Week Budget

Are there specific days of the week or times of the month when sales are most common ?

This text discusses common patterns and trends in sales throughout the week and month. It suggests that there are certain days of the week and times of the month when sales tend to be higher or lower, depending on the industry, product, and target audience. The text provides general insights for each day of the week and different times of the month, such as Monday being a slower start to the week with people getting back into their routines after the weekend, Tuesday showing an uptick in sales as the workweek progresses, Wednesday offering midweek deals, Thursday seeing increased sales in certain categories as customers plan for the weekend, Friday experiencing a spike in sales due to weekend excitement, Saturday being a busy retail day due to more free time, and Sunday having tapering off sales as people prepare for the upcoming week. The text also suggests that there are certain times of the month when sales are most common, such as the beginning of the month when many consumers receive their paychecks and have more spending power, mid-month when people adjust their budgets and look for deals or necessities they've run out of, and the end of the month when businesses aim to meet monthly targets and offer promotions to boost numbers before the month ends. However, the text emphasizes that these trends are general and that it's important to analyze one's own business data and customer behavior to determine the best timing for sales and promotions. Additionally, external factors such as holidays, seasonality, and economic conditions can also significantly influence sales patterns.

How much money do top football players earn per week ?

Top football players can earn a significant amount of money per week, with factors such as performance, club affiliation, market value, sponsorship deals, and image rights affecting their earnings. Some of the highest-paid players, like Lionel Messi and Cristiano Ronaldo, can earn millions per week when taking into account their salary, bonuses, and endorsements. However, it's important to note that these earnings are the result of immense talent, hard work, and dedication to the sport.

How much exercise is needed per week to prevent chronic disease ?

Chronic diseases are a major cause of death and disability worldwide. Regular physical activity can help reduce the risk of developing chronic diseases such as heart disease, diabetes, and some types of cancer. According to the World Health Organization (WHO), adults should aim to do at least 150 minutes of moderate-intensity aerobic exercise or 75 minutes of vigorous-intensity aerobic exercise each week, along with muscle-strengthening activities at least twice a week. However, the amount of exercise needed to prevent chronic diseases may vary depending on individual factors such as age, sex, body weight, and overall health status. It's recommended that people try to incorporate at least 30 minutes of moderate-intensity aerobic exercise into their daily routine, along with strength training exercises whenever possible.

How do I meal prep for a week using simple home-cooked recipes ?

Meal prepping is an excellent way to save time, money, and ensure that you are eating healthy meals throughout the week. Here's how you can meal prep for a week using simple home-cooked recipes: 1. Plan your meals based on your dietary needs, preferences, and schedule. 2. Shop for ingredients according to your meal plan. 3. Prep your ingredients ahead of time by washing, chopping, and storing them in airtight containers. 4. Cook and assemble your meals into individual portions and store them in meal prep containers. 5. Reheat and enjoy your pre-made meals throughout the week. By following these steps, you can successfully meal prep for an entire week using simple home-cooked recipes.

What are some tips for managing an education budget effectively ?

The article provides effective tips for managing an education budget, including creating a budget plan, tracking spending, looking for scholarships and grants, considering part-time work or freelancing, reducing unnecessary expenses, and planning ahead for future expenses. It emphasizes the importance of staying organized, prioritizing expenses, and seeking out funding opportunities to ensure that students have the resources they need to succeed in their academic pursuits.

Is there a specific amount of exercise needed per week to see mental health benefits ?

The article discusses the importance of exercise for mental health and explores if there is a specific amount of exercise needed per week to see mental health benefits. It mentions that various health organizations have established guidelines for the recommended amount of exercise per week for adults, focusing on physical health outcomes but also acknowledging the mental health benefits associated with regular exercise. The article suggests that engaging in at least 150 minutes of moderate-intensity exercise per week can lead to significant improvements in mental health, alternatively performing at least 75 minutes of vigorous-intensity exercise per week can also yield positive results. A combination of moderate and vigorous exercises can provide a well-rounded approach to enhancing mental well-being.

How can I create an effective education budget plan ?

