Term People

What is the significance of setting short-term versus long-term climate targets ?

The article emphasizes the importance of setting both short-term and long-term climate targets to effectively address climate change. Short-term targets focus on immediate actions, creating urgency, measurable progress, immediate benefits, and building momentum for more ambitious goals. Long-term targets ensure sustainability, deep decarbonization, adaptation, and global cooperation. Achieving these goals is crucial for mitigating the worst effects of climate change and creating a more resilient future.

Is social distancing a long-term solution for controlling the spread of viruses ?

Social distancing is an effective measure for controlling the spread of viruses in the short term, but its feasibility as a long-term solution depends on various factors such as the nature of the virus, availability of medical resources, and willingness of people to adhere to guidelines. Other measures such as mask-wearing, hand hygiene, contact tracing, regular testing, and vaccine development should also be considered alongside social distancing to effectively control the spread of viruses over time.

Is there a difference between short-term and long-term memory in scientific terms ?

Short-term memory and long-term memory are two different types of memory with distinct characteristics. Short-term memory has a limited capacity, typically able to hold around seven items for a brief period, while long-term memory has a large capacity, virtually unlimited, and can store vast amounts of information for an extended period. Short-term memory lasts only for a few seconds unless it is repeatedly rehearsed or transferred to long-term memory, while long-term memory can last for minutes, hours, days, years, or even a lifetime. Short-term memory acts as a temporary holding place for new information, processing it before transferring it to long-term memory, while long-term memory stores information for future use, including facts, experiences, skills, and knowledge. Short-term memory has a faster retrieval speed since the information is readily available in the mind, while long-term memory has a slower retrieval speed as it requires more effort to recall the information from the vast storage. Short-term memory is more susceptible to interference and forgetting due to its transient nature, while long-term memory is more stable and less prone to interference, making it easier to retain information over time. Short-term memory requires rehearsal or encoding processes to transfer information to long-term memory, while long-term memory involves consolidation processes that strengthen neural connections and make the memory more durable.

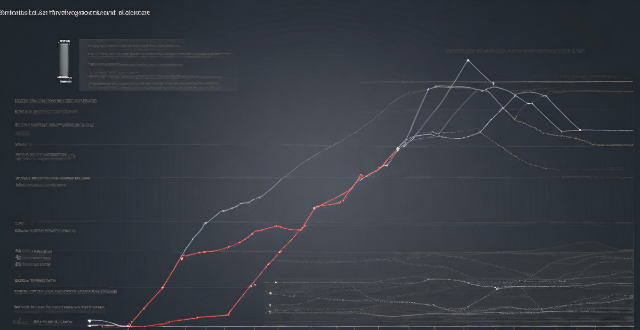

What is the importance of long-term climate data analysis ?

Long-term climate data analysis is crucial for understanding the Earth's climate system and its changes over time. It provides valuable insights into past climate patterns and trends, which are critical for predicting future climate conditions and developing effective adaptation strategies. By continuing to collect and analyze long-term climate data, we can better prepare ourselves for the challenges posed by a changing climate and work towards a sustainable future.

What are some long-term saving strategies ?

Saving for the long term requires a disciplined approach and a solid plan. Here are some strategies to help you save effectively over the years: 1. Set clear financial goals: short-term, medium-term, and long-term. 2. Create a budget and stick to it by tracking expenses, cutting unnecessary costs, and automating savings. 3. Build an emergency fund that is easily accessible and covers at least 3-6 months' worth of living expenses. 4. Take advantage of employer matches and maximize contributions to retirement accounts like 401(k)s and IRAs. 5. Invest wisely with diversification, risk management, and a long-term perspective. 6. Manage debt by paying off high-interest debts first and considering refinancing options. 7. Regularly review and adjust your financial plan, adapting to life changes as needed. 8. Plan for taxes by choosing tax-efficient investments and being strategic about withdrawals and contributions. 9. Consider estate planning with wills, trusts, and life insurance to protect your family's financial wellbeing. 10. Continuously learn and seek advice from financial professionals when needed. By consistently implementing these strategies, you can build a strong financial foundation for your future.

How do I invest my money wisely for long-term growth ?

Investing wisely for long-term growth involves setting financial goals, creating a diversified portfolio, considering risk tolerance, investing for the long-term, and monitoring investments regularly.

How accurate are long-term climate predictions ?

Long-term climate predictions are essential for understanding potential future changes in the environment, but their accuracy is often questioned due to the complexity of the climate system. Factors that influence the accuracy of these predictions include uncertainty in emission scenarios, natural variability, and model limitations. However, advancements in climate modeling, such as higher-resolution models, ensemble modeling, and data assimilation techniques, have significantly improved our ability to make accurate predictions about future climate changes. By continuing to invest in research and development, we can further enhance the precision and reliability of long-term climate predictions, providing critical information for decision-makers and the public alike.

What is the importance of long-term monitoring and evaluation in climate policy ?

The importance of long-term monitoring and evaluation in climate policy is discussed. Long-term monitoring and evaluation help ensure accountability for climate action, identify gaps and opportunities for improvement, inform future policies, build public trust, and promote sustainable development.

What are the best financial products for long-term investment ?

