Value Firm

How long does it typically take to secure funding from a venture capital firm ?

Securing funding from a venture capital firm involves several stages, including preparation, initial meetings and screening, negotiation and terms sheets, and closing and funding. The timeframe for each stage can vary depending on factors such as the industry, company growth stage, VC firm investment criteria, and market conditions. The preparation phase involves researching and identifying suitable VC firms, preparing pitch materials, and networking and outreach. The initial meetings and screening stage includes first meetings with VC firms and due diligence and screening. The negotiation and terms sheets phase involves investment terms negotiation and signing the terms sheet. Finally, the closing and funding stage includes legal and financial due diligence and receiving funding and post-investment support.

How do private equity firms value companies ?

Private equity firms value companies using various methods, includingPrivate equity firms value companies using various methods, including, discounted cash flow ( These approaches help them assess the company's financial health, market position, growth potential, and risks to make informed investment decisions.

How do private equity firms exit their investments ?

Private equity firms employ various exit strategies to realize the value created during their investments, including IPOs, trade sales, secondary sales, recapitalizations, management buyouts, and write-offs. Each strategy has its own advantages and disadvantages, and PE firms must carefully consider which option will maximize their return on investment while minimizing risks.

How is the value of carbon credits determined ?

Carbon credits are a valuable tool in the fight against climate change. Their value is determined by supply and demand, quality of the project used to generate them, and market conditions. Supply and demand can be influenced by government regulations, public opinion, and technological advancements. The quality of a carbon offset project can be influenced by verification and certification, additionality, and permanence. Market conditions such as economic growth, political stability, and global events can also impact the value of carbon credits.

How can we measure the value of ecosystem services ?

The article discusses various methods to measure the value of ecosystem services, which are benefits humans derive from ecosystems. These include provisioning, regulating, cultural, and supporting services. Measuring their value is crucial for informed decisions about management and conservation. Methods include direct market valuation, indirect market valuation, revealed preference methods, avoided cost method, replacement cost method, and benefit transfer method. By using these techniques, policymakers and managers can make informed decisions about resource allocation for ecosystem conservation and restoration.

How are carbon credits traded and what is their market value ?

The article discusses the trading of carbon credits, which are tradable permits allowing holders to emit certain amounts of greenhouse gases. It explains how carbon credits are traded and their market value, outlining steps in their creation, verification, issuance, trading, and retirement. It also notes that the market value of carbon credits varies based on project type, location, and demand for offsets.

What is the typical structure of a private equity deal ?

The typical structure of a private equity deal involves several key components, including due diligence, investment structure, capital structure, governance and control, exit strategy, and legal agreements. The process begins with thorough due diligence to evaluate the target company's financial health, operational efficiency, market position, and growth potential. The investment structure defines how the PE firm will invest in the target company, while the capital structure determines how the target company will be financed after the PE firm's investment. Governance and control involve securing representation on the company's board of directors, gaining certain rights to veto major decisions, and bringing in new management or working closely with existing management to drive performance improvements. A successful private equity deal also requires a well-defined exit strategy for the PE firm to realize its investment return. Lastly, various legal agreements are put in place to govern the relationship between the PE firm and the target company.

How does private equity affect corporate governance ?

Private equity (PE) plays a significant role in shaping the governance of companies. It can have both positive and negative impacts on corporate governance, depending on various factors such as the PE firm's strategy, the nature of the investment, and the target company's existing governance structure. This article will explore the ways in which private equity affects corporate governance. ### Positive Impacts of Private Equity on Corporate Governance - **Improved Decision-Making Processes**: Private equity firms often bring fresh perspectives and expertise to the decision-making processes within a company. They may introduce new management practices or technologies that enhance efficiency and productivity. This can lead to better strategic planning and more informed decisions being made by the board of directors. - **Greater Transparency and Accountability**: Private equity investors typically demand greater transparency and accountability from the companies they invest in. This can result in improved financial reporting, regular board meetings, and increased communication between management and shareholders. Such measures help to ensure that all stakeholders are kept informed about the company's performance and future plans. - **Increased Focus on Long-Term Value Creation**: Private equity firms generally have a long-term investment horizon, which means they are more likely to focus on creating value over the long term rather than pursuing short-term gains. This can lead to a greater emphasis on sustainable growth, innovation, and responsible business practices. ### Negative Impacts of Private Equity on Corporate Governance - **Potential Conflicts of Interest**: Private equity investors may have conflicts of interest with other stakeholders, such as employees, customers, or suppliers. For example, a PE firm might push for cost-cutting measures that negatively impact employee morale or customer satisfaction. These conflicts can undermine good governance practices and harm the company's reputation. - **Pressure for Short-Term Profits**: While some private equity firms focus on long-term value creation, others may prioritize short-term profits at the expense of long-term sustainability. This can lead to excessive risk-taking, aggressive financial engineering, or even fraudulent activities aimed at boosting short-term earnings. Such behaviors can ultimately damage the company's reputation and financial health. - **Lack of Diversity in Board Composition**: Private equity firms often control a majority of the seats on a company's board of directors. This can limit diversity in terms of gender, ethnicity, and professional background among board members. A lack of diversity can lead to groupthink and reduce the effectiveness of the board in providing independent oversight and guidance to management. In conclusion, private equity has both positive and negative effects on corporate governance. The key is for PE firms to balance their pursuit of profit with a commitment to ethical business practices and responsible stewardship of the companies they invest in. By doing so, they can help build stronger, more sustainable businesses that benefit all stakeholders.