Creating an effective education budget plan involves identifying educational goals, determining expenses, evaluating financial resources, creating a budget timeline, tracking spending, and reviewing and revising the budget regularly. This process helps ensure that you have the necessary funds to cover your educational expenses while achieving your academic objectives responsibly.

What are the best practices for setting a personal budget ?

The article outlines best practices for setting a personal budget to achieve financial stability and success. It suggests determining income, listing expenses, setting financial goals, creating a budget plan, tracking spending, and adjusting the budget as needed.

How many times a week should I practice yoga poses to see results ?

Practicing yoga poses is an excellent way to improve your flexibility, strength, and overall well-being. However, the frequency of your practice can greatly impact the results you achieve. In this article, we will discuss how many times a week you should practice yoga poses to see noticeable improvements in your physical and mental health. Before determining the ideal number of yoga sessions per week, it's essential to consider several key factors: your current fitness level and experience with yoga, the amount of time you can dedicate to each session, and your specific goals (e.g., increased flexibility, stress relief, muscle building). By taking these factors into account, you can create a personalized yoga routine that suits your needs and helps you achieve your desired outcomes. For beginners, starting with two or three sessions per week is generally recommended. This allows your body to gradually adapt to the postures and prevents overexertion or injury. As you become more comfortable with the practice, you can gradually increase the frequency of your sessions. Once you have established a consistent yoga practice and gained some experience, increasing the frequency of your sessions can help you continue to see progress. For intermediate practitioners, aiming for four to five sessions per week is often beneficial. This allows you to maintain your current level of flexibility and strength while also challenging yourself to try more advanced postures and sequences. Advanced yogis who have been practicing for several years may choose to practice daily or even multiple times per day. This level of commitment requires a significant amount of time, discipline, and dedication but can lead to profound transformations in both physical ability and mental clarity. Regardless of how frequently you choose to practice yoga poses, there are several tips that can help you maximize the benefits of your sessions: set clear goals, mix up your routine, stay hydrated, and listen to your body. By following these guidelines and adjusting your frequency based on your individual needs and goals, you can create a yoga practice that leads to lasting improvements in both your physical and mental well-being.

How do I plan a backpacking trip on a budget ?

This guide outlines how to plan a budget-friendly backpacking trip by defining a realistic budget, choosing an affordable destination, traveling during off-peak season, opting for budget accommodations, cooking own meals, using public transport, engaging in free activities, packing light, staying connected affordably, and not skimping on trip insurance. It emphasizes the importance of research, flexibility, and openness to new experiences for a memorable adventure without financial strain.

What are the best budget-friendly family meals ?

When it comes to feeding a family on a budget, there are plenty of delicious and nutritious meal options that won't break the bank. Here are some of the best budget-friendly family meals: 1. Spaghetti with Meat Sauce 2. Chicken Stir Fry 3. Baked Potatoes with Toppings 4. Tacos 5. Roasted Vegetables and Quinoa Salad

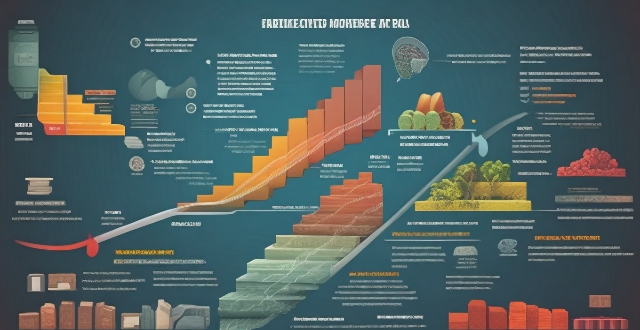

How do I create a budget plan for my small business ?

This guide provides a step-by-step approach to creating a budget plan for small businesses, emphasizing the importance of defining business goals, analyzing financial data, categorizing expenses, setting realistic revenue projections, determining break-even points, and allocating funds accordingly. It also stresses the need for regular monitoring and adjustments to the budget, along with tips for effective budget management such as staying flexible, using budgeting tools, seeking professional advice, communicating with the team, and reviewing past budgets.

