Secure Payment

Is Cross-Border Payment secure ?

Cross-border payments are essential for international trade and business transactions but can pose security risks. Factors like regulatory compliance, technology, fraud prevention measures, and the reputation of the payment service provider affect the security of these payments. Risks include currency fluctuations, political instability, and cyber threats. To ensure security, choose a reputable provider, use secure payment methods, verify recipient details, and keep track of transactions.

How can I ensure safe and secure payment when shopping internationally ?

When shopping internationally, it's important to ensure safe and secure payment. Here are some tips on how to do so: - Use a reputable payment method such as credit cards, debit cards, or digital wallets. - Check for security features like HTTPS, a lock icon in the address bar, and a clear privacy policy. - Keep track of your purchases by saving receipts, order confirmations, and shipping information. - Be aware of scams and research the company or seller before making a purchase.

What is the future of Cross-Border Payment ?

The future of cross-border payment is expected to be influenced by trends such as digitalization, regulatory changes, innovation in payment methods, and global economic integration. However, challenges like high fees, security risks, and lack of standardization need to be addressed for the industry to become more accessible, secure, and efficient.

How does Fintech enable faster and more secure payments ?

Fintech has revolutionized payment systems by making them faster and more secure. Instant transfers, mobile payments, and automated options have streamlined the process, while encryption, tokenization, two-factor authentication, and fraud detection systems have enhanced security. These advancements benefit both individuals and businesses.

What are some of the most secure online shopping platforms ?

Secure online shopping platforms are essential in protecting personal and financial information. Amazon, eBay, Walmart, Target, Best Buy, and Etsy are some of the most secure online shopping platforms available today. These platforms use advanced security measures such as SSL encryption and two-factor authentication to protect users' data. Additionally, they offer various payment options and excellent customer service. By choosing these reputable platforms, you can enjoy a safe and convenient online shopping experience.

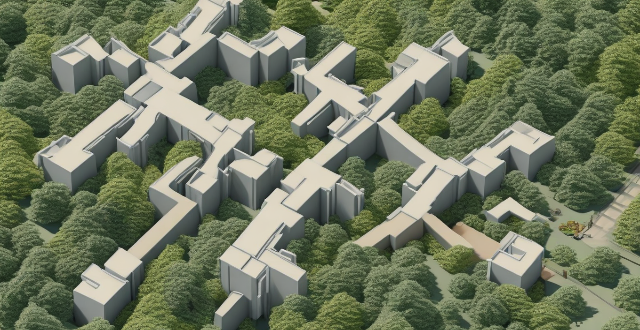

How does Cross-Border Payment work ?

Cross-border payments are transactions that involve transferring money between different countries. The process is complex and requires coordination among various parties, including banks, payment processors, and financial institutions. The steps involved in cross-border payments include initiation of the payment, verification and authorization, execution of the payment, and settlement and reconciliation. There are several methods available for cross-border payments, such as wire transfers, online payment platforms, and mobile wallets. Choosing the appropriate method ensures safe, secure, and efficient cross-border payments.

Is Apple Pay safe to use ?

Apple Pay is a secure payment technology that employs multiple security layers to protect user information. Its safety features include device-specific numbers, unique transaction codes, and secure element chips. Apple Pay also emphasizes privacy protection by abstracting actual payment information from transactions. The service supports a wide range of devices and is easy to set up. It is widely accepted in both physical and online locations. Additionally, Apple Pay collaborates with numerous financial institutions worldwide, further enhancing its accessibility and security. Overall, Apple Pay is a reliable and secure digital payment solution.

What are the most popular Cross-Border Payment platforms ?

The global economy heavily relies on cross-border payments, and several platforms have emerged to facilitate these transactions. PayPal is a widely used online payment system offering a secure way to send and receive money internationally. Stripe provides APIs for integrating payments into applications and supports multiple currencies. Adyen offers a one-stop platform for all payment methods, reducing transaction friction. TransferWise (now Wise) focuses on reducing transfer costs using a peer-to-peer model. WorldRemit specializes in remittances to mobile wallets and bank accounts in developing countries. Skrill is a digital wallet service with merchant services and a prepaid card option. Payoneer provides mass payments solutions and multi-currency accounts, particularly benefiting affiliate marketers. Each platform caters to different needs, from individual remittances to business solutions, ensuring options for various cross-border payment scenarios.

How can I set up a Cross-Border Payment account ?

The text provides a detailed guide on how to set up a cross-border payment account, including steps such as researching and choosing a provider, checking compliance and regulations, opening an account, verifying the account, configuring payment settings, linking to a business account, testing the system, monitoring and maintaining the account, understanding fees and exchange rates, and optimizing for tax implications. It emphasizes the importance of complying with legal and regulatory requirements, maintaining detailed records, and working with a tax advisor.

How long does it take for a Cross-Border Payment to process ?

