Type Repayment

How do interest rates on student loans work ?

Interest rates on student loans are the percentage of the loan amount that borrowers must pay in addition to the principal balance. The interest rate is determined by the lender and can vary based on factors such as creditworthiness, type of loan, and repayment term. There are two main types of student loans: federal and private. Federal student loans have fixed interest rates that are set by Congress each year, while private student loans have variable or fixed interest rates that are determined by the lender. Interest on student loans begins to accrue as soon as the loan is disbursed, and there are several repayment options available for student loans. By choosing the right type of loan and repayment plan, you can minimize your interest costs and pay off your student loans more efficiently.

How can I manage my student loan repayment after graduation ?

## Summary of Managing Student Loan Repayment After Graduation After graduation, managing student loan repayment can be a significant challenge. However, by following these steps, you can effectively manage your loans and avoid unnecessary fees or damage to your credit score: 1. **Understand Your Loan Terms**: Before starting any repayment plan, it's crucial to understand the terms of your student loans, including interest rates, monthly payments, and grace periods. 2. **Create a Budget**: A budget helps prioritize expenses and determine how much money can be allocated towards student loan repayment each month. Include all necessary expenses in your budget. 3. **Make Payments On Time**: Late payments can lead to fees and negatively impact your credit score. Set up automatic payments or make manual payments on time to avoid penalties. 4. **Consider Consolidation or Refinancing**: If you have multiple loans with different terms, consolidating them into one payment or refinancing at a lower rate may simplify repayment and save money. 5. **Explore Repayment Options**: Federal student loans offer various repayment plans, such as income-driven plans that adjust your payments based on your income and family size. Discuss the best plan with your loan servicer. 6. **Seek Help if Needed**: If struggling to make payments, don't hesitate to reach out for assistance. Many loan servicers offer forbearance or deferment options, and there are also government programs that can provide support for student loan repayment.

What are some examples of successful climate debt repayment programs ?

Climate debt repayment programs aim to address the disproportionate impact of climate change on vulnerable communities and countries. Successful programs include the Green Climate Fund, Global Environment Facility, World Bank's Climate Investment Funds, and African Development Bank's Africa Adaptation Initiative. These programs provide financial support and resources for adaptation, mitigation, and sustainable development projects in developing countries. Key features include funding for biodiversity conservation, land degradation prevention, private sector involvement, and disaster risk reduction.

What happens if I can't repay my student loans ?

Student loans are a common way for individuals to finance their education. However, what happens if you are unable to repay your student loans? This article will explore the consequences of not being able to repay your student loans and provide some suggestions on how to avoid these consequences. If you fail to make payments on your student loans, you will eventually default on your loans. This means that you have failed to make payments for a certain period of time, usually 270 days. Once you default on your loans, the following consequences may occur: - Damage to Your Credit Score: Your credit score will be negatively impacted, which can affect your ability to obtain credit in the future. - Wage Garnishment: The government or your lender may take legal action against you to garnish your wages, which means taking a portion of your paycheck to cover the debt. - Tax Refund Offset: The government may also take a portion of your tax refund to cover the debt. - Loss of Eligibility for Future Financial Aid: You may lose eligibility for future financial aid, including grants and scholarships. In addition to the above consequences, the government or your lender may take legal action against you to recover the debt. This can result in additional fees and court costs, as well as potential damage to your reputation and career prospects. Failing to repay your student loans can have a negative impact on your future opportunities, including difficulty renting an apartment, getting hired, or starting a business. To avoid the consequences of not repaying your student loans, consider the following suggestions: - Create a Budget: Create a budget that includes your monthly expenses and income, and prioritize paying off your student loans as soon as possible. - Explore Repayment Options: Talk to your lender about different repayment options that may be available to you, such as income-driven repayment plans or deferment/forbearance options. - Seek Professional Help: If you are struggling with repayment, seek professional help from a financial advisor or credit counselor who can provide guidance on managing your debt. - Stay in Touch with Your Lender: Keep in touch with your lender and communicate any changes in your financial situation that may affect your ability to repay your loans. - Consider Consolidation or Refinancing: If you have multiple loans with different interest rates and terms, consider consolidating or refinancing them into one loan with a lower interest rate and more manageable repayment terms.

How do I manage debt effectively and pay it off quickly ?

Managing debt effectively and paying it off quickly requires a combination of discipline, strategy, and sometimes professional advice. Here are some steps you can take to get started: ### Assess Your Debt Situation - **Understand Your Debts**: List all your debts and identify high-interest debts. - **Determine Your Budget**: Calculate your monthly income and evaluate your expenses. ### Create a Debt Repayment Plan - **Choose a Repayment Method**: Avalanche or Snowball method. - **Make a Budget and Stick to It**: Allocate more funds to debt repayment and adjust as needed. - **Consider Refinancing Options**: Consolidate debts or negotiate with creditors. ### Implement Additional Strategies - **Increase Your Income**: Take on additional work or sell unwanted items. - **Reduce Your Expenses**: Cut out luxury spending and shop smarter. - **Improve Your Credit Score**: Pay on time and monitor your credit report. ### Seek Professional Advice if Needed - **Consult a Financial Advisor**: Personalized advice and debt management plans. - **Consider Debt Counseling**: Nonprofit credit counseling and beware of scams. Consistency and perseverance are key in paying off debt quickly.

