Value Term

What is the difference between term life insurance and whole life insurance ?

Difference between term life insurance and whole life insurance: - Term life insurance is temporary coverage, no cash value, renewable, and affordable. - Whole life insurance is permanent coverage, accumulates cash value, has level premiums, and is more expensive.

How is the value of carbon credits determined ?

Carbon credits are a valuable tool in the fight against climate change. Their value is determined by supply and demand, quality of the project used to generate them, and market conditions. Supply and demand can be influenced by government regulations, public opinion, and technological advancements. The quality of a carbon offset project can be influenced by verification and certification, additionality, and permanence. Market conditions such as economic growth, political stability, and global events can also impact the value of carbon credits.

How are carbon credits traded and what is their market value ?

The article discusses the trading of carbon credits, which are tradable permits allowing holders to emit certain amounts of greenhouse gases. It explains how carbon credits are traded and their market value, outlining steps in their creation, verification, issuance, trading, and retirement. It also notes that the market value of carbon credits varies based on project type, location, and demand for offsets.

How do private equity firms value companies ?

Private equity firms value companies using various methods, includingPrivate equity firms value companies using various methods, including, discounted cash flow ( These approaches help them assess the company's financial health, market position, growth potential, and risks to make informed investment decisions.

How can we measure the value of ecosystem services ?

The article discusses various methods to measure the value of ecosystem services, which are benefits humans derive from ecosystems. These include provisioning, regulating, cultural, and supporting services. Measuring their value is crucial for informed decisions about management and conservation. Methods include direct market valuation, indirect market valuation, revealed preference methods, avoided cost method, replacement cost method, and benefit transfer method. By using these techniques, policymakers and managers can make informed decisions about resource allocation for ecosystem conservation and restoration.

How can I determine the value of a second-hand item before purchasing it ?

When considering purchasing a second-hand item, itWhen considering purchasing a second-hand item, it its value to ensure you' it's important to determine its value to ensure you're getting a fair deal. Here are some steps to help you assess the value of a pre-owned item: 1. Research the market price by checking online marketplaces, consulting auction houses, and reading reviews and forums. 2. Evaluate the condition of the item by inspecting for damage, considering age and obsolescence, and testing functionality. 3. Negotiate with the seller by making an offer based on your research and evaluation, being prepared to walk away if necessary, and asking for more information if needed.

What are some proven strategies for long-term wealth accumulation ?

Long-term wealth accumulation is a goal for many individuals, and there are several proven strategies that can help achieve this objective. Here are some of the most effective approaches: 1\. Start Early: The earlier you start saving and investing, the more time your money has to grow through compound interest. 2\. Live Below Your Means: Spend less than you earn and save the difference. 3\. Invest Wisely: Choose investments that align with your goals, risk tolerance, and time horizon. Diversify your portfolio to spread risk and maximize returns. 4\. Pay Off High-Interest Debt: High-interest debt like credit card balances can be a significant obstacle to wealth accumulation. Paying off these debts should be a priority. 5\. Increase Your Income: Increasing your income can provide more resources for saving and investing, which can help accelerate wealth accumulation. 6\. Plan for Retirement: Retirement planning is an essential component of long-term wealth accumulation, ensuring you have enough funds to support yourself during your golden years. 7\. Protect Your Wealth: Ensure that your hard-earned wealth is protected against unexpected events like lawsuits, accidents, or health issues.

How can I make sure my fitness meal plan is sustainable long-term ?

A sustainable fitness meal plan is essential for achieving long-term health and wellness goals. To make it work, set realistic goals, plan ahead, incorporate variety, make it enjoyable, stay flexible, and seek professional advice.

How can I make sure I'm getting the best value for my money when shopping ?

When it comes to shopping, ensuring you're getting the best value for your money is crucial. Here are some tips to help you make informed decisions and get the most out of your purchases: 1. Research Before You Buy: Read reviews, compare prices, and check for sales and discounts. 2. Set a Budget: Determine your needs, prioritize items, and allocate funds accordingly. 3. Choose Quality Over Quantity: Invest in durable items and consider warranties and guarantees. 4. Take Advantage of Loyalty Programs: Join reward programs and use credit card rewards wisely. 5. Don't Forget About Return Policies: Understand store policies and keep receipts organized. By following these tips, you can ensure that you're getting the best value for your money when shopping. Remember to take your time, do your research, and make well-informed decisions to get the most out of your purchases.

