Strategy Stakeholder

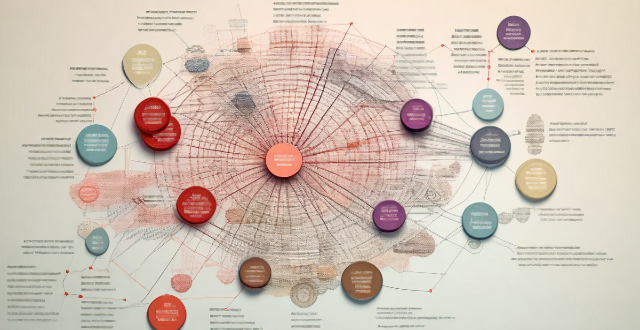

What role do stakeholders play in shaping a company's CSR strategy ?

The text is a summary of the key points on the role of stakeholders in shaping a company's Corporate Social Responsibility (CSR) strategy. Stakeholders, including customers, employees, suppliers, shareholders, communities, government agencies, and non-governmental organizations (NGOs), are crucial in identifying and analyzing their interests, needs, and expectations. Companies need to communicate openly and regularly with their stakeholders to gather feedback and build trust. Collaboration and partnerships with stakeholders on CSR projects help achieve shared goals and strengthen relationships. Accountability and transparency are essential for companies to act responsibly and ethically. Continuous improvement is necessary based on stakeholder feedback. Risk management involves stakeholders in risk assessment and management processes. Legal and ethical obligations must be considered when developing CSR strategies. Innovation and sustainability can be driven by stakeholder input. A strong CSR strategy enhances brand reputation and loyalty. Long-term success can be ensured by involving stakeholders in shaping CSR strategy.

What is the significance of ESG for stakeholder management ?

This article discusses the importance of ESG factors for stakeholder management. Environmental factors such as climate change and resource depletion, social factors such as labor practices and community relations, and governance factors such as board diversity and anti-corruption policies are all crucial for companies to consider in order to enhance their reputation, build stronger relationships with their stakeholders, and ensure the long-term viability of their operations. By incorporating ESG principles into their stakeholder management strategies, companies can demonstrate their commitment to sustainability and responsibility, which is increasingly important in today's business environment.

What is the role of public participation and stakeholder engagement in the development of climate and environmental policies ?

The article discusses the importance of public participation and stakeholder engagement in developing climate and environmental policies. It highlights that these processes enhance transparency, build consensus, provide local knowledge, identify gaps and priorities, promote equity and fairness, facilitate implementation and compliance, and promote innovation. Overall, involving a diverse range of stakeholders in the policy-making process leads to more effective, equitable, and sustainable solutions to environmental challenges.

What is the relationship between ESG and corporate governance ?

The article explores the relationship between Environmental, SocialThe article explores the relationship between Environmental, Social (ESG) factors and It states that ESG is often considered a subset of corporate governance and focuses on specific aspects of how a company operates. Companies that prioritize ESG factors tend to have stronger corporate governance structures in place. The role of boards in overseeing a company's ESG initiatives is also discussed. Regulations and stakeholder pressure are driving the need for effective corporate governance. Best practices for integrating ESG into corporate governance include defining clear objectives, regular reviews, stakeholder engagement, and maintaining transparency and accountability.

How do tax laws impact my strategy for wealth growth ?

Tax laws play a significant role in shaping your wealth growth strategy. They can impact your investment decisions, retirement planning, and estate planning. Understanding how tax laws impact your wealth growth strategy is crucial for making informed financial decisions. By considering the tax implications of your investments, retirement planning, and estate planning, you can develop a comprehensive wealth growth strategy that maximizes your after-tax returns and helps you achieve your financial goals.

How often should I review and adjust my tax planning strategy ?