How can I determine the value of a second-hand item before purchasing it ?

When considering purchasing a second-hand item, itWhen considering purchasing a second-hand item, it its value to ensure you' it's important to determine its value to ensure you're getting a fair deal. Here are some steps to help you assess the value of a pre-owned item: 1. Research the market price by checking online marketplaces, consulting auction houses, and reading reviews and forums. 2. Evaluate the condition of the item by inspecting for damage, considering age and obsolescence, and testing functionality. 3. Negotiate with the seller by making an offer based on your research and evaluation, being prepared to walk away if necessary, and asking for more information if needed.

How do private equity firms make money ?

Private equity firms generate profits through various strategies, includingPrivate equity firms generate profits through various strategies, includingLBOs), growth capital including leveraged buyouts (LBOs), growth capital investments, and venture capital investments. LBOs involve acquiring companies with debt and equity financing to improve their value for a higher sale price or public offering. Growth capital investments provide funding to established companies with growth potential but not ready for an LBO or public offering. Venture capital investments target early-stage startups with high growth potential but limited track records. Private equity firms manage risk by diversifying across industries and geographies, conducting thorough due diligence, actively involving portfolio company management, and monitoring financial performance metrics. By balancing risk and reward, they can achieve consistent returns over time while minimizing losses from individual investments.

How can I make sure I'm getting the best value for my money when shopping ?

When it comes to shopping, ensuring you're getting the best value for your money is crucial. Here are some tips to help you make informed decisions and get the most out of your purchases: 1. Research Before You Buy: Read reviews, compare prices, and check for sales and discounts. 2. Set a Budget: Determine your needs, prioritize items, and allocate funds accordingly. 3. Choose Quality Over Quantity: Invest in durable items and consider warranties and guarantees. 4. Take Advantage of Loyalty Programs: Join reward programs and use credit card rewards wisely. 5. Don't Forget About Return Policies: Understand store policies and keep receipts organized. By following these tips, you can ensure that you're getting the best value for your money when shopping. Remember to take your time, do your research, and make well-informed decisions to get the most out of your purchases.

What are some notable private equity firms ?

Private equity firms are investment companies that pool funds from various investors to acquire and manage private companies, typically investing in undervalued or distressed businesses, restructuring them, and selling them at a profit. Some of the most notable private equity firms include Blackstone Group, The Carlyle Group, Kohlberg Kravis Roberts & Co. (KKR), TPG Capital, and Warburg Pincus. These firms have diverse portfolios and investment strategies, with assets under management ranging from $600 billion to $79 billion as of 2022.

What strategies can women use to negotiate salaries and promotions effectively ?

Effective Strategies for Women to Negotiate Salaries and Promotions: 1. Do Your Research: Understand the market value of your position, the company's financial situation, and the salary range for similar roles in your industry. 2. Articulate Your Value: Highlight your achievements, contributions, and unique skills that set you apart from others in your role. 3. Practice Active Listening: Pay attention to what the other party is saying and ask questions to clarify their position. 4. Use Assertive Language: Use phrases like "I believe I deserve" or "I am confident that I have earned" to express your worth. 5. Be Flexible and Open to Options: Consider alternative compensation packages, such as additional vacation time or professional development opportunities, if a salary increase is not immediately possible. 6. Stay Professional and Courteous: Avoid getting emotional or making personal attacks and remember that you are advocating for yourself and your career goals.