What is the significance of setting short-term versus long-term climate targets ?

The article emphasizes the importance of setting both short-term and long-term climate targets to effectively address climate change. Short-term targets focus on immediate actions, creating urgency, measurable progress, immediate benefits, and building momentum for more ambitious goals. Long-term targets ensure sustainability, deep decarbonization, adaptation, and global cooperation. Achieving these goals is crucial for mitigating the worst effects of climate change and creating a more resilient future.

Is there a difference between short-term and long-term memory in scientific terms ?

Short-term memory and long-term memory are two different types of memory with distinct characteristics. Short-term memory has a limited capacity, typically able to hold around seven items for a brief period, while long-term memory has a large capacity, virtually unlimited, and can store vast amounts of information for an extended period. Short-term memory lasts only for a few seconds unless it is repeatedly rehearsed or transferred to long-term memory, while long-term memory can last for minutes, hours, days, years, or even a lifetime. Short-term memory acts as a temporary holding place for new information, processing it before transferring it to long-term memory, while long-term memory stores information for future use, including facts, experiences, skills, and knowledge. Short-term memory has a faster retrieval speed since the information is readily available in the mind, while long-term memory has a slower retrieval speed as it requires more effort to recall the information from the vast storage. Short-term memory is more susceptible to interference and forgetting due to its transient nature, while long-term memory is more stable and less prone to interference, making it easier to retain information over time. Short-term memory requires rehearsal or encoding processes to transfer information to long-term memory, while long-term memory involves consolidation processes that strengthen neural connections and make the memory more durable.

What is the importance of long-term climate data analysis ?

Long-term climate data analysis is crucial for understanding the Earth's climate system and its changes over time. It provides valuable insights into past climate patterns and trends, which are critical for predicting future climate conditions and developing effective adaptation strategies. By continuing to collect and analyze long-term climate data, we can better prepare ourselves for the challenges posed by a changing climate and work towards a sustainable future.

What are some long-term saving strategies ?

Saving for the long term requires a disciplined approach and a solid plan. Here are some strategies to help you save effectively over the years: 1. Set clear financial goals: short-term, medium-term, and long-term. 2. Create a budget and stick to it by tracking expenses, cutting unnecessary costs, and automating savings. 3. Build an emergency fund that is easily accessible and covers at least 3-6 months' worth of living expenses. 4. Take advantage of employer matches and maximize contributions to retirement accounts like 401(k)s and IRAs. 5. Invest wisely with diversification, risk management, and a long-term perspective. 6. Manage debt by paying off high-interest debts first and considering refinancing options. 7. Regularly review and adjust your financial plan, adapting to life changes as needed. 8. Plan for taxes by choosing tax-efficient investments and being strategic about withdrawals and contributions. 9. Consider estate planning with wills, trusts, and life insurance to protect your family's financial wellbeing. 10. Continuously learn and seek advice from financial professionals when needed. By consistently implementing these strategies, you can build a strong financial foundation for your future.

How do I invest my money wisely for long-term growth ?

Investing wisely for long-term growth involves setting financial goals, creating a diversified portfolio, considering risk tolerance, investing for the long-term, and monitoring investments regularly.

How accurate are long-term climate predictions ?

Long-term climate predictions are essential for understanding potential future changes in the environment, but their accuracy is often questioned due to the complexity of the climate system. Factors that influence the accuracy of these predictions include uncertainty in emission scenarios, natural variability, and model limitations. However, advancements in climate modeling, such as higher-resolution models, ensemble modeling, and data assimilation techniques, have significantly improved our ability to make accurate predictions about future climate changes. By continuing to invest in research and development, we can further enhance the precision and reliability of long-term climate predictions, providing critical information for decision-makers and the public alike.

What is the importance of long-term monitoring and evaluation in climate policy ?

The importance of long-term monitoring and evaluation in climate policy is discussed. Long-term monitoring and evaluation help ensure accountability for climate action, identify gaps and opportunities for improvement, inform future policies, build public trust, and promote sustainable development.

What are the best financial products for long-term investment ?

