Tax Text

Can a carbon tax be regressive or progressive ?

The text discusses the nature of a carbon tax and how it can be designed to be regressive, progressive, or neutral. It outlines the definitions of regressive and progressive taxes in the context of income levels and explains how a carbon tax could disproportionately affect lower-income households if not structured carefully. The text then details ways in which a carbon tax could be made progressive, such as through tiered rates, revenue recycling, and investments in infrastructure that benefit all income levels. The conclusion emphasizes the importance of considering distributional impacts and designing the tax to support equity and fairness. Overall, the text suggests that a carbon tax has the potential to be either regressive or progressive, depending on its structure and implementation.

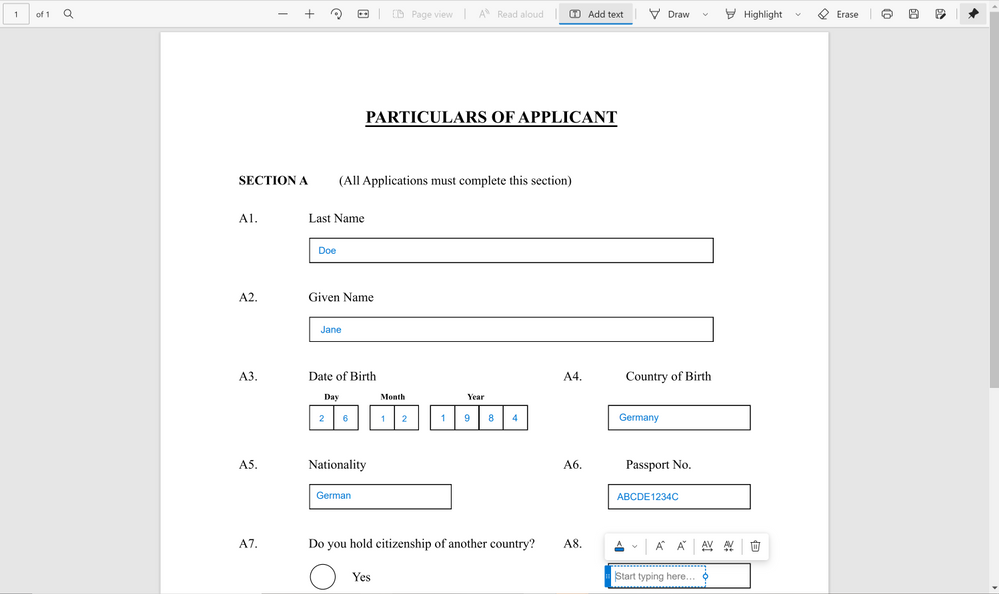

What documents are required to apply for a shopping tax refund ?

The text is a topic summary for "Required Documents for Shopping Tax Refund Application." It lists the necessary documents needed to apply for a tax refund, including a passport or travel document, receipts and invoices, a tax-free form, credit card or bank statement, boarding pass or flight itinerary, customs declaration form, and shipping documents (if applicable). The text also mentions that once all the required documents are gathered, the tax refund application can be made at the airport or through the designated tax refund office in the city where purchases were made.

How do changes in tax laws impact tax planning strategies ?

This text discusses the impact of changes in tax laws on tax planning strategies. It emphasizes the importance of staying informed about legislative developments, reevaluating current strategies, adjusting approaches, and staying informed about future changes. The text also provides examples of how specific tax law changes can impact tax planning strategies, such as increased standard deductions, new tax credits or deductions, changes in capital gains taxes, and changes in estate and gift taxes. Overall, the text highlights the need for taxpayers to adapt their strategies in response to evolving tax laws to minimize their overall tax liability.

Are there any tax incentives for buying a hybrid car ?

The text discusses the tax incentives available for buying a hybrid car, including federal and state tax credits and other benefits such as fuel efficiency and reduced maintenance costs. It also emphasizes the importance of researching specific requirements and limitations before making a purchase decision.

How can a carbon tax be implemented fairly ?

The text discusses the implementation of a fair carbon tax, which is a fee on burning carbon-based fuels to reduce emissions contributing to global warming. It suggests methods such as progressive taxation, revenue neutrality, renewable energy incentives, public education, phased implementation, and international cooperation to ensure the tax does not disproportionately affect low-income households or certain industries.

Are there any tax benefits associated with buying certain types of insurance ?

The text discusses the tax benefits associated with buying various types of insurance, including health insurance, life insurance, disability insurance, long-term care insurance, and homeowner's insurance. The benefits include tax-deductible premiums and tax-free death benefits for certain policies. It is emphasized that consulting a tax professional or financial advisor is crucial to understand how these benefits apply to individual situations, as tax laws vary by country and can be complex.

Are there any online tools available for calculating personal income tax ?