Tax planning is an ongoing process that requires regular review and adjustment to ensure that you are taking advantage of all available tax breaks and staying in compliance with the law. Here are some factors to consider when determining how often to review and adjust your tax planning strategy: - Major life changes such as marriage, divorce, having a child, buying or selling a home, starting or closing a business, or retirement should prompt a review of your tax planning strategy. - Changes in tax laws can significantly impact your tax liability, so it's important to stay up-to-date on any changes and review your strategy accordingly. - Even if nothing significant has changed in your life or the tax laws, it's a good idea to review your tax planning strategy at least once a year. - For businesses or individuals with complex tax situations, quarterly reviews may be beneficial to stay on top of any changes in income or expenses and make adjustments throughout the year to minimize tax liability.

How do I know if a clearance sale is the right strategy for my business ?

Clearance sales can be an effective strategy for businesses looking to move inventory and boost revenue. However, it's important to consider whether this approach aligns with your overall business goals before implementing it. Here are some factors to consider: - **Objectives and Goals**: What are your objectives and goals for holding a clearance sale? Are you trying to liquidate old stock, increase cash flow, boost customer traffic during slow periods, or enhance brand recognition by offering discounts to a wider audience? Understanding your primary goal will help you determine if a clearance sale is the right strategy. - **Inventory Analysis**: Analyze your current inventory to see if there are products that could benefit from a clearance sale. Identify slow-moving items, seasonal goods, and discontinued or outdated products. - **Customer Behavior**: Consider how your customers might react to a clearance sale. Do your customers typically look for deals and discounts? Will discounting affect how customers view your brand in the long term? Will regular customers feel alienated if they missed out on the sale? - **Market Conditions**: Take into account external market conditions that may influence the success of a clearance sale. Are other businesses in your industry also having sales? This could impact your strategy. During economic downturns, consumers may be more inclined to wait for sales. Timing your sale around holidays or seasonal changes can increase its effectiveness. - **Financial Impact**: Assess the potential financial implications of holding a clearance sale. Calculate the minimum acceptable price to ensure you don't lose money. Determine if the immediate influx of cash from a sale is necessary for operations. Consider how much budget you'll have left for upcoming inventory after the sale. - **Alternative Strategies**: Explore other strategies besides a clearance sale that might achieve similar results. Offer volume discounts instead of across-the-board discounts. Reward repeat customers with exclusive discounts or early access to sales through loyalty programs. Group products together at a discounted price to encourage larger purchases through bundle offers. If, after considering all these factors, you find that a clearance sale aligns well with your business objectives and will not negatively impact your brand or financial health, then it could be the right strategy for you. Always remember to communicate clearly with your customers about the reasons behind the sale and ensure that it complements rather than detracts from your overall business strategy.

What are the benefits of adopting TCFD for a company's sustainability strategy ?

Adopting TCFD for a company's sustainability strategy can bring several benefits, including increased transparency and accountability, improved risk management, alignment with investor expectations, enhanced reputation and brand value, and greater access to financing and lower cost of capital.

What are the key components of an effective climate risk management strategy ?

Climate risk management is a crucial aspect of any organization's sustainability strategy. It involves identifying, assessing, and mitigating the potential risks associated with climate change. An effective climate risk management strategy should include key components such as identification of climate-related risks, assessment of risks, prioritization of risks, development of response strategies, and monitoring and review. By implementing these components, organizations can effectively manage climate-related risks and contribute to a more sustainable future.

What are the best practices for businesses to report on their environmental impact as part of their CSR initiatives ?

Reporting on environmental impact is crucial for businesses as part of their CSR initiatives. Best practices include setting clear objectives and goals, collecting relevant data, analyzing environmental footprint, developing an action plan, communicating findings, encouraging stakeholder engagement, and continuously improving the reporting process. By following these steps, businesses can demonstrate their commitment to sustainability and transparency while providing valuable information to stakeholders about their environmental performance.

What are the most common ESG reporting frameworks used by companies ?