The text provides a comprehensive overview of the various financial products available for long-term investment. It explains the definition, benefits, and risks of each option including stocks, bonds, mutual funds, ETFs, and REITs. The text emphasizes the importance of considering one's investment goals, risk tolerance, and financial situation before choosing which products to include in a portfolio. Overall, the text serves as a useful guide for individuals looking to make informed decisions about their long-term investments.

What is the difference between term life insurance and whole life insurance ?

Difference between term life insurance and whole life insurance: - Term life insurance is temporary coverage, no cash value, renewable, and affordable. - Whole life insurance is permanent coverage, accumulates cash value, has level premiums, and is more expensive.

How can women protect their assets and ensure long-term financial security ?

The article provides a list of strategies that women can employ to ensure their financial security over the long term. These include building an emergency fund, investing in retirement accounts, purchasing life insurance, creating a will, considering long-term care insurance, educating oneself about finance, working with a financial advisor, and prioritizing career development. Each of these steps is crucial in its own way for safeguarding one's assets and ensuring financial stability.

What are some proven strategies for long-term wealth accumulation ?

Long-term wealth accumulation is a goal for many individuals, and there are several proven strategies that can help achieve this objective. Here are some of the most effective approaches: 1\. Start Early: The earlier you start saving and investing, the more time your money has to grow through compound interest. 2\. Live Below Your Means: Spend less than you earn and save the difference. 3\. Invest Wisely: Choose investments that align with your goals, risk tolerance, and time horizon. Diversify your portfolio to spread risk and maximize returns. 4\. Pay Off High-Interest Debt: High-interest debt like credit card balances can be a significant obstacle to wealth accumulation. Paying off these debts should be a priority. 5\. Increase Your Income: Increasing your income can provide more resources for saving and investing, which can help accelerate wealth accumulation. 6\. Plan for Retirement: Retirement planning is an essential component of long-term wealth accumulation, ensuring you have enough funds to support yourself during your golden years. 7\. Protect Your Wealth: Ensure that your hard-earned wealth is protected against unexpected events like lawsuits, accidents, or health issues.

How can I make sure my fitness meal plan is sustainable long-term ?

A sustainable fitness meal plan is essential for achieving long-term health and wellness goals. To make it work, set realistic goals, plan ahead, incorporate variety, make it enjoyable, stay flexible, and seek professional advice.

What are the potential long-term effects of sports injuries on adolescent development ?

Sports injuries can have a significant impact on the physical, mental, and social development of adolescents. Potential long-term effects include chronic pain, limited mobility, disfigurement, anxiety, depression, low self-esteem, PTSD, isolation, bullying, and relationship difficulties. Proper treatment and rehabilitation are crucial for minimizing these effects.

What are some common mistakes people make when trying to save money ?

Saving money is a crucial aspect of financial planning, but it's not always easy. Many people struggle with saving money and often make some common mistakes that can hinder their progress. Here are some of the most frequent errors people commit when trying to save money: Not having a clear savings goal, underestimating expenses or overestimating income, impulse buying, not taking advantage of discounts and deals, not automating savings, spending on depreciating assets, not reviewing banking and service providers, and ignoring the power of compound interest. By avoiding these common pitfalls, individuals can make substantial progress in their savings journey and achieve their financial goals more efficiently.

What are the common mistakes people make when trying to achieve financial freedom ?

Achieving financial freedom is a goal for many, but it's not always easy. Along the way, people often make mistakes that can hinder their progress. Here are some of the most common errors: ## 1\. Not Having a Clear Plan One of the biggest mistakes people make is not having a clear plan for achieving financial freedom. Without a roadmap, it's easy to get sidetracked or lose motivation. * **Solution**: Create a detailed plan that outlines your goals, timeline, and strategies for achieving them. ## 2\. Spending Beyond Their Means Many people fall into the trap of spending more than they earn, which leads to debt and financial stress. * **Solution**: Live below your means by budgeting, tracking expenses, and cutting unnecessary costs. ## 3\. Not Investing in Their Future Failing to invest in long-term goals like retirement or building wealth can set people back years or even decades. * **Solution**: Start investing early and regularly, even if it's just a small amount each month. ## 4\. Ignoring Debt Repayment Carrying high-interest debt can be a major obstacle to achieving financial freedom. * **Solution**: Prioritize paying off high-interest debt as soon as possible. ## 5\. Lacking Diversification in Investments Putting all your eggs in one basket can be risky. Many people make the mistake of not diversifying their investments. * **Solution**: Spread your investments across different asset classes to reduce risk. ## 6\. Not Educating Themselves About Finance A lack of financial knowledge can lead to poor decision-making and missed opportunities. * **Solution**: Educate yourself about personal finance through books, courses, and other resources. ## 7\. Failing to Review and Adjust Financial Plans Life changes, and so should your financial plans. Many people forget to review and adjust their strategies over time. * **Solution**: Regularly review your financial situation and adjust your plans accordingly.

How can we prevent more people from becoming climate refugees ?

Strategies to prevent more people from becoming climate refugees include reducing greenhouse gas emissions, implementing adaptation measures, promoting international cooperation, raising awareness and education, and fostering sustainable development. By taking these actions, we can work towards a future where fewer people are forced to become climate refugees due to the devastating effects of climate change.