Bank Stability

What is the role of international organizations in financial regulation ?

International organizations are crucial in financial regulation, promoting stability, cooperation, and coordination among countries. They set global standards, enhance coordination, provide policy advice, facilitate information exchange, and monitor market developments. The Basel Committee on Banking Supervision, International Organization of Securities Commissions, and International Association of Insurance Supervisors develop regulatory standards for banks, securities regulators, and insurance, respectively. The Financial Stability Board coordinates international financial regulation, while the Bank for International Settlements facilitates cooperation among central banks. The World Bank and IMF offer technical assistance and support for financial sector development and reform. The Committee on Payment and Settlement Systems promotes payment system stability, and the Joint Forum of Tax Administrations addresses tax evasion. The Global Financial Stability Report and Early Warning Exercises monitor market developments and emerging risks. Overall, these organizations help ensure financial stability, reduce systemic risks, and foster a more transparent and resilient global financial system.

How does social harmony impact economic development and stability ?

Social harmony is essential for economic development and stability, as it increases productivity, reduces conflict, improves governance, attracts foreign investment, and enhances social cohesion.

Should I use a bank or a currency exchange service ?

When it comes to exchanging currencies, you have two main options: banks and currency exchange services. Both have their advantages and disadvantages, so it's important to consider your specific needs before making a decision. Advantages of Using a Bank: - Security: Banks are generally considered more secure than currency exchange services because they are regulated by government agencies. Your money is protected by insurance policies, such as the Federal Deposit Insurance Corporation (FDIC) in the United States. - Convenience: Many banks offer online and mobile banking services, allowing you to easily manage your account and make transactions from anywhere. You can also withdraw cash from ATMs worldwide without additional fees. - Fees: Banks typically charge lower fees for currency exchange compared to currency exchange services. Some banks even offer fee-free currency exchange if you have an account with them. Advantages of Using a Currency Exchange Service: - Better Exchange Rates: Currency exchange services often offer better exchange rates than banks because they specialize in foreign currency exchange. This means you can get more money for your currency than if you were to use a bank. - No Fees: Many currency exchange services do not charge any fees for exchanging currencies. However, some may still charge a small commission or service fee. - Speed: Currency exchange services are usually faster than banks when it comes to exchanging currencies. They often have shorter processing times and can provide you with the currency you need quickly. Disadvantages of Using a Bank: - Limited Availability: Not all banks offer foreign currency exchange services, especially smaller local banks. You may need to visit multiple banks to find one that offers this service. - Higher Fees: As mentioned earlier, banks typically charge higher fees for currency exchange compared to currency exchange services. This can add up quickly if you need to exchange large amounts of currency. Disadvantages of Using a Currency Exchange Service: - Security Risks: Currency exchange services are not regulated by government agencies like banks are. This means there is a higher risk of fraud or theft when using these services. - Limited Locations: Currency exchange services may not be available in all locations, especially in rural areas or smaller towns. You may need to travel to a larger city or airport to find one. - Limited Services: Currency exchange services typically only offer foreign currency exchange and do not provide other banking services like checking accounts or loans. If you need additional financial services, you will need to use a separate bank.

How does exercise influence mood and emotional stability ?

Exercise has a positive impact on mood and emotional stability by releasing endorphins, reducing stress hormones, enhancing resilience, promoting mindfulness, and providing a sense of achievement. Incorporating regular exercise into your lifestyle can lead to better mental health and overall well-being.

Are there specific workout routines designed for emotional stability ?

Emotional stability is an important aspect of overall well-being, and exercise can play a significant role in achieving it. Cardiovascular exercises like running, cycling, swimming, and dancing increase heart rate and blood flow, reducing stress and anxiety levels while releasing endorphins that improve mood. Strength training such as weightlifting or resistance band exercises build muscle strength and endurance, improving self-esteem and confidence while reducing symptoms of anxiety and depression by promoting the growth of new brain cells and increasing neurotransmitter levels. Yoga and meditation practices focus on mindfulness, breathing techniques, and relaxation, reducing stress levels and improving cognitive function, memory, and attention span. Incorporating these activities into your fitness routine can have a positive impact on your emotional stability and overall well-being.

What is the relationship between financial regulation and financial stability ?