The Global Reporting Initiative (GRI) is a widely used sustainability reporting framework that provides a standardized approach for companies to report on their economic, environmental, and social performance. The GRI consists of several standards, including those related to disclosure principles, management approach, economic performance, environmental performance, social performance, governance, non-financial information disclosure, reporting principles, boundaries, guidelines, content, quality, frequency, language, format, timeframe, period, entities, scope, limitations, assurance, certification, training, tools, collaboration, innovation, stakeholder engagement, data quality, impact assessment, risk management, performance indicators, materiality analysis, and stakeholder engagement process. These standards help organizations prepare high-quality GRI reports that are accurate, reliable, and consistent across different organizations and sectors.

How can companies effectively implement CSR initiatives ?

Companies can effectively implement CSR initiatives by defining clear objectives, conducting a stakeholder analysis, developing a CSR strategy, integrating CSR into business operations, communicating CSR initiatives, collaborating with partners, and evaluating and improving CSR initiatives regularly. This helps companies build a good reputation, attract customers, and improve employee satisfaction.

What are the potential risks and challenges associated with implementing CSR initiatives ?

Implementing Corporate Social Responsibility (CSR) initiatives can bring benefits to a company, but also comes with potential risks and challenges. These include lack of clear goals and objectives, limited resources, stakeholder pressure, legal and regulatory issues, difficulty measuring impact, and potential backlash from stakeholders. Companies need to carefully consider these issues before committing to CSR efforts, and should work to mitigate any potential risks through careful planning and execution.

Is carbon offsetting effective in reducing greenhouse gas emissions ?

Carbon offsetting is a strategy to compensate for CO2 emissions by investing in projects that reduce, avoid, or absorb an equivalent amount of CO2 elsewhere. While it can provide immediate action and support clean projects, there's a lack of standardization and potential for perverse incentives. Effectiveness depends on project quality and organizational integrity. It should be part of a broader strategy, not seen as a silver bullet.

What are the benefits of carbon offsetting for businesses ?

Carbon offsetting is a strategy that businesses can use to reduce their carbon footprint and mitigate the impact of their operations on the environment. By investing in projects that offset their emissions, businesses can demonstrate their commitment to sustainability and contribute to global efforts to combat climate change. Some of the benefits of carbon offsetting for businesses include reduced carbon footprint, improved reputation and brand image, financial benefits, and stakeholder engagement. By investing in carbon offsetting projects, businesses can demonstrate their commitment to sustainability and contribute to global efforts to combat climate change.

How does TCFD align with other global reporting initiatives like the Global Reporting Initiative (GRI) ?

The Task Force on Climate-related Financial Disclosures (TCFD) and the Global Reporting Initiative (GRI) are two global sustainability reporting frameworks that share several key points of alignment. Both provide guidelines for companies to report on their sustainability performance, with TCFD focusing specifically on climate-related financial disclosures and GRI covering a broader range of sustainability issues. They also emphasize the importance of materiality assessment, stakeholder engagement, risk management, and climate change disclosures in determining which aspects are most relevant to an organization's business model and strategy. By following both frameworks, companies can provide a more comprehensive picture of their sustainability performance and demonstrate their commitment to addressing climate change and other sustainability issues.

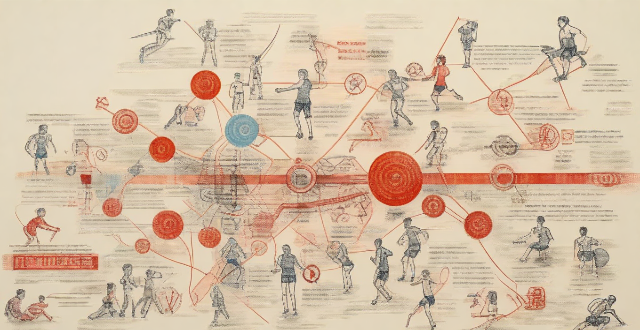

How do you create an effective sports marketing strategy ?

