Value Trading

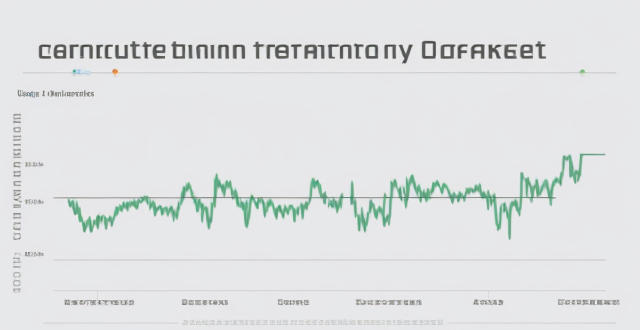

How are carbon credits traded and what is their market value ?

The article discusses the trading of carbon credits, which are tradable permits allowing holders to emit certain amounts of greenhouse gases. It explains how carbon credits are traded and their market value, outlining steps in their creation, verification, issuance, trading, and retirement. It also notes that the market value of carbon credits varies based on project type, location, and demand for offsets.

What are the risks associated with investing in the carbon trading market ?

The carbon trading market offers lucrative investment opportunities but also carries significant risks, including price volatility, lack of transparency, legal and regulatory changes, and environmental impacts. To mitigate these risks, investors should diversify their portfolios, conduct thorough research, stay updated on regulatory changes, and consider the environmental impact of their investments. By taking these steps, investors can potentially reduce their exposure to risks while still benefiting from the profitability of the carbon trading market.

How can I invest in the carbon trading market ?

The carbon trading market offers a lucrative investment opportunity for those interested in environmental sustainability and financial gain. To invest successfully, one should understand the basics of carbon trading, research different carbon markets, choose a broker or exchange, determine an investment strategy, and start trading while managing risk.

What is the carbon trading market ?

The carbon trading market is a financial mechanism that allows for the trading of emissions reductions to meet greenhouse gas emission targets. It is based on cap-and-trade, where a limit is set on total emissions and those who reduce their emissions below the cap can sell their surplus allowances. Key components include carbon credits, emissions caps, trading mechanisms, verification and certification, and regulation and governance. Benefits include cost-effectiveness, flexibility, innovation incentives, and global collaboration. Challenges and criticisms include equity concerns, market inefficiencies, environmental integrity, and political will. The carbon trading market serves as a crucial tool in the fight against climate change but requires ongoing attention and improvement to maximize its effectiveness.

How does the carbon trading market work ?

The carbon trading market is a mechanism designed to reduce greenhouse gas emissions by providing economic incentives for their reduction, operating on the principle of "cap and trade." It involves setting a cap on the total amount of greenhouse gases that can be emitted by regulated entities, who can then buy and sell allowances or credits for emissions. The process includes establishing the cap, allocating allowances, trading allowances, banking allowances, offsetting emissions through projects, verification and certification, regulation and oversight, and dealing with benefits and criticisms.

How do emission trading schemes work and are they effective ?

Emission trading schemes are market-based mechanisms designed to regulate the release of pollutants, especially greenhouse gases like CO2. These schemes operate on a "cap and trade" principle, whereby a regulatory body sets a limit on emissions, allocates emission allowances, and allows businesses to buy and sell these allowances in a marketplace. Companies must monitor and report their emissions, facing penalties for non-compliance. The effectiveness of such schemes varies but offers advantages like cost-efficiency, flexibility, and innovation incentives. However, challenges include complexity, political will, leakage, and equity concerns. Case studies like the EU ETS and California's Cap-and-Trade Program show mixed results, indicating that while emission trading schemes can be effective, their success depends on careful planning, robust implementation, and continuous evaluation.

What are the benefits of participating in the carbon trading market ?