How does exercise impact the prevention and management of type 2 diabetes ?

Exercise is important to prevent and manage type 2 diabetes. It improves insulin sensitivity, reduces blood sugar levels, and promotes weight loss. Regular physical activity can help prevent type 2 diabetes by improving the body's ability to use glucose for energy and reducing visceral fat. To prevent type 2 diabetes, adults should aim for at least 150 minutes of moderate-intensity aerobic exercise per week or 75 minutes of vigorous-intensity aerobic exercise per week. For managing type 2 diabetes, it is recommended that people engage in at least 150 minutes of moderate-intensity aerobic exercise per week or 75 minutes of vigorous-intensity aerobic exercise per week. Strength training exercises should also be included at least twice per week.

How do I choose the right makeup products for my skin type ?

The text provides a comprehensive guide on how to choose the right makeup products for different skin types. It starts by explaining the characteristics of each skin type and then suggests suitable makeup products based on these characteristics. For normal skin, lightweight and breathable formulas are recommended; for dry skin, hydrating products like rich moisturizers and liquid or cream foundations are suggested; oily skin should opt for oil-controlling primers and mattifying foundations; combination skin requires customization with balanced formulas; and sensitive skin should look for hypoallergenic and fragrance-free products with soothing ingredients. Additionally, the text offers general tips applicable to all skin types such as using sunscreen, gentle cleansers, and allowing each product to absorb before applying the next one. Overall, the guide emphasizes the importance of understanding your skin type to select makeup products that cater to its specific needs and enhance natural beauty.

How does the type of sport influence the design of a sports stadium ?

The type of sport played in a stadium significantly influences its design, with each sport having unique requirements and considerations. The size and layout of the stadium must accommodate the specific dimensions needed for the sport, such as a larger soccer field compared to a basketball court. The seating capacity is also influenced by the popularity of the sport, with larger stadiums often required for sports with large fan bases. Facilities and amenities within the stadium are tailored to the sport, including specialized equipment or technology like scoreboards for sports that require them. Acoustics play a role in some sports, with quiet environments necessary for tennis matches and louder environments for football games. Safety and security measures are also tailored to the sport, with additional padding or barriers needed for contact sports and extra security measures for sports that attract rowdy fans. In conclusion, the design of a sports stadium is heavily influenced by the type of sport being played, requiring unique considerations for each sport's needs in terms of size, layout, facilities, acoustics, and safety.

What should I consider when choosing a private vs federal student loan ?

When choosing between a private and federal student loan, consider interest rates, repayment options, forgiveness programs, eligibility requirements, and the application process. Federal loans usually have lower interest rates and more lenient eligibility requirements, while private loans may offer more flexibility in repayment options but typically have higher interest rates. Weigh these factors against your individual circumstances and financial goals to make an informed decision about which type of loan is best for you.

What factors determine the amount of a student loan ?

The amount of a student loan is determined by several key factors, including eligibility criteria set by the lender, the cost of attendance at the chosen school, the student's financial need, and the type of loan (federal or private). Other influential factors include repayment options, school choice, and the availability of other financial aid. Students should consider all these elements and explore all possible funding options before taking out a loan.

What is the difference between a Roth IRA and a traditional IRA ?

The article discusses the differences between Roth IRAs and traditional IRAs, focusing on aspects such as tax treatment, contribution limits, early withdrawal penalties, required minimum distributions (RMDs), rollover rules, and estate planning considerations. It emphasizes that each type of IRA has its own unique set of rules, benefits, and drawbacks, and suggests consulting with a financial advisor to determine which type aligns best with individual retirement goals and financial strategy.

What are the main types of power batteries used in electric vehicles ?

The text discusses the main types of power batteries used in electric vehicles (EVs), including lead-acid, nickel-cadmium (NiCd), nickel-metal hydride (NiMH), lithium-ion (Li-ion), and lithium-iron phosphate (LiFePO₄) batteries. Each type has its own advantages and disadvantages, such as cost, lifespan, energy density, self-discharge rate, safety concerns, and environmental impact. The choice of battery type depends on the specific requirements and priorities of the vehicle manufacturer and end-user.

How does a home equity loan work in relation to my mortgage ?

A home equity loan allows homeowners to borrow against the equity in their property, serving as a second mortgage without requiring refinancing. It offers advantages such as lower interest rates and potential tax deductions but also presents risks like foreclosure and additional debt. Understanding how it works in relation to your primary mortgage is crucial for making an informed financial decision.

What is the most common type of cyber attack ?

Phishing attacks are the most common type of cyber attack, involving tricking individuals into providing sensitive information by posing as a trustworthy entity. They can be carried out through email, social media, or phone calls and involve spoofing, luring, and stealing. Examples include email phishing, spear phishing targeting specific individuals, and whaling targeting high-profile individuals. To prevent phishing attacks, individuals and organizations should educate themselves on identifying and reporting phishing attempts, implement multi-factor authentication, keep software and antivirus programs up-to-date, and use strong and unique passwords for each account.