The text provides a summary of online tools available for calculating personal income tax. It mentions TurboTax, H&R Block, IRS Free File, and TaxAct as popular options. These tools help individuals determine their tax liability based on their income, deductions, and other factors. However, it is important to consult with a qualified tax professional if there are any questions or concerns about the tax situation.

What is the impact of a carbon tax on low-income households ?

The text discusses the impact of a carbon tax on low-income households, emphasizing that such a tax can significantly and negatively affect these households due to increased costs and its regressive nature. However, potential long-term benefits are also highlighted, including revenue generation for energy-efficient programs and overall cost reduction as carbon-based fuel use decreases. To mitigate negative impacts, strategies like revenue recycling, progressive tax design, and energy efficiency programs are suggested. The text concludes that with careful policy design and implementation, a carbon tax can contribute to a sustainable future while benefiting all income levels over time.

How does the tax bracket affect my personal income tax calculation ?

Tax brackets define the range of income subject to specific tax rates, embodying the principle of progressive taxation. Your income level determines the applicable tax bracket(s), which influences how much personal income tax you must pay. The marginal tax rate represents the highest rate on additional income, while the effective tax rate is the average rate across your total income. Being aware of your tax bracket can guide financial planning and strategies to possibly lower your taxable income.

Can you provide examples of international tax planning strategies ?

Here is a summary of the topic: The text discusses various international tax planning strategies that companies can use to reduce their tax liability. These include: 1\. Tax Treaty Shopping: Using provisions in tax treaties between two countries to lower taxes. 2\. Transfer Pricing: Manipulating transfer prices for transactions between related companies in different countries to shift profits to lower-tax jurisdictions. 3\. Deferral of Taxes on Foreign Income: Delaying payment of taxes on income earned in a foreign country until it is repatriated to the home country. 4\. Use of Offshore Companies: Setting up a company in a low-tax jurisdiction to conduct business activities and avoid high taxes in other countries. 5\. Cross-Border Inversions: Acquiring a company in a low-tax jurisdiction and moving the headquarters of the combined entity to that jurisdiction to reduce tax liability in the home country.

Is there a difference between tax avoidance and tax evasion in tax planning ?

Tax evasion involves illegal activities to avoid taxes, while tax avoidance minimizes tax legally through strategic planning and legal loopholes. Tax evasion can lead to severe consequences like fines and jail time, while tax avoidance is an accepted practice often encouraged by governments. It's crucial for taxpayers to understand these differences to ensure they stay on the right side of legal and ethical boundaries when planning their taxes.

What role do accountants play in tax planning ?

Accountants play a crucial role in tax planning by identifying deductions, structuring transactions, advising on business structure, ensuring international compliance, and staying updated with tax law changes to minimize clients' tax liabilities.

Are there any risks associated with aggressive tax planning ?

Aggressive tax planning, aimed at minimizing tax liabilities, carries risks including legal consequences, audit risks, and reputational damage. Recommendations to avoid these risks include staying within the law, maintaining accurate records, being transparent, and regularly reviewing tax strategies.

What is the optimal level for a carbon tax ?

The optimal level for a carbon tax should balance economic impact, environmental goals, social equity, and political feasibility. Recommended approaches include starting with a lower rate and gradually increasing it, implementing revenue-neutral tax reform, introducing rebate mechanisms, applying industry-specific rates, collaborating internationally, regularly reviewing and adjusting the tax, ensuring transparency, investing in clean technologies, and pairing the tax with other environmental policies.

What should I consider when choosing a tax planning consultant ?

When selecting a tax planning consultant, consider their qualifications, experience, reputation, fees, and communication skills. Look for certifications, industry expertise, positive reviews, transparent fee structures, and easy accessibility. This ensures effective financial management and tax compliance.

Are there any tax incentives for owning a gasoline hybrid car ?

Tax incentives for owning a gasoline hybrid car include federal tax credits, state and local tax breaks, and renewable fuel tax credits. These benefits aim to encourage eco-friendly vehicle choices and reduce greenhouse gas emissions.

What countries have successfully implemented a carbon tax ?

Countries that have successfully implemented a carbon tax include Canada, Sweden, Finland, Norway, Switzerland, and the UK. These countries have set different rates for their carbon taxes and have seen varying degrees of success in reducing greenhouse gas emissions. While there are challenges associated with implementing such a tax, these countries demonstrate that it can be an effective tool for achieving environmental goals.

What are the ethical considerations in tax planning ?

Tax planning is crucial for financial management but must be done ethically to maintain fairness and integrity. Key considerations include avoiding aggressive tax avoidance, ensuring transparency and honesty in reporting, paying a fair share of taxes, avoiding double standards, considering long-term sustainability, and recognizing the responsibility towards society by supporting public services through taxes.

Does a carbon tax lead to "carbon leakage" where companies move to areas without the tax ?