The processing time for cross-border payments can vary depending on several factors, including the payment method used, the countries involved, and the banks or financial institutions handling the transaction. Wire transfers typically take 1 to 5 business days, credit cards can take 3 to 7 business days, and digital wallet transactions are usually completed within 24 hours. However, these are just general guidelines and the actual processing time can vary based on the specific circumstances of each transaction.

How can I optimize my Cross-Border Payment strategy ?

This guide discusses how to optimize cross-border payment strategy by researching and understanding regulations and compliance requirements, choosing the right payment method, using technology to streamline processes, and working with reliable partners.

How do I track my Cross-Border Payment transaction ?

Cross-border payments can be tracked using various methods such as obtaining key information, utilizing online banking services, contacting the bank directly, using third-party tracking services, staying informed with updates, understanding time frames, confirming receipt with the beneficiary, and monitoring for errors or fraud. It is essential to collect all necessary transaction details before initiating a transfer, including the transaction ID, beneficiary details, date of transfer, amount, and expected delivery date. Most banks provide online services that allow customers to track their transactions, while some financial service providers offer tracking tools specifically designed for cross-border payments. Staying informed with updates through email or SMS notifications is crucial, along with understanding typical time frames for different types of transactions. Confirming receipt with the beneficiary and monitoring for any errors or fraud throughout the process are also important steps to ensure a smooth and secure transaction.

Can I cancel a Cross-Border Payment transaction ?

Canceling a cross-border payment depends on factors like the payment method, bank policies, and timing of cancellation. Wire transfers and electronic platforms are common methods, with immediate requests having higher chances of success. Costs may apply for cancellation, and effective communication with banks or providers is crucial. Steps include acting quickly, verifying transaction status, contacting support, and understanding any fees. Prevention tips involve double-checking details and using reliable platforms.

How do I ensure I'm getting the best deal when shopping online ?

When shopping online, it's important to take steps to ensure you're getting the best deal possible. Here are some tips: 1. Research before buying to compare prices and read reviews. 2. Look for coupons and discounts. 3. Be wary of scams and only shop from reputable retailers. 4. Use secure payment methods and avoid storing payment information on websites. 5. Keep track of your purchases and monitor your accounts for suspicious activity.

How much down payment do I need to buy a house ?

This article discusses the factors affecting the down payment amount for buying a house, including credit score, type of mortgage, and price of the house. It also provides common down payment requirements for different types of mortgages and tips for saving for a down payment.

What is Cross-Border Payment ?

Cross-border payment is the process of transferring money from one country to another, involving currency exchange and various payment methods. It is essential for businesses operating in multiple countries, allowing them to receive and make payments in different currencies. Key features include currency exchange, payment methods, regulations, fees, and timeframes. Benefits of cross-border payments include global expansion, increased sales, reduced costs, and improved cash flow.

What regulations govern Cross-Border Payment ?

Regulations governing cross-border payment include Anti-Money Laundering (AML) laws, Payment Card Industry Data Security Standard (PCI DSS), International Wire Transfer Regulations, and General Data Protection Regulation (GDPR). These regulations ensure the security, safety, and efficiency of the process by requiring financial institutions to verify customer identity, monitor transactions for suspicious activity, protect cardholder data, comply with US sanctions and embargoes, and protect personal data.

How to manage payment methods for my Apple account ?

Apple offers multiple payment methods for users, including creditApple offers multiple payment methods for users, including credit Apple Pay, and gift cardsManaging your payment methods ensures a smooth experience when making purchases on Apple services like the App Store and iTunes Store.

How do exchange rates affect Cross-Border Payment ?

Exchange rates play a crucial role in cross-border payments, impacting the cost, speed, and feasibility of transactions. They can affect transfer fees, currency fluctuations, processing time, trade opportunities, and investment opportunities. Understanding exchange rates is essential for managing them effectively in international trade or finance.

Can you consolidate multiple student loans into one payment ?

Consolidating multiple student loans into one payment simplifies monthly expenses and can reduce overall interest rates. The process involves taking out a new loan to pay off existing ones, resulting in a single fixed interest rate and monthly payment. Benefits include lower monthly payments and easier management, but potential drawbacks such as longer repayment periods and loss of lender benefits should be considered. Successful consolidation requires evaluating current loans, comparing offers, and understanding all terms before committing.

What are the benefits of using Cross-Border Payment ?

Cross-border payments are essential for global commerce, offering benefits such as increased access to markets, improved efficiency, lower costs, greater flexibility, enhanced security, and scalability. These advantages help businesses expand globally, making cross-border payments a vital tool for modern commerce.

Can small businesses benefit from Cross-Border Payment ?

Cross-border payments are increasingly vital in the global economy, enabling businesses to tap into new markets. Small businesses can benefit from this trend by expanding market access, increasing revenue potential, improving customer experience, reducing costs, and gaining a competitive advantage. As technology continues to evolve, small businesses should consider taking advantage of cross-border payments to grow and succeed on a global scale.

What are the best practices for secure online communication ?