Participating in the carbon trading market offers a multitude of benefits, which can be categorized into environmental, economic, and social aspects. Here are some of the key advantages: 1. **Environmental Benefits**: - Reduction in Greenhouse Gas Emissions: The primary goal of carbon trading is to reduce greenhouse gas emissions by creating financial incentives for companies to adopt cleaner technologies and practices. This helps to mitigate climate change and its associated impacts on ecosystems and biodiversity. - Promotion of Renewable Energy Sources: As companies strive to reduce their carbon footprint, they are more likely to invest in renewable energy sources such as solar, wind, and hydroelectric power. This shift towards green energy promotes sustainable development and reduces reliance on fossil fuels. - Enhanced Energy Efficiency: Carbon trading encourages businesses to improve their energy efficiency, leading to reduced energy consumption and lower operating costs. This results in fewer resources being used and less waste generated. 2. **Economic Benefits**: - Creation of New Industries and Jobs: The growth of the carbon trading market has led to the emergence of new industries focused on developing and implementing low-carbon technologies. These industries create job opportunities and contribute to economic growth. - Potential for Profitability: Companies that effectively manage their carbon emissions can generate additional revenue by selling excess emission allowances or credits. This provides an incentive for businesses to become more environmentally friendly while also increasing their profitability. - Access to International Markets: Participation in the carbon trading market allows companies to access global markets and take advantage of international trade opportunities related to low-carbon products and services. 3. **Social Benefits**: - Improved Public Health: By reducing air pollution caused by greenhouse gas emissions, carbon trading can lead to improved public health outcomes. This includes reductions in respiratory illnesses, heart disease, and other health issues associated with poor air quality. - Increased Awareness and Education: The existence of a carbon trading market raises public awareness about climate change and its implications. This increased understanding can drive behavioral changes among consumers, leading to more sustainable choices and lifestyles. - Community Engagement: Carbon trading projects often involve local communities, providing opportunities for community engagement and empowerment. This can lead to improved infrastructure, enhanced educational programs, and increased social cohesion within affected areas.

How does the carbon trading market contribute to reducing greenhouse gas emissions ?

Carbon trading markets are a key tool in the global fight against climate change by offering economic incentives for reducing greenhouse gas emissions. They set a price on carbon, encouraging businesses to invest in cleaner technologies and practices. These markets also promote innovation, international cooperation, and the implementation of robust regulatory frameworks. Additionally, they raise public awareness about the importance of combating climate change. Overall, carbon trading markets play a crucial role in mitigating the effects of climate change by creating a structured approach to reducing GHG emissions.

What are the most popular platforms for second-hand trading ?

The text discusses various popular platforms for second-hand trading, which are categorized into online marketplaces, specialty websites, auction houses, and consignment stores. The online marketplaces include eBay, Craigslist, and Facebook Marketplace, with their pros and cons highlighted. Specialty websites such as Poshmark, Reverb, and OfferUp cater to specific interests or industries. Auction houses like Sotheby's and Heritage Auctions offer high-end items but come with higher fees. Consignment stores including Buffalo Exchange and Plato's Closet provide an in-person shopping experience with a focus on sustainability. These platforms cater to different needs and preferences when it comes to second-hand trading, allowing users to find unique items at a lower cost or declutter their homes.

What are the potential benefits and drawbacks of using market-based mechanisms like carbon trading in global climate governance ?

The text discusses the potential benefits and drawbacks of using market-based mechanisms like carbon trading in global climate governance. The benefits include cost-effectiveness, flexibility and innovation, economic incentives, and global cooperation. However, there are also drawbacks such as equity concerns, complexity, uncertainty, and lack of public acceptance. It is important to consider these factors carefully when designing a carbon trading system to ensure that it is equitable, transparent, and effective in reducing carbon emissions.

How do private equity firms value companies ?

Private equity firms value companies using various methods, includingPrivate equity firms value companies using various methods, including, discounted cash flow ( These approaches help them assess the company's financial health, market position, growth potential, and risks to make informed investment decisions.

How is the value of carbon credits determined ?

Carbon credits are a valuable tool in the fight against climate change. Their value is determined by supply and demand, quality of the project used to generate them, and market conditions. Supply and demand can be influenced by government regulations, public opinion, and technological advancements. The quality of a carbon offset project can be influenced by verification and certification, additionality, and permanence. Market conditions such as economic growth, political stability, and global events can also impact the value of carbon credits.

How can we measure the value of ecosystem services ?

The article discusses various methods to measure the value of ecosystem services, which are benefits humans derive from ecosystems. These include provisioning, regulating, cultural, and supporting services. Measuring their value is crucial for informed decisions about management and conservation. Methods include direct market valuation, indirect market valuation, revealed preference methods, avoided cost method, replacement cost method, and benefit transfer method. By using these techniques, policymakers and managers can make informed decisions about resource allocation for ecosystem conservation and restoration.

Who are the main participants in the carbon trading market ?