The article discusses the potential for "carbon leakage," where companies might relocate to regions without a carbon tax to avoid additional costs. It highlights economic impacts, geographical considerations, industry-specific impacts, and mitigating factors that could affect the outcome of implementing a carbon tax. The potential negative outcomes include job losses and environmental displacement, while positive outcomes could be innovation and efficiency improvements. The conclusion emphasizes the need for coordinated international efforts and support for affected industries to minimize leakage and promote sustainable practices.

What are the challenges of enforcing a carbon tax ?

Enforcing a carbon tax is not without its challenges, including gaining public acceptance, managing economic impacts, implementation and enforcement complexities, international cooperation issues, distributional effects on certain groups within society, and deciding how to use the revenue generated by the tax. Governments need to effectively communicate the reasons behind the tax and find a balance between environmental goals and economic stability while considering how to mitigate potential negative effects on vulnerable populations.

How can I legally minimize my taxes through tax planning ?

Tax planning is a crucial aspect of financial management that helps individuals legally reduce their tax liability. Some tips on how to minimize taxes through tax planning include maximizing retirement account contributions, taking advantage of tax credits, investing in tax-exempt bonds, considering real estate investments, utilizing education tax breaks, planning charitable giving, and timing capital gains and losses strategically. Consulting with a tax professional is recommended before making any significant financial decisions to ensure compliance with all applicable laws and regulations.

What are the tax implications of retirement accounts such as 401(k)s and IRAs ?

The text discusses the tax implications of retirement accounts, specifically 401(k)s and Individual Retirement Accounts (IRAs), highlighting their contribution rules, earnings treatment, withdrawal considerations, and overall tax strategies. Both types of accounts offer tax benefits to encourage retirement savings but differ in their contributions, earnings growth, and withdrawal rules. Understanding these differences is crucial for maximizing the benefits of retirement savings while minimizing tax liabilities.

What are some common tax planning strategies for individuals ?

Tax planning is crucial for individuals to minimize taxes and maximize savings. Common strategies include maximizing retirement account contributions, utilizing tax credits/deductions, harvesting capital losses, investing tax-efficiently, timing income/expenses strategically, and using education tax benefits. Regular attention and adjustment to these strategies are necessary for effective tax management.

How is individual income tax calculated ?

Individual income tax calculation involves determining gross income, subtracting allowable deductions, calculating adjusted gross income (AGI), identifying tax credits, calculating taxable income, applying tax rates, and considering withholding and estimated tax payments. The process varies slightly by jurisdiction but generally follows these key steps. It is recommended to consult with a tax professional or use reliable tax preparation software to ensure accuracy and maximize any applicable deductions and credits.

What are the tax implications of receiving a scholarship ?

Receiving a scholarship can offset higher education costs, but understanding the tax implications is crucial. Scholarships for tuition, fees, and educational expenses are typically non-taxable, but those covering personal expenses may be taxed. Accurate record-keeping, separating expenses, consulting tax professionals, and planning ahead are key to managing these implications effectively.

What are the tax implications of receiving venture capital investment ?

Receiving venture capital investment can have significant tax implications for a startup company, including the treatment of investment proceeds as ordinary income and potential valuation issues. Tax credits and incentives may be available, and exit strategies should be evaluated for their tax consequences. Additional accounting and reporting requirements may also arise. It is important to work with a qualified tax professional to ensure compliance with tax laws and maximize the benefits of venture capital investment.

How do businesses implement effective tax planning ?

This comprehensive guide provides effective tax planning strategies for businesses, emphasizing the importance of understanding tax laws and regulations, hiring a qualified tax professional, timing income and expenses strategically, making use of tax credits and deductions, investing in retirement plans, leveraging tax-advantaged investments, maximizing depreciation deductions, considering alternative entity structures, and staying up-to-date on tax law changes. By implementing these strategies, businesses can minimize their tax liabilities while ensuring compliance with tax laws.

What happens if I make a mistake in my personal income tax calculation ?

Mistakes in personal income tax calculation can lead to underpayment or overpayment of taxes, errors in reporting income or deductions, and potential penalties, interest charges, or even criminal charges. To avoid these consequences, it's essential to stay organized, use tax software or consult a professional, review your return carefully, and file on time.

What is tax planning and why is it important ?

Tax planning is the process of organizing one's financial affairs to minimize tax liability and maximize after-tax returns. It involves analyzing current tax laws, understanding deductions, credits, and exemptions, and applying them to personal or business finances. Tax planning is important for legal compliance, maximizing wealth, avoiding surprises at tax time, retirement planning, estate planning, charitable giving, income management, risk mitigation, business strategy, international considerations, and peace of mind. It is an essential part of financial management for both individuals and businesses looking to build and preserve wealth over time.