The text provides a comprehensive overview of the various financial products available for long-term investment. It explains the definition, benefits, and risks of each option including stocks, bonds, mutual funds, ETFs, and REITs. The text emphasizes the importance of considering one's investment goals, risk tolerance, and financial situation before choosing which products to include in a portfolio. Overall, the text serves as a useful guide for individuals looking to make informed decisions about their long-term investments.

How can women protect their assets and ensure long-term financial security ?

The article provides a list of strategies that women can employ to ensure their financial security over the long term. These include building an emergency fund, investing in retirement accounts, purchasing life insurance, creating a will, considering long-term care insurance, educating oneself about finance, working with a financial advisor, and prioritizing career development. Each of these steps is crucial in its own way for safeguarding one's assets and ensuring financial stability.

Is social distancing a long-term solution for controlling the spread of viruses ?

Social distancing is an effective measure for controlling the spread of viruses in the short term, but its feasibility as a long-term solution depends on various factors such as the nature of the virus, availability of medical resources, and willingness of people to adhere to guidelines. Other measures such as mask-wearing, hand hygiene, contact tracing, regular testing, and vaccine development should also be considered alongside social distancing to effectively control the spread of viruses over time.

Are electric cars more expensive than gasoline cars ?

Electric cars, also known as EVs, have been gaining popularity due to their eco-friendly nature and lower operating costs. However, the initial purchase price of an electric car is often higher than that of a traditional gasoline-powered car. In this article, we will explore the cost differences between electric and gasoline cars. ## Upfront Cost **Electric Cars:** - Higher upfront cost due to expensive battery technology and limited production scale. - Prices vary depending on the model, brand, and range. - Some governments offer incentives and tax credits to offset the high initial cost. **Gasoline Cars:** - Generally less expensive upfront compared to electric cars. - Wide variety of models and brands available at different price points. - No government incentives or tax credits for purchasing a gasoline car. ## Operating Costs **Electric Cars:** - Lower operating costs due to cheaper electricity rates compared to gasoline prices. - Maintenance costs are generally lower since there are fewer moving parts in an electric motor. - Battery replacement can be costly, but it is not expected until after several years of use. **Gasoline Cars:** - Higher operating costs due to fluctuating gasoline prices and regular maintenance requirements. - More frequent oil changes, tune-ups, and other routine maintenance tasks. - Fuel efficiency varies widely among gasoline cars, affecting overall operating costs. ## Depreciation **Electric Cars:** - Depreciation rate may be higher for electric cars due to rapid advancements in technology and changing consumer preferences. - Some early adopters may experience significant depreciation if they choose to sell their electric car before its battery lifespan ends. **Gasoline Cars:** - Generally slower depreciation rate compared to electric cars. - Well-maintained gasoline cars can retain their value for longer periods. ## Resale Value **Electric Cars:** - Resale value depends on factors such as battery health, range, and charging infrastructure availability. - As more people switch to electric cars, the demand for used electric vehicles may increase, potentially boosting resale values. **Gasoline Cars:** - Resale value is typically more predictable and stable compared to electric cars. - Factors such as fuel efficiency, brand reputation, and vehicle condition affect resale value. In conclusion, while electric cars may have a higher upfront cost, they offer lower operating costs and potentially better resale value in the future. It's essential for consumers to consider both short-term and long-term costs when deciding between an electric or gasoline car.

What are the potential long-term effects of sports injuries on adolescent development ?

Sports injuries can have a significant impact on the physical, mental, and social development of adolescents. Potential long-term effects include chronic pain, limited mobility, disfigurement, anxiety, depression, low self-esteem, PTSD, isolation, bullying, and relationship difficulties. Proper treatment and rehabilitation are crucial for minimizing these effects.

How do retailers benefit from offering a buy one get one free promotion ?

Retailers can benefit from offering a "buy one get one free" (BOGO) promotion by attracting new customers, increasing sales, managing inventory more effectively, enhancing brand perception, and collecting valuable customer data. This marketing strategy not only boosts short-term revenue but also helps build long-term customer loyalty and brand equity.