What are the key factors to consider when planning an education budget ?

The text provides a comprehensive guide on the key factors to consider when planning an education budget. These factors include student population, curriculum and program offerings, faculty and staff salaries, infrastructure and maintenance costs, technology and digital learning tools, professional development opportunities, student support services, community partnerships and collaborations, and contingency funding. By considering these factors, one can create a budget that meets the educational needs of students while staying within financial constraints.

How can I track and monitor my education budget plan effectively ?

Effectively tracking and monitoring your education budget plan is crucial for managing finances and achieving academic goals without unnecessary debt. Strategies include setting clear goals, creating a comprehensive budget, using financial tools, regularly tracking expenses, making adjustments as needed, and seeking professional advice when necessary. Following these steps can help you stay on track financially while pursuing your academic objectives.

How can I find the best holiday gifts within a specific budget ?

Finding the best holiday gifts within a specific budget can be challenging, but with careful planning and research, it is possible. Set your budget, make a list of people to buy for, research gift ideas, compare prices, consider alternatives to traditional gifts, start early, and use credit card rewards to find great gifts that won't break the bank.

Is there a specific formula for allocating funds in a startup budget ?

This guide provides a structured approach for startup budget allocation, emphasizing the importance of understanding the basic components of a budget and key areas of investment such as product development, marketing and sales, operational expenses, and contingency funds. It suggests following the 50/30/20 rule as a starting point and emphasizes the need for regular reviews and adaptability to ensure scalability and growth.

In what situations is it important to involve a financial advisor in budget planning ?

Involving a financial advisor in budget planning is crucial during significant life events, large investments, debt management, retirement planning, and tax planning. A professional can help develop a budget that meets short-term needs while achieving long-term goals.

How do I manage unexpected expenses within my budget ?

Unexpected expenses can be managed within your budget by establishing an emergency fund, reviewing and adjusting your budget, prioritizing expenses, considering short-term solutions, negotiating and seeking assistance, avoiding taking on debt, planning for future expenses, and staying vigilant with your budget. Start small with saving for emergencies, identify non-essential expenses to cut back on, prioritize essential expenses, consider side hustles or selling unused items for extra income, negotiate bills and seek assistance when needed, avoid high-interest loans, learn from past experiences to anticipate future expenses, and regularly review and adjust your budget as circumstances change.

What is the ideal duration for a European backpacking holiday ?

The ideal duration for a European backpacking holiday depends on factors such as budget, travel style, and the number of destinations. A short trip (1-2 weeks) is suitable for those with limited time or a tight budget, focusing on one or two countries or regions. A medium-length trip (3-4 weeks) allows for a more balanced approach, visiting several countries or regions and spending enough time in each location. A long trip (5 weeks or more) is ideal for those with a flexible schedule and budget, providing ample time to explore multiple countries and off-the-beaten-path destinations.

How do I create a budget for a special project at work ?

Creating a budget for a special project at work requires careful planning and consideration of various factors. Here are some steps to help you create an effective budget: 1. Define the project scope, including goals, objectives, and deliverables. 2. Identify all resources needed, such as personnel, equipment, software, and materials. 3. Estimate costs associated with each resource, including direct and indirect costs. 4. Determine funding sources and how much funding is available. 5. Create a timeline with key milestones and deadlines. 6. Assign responsibilities for managing different aspects of the budget. 7. Regularly monitor progress and adjust the budget as needed.

How can I stick to my budget without feeling deprived ?

Sticking to a budget is easier when you don't feel deprived. Here's how to do it: 1. **Set Realistic Goals**: Break down your financial goals into smaller, more manageable ones and make them specific and measurable. 2. **Prioritize Your Expenses**: Categorize your expenses into essential and non-essential, and differentiate between needs and wants. 3. **Find Alternatives**: Consider DIY projects and buying used items instead of new ones to save money. 4. **Track Your Spending**: Use budgeting apps or visual aids to monitor your expenses and progress toward your financial goals. 5. **Reward Yourself**: Allow yourself small treats for sticking to your budget and plan larger rewards for achieving long-term financial goals. 6. **Stay Motivated**: Keep reminders of your financial goals visible and share your goals with friends or family members who can provide support.

