Track Border

How do I track my Cross-Border Payment transaction ?

Cross-border payments can be tracked using various methods such as obtaining key information, utilizing online banking services, contacting the bank directly, using third-party tracking services, staying informed with updates, understanding time frames, confirming receipt with the beneficiary, and monitoring for errors or fraud. It is essential to collect all necessary transaction details before initiating a transfer, including the transaction ID, beneficiary details, date of transfer, amount, and expected delivery date. Most banks provide online services that allow customers to track their transactions, while some financial service providers offer tracking tools specifically designed for cross-border payments. Staying informed with updates through email or SMS notifications is crucial, along with understanding typical time frames for different types of transactions. Confirming receipt with the beneficiary and monitoring for any errors or fraud throughout the process are also important steps to ensure a smooth and secure transaction.

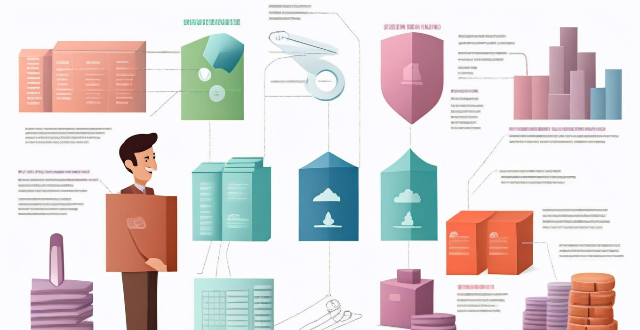

How does Cross-Border Payment work ?

Cross-border payments are transactions that involve transferring money between different countries. The process is complex and requires coordination among various parties, including banks, payment processors, and financial institutions. The steps involved in cross-border payments include initiation of the payment, verification and authorization, execution of the payment, and settlement and reconciliation. There are several methods available for cross-border payments, such as wire transfers, online payment platforms, and mobile wallets. Choosing the appropriate method ensures safe, secure, and efficient cross-border payments.

What is Cross-Border Payment ?

Cross-border payment is the process of transferring money from one country to another, involving currency exchange and various payment methods. It is essential for businesses operating in multiple countries, allowing them to receive and make payments in different currencies. Key features include currency exchange, payment methods, regulations, fees, and timeframes. Benefits of cross-border payments include global expansion, increased sales, reduced costs, and improved cash flow.

What are the benefits of using Cross-Border Payment ?

Cross-border payments are essential for global commerce, offering benefits such as increased access to markets, improved efficiency, lower costs, greater flexibility, enhanced security, and scalability. These advantages help businesses expand globally, making cross-border payments a vital tool for modern commerce.

How do exchange rates affect Cross-Border Payment ?

Exchange rates play a crucial role in cross-border payments, impacting the cost, speed, and feasibility of transactions. They can affect transfer fees, currency fluctuations, processing time, trade opportunities, and investment opportunities. Understanding exchange rates is essential for managing them effectively in international trade or finance.

Can small businesses benefit from Cross-Border Payment ?

Cross-border payments are increasingly vital in the global economy, enabling businesses to tap into new markets. Small businesses can benefit from this trend by expanding market access, increasing revenue potential, improving customer experience, reducing costs, and gaining a competitive advantage. As technology continues to evolve, small businesses should consider taking advantage of cross-border payments to grow and succeed on a global scale.

Are there any risks associated with Cross-Border Payment ?

Cross-border payments come with several risks, includingCross-border payments come with several risks, including risk, legal risk, and it's essential to use reputable payment providers and take steps to protect personal information.

What currencies can be used for Cross-Border Payment ?

The currencies used for cross-border payments vary widely depending on numerous factors, including economic strength, political stability, and market acceptance. Major world currencies like the US Dollar, Euro, British Pound Sterling, and Japanese Yen are commonly used due to their global acceptance and role in international trade and financial markets. Other currencies such as the Chinese Yuan/Renminbi, Canadian Dollar, and Australian Dollar also play significant roles in cross-border payments, particularly in commodities trade and regional economies. Digital currencies, including Bitcoin and stablecoins, are increasingly being used for cross-border payments, offering decentralized transactions and the benefits of blockchain technology. Factors influencing currency choice include regulatory environment, cost considerations, market fluctuations, and business agreements.