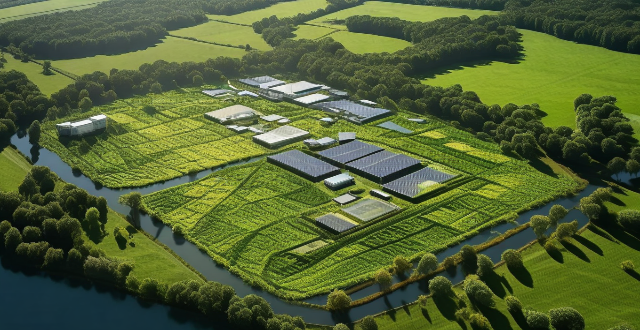

How does proper insulation contribute to energy efficiency ?

Proper insulation is crucial for energy efficiency, providing thermal comfort, reducing energy costs, and alleviating strain on power grids. It also improves indoor air quality by controlling moisture and limiting allergens. Furthermore, it decreases greenhouse gas emissions, supports sustainable living, and offers long-term economic benefits like higher property value. Implementing proper insulation involves sealing air leaks, considering R-values, and focusing on key areas like attics and basements.

How do I negotiate terms with an investor without giving away too much control ?

Negotiating terms with an investor requires careful consideration and planning. Here are some tips on how to negotiate terms with an investor without giving away too much control: 1. Understand your value proposition: Before entering into any negotiations, it's essential to understand the value of your business. This includes knowing your company's strengths, weaknesses, opportunities, and threats (SWOT analysis). 2. Set clear expectations: It's crucial to set clear expectations from the outset of the negotiation process. This means being upfront about what you're willing to give up and what you're not. 3. Focus on long-term goals: When negotiating with an investor, keep your long-term goals in mind. Consider how the terms of the investment will impact your business in the future and whether they align with your long-term vision. 4. Be willing to walk away: If an investor is asking for too much control or making unreasonable demands, don't be afraid to walk away from the deal. Remember that there are other investors out there who may be more willing to work with you on terms that suit both parties. 5. Seek legal advice: Before finalizing any agreements with an investor, seek legal advice. A lawyer can help you understand the implications of the terms being proposed and ensure that your interests are protected.

How does private equity affect corporate governance ?

Private equity (PE) plays a significant role in shaping the governance of companies. It can have both positive and negative impacts on corporate governance, depending on various factors such as the PE firm's strategy, the nature of the investment, and the target company's existing governance structure. This article will explore the ways in which private equity affects corporate governance. ### Positive Impacts of Private Equity on Corporate Governance - **Improved Decision-Making Processes**: Private equity firms often bring fresh perspectives and expertise to the decision-making processes within a company. They may introduce new management practices or technologies that enhance efficiency and productivity. This can lead to better strategic planning and more informed decisions being made by the board of directors. - **Greater Transparency and Accountability**: Private equity investors typically demand greater transparency and accountability from the companies they invest in. This can result in improved financial reporting, regular board meetings, and increased communication between management and shareholders. Such measures help to ensure that all stakeholders are kept informed about the company's performance and future plans. - **Increased Focus on Long-Term Value Creation**: Private equity firms generally have a long-term investment horizon, which means they are more likely to focus on creating value over the long term rather than pursuing short-term gains. This can lead to a greater emphasis on sustainable growth, innovation, and responsible business practices. ### Negative Impacts of Private Equity on Corporate Governance - **Potential Conflicts of Interest**: Private equity investors may have conflicts of interest with other stakeholders, such as employees, customers, or suppliers. For example, a PE firm might push for cost-cutting measures that negatively impact employee morale or customer satisfaction. These conflicts can undermine good governance practices and harm the company's reputation. - **Pressure for Short-Term Profits**: While some private equity firms focus on long-term value creation, others may prioritize short-term profits at the expense of long-term sustainability. This can lead to excessive risk-taking, aggressive financial engineering, or even fraudulent activities aimed at boosting short-term earnings. Such behaviors can ultimately damage the company's reputation and financial health. - **Lack of Diversity in Board Composition**: Private equity firms often control a majority of the seats on a company's board of directors. This can limit diversity in terms of gender, ethnicity, and professional background among board members. A lack of diversity can lead to groupthink and reduce the effectiveness of the board in providing independent oversight and guidance to management. In conclusion, private equity has both positive and negative effects on corporate governance. The key is for PE firms to balance their pursuit of profit with a commitment to ethical business practices and responsible stewardship of the companies they invest in. By doing so, they can help build stronger, more sustainable businesses that benefit all stakeholders.