What is the role of a private equity firm in a company's growth ?

Private equity firms contribute to a company's growth by providing capital, strategic expertise, and operational support. They invest significant amounts of capital into companies for expansion, refinance debt, offer industry experience and management consulting services, assist in talent acquisition, and help integrate new technologies. This collaboration helps companies navigate challenges, seize opportunities, and achieve success.

How does climate change impact the nutritional value of crops ?

Climate change is affecting the nutritional value of crops by altering CO2 levels, temperature fluctuations, and water availability. Elevated CO2 concentrations can lead to nutrient dilution in staple crops like wheat, rice, and soybeans. Temperature extremes cause protein denaturation and interfere with enzyme function, reducing nutrient content. Water stress from drought or flooding impairs nutrient uptake and synthesis. Adaptation strategies include breeding resilient crop varieties, implementing efficient irrigation systems, and using protective structures against extreme temperatures. By addressing these challenges, it's possible to maintain crop nutrition amidst climate change impacts.

How do I maximize the value of coupons and promotional codes ?

Coupons and promotional codes are a great way to save money on your purchases. Here are some tips: 1. Use Them Wisely: Combine coupons and stack promotions for maximum savings. 2. Plan Ahead: Check expiration dates and plan your shopping trips accordingly. 3. Be Strategic: Use coupons on high-value items and stock up on essentials when they go on sale. 4. Sign Up for Rewards Programs: Join loyalty programs and follow brands on social media for exclusive offers.

Are there any restrictions on how I can use my credit card rewards ?

Using credit card rewards can save money and add value to purchases, but it's crucial to understand potential restrictions. Restrictions may include limited redemption options, expiration dates, minimum thresholds, blackout dates/capacity controls for travel expenses, transfer partnership requirements, and tax implications. By understanding these limitations, you can maximize the value of your rewards while avoiding surprises.

What is the average return on investment for private equity ?

Private equity (PE) investments can offer attractive returns, but these are influenced by several factors. The success of the companies in which PE firms invest, market conditions, investment strategy, and timing all play a role. Historically, PE has delivered average annualized returns of 12-15%, though these can be volatile. It's important for investors to understand the J-curve effect, fees, and the benefits of diversification when considering PE investments.

What are the taxes and duties involved in global shopping ?

Global shopping popularity has grown, but understanding the taxes and duties involved is crucial for informed purchasing decisions. Types of taxes and duties include import duty, value added tax (VAT), customs clearance fee, and excise tax. To calculate these charges, one needs to know the product category, country of origin, value of goods, and local tax laws. The responsibility for payment can be on either the seller or the buyer, depending on the transaction terms. To avoid unexpected charges, research before buying, ask for a full cost breakdown, and consider using a package forwarding service.

What is the difference between term life insurance and whole life insurance ?

Difference between term life insurance and whole life insurance: - Term life insurance is temporary coverage, no cash value, renewable, and affordable. - Whole life insurance is permanent coverage, accumulates cash value, has level premiums, and is more expensive.

Are all hybrid cars made equal or are some brands better than others ?

Hybrid cars vary in performance, reliability, and value across different brands. Brand A leads in engine efficiency, driving experience, acceleration, durability, maintenance costs, warranty, cost of ownership, resale value, and innovation. Brand B performs moderately well but lags behind Brand A in several areas. Brand C has the lowest ratings for most criteria, including durability, maintenance costs, warranty, cost of ownership, resale value, and innovation. Consumers should consider these factors when choosing a hybrid car to ensure they get the best value for their money.

What are the benefits of buying second-hand goods instead of new ones ?

The benefits of buying second-hand goods instead of new ones include reduced waste, conservation of resources, cost savings, resale value, supporting local economies, and promoting sustainable consumption. Buying used items helps reduce the amount of waste generated, conserves natural resources, saves money, retains high resale value, supports small businesses, and encourages a more responsible approach to shopping.

What are the best brands to look for at a brand sale event ?

The text provides a guide on the best brands to look for at a brand sale event, focusing on their reputation for quality, style, and value. The brands are categorized into luxury fashion brands (Gucci and Louis Vuitton), tech and electronics brands (Apple and Samsung), beauty and skincare brands (Sephora and Kiehl's), and sportswear and apparel brands (Nike and Lululemon). Each brand is described in terms of quality, style, and value, highlighting their unique features and benefits. The guide emphasizes the importance of prioritizing reputable brands during brand sale events to maximize savings while investing in products that will bring lasting satisfaction.