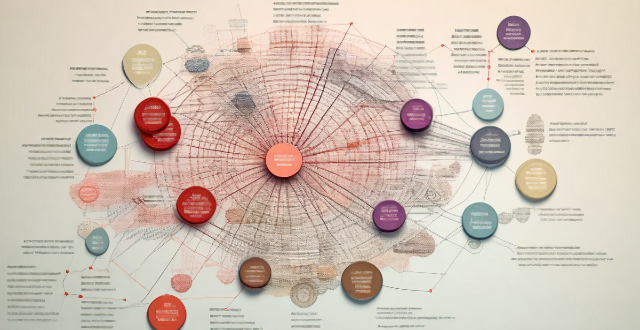

What are the most popular Cross-Border Payment platforms ?

The global economy heavily relies on cross-border payments, and several platforms have emerged to facilitate these transactions. PayPal is a widely used online payment system offering a secure way to send and receive money internationally. Stripe provides APIs for integrating payments into applications and supports multiple currencies. Adyen offers a one-stop platform for all payment methods, reducing transaction friction. TransferWise (now Wise) focuses on reducing transfer costs using a peer-to-peer model. WorldRemit specializes in remittances to mobile wallets and bank accounts in developing countries. Skrill is a digital wallet service with merchant services and a prepaid card option. Payoneer provides mass payments solutions and multi-currency accounts, particularly benefiting affiliate marketers. Each platform caters to different needs, from individual remittances to business solutions, ensuring options for various cross-border payment scenarios.

Is Cross-Border Payment secure ?

Cross-border payments are essential for international trade and business transactions but can pose security risks. Factors like regulatory compliance, technology, fraud prevention measures, and the reputation of the payment service provider affect the security of these payments. Risks include currency fluctuations, political instability, and cyber threats. To ensure security, choose a reputable provider, use secure payment methods, verify recipient details, and keep track of transactions.

Can I use Cross-Border Payment for personal transactions ?

Cross-border payment systems are designed to facilitate international transactions, allowing individuals and businesses to send and receive money across borders. These systems can be used for various purposes, including personal transactions. In this article, we will discuss the use of cross-border payment systems for personal transactions and provide some tips on how to make the most of them. Cross-border payment refers to the process of transferring money from one country to another. This can be done through various methods, such as wire transfers, credit cards, or digital wallets. The main purpose of cross-border payment systems is to simplify the process of sending and receiving money internationally, making it easier for people to conduct business or personal transactions with others around the world. While cross-border payment systems are primarily used for business transactions, they can also be used for personal transactions. Here are some examples of when you might use a cross-border payment system for personal transactions: Sending Money to Friends and Family Abroad: If you have friends or family members living in another country, you may need to send them money occasionally. Cross-border payment systems allow you to do this quickly and easily, without having to worry about exchange rates or bank fees. Paying for Online Shopping: Many online retailers offer international shipping, allowing you to purchase goods from other countries. When paying for these purchases, you can use a cross-border payment system to ensure that your payment is processed securely and efficiently. Travel Expenses: When traveling abroad, you may need to pay for expenses such as accommodation, transportation, or food. Cross-border payment systems can be useful in these situations, as they allow you to make payments in local currencies without having to carry large amounts of cash. To make the most of cross-border payment systems for personal transactions, consider the following tips: Choose the Right Provider: Not all cross-border payment systems are created equal. Some may offer better exchange rates or lower fees than others. Research different providers before choosing one to ensure that you get the best deal possible. Understand Fees and Exchange Rates: Before making any cross-border payment, be sure to understand the fees and exchange rates involved. Some providers may charge additional fees for certain types of transactions, so it's important to know what you're getting into before sending money. Keep Track of Your Transactions: When using cross-border payment systems for personal transactions, it's important to keep track of your transactions. This will help you stay organized and ensure that you don't overspend or lose track of your finances. Be Aware of Scams: Unfortunately, there are scammers who target people using cross-border payment systems. Be cautious when sharing personal information or sending money to someone you don't know well. If something seems suspicious, trust your instincts and report it to the appropriate authorities. In conclusion, cross-border payment systems can be a convenient and efficient way to handle personal transactions with people in other countries. By choosing the right provider, understanding fees and exchange rates, keeping track of your transactions, and being aware of potential scams, you can make the most of these systems and enjoy smoother international financial interactions.