Are all hybrid cars made equal or are some brands better than others ?

Hybrid cars vary in performance, reliability, and value across different brands. Brand A leads in engine efficiency, driving experience, acceleration, durability, maintenance costs, warranty, cost of ownership, resale value, and innovation. Brand B performs moderately well but lags behind Brand A in several areas. Brand C has the lowest ratings for most criteria, including durability, maintenance costs, warranty, cost of ownership, resale value, and innovation. Consumers should consider these factors when choosing a hybrid car to ensure they get the best value for their money.

Are ESG investments more resilient during economic downturns ?

The text discusses the resilience of Environmental, Social, and Governance (ESG) investments during economic downturns. It defines ESG investments as those that prioritize sustainability, fair labor practices, and transparent operations. The importance of ESG criteria is highlighted in terms of risk management, stakeholder engagement, and long-term performance. The historical performance data suggests that ESG investments have performed comparably to non-ESG investments during previous economic downturns, potentially offering diversification benefits. The impact of ESG factors on resilience is discussed, including environmental factors, social factors, and governance factors. However, risks and challenges such as market sentiment and liquidity issues are also mentioned. The conclusion emphasizes that ESG investments have shown resilience during economic downturns due to their focus on long-term value creation and risk management strategies. It suggests that a well-diversified ESG portfolio can provide a balance between financial returns and positive social and environmental impacts, even during challenging economic times.

How does climate leadership differ from traditional forms of leadership ?

Climate leadership is a specialized form of leadership that focuses on addressing the challenges and complexities associated with climate change. It differs from traditional forms of leadership in several key ways, including its scope, urgency, collaborative nature, and long-term perspective. Climate leadership addresses global issues that affect the entire planet and all its inhabitants, while traditional leadership often focuses on organizational goals, profits, or specific projects. Climate leadership operates with a sense of urgency due to the accelerating pace of climate change, while traditional leadership may operate on a more relaxed timeline. Climate leadership emphasizes horizontal integration and networked governance structures, engaging with external stakeholders such as governments, NGOs, and international bodies. In contrast, traditional leadership typically operates within a hierarchical structure where decision-making is centralized. Climate leadership considers the long-term implications of decisions for future generations and prioritizes sustainable practices that balance economic growth with environmental stewardship. Traditional leadership tends to focus on quarterly results or annual performance targets and may prioritize short-term gains over long-term sustainability. Climate leadership encourages innovation and experimentation to find new solutions to complex problems and fosters a learning environment where failure is seen as an opportunity for growth. Traditional leadership may rely on established methods and processes and can be resistant to change if it disrupts current operations. Finally, climate leadership places ethical considerations at the forefront, acknowledging the moral imperative to act and recognizing the interconnectedness of environmental health with social equity and justice. In contrast, traditional leadership is often centered on legal compliance and shareholder value, with ethics being secondary to profitability and efficiency. In summary, climate leadership demands a broader vision, greater urgency, extensive collaboration, a long-term outlook, continual innovation, and a strong ethical foundation. It requires leaders who are not only skilled in their respective fields but also possess a deep understanding of environmental issues and the ability to inspire collective action towards a more sustainable future.

What are the risks associated with investing in financial products ?

Investing in financial products can be a great way to grow your wealth, but it's important to understand the risks involved. Here are some of the key risks associated with investing in financial products: 1. Market risk refers to the possibility that an investment may lose value due to changes in market conditions. 2. Credit risk is the risk that a borrower or counterparty will fail to meet its obligations under a financial contract. 3. Interest rate risk is the risk that changes in interest rates will negatively impact the value of an investment. 4. Inflation risk is the risk that inflation will erode the purchasing power of your investments over time. 5. Liquidity risk is the risk that you may not be able to sell your investment quickly without affecting its price. 6. Currency risk is the risk that fluctuations in exchange rates will negatively impact the value of your investments. 7. Concentration risk is the risk that your portfolio is too heavily invested in a single asset class, sector, or geographic region. 8. Tax risk is the risk that changes in tax laws or regulations will negatively impact the after-tax returns of your investments. 9. Fraud risk is the risk that you may be victimized by fraudulent activities related to your investments.