The relationship between financial regulation and financial stability is crucial for the proper functioning of the economy. Financial regulation, consisting of laws and guidelines, aims to ensure the safety and soundness of the financial system and protect consumers. Financial stability, on the other hand, refers to a condition where the financial system can withstand shocks without significant disruptions. Financial regulation affects financial stability in several ways: 1. It prevents financial fraud and misconduct by enforcing strict rules and penalties, maintaining public trust in the financial sector. 2. It promotes transparency and disclosure, allowing stakeholders to make informed decisions and enabling regulators to monitor the financial system effectively. 3. Regulators encourage sound risk management practices, such as capital requirements and stress testing, contributing to overall financial stability. 4. They maintain market integrity by promoting fair competition and preventing monopolistic behavior, ensuring confidence in the financial system. 5. Regulators address systemic risks through macroprudential policies, safeguarding against widespread financial instability. In conclusion, financial regulation plays a vital role in maintaining financial stability by preventing fraud, promoting transparency, encouraging sound risk management, maintaining market integrity, and addressing systemic risks. However, finding the right balance between regulation and innovation is crucial for achieving both regulatory effectiveness and financial stability.

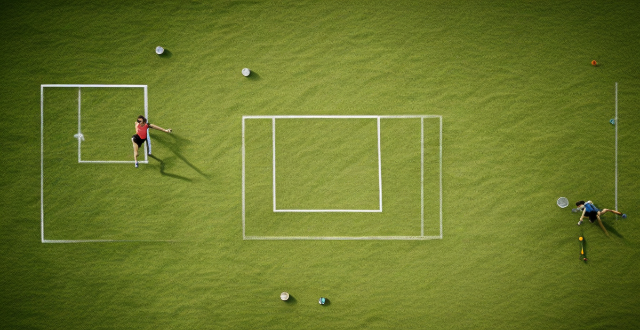

How do sponsorships and advertising impact the financial stability of sports organizations ?

Sports organizations depend on sponsorships and advertising for financial stability, covering operational costs and ensuring long-term sustainability. Sponsorships provide revenue, reduce expenses, invest in infrastructure, increase attendance, and ensure long-term sustainability. Advertising generates additional revenue, increases brand awareness, expands the market, promotes merchandise sales, and enhances fan engagement. Sports organizations must seek innovative sponsorship and advertising opportunities to maintain financial stability and grow their brands.

How do virtual power plants utilizing renewable energy affect grid stability and management ?

**The Impact of Virtual Power Plants Utilizing Renewable Energy on Grid Stability and Management** Virtual power plants (VPPs) aggregate various renewable energy resources to optimize electricity production and supply, enhancing grid stability and management. They balance supply and demand, reduce transmission losses, and enhance reliability by integrating distributed energy resources into a controllable network. VPPs offer operational flexibility, optimize resources, integrate electric vehicles, and facilitate energy trading. However, they also pose challenges such as complexity in management, interoperability issues, security concerns, and the need for regulatory adaptation. Overall, VPPs utilizing renewable energy sources have a profound effect on grid stability and management, offering enhanced reliability, efficiency, and flexibility, but require careful planning and adaptation to fully realize their potential.

How does credit management work in a bank ?

Credit management is a crucial function of banks that involves assessing and managing the risks associated with lending money to individuals and businesses. The process includes evaluating borrowers' creditworthiness, using credit scoring models to determine risk, making loan decisions, servicing and monitoring loans, and managing credit risk through diversification and risk management strategies.

Can I cancel a Cross-Border Payment transaction ?

Canceling a cross-border payment depends on factors like the payment method, bank policies, and timing of cancellation. Wire transfers and electronic platforms are common methods, with immediate requests having higher chances of success. Costs may apply for cancellation, and effective communication with banks or providers is crucial. Steps include acting quickly, verifying transaction status, contacting support, and understanding any fees. Prevention tips involve double-checking details and using reliable platforms.

What progress has been made with organic radical polymer batteries ?

The article discusses the advancements in organic radical polymer batteries (ORPBs), highlighting their potential as a sustainable and safe alternative to traditional energy storage systems. Key improvements include increased capacity, enhanced cycling stability, and faster charge/discharge rates. Safety and environmental benefits are also noted, such as reduced toxicity and the use of renewable resources. Future prospects for ORPBs involve addressing challenges related to energy density, mechanical stability, and scalability for commercial production. Overall, ORPBs show promise as a next-generation power source for various applications, from electric vehicles to portable electronics.

How do fuel vehicles affect the economy, particularly in terms of employment in the oil industry ?