How do I track the success of my clearance sale ?

When it comes to tracking the success of your clearance sale, there are several key metrics and strategies you can use. Here's a detailed guide on how to do so effectively: 1. **Sales Revenue**: Measure the total revenue generated from the clearance sale and compare it with past sales data to see if there has been an increase or decrease in revenue. 2. **Customer Engagement**: Track the number of visitors who came specifically for the clearance sale and look at the engagement rate - how long were they on your site? Did they interact with multiple products? 3. **Conversion Rates**: What percentage of visitors made a purchase during the clearance sale? Also consider the cart abandonment rate. If many potential customers added items to their cart but didn't complete the purchase, this indicates areas for improvement. 4. **Inventory Movement**: Keep track of the units sold during the clearance sale and measure the reduction in inventory levels as a result of the clearance sale. This helps in future planning and management of stock. 5. **Profit Margin Analysis**: Calculate the profit margin per item sold during the clearance sale and measure the overall profit margin for the clearance sale period. This includes all costs associated with running the sale. 6. **Return on Investment (ROI)**: Include any additional costs incurred due to the clearance sale, such as marketing expenses or extra staff hours, and calculate the return on investment by comparing the net profits against the costs of running the clearance sale. 7. **Customer Feedback**: Use customer surveys and reviews to gather feedback about the clearance sale and analyze social media sentiment during and after the clearance sale. Positive comments and shares indicate a successful event. 8. **Post-Sale Analysis**: After the sale, analyze which products need replenishment based on their performance during the clearance sale and use the data collected to plan future sales events more effectively. Identify what worked well and what didn't, and make adjustments accordingly. By focusing on these key metrics and strategies, you can effectively track the success of your clearance sale and make informed decisions for future sales events.

How can I track my progress if I'm only exercising at home ?

**Tracking Progress in Home Exercises** When working out at home, monitoring your progress helps you stay motivated and makes adjustments to your routine. Here are key strategies: 1. **Set Clear Goals:** Divide goals into short-term (e.g., increasing push-ups) and long-term (e.g., weight loss). Ensure they're specific and achievable. 2. **Keep a Workout Journal:** Record details of each session, reflect on what works, and make necessary changes. 3. **Use Technology:** Fitness apps and smart devices can track metrics like steps and heart rate. 4. **Take Measurements:** Regularly measure weight, body fat, and performance metrics to see physical changes. 5. **Evaluate Intensity and Recovery:** Use RPE to assess workout difficulty and monitor recovery times after exercise. 6. **Compare Against Baseline:** Regularly reassess initial measurements and performances to gauge improvement. 7. **Utilize Visual Cues:** Photos and mirror checks can show changes in your physique over time. 8. **Engage in Strength Training:** Track the weight lifted and rep maxes to indicate strength gains. 9. **Focus on Feel and Function:** Pay attention to how your body feels during workouts and improve the quality of movement. By employing these methods, you can effectively track your progress while exercising at home, ensuring consistent improvements and maintaining motivation.

What regulations govern Cross-Border Payment ?

Regulations governing cross-border payment include Anti-Money Laundering (AML) laws, Payment Card Industry Data Security Standard (PCI DSS), International Wire Transfer Regulations, and General Data Protection Regulation (GDPR). These regulations ensure the security, safety, and efficiency of the process by requiring financial institutions to verify customer identity, monitor transactions for suspicious activity, protect cardholder data, comply with US sanctions and embargoes, and protect personal data.

What is the future of Cross-Border Payment ?

The future of cross-border payment is expected to be influenced by trends such as digitalization, regulatory changes, innovation in payment methods, and global economic integration. However, challenges like high fees, security risks, and lack of standardization need to be addressed for the industry to become more accessible, secure, and efficient.

How does Cross-Border Payment impact global trade ?