The carbon trading market is a complex ecosystem involving various stakeholders who play crucial roles in reducing greenhouse gas emissions and promoting sustainable development. These participants include governments and regulatory bodies, companies and businesses, investors and financial institutions, project developers and consulting firms, and NGOs and environmental groups. Governments establish the legal framework and policies that govern the market, while companies are required to hold sufficient allowances to cover their emissions or purchase additional allowances if needed. Investors provide liquidity by buying and selling allowances based on their expectations of future price movements. Project developers design and implement projects that generate credits for sale on the carbon market, working closely with governments, companies, and investors. NGOs and environmental groups advocate for stronger climate policies and support initiatives that promote sustainable development.

How do I choose a reliable cryptocurrency exchange platform ?

This guide offers a comprehensive checklist for selecting a trustworthy cryptocurrency exchange platform, emphasizing security measures, user interface, trading volume and liquidity, fees, coin support, regulation compliance, and reputation. It encourages potential users to consider factors such as two-factor authentication, cold storage, encrypted data, regular audits, clean layout, mobile accessibility, customer support, high trading volume, liquid markets, transparent fee structures, available coins, trading pairs, licensed operations, AML and KYC compliance, as well as online reviews and community feedback to make an informed decision.

How can I determine the value of a second-hand item before purchasing it ?

When considering purchasing a second-hand item, itWhen considering purchasing a second-hand item, it its value to ensure you' it's important to determine its value to ensure you're getting a fair deal. Here are some steps to help you assess the value of a pre-owned item: 1. Research the market price by checking online marketplaces, consulting auction houses, and reading reviews and forums. 2. Evaluate the condition of the item by inspecting for damage, considering age and obsolescence, and testing functionality. 3. Negotiate with the seller by making an offer based on your research and evaluation, being prepared to walk away if necessary, and asking for more information if needed.

How can I make sure I'm getting the best value for my money when shopping ?

When it comes to shopping, ensuring you're getting the best value for your money is crucial. Here are some tips to help you make informed decisions and get the most out of your purchases: 1. Research Before You Buy: Read reviews, compare prices, and check for sales and discounts. 2. Set a Budget: Determine your needs, prioritize items, and allocate funds accordingly. 3. Choose Quality Over Quantity: Invest in durable items and consider warranties and guarantees. 4. Take Advantage of Loyalty Programs: Join reward programs and use credit card rewards wisely. 5. Don't Forget About Return Policies: Understand store policies and keep receipts organized. By following these tips, you can ensure that you're getting the best value for your money when shopping. Remember to take your time, do your research, and make well-informed decisions to get the most out of your purchases.

What are the challenges and opportunities for developing countries in the carbon trading market ?

Challenges and opportunities for developing countries in the carbon trading market include lack of infrastructure, legal and regulatory hurdles, market access and information asymmetry, capacity building needs, economic growth and investment, technology transfer and innovation, environmental sustainability, policy influence and leadership.

What are the risks associated with investing in financial products ?

Investing in financial products can be a great way to grow your wealth, but it's important to understand the risks involved. Here are some of the key risks associated with investing in financial products: 1. Market risk refers to the possibility that an investment may lose value due to changes in market conditions. 2. Credit risk is the risk that a borrower or counterparty will fail to meet its obligations under a financial contract. 3. Interest rate risk is the risk that changes in interest rates will negatively impact the value of an investment. 4. Inflation risk is the risk that inflation will erode the purchasing power of your investments over time. 5. Liquidity risk is the risk that you may not be able to sell your investment quickly without affecting its price. 6. Currency risk is the risk that fluctuations in exchange rates will negatively impact the value of your investments. 7. Concentration risk is the risk that your portfolio is too heavily invested in a single asset class, sector, or geographic region. 8. Tax risk is the risk that changes in tax laws or regulations will negatively impact the after-tax returns of your investments. 9. Fraud risk is the risk that you may be victimized by fraudulent activities related to your investments.

In what industries is blockchain being explored currently ?

Blockchain technology is being explored across various industries to improve transparency, security, and efficiency. Here's a summary of its applications in different sectors: 1. **Finance and Banking**: Secure and efficient financial operations like international money transfers, smart contracts, trading, clearing, and loyalty rewards programs. 2. **Healthcare**: Secure patient data management, clinical trials, drug traceability, and insurance claims processing. 3. **Supply Chain Management**: End-to-end traceability for food safety, pharmaceutical supply chain, luxury goods authentication, and carbon credit trading. 4. **Real Estate**: Efficient property transactions, ownership records, rent collection, and dispute resolution. 5. **Education**: Verification and secure storage of academic credentials, lifelong learning records, and scholarship disbursements. 6. **Governance**: Transparent voting systems, public records management, and identity verification. 7. **Art and Entertainment**: Creation of unique digital assets like NFTs for artwork, music, films, ensuring authenticity and provenance.

