exchange rates. It's important to stay organized, use trackable shipping methods, and keep records of all communications with the seller to ensure a smooth and effective return.

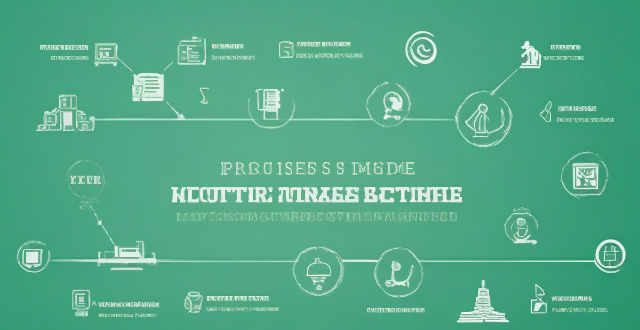

How can blockchain technology be used in supply chain management ?

Blockchain technology is poised to revolutionize supply chain management by offering transparency, traceability, and security. Smart contracts automate transactions, while secure data sharing promotes collaboration. The technology also reduces manual processes, paperwork, and enhances compliance.

What role does recovery play in a sports health management plan ?

Recovery is a crucial component of sports health management, enhancing performance, preventing injuries, promoting mental health, and maintaining a balanced lifestyle. It involves activities like sleep, nutrition, stress reduction techniques, and time management to ensure athletes can perform at their best while staying healthy and motivated.

What is credit management ?

Credit management is the process of managing and controlling the use of credit by individuals or businesses. It involves evaluating borrowers' creditworthiness, determining the amount of credit to extend, monitoring loan repayment, and taking action for late payments. Key components include credit analysis, evaluation, loan monitoring, collections management, risk management, and customer relationship management. Effective credit management benefits include reduced default risk, improved cash flow, increased customer satisfaction, and enhanced reputation.

How does risk management relate to compliance and regulatory requirements ?

Risk management and compliance are interconnected aspects of organizational operations, aimed at safeguarding against potential losses and legal issues. Risk management identifies and prioritizes risks impacting objectives, while compliance ensures adherence to laws and regulations. An integrated approach enhances efficiency, and collaboration between departments is key for success. Regulatory requirements significantly influence risk management and compliance strategies, with direct rules and indirect environmental changes. Understanding these dynamics is vital for maintaining reputation and avoiding compliance breaches.

How do different countries approach flood control and management ?

Flood control and management strategies vary across different countries, influenced by factors such as geographic location, climate conditions, economic resources, and technological advancements. The United States relies on early warning systems, flood insurance programs, and floodplain zoning regulations. The Netherlands invests in flood barriers and dikes, water management policies, and international cooperation. China focuses on the Three Gorges Dam, flood prevention campaigns, and reforestation efforts. India adopts community-based approaches, integrated water resource management, and disaster risk reduction programs.

How does network slicing differ from traditional network management techniques ?

Network slicing, enabled by SDN and NFV, allows creating multiple virtual networks on a common infrastructure for tailored services like IoT and automotive systems. It offers dynamic resource allocation, scalability, better security, and can simplify management through automation. In contrast, traditional network management is monolithic with static resources, complex and potentially less secure. Network slicing is a more adaptable solution for diverse and growing connectivity needs.

What role does investment play in women's wealth management ?

Investing is crucial for women's wealth management, offering benefits like diversification, long-term growth, inflation protection, tax advantages, and flexibility. By wisely investing, women can enhance their financial security and achieve their financial goals.

How does stress management affect women's well-being ?

Stress management plays a crucial role in women's well-being, affecting their physical, mental, and emotional health. By managing stress, women can improve their immunity, sleep quality, and reduce the risk of chronic diseases. It also helps in improving mood, concentration, and reducing anxiety and depression. Stress management can lead to improved relationships, self-esteem, and increased resilience. Overall, it is essential for women's well-being and can lead to a happier and healthier life.

How can stress management contribute to better personal health ?

Stress management is crucial for maintaining physical and mental health, as it can reduce the risk of chronic diseases, improve sleep quality, boost the immune system, reduce anxiety and depression symptoms, enhance cognitive function, and increase resilience. Incorporating stress management techniques into daily routines can lead to better overall well-being and a higher quality of life.

How does ecological design address issues related to water management and consumption ?

Ecological design addresses water management and consumption issues through strategies such as rainwater harvesting, water recycling, using native plants in landscaping, installing efficient water fixtures, permeable paving, smart water management systems, and promoting education on water conservation.

What are the best practices for sustainable groundwater management ?

The provided text discusses the importance of sustainable groundwater management and outlines several best practices to ensure the long-term availability and quality of this vital resource. These practices include monitoring and data collection, enhancing recharge, maintaining sustainable withdrawal rates, protecting groundwater from pollution, integrated water resources management, legal and policy framework, public participation and education, technological innovation, and responding to climate change. By following these guidelines, depletion, contamination, and environmental damage can be prevented, supporting ecosystems, agriculture, and human consumption.

How can companies implement effective risk management strategies ?