Creating an effective sports marketing strategy requires a deep understanding of the target audience, the sports industry, and the brand's goals. Here are some steps to follow: 1. Identify the Target Audience: Research demographics, interests, and behaviors of potential customers. 2. Define the Brand's Goals: Set specific, measurable, achievable, relevant, and time-bound (SMART) goals. 3. Conduct Market Research: Analyze competitors, trends, and consumer preferences, and identify opportunities for partnerships or sponsorships. 4. Develop a Unique Selling Proposition (USP): Highlight the brand's strengths and benefits that resonate with the target audience. 5. Create a Marketing Mix: Tailor advertising, public relations, promotions, and sponsorships to the target audience and align with the brand's goals. 6. Measure and Evaluate Results: Track key performance indicators (KPIs) such as website traffic, social media engagement, and sales revenue to identify areas for improvement and inform future marketing strategies.

How does AI influence coaching and strategy development in sports ?

Artificial Intelligence (AI) is transforming the world of sports, especially in coaching and strategic planning. AI technologies offer coaches valuable insights to make data-based decisions that can significantly boost team performance. AI's influence on coaching and strategy development in sports includes performance analysis, game strategy development, and injury prevention and recovery. AI algorithms can analyze vast amounts of player performance data, providing coaches with detailed insights into areas where improvements can be made. AI technologies can also assist coaches in developing game strategies by analyzing opponent teams' strengths and weaknesses. Additionally, AI plays a crucial role in injury prevention and recovery by monitoring player health and fitness levels. As AI technologies continue to advance, we can expect even more innovative solutions that will further enhance the coaching experience and drive success in sports.

How can I optimize my Cross-Border Payment strategy ?

This guide discusses how to optimize cross-border payment strategy by researching and understanding regulations and compliance requirements, choosing the right payment method, using technology to streamline processes, and working with reliable partners.

How can carbohydrate loading benefit endurance athletes ?

Carbohydrate loading, or "carb-loading," is a dietary strategy used by athletes to maximize glycogen storage in muscles and liver for endurance sports. It offers benefits like increased energy availability, enhanced recovery, and mental advantages such as confidence and focus. Implementing this strategy involves reducing training intensity while increasing carbohydrate intake, choosing complex carbs over refined sugars, and maintaining proper hydration and electrolyte balance. While effective for many endurance athletes, individualized planning with a nutritionist is recommended.

How do you create a successful digital marketing strategy ?

Creating a successful digital marketing strategy involves defining goals, identifying the target audience, conducting market research, selecting appropriate channels, developing engaging content, optimizing for conversions, and measuring results. It requires careful planning, execution, and continuous optimization based on data analysis to effectively reach and engage the target audience online.

Where can I find comprehensive online learning resources for business management ?

The article discusses various online learning platforms that offer comprehensive resources for business management. These include Coursera, Udemy, edX, Khan Academy, and LinkedIn Learning. The courses provided by these platforms cover a wide range of topics, such as strategy formulation, financial management, human resource management, and marketing. Some of the popular courses mentioned are Introduction to Marketing by Northwestern University on Coursera, Business Finance for Non-Finance Managers on Udemy, and Strategy and Innovation in the New Economy by Stanford University on edX. The article emphasizes that these platforms offer courses suitable for learners of all levels and can help individuals acquire the necessary knowledge and skills to become successful business managers.

What is the role of asset allocation in an investment strategy ?

Asset allocation is a crucial component of any investment strategy, involving dividing your portfolio among different asset classes based on your financial goals, risk tolerance, and investment horizon. It plays a vital role in determining the overall performance of your portfolio by helping you manage risk and maximize returns through diversification. To determine your asset allocation, consider your financial goals, risk tolerance, investment horizon, and consult with a financial advisor. Review and adjust your asset allocation regularly as your circumstances change and new opportunities arise.

How do I adjust my investment strategy during economic downturns ?