How is the price of carbon credits determined in the carbon trading market ?

The price of carbon credits in the carbon trading market is determined by various factors, including supply and demand, regulatory policies, and market dynamics. The balance between supply and demand significantly affects the price, with high demand increasing the price and oversupply decreasing it. Regulatory policies such as cap-and-trade systems and carbon taxes also play a crucial role in setting limits on emissions and creating incentives for companies to reduce their emissions or purchase carbon credits to offset them. Market dynamics such as speculation, liquidity, and transparency can also impact the price of carbon credits. As awareness of climate change grows, the demand for carbon credits is likely to increase, driving up their price. However, ensuring transparent and efficient operation of the carbon market is essential to maximize its potential benefits for both companies and the environment.

How does climate change impact the nutritional value of crops ?

Climate change is affecting the nutritional value of crops by altering CO2 levels, temperature fluctuations, and water availability. Elevated CO2 concentrations can lead to nutrient dilution in staple crops like wheat, rice, and soybeans. Temperature extremes cause protein denaturation and interfere with enzyme function, reducing nutrient content. Water stress from drought or flooding impairs nutrient uptake and synthesis. Adaptation strategies include breeding resilient crop varieties, implementing efficient irrigation systems, and using protective structures against extreme temperatures. By addressing these challenges, it's possible to maintain crop nutrition amidst climate change impacts.

Can I get money for recycling my old iPhone ?

You can get money for recycling your old iPhone by selling it online, trading it in at a store, or recycling it through Apple's program. Selling online allows you to set your price and reach a large audience, but may take time and require dealing with shipping and payment issues. Trading in at a store is convenient and doesn't require finding a buyer, but the trade-in value may be lower than selling it yourself. Recycling through Apple's program is environmentally friendly and gives you a gift card, but the value may be lower than other options and requires packaging and shipping your iPhone. Choose the option that works best for you based on your needs and preferences.

How do I maximize the value of coupons and promotional codes ?

Coupons and promotional codes are a great way to save money on your purchases. Here are some tips: 1. Use Them Wisely: Combine coupons and stack promotions for maximum savings. 2. Plan Ahead: Check expiration dates and plan your shopping trips accordingly. 3. Be Strategic: Use coupons on high-value items and stock up on essentials when they go on sale. 4. Sign Up for Rewards Programs: Join loyalty programs and follow brands on social media for exclusive offers.

How often do exchange rates fluctuate ?

Exchange rates, which determine the value of one currency in relation to another, are subject to constant fluctuations influenced by various factors such as economic indicators, political events, market speculation, and central bank policies. These fluctuations occur at different frequencies ranging from intraday to yearly intervals and can significantly impact traders, investors, and businesses involved in international trade. It is crucial for these entities to stay informed about exchange rate movements to make well-informed financial decisions.

Are there any restrictions on how I can use my credit card rewards ?

Using credit card rewards can save money and add value to purchases, but it's crucial to understand potential restrictions. Restrictions may include limited redemption options, expiration dates, minimum thresholds, blackout dates/capacity controls for travel expenses, transfer partnership requirements, and tax implications. By understanding these limitations, you can maximize the value of your rewards while avoiding surprises.

Can I trade in my old iPhone for a new one ?

This article discusses various options for trading in an old iPhone for a new one, including Apple's trade-in program, carrier trade-in programs, and third-party trade-in websites. It highlights the benefits and considerations of each option and provides tips on how to get the most value for your old device.

What are the taxes and duties involved in global shopping ?

Global shopping popularity has grown, but understanding the taxes and duties involved is crucial for informed purchasing decisions. Types of taxes and duties include import duty, value added tax (VAT), customs clearance fee, and excise tax. To calculate these charges, one needs to know the product category, country of origin, value of goods, and local tax laws. The responsibility for payment can be on either the seller or the buyer, depending on the transaction terms. To avoid unexpected charges, research before buying, ask for a full cost breakdown, and consider using a package forwarding service.

What is the difference between term life insurance and whole life insurance ?

Difference between term life insurance and whole life insurance: - Term life insurance is temporary coverage, no cash value, renewable, and affordable. - Whole life insurance is permanent coverage, accumulates cash value, has level premiums, and is more expensive.