Are there any programs that help with student loan forgiveness or relief ?

There are several programs available to help with student loan forgiveness or relief, including Public Service Loan Forgiveness (PSLF), Income-Driven Repayment Plans (IDRs), Teacher Loan Forgiveness Program, Disability Discharge, Closed School Discharge, and Borrower Defense to Repayment. These programs vary by country and eligibility requirements, but they all aim to make student loan payments more affordable or forgivable based on certain criteria such as employment in public service, income level, teaching at a low-income school, disability status, school closure, or being misled or defrauded by a college or university. It's important to research each option thoroughly and determine which one best fits your individual circumstances and needs.

How do I choose the right type of rice for Chinese cooking ?

When it comes to Chinese cooking, selecting the rightWhen it comes to Chinese cooking, selecting the right for achieving the desired texture and selecting the right type of rice is crucial for achieving the desired texture and flavor in your dishes. Consider the dish you are making, look for quality and freshness when purchasing rice, and don't forget to consider your personal preferences. By following these steps, you can choose the perfect type of rice for your Chinese cooking needs.

Can you consolidate multiple student loans into one payment ?

Consolidating multiple student loans into one payment simplifies monthly expenses and can reduce overall interest rates. The process involves taking out a new loan to pay off existing ones, resulting in a single fixed interest rate and monthly payment. Benefits include lower monthly payments and easier management, but potential drawbacks such as longer repayment periods and loss of lender benefits should be considered. Successful consolidation requires evaluating current loans, comparing offers, and understanding all terms before committing.

Can parents take out loans for their children's education ?

The article discusses the options available for parents who want to take out loans for their children's education. These options include federal student loans, private student loans, and parent loans. Federal student loans offer low interest rates and flexible repayment terms, while private student loans have higher interest rates but more flexible repayment options. Parent loans are specifically designed for parents who want to help their children pay for college. The article emphasizes the importance of carefully considering all options before choosing the best one that suits the parents' financial situation and goals.

What is private mortgage insurance (PMI) and do I need it ?

Private Mortgage Insurance (PMI) is a type of insurance that protects the lender, not the borrower, in case of default on a mortgage loan. It is typically required when a homebuyer makes a down payment of less than 20% of the home's purchase price. Whether you need PMI depends on factors such as your down payment, credit score, loan-to-value ratio, and type of loan. Consider the cost of PMI and alternatives before deciding to obtain it.

How much should I invest in each type of asset class ?

The text provides a guide on how to determine the allocation of funds across different asset classes based on investment goals, risk tolerance, time horizon, and financial situation. It suggests that younger investors should allocate more towards stocks while older investors should gradually shift towards safer investments. The text also emphasizes the importance of regularly reviewing and rebalancing the portfolio and seeking professional advice when unsure about investment decisions.

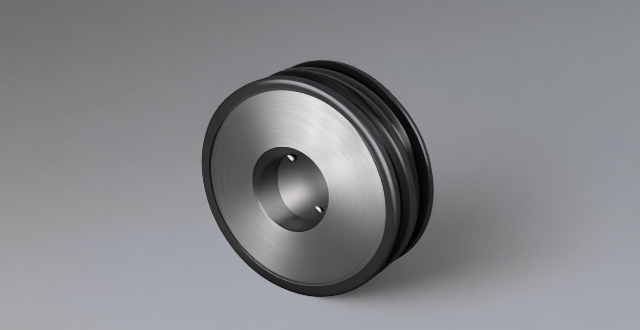

How does the design of a DC brushed motor impact its performance and efficiency ?

The performance and efficiency of a DC brushed motor are significantly influenced by its design. Key factors include the materials used, winding configuration, magnet strength, bearing type, and cooling system. Materials such as silicon steel for stator cores and carbon steel or aluminum alloys for rotor cores affect magnetic properties and mechanical strength. Winding configuration, including the number of poles and winding type (lap or wave), determines speed and torque characteristics. Magnet strength, shape, and placement impact torque production and power density. Bearing type (ball or roller) affects precision, friction, and load capacity. Finally, proper cooling through active or passive methods is essential for preventing overheating during operation. Overall, careful consideration of these design elements is crucial for achieving desired motor performance and efficiency goals.

Should I use fertilizer for my indoor plants, and if so, how often ?

Fertilization is crucial for indoor plants, providing essential nutrients for growth. The need for fertilizer depends on factors like plant type, soil quality, and light exposure. Most indoor plants benefit from monthly fertilization during the growing season, while slow-growing plants may need it less frequently. Signs of nutrient deficiency can guide adjustments to the fertilization schedule. Choosing the right fertilizer involves considering its type (synthetic or organic) and NPK ratio. Proper application includes diluting the fertilizer, watering beforehand, and avoiding direct contact with leaves and stem. Balancing nutrients and care ensures healthy plant growth without the risks of over-fertilization.