What are some common pitfalls when creating a household budget ?

When creating a household budget, people often fall intoWhen creating a household budget, people often fall into can lead to financial difficulties and people often fall into common pitfalls that can lead to financial difficulties and make it harder to achieve financial goals. These pitfalls include not tracking expenses, underestimating expenses, ignoring debt repayment, failing to plan for emergencies, and overspending on non-essentials. To avoid these mistakes, people should keep track of all expenses, be realistic when estimating expenses, prioritize paying off high-interest debt, set aside money for emergencies, and limit discretionary spending. By avoiding these pitfalls, people can create a budget that works for them and helps them achieve their financial goals.

Can you recommend any budget-friendly gym equipment ?

The text offers recommendations for budget-friendly gym equipment, including multi-functional fitness equipment like adjustable dumbbells, resistance bands, and a jump rope; bodyweight training essentials such as a pull-up bar, push-up stands, and an ab wheel; and additional accessories like a gym mat, foam roller, and kettlebell. These affordable items can help achieve fitness goals without the need for expensive gear or a gym membership.

How can I ensure that my education budget plan is sustainable in the long term ?

Proper planning and management of an education budget are crucial for ensuring its long-term sustainability. Here's how you can achieve that: * Establish clear goals that are specific, measurable, achievable, relevant, and time-bound (SMART). * Conduct a thorough analysis of your current financial situation, projected costs, and sources of funding. * Create a comprehensive plan that includes budget allocation, revenue streams, and expense tracking. * Review and adjust the plan periodically to adapt to changes in personal circumstances, market conditions, or educational requirements. * Seek professional advice from financial advisors and education counselors to ensure the best outcomes.

How can I make a family dinner more budget-friendly ?

The article provides various tips for making family dinners more budget-friendly, including meal planning, buying in bulk, cooking from scratch, shopping seasonally, using leftovers creatively, avoiding impulse buys, and sharing meals with friends or family. By following these suggestions, families can save money while still enjoying tasty and nutritious home-cooked meals.

How can I avoid impulse buying and stick to my budget ?

Impulse buying is a common problem for many people, but there are strategies you can use to avoid it and stick to your budget. Creating a budget, setting financial goals, using cash instead of credit cards, avoiding temptation, and practicing mindful spending are all effective ways to control your spending and achieve your financial objectives. By implementing these strategies, you can take control of your finances and make progress towards your long-term goals.

What are some effective ways to save money while shopping ?

Shopping can be enjoyable but also strain budgets. Effective ways to save money include making a shopping list, using coupons and promo codes, buying in bulk for non-perishable items, taking advantage of seasonal sales, comparing prices, and avoiding impulse buys. Planning ahead and setting a budget can help stick to necessary purchases and avoid overspending.

What are some common mistakes people make when planning an education budget ?

Planning an education budget is crucial for achieving academic and professional goals, but common mistakes can cause financial difficulties. Mistakes include underestimating costs by failing to account for all expenses or ignoring hidden fees, overlooking future opportunities like extracurricular activities or networking events, misjudging financial aid and scholarships, disregarding potential income sources such as part-time work or skill-based services, and inadequate contingency planning without an emergency fund or considering changes in personal circumstances. Avoiding these pitfalls can lead to a more realistic and effective education budget that supports your academic journey without unnecessary stress or debt.

What are some resources available to help me with education budget planning ?

Education budget planning is crucial for managing finances and ensuring sufficient funds for educational expenses. Various resources are available to assist in this process, including government websites, college websites, scholarship search engines, financial aid consultants, online tools, and personal finance apps. These resources provide information on financial aid, scholarships, grants, loans, tuition fees, payment plans, and personalized guidance for securing funding. By utilizing these resources, individuals can effectively plan their education budget and achieve their academic goals.

How can I make a healthy breakfast on a budget ?

How to make a healthy breakfast on a budget: plan ahead, buy in bulk, cook at home, use seasonal produce, don't skip protein, get creative with leftovers, and keep it simple.