Are electric cars more expensive than gasoline cars ?

Electric cars, also known as EVs, have been gaining popularity due to their eco-friendly nature and lower operating costs. However, the initial purchase price of an electric car is often higher than that of a traditional gasoline-powered car. In this article, we will explore the cost differences between electric and gasoline cars. ## Upfront Cost **Electric Cars:** - Higher upfront cost due to expensive battery technology and limited production scale. - Prices vary depending on the model, brand, and range. - Some governments offer incentives and tax credits to offset the high initial cost. **Gasoline Cars:** - Generally less expensive upfront compared to electric cars. - Wide variety of models and brands available at different price points. - No government incentives or tax credits for purchasing a gasoline car. ## Operating Costs **Electric Cars:** - Lower operating costs due to cheaper electricity rates compared to gasoline prices. - Maintenance costs are generally lower since there are fewer moving parts in an electric motor. - Battery replacement can be costly, but it is not expected until after several years of use. **Gasoline Cars:** - Higher operating costs due to fluctuating gasoline prices and regular maintenance requirements. - More frequent oil changes, tune-ups, and other routine maintenance tasks. - Fuel efficiency varies widely among gasoline cars, affecting overall operating costs. ## Depreciation **Electric Cars:** - Depreciation rate may be higher for electric cars due to rapid advancements in technology and changing consumer preferences. - Some early adopters may experience significant depreciation if they choose to sell their electric car before its battery lifespan ends. **Gasoline Cars:** - Generally slower depreciation rate compared to electric cars. - Well-maintained gasoline cars can retain their value for longer periods. ## Resale Value **Electric Cars:** - Resale value depends on factors such as battery health, range, and charging infrastructure availability. - As more people switch to electric cars, the demand for used electric vehicles may increase, potentially boosting resale values. **Gasoline Cars:** - Resale value is typically more predictable and stable compared to electric cars. - Factors such as fuel efficiency, brand reputation, and vehicle condition affect resale value. In conclusion, while electric cars may have a higher upfront cost, they offer lower operating costs and potentially better resale value in the future. It's essential for consumers to consider both short-term and long-term costs when deciding between an electric or gasoline car.

How does proper insulation contribute to energy efficiency ?

Proper insulation is crucial for energy efficiency, providing thermal comfort, reducing energy costs, and alleviating strain on power grids. It also improves indoor air quality by controlling moisture and limiting allergens. Furthermore, it decreases greenhouse gas emissions, supports sustainable living, and offers long-term economic benefits like higher property value. Implementing proper insulation involves sealing air leaks, considering R-values, and focusing on key areas like attics and basements.

How do I avoid customs fees when buying from overseas ?

When purchasing goods from overseas, it's common to encounter customs fees, which can significantly increase the total cost of your purchase. However, there are several strategies you can use to minimize or avoid these fees altogether. Here's a detailed guide on how to do so: ## Understanding Customs Fees Customs fees are taxes imposed on imported goods by the government of the destination country. These fees are typically based on the value of the items being imported and may vary depending on the type of product and its classification under international trade regulations.### Key Points to Remember: - **Research Regulations**: Familiarize yourself with the customs regulations of the country you're importing goods into.- **Check Import Restrictions**: Some items may be prohibited or have specific requirements.- **Know the Thresholds**: Many countries have de minimis thresholds below which no customs duties are charged.## Strategies to Minimize Customs Fees### 1. Declare Lower Value Some countries offer a de minimis threshold, meaning that if the value of the goods is below a certain amount, no customs fees will be charged. Be cautious with this approach, as undervaluing goods can be considered a violation and may result in penalties.### 2. Use a Package Forwarding Service Package forwarding services allow you to ship your purchases to an intermediary address before sending them on to you. This can help by: - **Consolidating Packages**: Reducing the number of shipments can lower handling fees.- **Repackaging**: To make the package look less valuable.- **Value Declaration**: Some services may adjust the declared value to stay within de minimis limits.### 3. Shop at Online Stores That Offer Free International Shipping Many online retailers offer international shipping with customs fees included in the price or have agreements that reduce these fees.### 4. Consider Using an Import Broker Import brokers specialize in facilitating the clearance of goods through customs and can provide expert advice on minimizing fees. They have knowledge of customs laws and can assist with proper classification and valuation of goods.### 5. Check for Tax-Free Shopping Options Some countries offer tax-free shopping for tourists, which can be a way to avoid customs fees when bringing in goods personally.## Examples of Goods That May Incur Lower Customs Fees - **Personal Use Items**: Clothing, toiletries, and other personal use items often have lower customs fees.- **Unboxed or Opened Electronics**: Sometimes unboxed or opened electronics are subject to reduced customs fees.- **Gifts**: Sending items as gifts can sometimes result in lower customs fees, but this must be declared properly.## Tips for Successful Importing - **Keep Records**: Save all receipts and documentation related to your purchases.- **Stay Informed**: Customs policies can change, so stay updated on the latest regulations.- **Be Honest**: Always declare the true value and nature of your goods to avoid legal issues. By following these strategies and tips, you can effectively minimize or avoid customs fees when buying from overseas. However, always remember to comply with the laws and regulations of both the exporting and importing countries to ensure a smooth importing process.