This article outlines best practices for secure online communication, emphasizing the importance of strong passwords, keeping software up-to-date, being cautious with emails and links, and using encrypted communication channels. It suggests creating unique passwords for each account, updating operating systems and applications regularly, verifying sender identity in emails, and using HTTPS for web browsing and secure messaging apps with end-to-end encryption. By following these practices, individuals can enhance their online communication security and protect themselves from cyber threats and privacy breaches.

How do I create a secure digital identity for myself ?

Creating a secure digital identity is crucial in today's digital age. Here are some steps you can follow to create a secure digital identity: choose a strong password, enable two-factor authentication, keep your software up-to-date, be cautious with personal information online, use encryption tools, and monitor your online presence. By following these steps, you can protect your personal information and reduce the risk of identity theft or cyber attacks.

Are there any risks associated with Cross-Border Payment ?

Cross-border payments come with several risks, includingCross-border payments come with several risks, including risk, legal risk, and it's essential to use reputable payment providers and take steps to protect personal information.

**What does the HomeKit Secure Video feature offer and how does it work with iCloud ?

The HomeKit Secure Video feature is a security enhancement for Apple's HomeKit platform that allows users to store and analyze video from their home security cameras in a secure and private manner. This feature offers several benefits, including end-to-end encryption, activity zones, motion detection, 10-day video storage, and multiple camera support. When enabled on compatible security cameras, all video data captured by those cameras is automatically encrypted and sent to iCloud for secure storage. To use HomeKit Secure Video, an active iCloud storage plan with enough space to store video recordings is required. Once set up, users can access recorded footage through the Home app on their Apple devices and review specific events or download clips as needed. Overall, HomeKit Secure Video provides a convenient and secure way to manage video from home security cameras using iCloud while maintaining privacy.

What are the best practices for safe global shopping ?

Global shopping has become increasingly popular in recent years, with the rise of e-commerce platforms and international shipping options. However, it also comes with its own set of risks and challenges. To ensure a safe and secure global shopping experience, here are some best practices to follow: 1) Research the seller before making a purchase from an international seller. Look for reviews and feedback from other customers, and check the seller's reputation on trusted review sites like Trustpilot or ResellerRatings. 2) Use a secure payment method when shopping globally. Look for sellers that accept credit cards or reputable third-party payment processors like PayPal. Avoid using wire transfers or other unsecured payment methods. 3) Verify the shipping details before making a purchase. Check the estimated delivery time, shipping costs, and any customs fees that may apply. Choose a shipping option that includes tracking and insurance to protect your purchase during transit. 4) Be aware of customs regulations in both your home country and the seller's country. Some items may be prohibited or restricted, and there may be additional taxes or duties applied to your purchase. Make sure you understand these requirements before making a purchase to avoid any unexpected charges or delays. 5) Keep records of your global shopping purchases. Save copies of receipts, order confirmations, and any communication with the seller. These records can be helpful if there are any issues with your purchase or if you need to file a dispute with your payment provider or credit card company.

**Is there a limit to the number of cameras I can connect to iCloud for HomeKit Secure Video ?

HomeKit Secure Video allows users to securely store video from their home security cameras in iCloud. The current limit set by Apple is up to ten cameras per account, including both indoor and outdoor cameras. If you have more than ten cameras, you will need to choose which ones are connected to iCloud for HomeKit Secure Video. Despite the limit on the number of cameras, there are several benefits to using HomeKit Secure Video, such as end-to-end encryption, motion detection, activity zones, and iCloud storage.

Can I use Apple Pay for online purchases ?

Apple Pay is a mobile payment and digital wallet service that allows users to make secure and convenient payments using their Apple devices. It works by transmitting payment information between the user's device and the merchant's payment terminal using near-field communication (NFC) technology. Using Apple Pay for online purchases offers several benefits, including convenience, security, speed, and integration with other Apple services. To set up Apple Pay for online purchases, users must add their credit or debit card details to the Wallet app on their iPhone or iPad, choose a default card, look for the Apple Pay button at checkout when shopping online, confirm their payment using Touch ID or Face ID, and wait for confirmation from the merchant. If issues arise while using Apple Pay for online purchases, users can check their device compatibility, update their billing and shipping information, or contact customer support for assistance.

What currencies can be used for Cross-Border Payment ?

The currencies used for cross-border payments vary widely depending on numerous factors, including economic strength, political stability, and market acceptance. Major world currencies like the US Dollar, Euro, British Pound Sterling, and Japanese Yen are commonly used due to their global acceptance and role in international trade and financial markets. Other currencies such as the Chinese Yuan/Renminbi, Canadian Dollar, and Australian Dollar also play significant roles in cross-border payments, particularly in commodities trade and regional economies. Digital currencies, including Bitcoin and stablecoins, are increasingly being used for cross-border payments, offering decentralized transactions and the benefits of blockchain technology. Factors influencing currency choice include regulatory environment, cost considerations, market fluctuations, and business agreements.