Cross-border payment plays a crucial role in the global trade ecosystem by enabling businesses to buy and sell goods and services internationally. It reduces transaction costs, enhances transparency and efficiency, and promotes economic growth. However, challenges related to regulatory compliance, currency fluctuations, and technological barriers need to be addressed.

Can I cancel a Cross-Border Payment transaction ?

Canceling a cross-border payment depends on factors like the payment method, bank policies, and timing of cancellation. Wire transfers and electronic platforms are common methods, with immediate requests having higher chances of success. Costs may apply for cancellation, and effective communication with banks or providers is crucial. Steps include acting quickly, verifying transaction status, contacting support, and understanding any fees. Prevention tips involve double-checking details and using reliable platforms.

What fees are associated with Cross-Border Payment ?

Cross-border payments are subject to various fees, including transfer fees, exchange rate markups, receiving fees, and intermediary bank fees. Understanding these fees is crucial for cost-effective international money transfers.

How can I optimize my Cross-Border Payment strategy ?

This guide discusses how to optimize cross-border payment strategy by researching and understanding regulations and compliance requirements, choosing the right payment method, using technology to streamline processes, and working with reliable partners.

How long does it take for a Cross-Border Payment to process ?

The processing time for cross-border payments can vary depending on several factors, including the payment method used, the countries involved, and the banks or financial institutions handling the transaction. Wire transfers typically take 1 to 5 business days, credit cards can take 3 to 7 business days, and digital wallet transactions are usually completed within 24 hours. However, these are just general guidelines and the actual processing time can vary based on the specific circumstances of each transaction.

What happens if my Cross-Border Payment transaction fails ?

If your cross-border payment transaction fails, itIf your cross-border payment transaction fails, it reasons such as insufficient funds it can be due to several reasons such as insufficient funds, invalid recipient information, transfer limit exceeded, technical issues, or fraud detection. It is important to identify the reason behind it and take appropriate action to resolve the issue and complete the transaction successfully.

How can I set up a Cross-Border Payment account ?

The text provides a detailed guide on how to set up a cross-border payment account, including steps such as researching and choosing a provider, checking compliance and regulations, opening an account, verifying the account, configuring payment settings, linking to a business account, testing the system, monitoring and maintaining the account, understanding fees and exchange rates, and optimizing for tax implications. It emphasizes the importance of complying with legal and regulatory requirements, maintaining detailed records, and working with a tax advisor.

How do I track my stock investments ?

How to track your stock investments effectively by setting up a brokerage account, creating a watchlist, using tracking tools, keeping records, monitoring market trends, evaluating performance regularly, and rebalancing your portfolio.

How can I track my lost iPhone ?

Losing an iPhone can be distressing, but with the right steps, recovery chances increase. Enable Find My iPhone beforehand and use it to locate your device on a map. Play a sound if it's nearby but hidden. Lost Mode locks and tracks your phone. Report to local authorities and notify your carrier for lost or stolen cases. Change passwords to protect data. Stay calm and act quickly for best recovery results.

What are the best iPhone apps for fitness and health tracking ?

Staying fit and healthy is essential for a happy life, and with the advancement of technology, there are numerous apps available on the iPhone that can help you track your fitness and health goals. Here are some of the best iPhone apps for fitness and health tracking: 1. MyFitnessPal - A popular calorie counter and diet tracker app that allows you to log your daily food intake and exercise routine. It has a massive database of foods, making it easy to find and track what you're eating. The app also integrates with other fitness apps, such as Apple Health, to provide a comprehensive view of your overall health and fitness. 2. Fitbit - A wearable device that tracks your daily activity, including steps taken, distance traveled, calories burned, and sleep quality. The accompanying iPhone app allows you to view your data in real-time and set personalized goals based on your fitness level. You can also join challenges with friends and compete against each other to stay motivated. 3. Strava - An excellent app for runners and cyclists who want to track their workouts and compare their performance with others. The app uses GPS to map your runs or rides, providing detailed metrics such as pace, speed, elevation gain, and heart rate. You can also join clubs and participate in virtual races to stay motivated. 4. Nike Training Club - Offers a wide range of workout routines designed by professional trainers to help you achieve your fitness goals. The app includes videos demonstrating each exercise, along with tips on proper form and technique. You can also track your progress over time and set personalized goals based on your fitness level. 5. Headspace - While not strictly a fitness app, Headspace is an excellent tool for managing stress and improving mental well-being, which are crucial components of overall health. The app offers guided meditation sessions suitable for beginners and experienced practitioners alike, helping you relax and refocus throughout the day.