How can I ensure I get the best exchange rate ?

When exchanging currencies, it is important to ensure that you get the best possible exchange rate. This can help you save money and get the most value for your money. In this guide, we will discuss some tips and strategies that can help you achieve the best exchange rate possible. The first step in ensuring the best exchange rate is to research the current exchange rates online. There are many websites that provide real-time information on exchange rates, such as XE.com or OANDA. By checking these sites, you can get an idea of what the current exchange rate is and compare it to other providers. Once you have an idea of the current exchange rate, it's time to compare different providers. Look for banks, currency exchange offices, and even online services that offer competitive rates. Make a list of potential providers and compare their rates side by side. Using a credit card that doesn't charge foreign transaction fees can be a great way to get the best exchange rate. Some credit cards also offer rewards programs that give you cashback or points for using your card abroad. Look for cards that offer these benefits and make sure they don't charge any additional fees for foreign transactions. Prepaid currency cards are another option to consider when traveling abroad. These cards allow you to load them with foreign currency before your trip and use them like a debit card. They often come with lower fees than traditional bank accounts and may offer better exchange rates than exchanging cash at a currency exchange office. If you prefer to exchange cash, shop around at local currency exchange offices to find the best rates. Don't be afraid to walk away from an office if you feel like the rate they're offering isn't fair. Often, just by showing that you're willing to walk away, they may offer you a better rate. Getting the best exchange rate requires some research and planning ahead of time. By following these tips and strategies, you can ensure that you get the most value for your money when exchanging currencies.

What are the risks associated with investing in financial products ?

Investing in financial products can be a great way to grow your wealth, but it's important to understand the risks involved. Here are some of the key risks associated with investing in financial products: 1. Market risk refers to the possibility that an investment may lose value due to changes in market conditions. 2. Credit risk is the risk that a borrower or counterparty will fail to meet its obligations under a financial contract. 3. Interest rate risk is the risk that changes in interest rates will negatively impact the value of an investment. 4. Inflation risk is the risk that inflation will erode the purchasing power of your investments over time. 5. Liquidity risk is the risk that you may not be able to sell your investment quickly without affecting its price. 6. Currency risk is the risk that fluctuations in exchange rates will negatively impact the value of your investments. 7. Concentration risk is the risk that your portfolio is too heavily invested in a single asset class, sector, or geographic region. 8. Tax risk is the risk that changes in tax laws or regulations will negatively impact the after-tax returns of your investments. 9. Fraud risk is the risk that you may be victimized by fraudulent activities related to your investments.

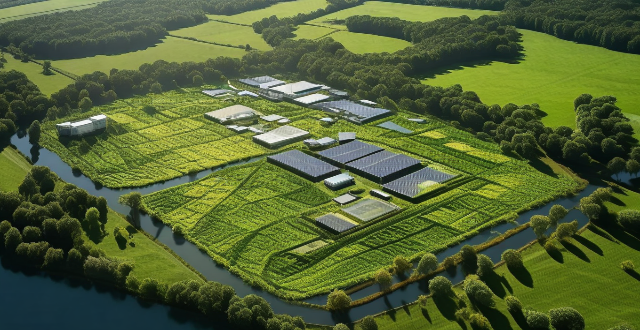

What is the importance of tree cover in urban areas ?

The text discusses the importance of tree cover in urban areas for environmental, social, and economic benefits. It highlights the role of trees in improving air quality, regulating climate, managing water, enhancing aesthetic value, building communities, reducing noise pollution, increasing property values, conserving energy, and attracting tourism. The text also suggests ways to promote tree cover in urban areas through planting initiatives, maintenance and protection, and education and awareness campaigns.