Adjusting Investment Strategy During Economic Downturns: - **Diversify Your Portfolio**: Allocate across stocks, bonds, and cash equivalents; invest in different sectors and international markets. - **Rebalance Your Portfolio**: Monitor performance and composition regularly; rebalance to maintain diversification. - **Focus on Quality Stocks**: Choose companies with strong financials, stable earnings, and resilient business models. - **Consider Bonds and Other Fixed Income Securities**: Invest in government, corporate, or municipal bonds for stability and potential returns. - **Stay Disciplined and Avoid Emotional Decisions**: Stay calm, focus on long-term goals, and avoid herd mentality.

How to collaborate with influencers for product launches ?

The text provides a comprehensive guide on how to collaborate with influencers for product launches, emphasizing the importance of this marketing strategy in boosting the success of such events. The process is divided into five main steps: identifying and selecting the right influencers, building relationships and agreements, planning and creating campaign content, executing and monitoring the campaign, and conducting a post-campaign analysis and follow-up. Each step includes detailed sub-steps and recommendations, such as defining the target audience, using influencer marketing platforms for research, negotiating terms and conditions, developing a content strategy, launching and tracking the campaign, and evaluating results. The guide emphasizes the need for clear communication, mutual understanding, and professionalism throughout the process to cultivate long-lasting partnerships.

What is the impact of market volatility on my investment strategy ?

Market volatility can significantly impact your investment strategy by affecting risk tolerance, portfolio allocation, timing of investments, emotional responses, and both long-term and short-term goals. It's crucial to anticipate and account for market fluctuations in your approach. Diversification, rebalancing, and strategies like dollar-cost averaging can help mitigate risks and smooth out the effects of volatility over time. Emotional discipline is also essential, as fear and greed can lead to suboptimal decisions. Opportunities may arise during volatile periods, but it's important not to overreact to short-term events and maintain a focus on long-term fundamentals. A well-diversified portfolio and a long-term perspective are key tools for navigating market volatility successfully.

What are the key elements of a successful social media strategy ?

Key elements of a successful social media strategy include defining clear objectives, knowing your audience, choosing the right platforms, creating engaging content, optimizing for SEO, engaging with your audience, and monitoring and analyzing performance. These steps help increase brand awareness, drive website traffic, generate leads and sales, build a community around your brand, improve customer service and support, and optimize results over time.

How do I choose the right broker for my investment strategy ?

Choosing the right broker is crucial for investment success. Understand your goals, risk tolerance, and horizon. Consider full-service, discount, or online brokers based on fees, services, and platform usability. Evaluate fees, customer service, regulation, security, and investment options. Follow a step-by-step process to choose the best broker for your needs.

What is corporate social responsibility (CSR) ?

Corporate social responsibility (CSR) is an approach where companies voluntarily integrate ethical and sustainable practices into their business model. It covers various aspects including environmental sustainability, ethical sourcing, community engagement, stakeholder relationships, and transparency. Implementing CSR can enhance a company's reputation, improve employee loyalty, and manage risks better. From a societal perspective, it can elevate living standards, promote sustainable development, and set ethical standards across industries. However, criticisms include potential greenwashing, increased costs for consumers, and a lack of universal standards for measuring CSR effectiveness. Despite these criticisms, the incorporation of CSR is becoming increasingly common, indicating a shift towards a more ethical and sustainable global economy.

How has the COVID-19 pandemic affected ESG priorities for businesses ?

The COVID-19 pandemic has significantly impacted businesses worldwide, affecting their operations, financial performance, and strategic priorities, particularly in the area of Environmental, Social, and Governance (ESG) priorities. The pandemic has led to an increased focus on sustainability, a shift towards remote work, health and safety concerns, mental health support, transparency and accountability, and stakeholder engagement. To address these challenges, businesses should conduct a comprehensive ESG assessment, develop a sustainability strategy, implement health and safety measures, offer mental health support, increase transparency and accountability, and engage with stakeholders. By taking proactive steps to address these challenges, businesses can improve their ESG performance and build resilience and adaptability in the face of future crises.