How can I track and monitor my education budget plan effectively ?

Effectively tracking and monitoring your education budget plan is crucial for managing finances and achieving academic goals without unnecessary debt. Strategies include setting clear goals, creating a comprehensive budget, using financial tools, regularly tracking expenses, making adjustments as needed, and seeking professional advice when necessary. Following these steps can help you stay on track financially while pursuing your academic objectives.

Can I customize the double-tap feature on my AirPods ?

To customize the double-tap feature on your AirPods, follow these steps: pair your AirPods with your iPhone or iPad, open the Settings app, select Bluetooth, find your AirPods in the list of devices, and customize the double-tap feature for each AirPod. You can choose between playing/pausing audio, skipping to the next track, going to the previous track, or activating Siri. Test your new settings by double-tapping your AirPods.

How can technology help in managing a sports career ?

Technology plays a crucial role in managing a sports career. It can help athletes improve their performance, track their progress, and stay connected with their fans and sponsors. Here are some ways technology can assist in managing a sports career: 1. Performance Tracking: Wearable devices such as fitness trackers, smartwatches, and heart rate monitors can help athletes track their physical activity, sleep patterns, and overall health. Video analysis software allows coaches and athletes to review game footage, identify areas for improvement, and develop strategies for future competitions. 2. Training Optimization: Virtual Reality (VR) technology can simulate various environments and scenarios, allowing athletes to train in a controlled setting without the risk of injury. Machine learning algorithms can analyze an athlete's training data and provide personalized recommendations for improving performance and reducing the risk of injury. 3. Injury Prevention and Recovery: Biometric data such as heart rate variability, muscle oxygenation, and fatigue levels can help coaches and trainers monitor an athlete's recovery status and adjust their training accordingly. Technological advancements in rehabilitation, such as electrotherapy, ultrasound therapy, and robotic assistance, can aid in faster recovery from injuries. 4. Nutrition and Hydration: Smart water bottles can track an athlete's hydration levels throughout the day and remind them when it's time to drink water. Nutrition apps can help athletes plan their meals, track their calorie intake, and ensure they are getting the necessary nutrients for optimal performance. 5. Communication and Networking: Social media platforms allow athletes to connect with fans, share their experiences, and promote their personal brand. Sports management software can help athletes manage their schedules, communicate with coaches and teammates, and keep track of their finances and sponsorships. 6. Mental Health Support: Mindfulness apps can help athletes manage stress, improve focus, and enhance their mental well-being. Teletherapy services enable athletes to access mental health support remotely, ensuring they have the resources needed to maintain their mental health while on the road or competing abroad.

How can I improve my productivity with educational software ?

Educational software can be a powerful tool to enhance your productivity, but it's essential to use it effectively. Here are some tips on how you can improve your productivity with educational software: 1. Set clear goals and objectives before using any educational software. This will help you select the right software that aligns with your needs and ensure that you stay focused on what you want to achieve. 2. Choose the right software for your specific needs. Look for software that is user-friendly, engaging, and relevant to your learning goals. Consider factors like cost, accessibility, and compatibility with your devices. 3. Use the software regularly. Consistency is key when it comes to improving your productivity with educational software. Make a schedule for when you will use the software and stick to it. Even if you can only devote a few minutes each day, regular use will help reinforce your learning and keep you on track. 4. Take advantage of interactive features like quizzes, games, and simulations. These can be great tools for reinforcing your learning and making the process more engaging. Be sure to take advantage of these features whenever possible. 5. Track your progress. Keeping track of your progress is an excellent way to stay motivated and see how far you've come. Many educational software programs have built-in tracking features that allow you to monitor your progress over time. If your software doesn't have this feature, consider using a separate tool like a spreadsheet or journal to track your progress manually.