Effective Risk Management Strategies for Companies Risk management is a critical aspect of any business operation. It involves identifying, assessing, and prioritizing potential risks that could impact the company's objectives. Here are some effective risk management strategies that companies can implement: 1. Identify Potential Risks: The first step in implementing effective risk management is to identify potential risks. This involves analyzing the company's operations and processes to determine what could go wrong. Some common types of risks include financial risks, operational risks, strategic risks, and compliance risks. 2. Assess and Prioritize Risks: Once potential risks have been identified, they need to be assessed and prioritized based on their likelihood and potential impact. This involves assigning each risk a score based on its severity and probability of occurrence. The risks can then be ranked in order of priority, with the most significant risks being addressed first. 3. Develop Risk Mitigation Plans: For each identified risk, a mitigation plan should be developed. This plan should outline the steps that will be taken to reduce or eliminate the risk. Mitigation plans can include avoidance, reduction, transfer, or acceptance. 4. Monitor and Review Risks Regularly: Risk management is an ongoing process, and companies should regularly monitor and review their risks. This involves tracking changes in the business environment and updating risk assessments accordingly. It also involves evaluating the effectiveness of risk mitigation plans and making adjustments as needed. In conclusion, effective risk management strategies involve identifying potential risks, assessing and prioritizing them, developing mitigation plans, and regularly monitoring and reviewing them. By implementing these strategies, companies can reduce their exposure to risks and protect their operations and bottom line.

Can exercise help with stress management ?

**Topic:** Can Exercise Help with Stress Management? **Summary:** * **Introduction:** The inevitability of stress and its potential impact on health highlight the importance of effective stress management. Exercise is often touted as a beneficial method for reducing stress. * **Relationship Between Exercise and Stress:** * **Physical Effects:** Exercise triggers endorphins, reduces cortisol levels, and improves sleep quality—all of which contribute to stress reduction. * **Mental Effects:** Enhanced cognitive function, increased self-esteem, and mindfulness techniques associated with exercise can aid in stress management. * **Benefits of Exercise for Stress Management:** * **Physical Benefits:** Improved cardiovascular health, weight management, and pain relief can reduce stress caused by related health issues. * **Mental Benefits:** Exercise can alleviate symptoms of anxiety and depression, improve mood, and increase resilience to stress. * **Practical Tips:** * **Setting Goals:** Start small and choose enjoyable activities to make exercise a sustainable habit. * **Consistency:** Scheduling workouts, finding an accountability partner, and tracking progress can help maintain a regular exercise routine. * **Conclusion:** Exercise is a powerful tool for managing stress, offering both physical and mental benefits. Incorporating it into one's lifestyle can significantly enhance overall well-being and resilience to life's challenges.

What are some innovative solutions for flood prevention and management ?

The provided text discusses innovative solutions for flood prevention and management, highlighting various strategies such as early warning systems, green infrastructure, smart water management systems, flood barriers and walls, and community engagement and education. Each strategy is briefly explained, emphasizing its key features and benefits in mitigating the impact of floods on lives and property. The conclusion emphasizes the importance of considering local conditions and needs when selecting appropriate measures for effective flood prevention and management.

How does credit management work in a bank ?

Credit management is a crucial function of banks that involves assessing and managing the risks associated with lending money to individuals and businesses. The process includes evaluating borrowers' creditworthiness, using credit scoring models to determine risk, making loan decisions, servicing and monitoring loans, and managing credit risk through diversification and risk management strategies.

What resources are available to help women learn about wealth management ?

The text provides a summary of resources available to help women learn about wealth management. It mentions online courses and webinars, books, podcasts, and financial planners and advisors as some of the resources that can be used by women to gain knowledge and skills in wealth management. The resources are aimed at helping women take control of their finances and secure their financial future.

How does technology impact credit management practices ?

Technology has revolutionized credit management practices by automating processes, enhancing data analysis capabilities, and streamlining communication channels. Automated credit scoring systems save time and reduce human error, while accounts receivable management software helps businesses track outstanding invoices and initiate collections actions if necessary. Technology also enables businesses to monitor changes in a borrower's creditworthiness in real-time, allowing them to make informed decisions about extending credit or adjusting terms. Enhanced data analysis tools like artificial intelligence and machine learning help businesses gain insights into customer behavior and make better-informed decisions about extending credit. Predictive analytics can identify potential risks, sentiment analysis gauges customer sentiment towards products or services, and fraud detection technology reduces the risk of financial losses due to credit card fraud or identity theft. Streamlined communication channels such as online portals, mobile apps, and chatbots powered by AI improve customer service and efficiency in credit management practices. Overall, technology has had a profound impact on credit management practices and will continue to do so as it evolves.

What are some examples of sustainable investments ?

Sustainable investments are becoming increasingly popular as investors seek to generate financial returns while also contributing to environmental and social causes. Examples of sustainable investments include green bonds, sustaple stocks, impact investing, and sustainable real estate. These investments offer benefits such as reducing carbon emissions, promoting renewable energy sources, supporting fair labor practices, and potentially earning competitive returns over time. By choosing to invest sustainably, investors can play an active role in protecting the environment, creating a more equitable society, and achieving financial success.

How does poor project management contribute to construction hazards ?

This text discusses the impact of poor project management on construction hazards, including inadequate planning, communication breakdown, ineffective risk management, unrealistic timelines and budgets, and inadequate supervision and training. It emphasizes the importance of effective project management practices for ensuring safety and success in construction projects.

What are some effective time management techniques for students ?

Effective time management techniques for students include prioritizing tasks, setting goals, creating a schedule, utilizing time management tools, minimizing distractions, and taking breaks. These strategies help students focus on important tasks, allocate time efficiently, avoid procrastination, and maintain a healthy work-life balance.