The text discusses the impact of fuel vehicles on employment in the oil industry. It highlights that the industry offers a range of jobs from exploration and extraction to refining, distribution, and sales. However, it also notes challenges such as market volatility, environmental concerns, and technological advances that could affect job stability in the sector. The text concludes by emphasizing the need for strategies that promote economic stability while encouraging sustainable practices and innovation.

How can I create a personalized gift without breaking the bank ?

The text provides guidance on creating personalized gifts without spending a lot of money. It suggests getting crafty by making handmade items, using what one already has to create sentimental gifts, thinking creatively about non-material presents, shopping sales and using coupons for purchased gifts, and collaborating with others for group gifts. The tips aim to help readers give meaningful presents while staying within budget.

How do I troubleshoot issues with Apple Pay ?

Troubleshooting issues with Apple Pay involves checking device compatibility, updating software, adding a new card, verifying bank support, and contacting Apple Support. Compatible devices include iPhone 8 or later, iPad Pro (all models), Apple Watch Series 1 or later, and Mac with Touch ID or T2 Security Chip. Updating software can be done through Settings > General > Software Update on iPhone or iPad, or System Preferences > Software Update on Mac. To add a new card, open the Wallet app, tap the plus sign, follow prompts, and call the bank if needed. Not all banks support Apple Pay, so check with your bank or visit Apple's website for a list of supported banks. If issues persist, contact Apple Support via phone, email, or chat on their website for further assistance.

What banks and credit card providers support Apple Pay ?

Apple Pay is a mobile payment and digital wallet service that works with Apple devices. It allows users to make secure purchases in person, in iOS apps, and on the web using Safari. Many banks and credit card providers support Apple Pay, including Bank of America, Capital One, Chase, Citi, Wells Fargo, American Express, Discover, MasterCard, and Visa. Adding your card to Apple Pay is a straightforward process involving opening the Wallet app, tapping the plus sign, and following the steps to add a new card. The availability of Apple Pay and the specific cards it supports may vary by country or region, so it's important to check with your bank or card issuer to confirm compatibility and get any necessary instructions.

What role do economic indicators play in policy making by central banks ?

Economic indicators play a crucial role in policy making by central banks. They provide valuable information about the state of the economy, which helps central banks make informed decisions about monetary policy. Economic indicators are used to measure economic performance, identify risks and challenges, guide monetary policy decisions, and communicate with markets. Central banks use these indicators to assess whether the economy is growing at a sustainable pace or if there are any imbalances that need to be addressed. They also help central banks identify potential risks and challenges facing the economy, such as a widening trade deficit or rising imports. Economic indicators guide monetary policy decisions by helping central banks determine whether to raise or lower interest rates based on inflation targets. Finally, economic indicators play an important role in communicating with markets by providing transparency and clarity about central bank policy decisions.

Who are the main financial regulators in the world ?

Financial regulators worldwide play a pivotal role in maintaining the stability and integrity of the global financial system. Key institutions include the SEC, Fed, CFTC, and FINRA in the US; ECB and ESMA in the EU; BoE and FCA in the UK; BoJ and FSA in Japan; and PBOC and CBIRC in China. The Basel Committee on Banking Supervision and IOSCO also set global standards for bank regulation and securities markets, respectively. These regulators collaborate to address cross-border issues and enhance the health and integrity of the global financial system through implementing regulations, monitoring market activities, promoting transparency, and taking action against illegal or unethical practices.

What is the relationship between climate change, food security, and national stability ?

The essay discusses the relationship between climate change, food security, and national stability. Climate change is causing extreme weather events that reduce crop yields and threaten biodiversity, leading to water scarcity. Food insecurity can result from these impacts, causing economic downturns, social unrest, migration, and political instability. Stable nations are better equipped to address these challenges through resource allocation, research, international cooperation, and emergency response.

How has the COVID-19 pandemic affected the financial markets ?

The COVID-19 pandemic caused significant disruptions in financial markets, including increased volatility, sector-specific impacts, and central bank interventions. Stock markets experienced sharp declines initially, with travel and retail sectors hit hard, while healthcare and technology sectors generally fared well. Central banks cut interest rates and injected liquidity to stabilize markets. Bond markets saw increased activity, and oil prices experienced dramatic swings. Investor behavior shifted towards defensive investing, and economic indicators showed negative trends. The long-term implications of these changes are still unfolding but are likely to shape the financial landscape for years to come.

In what ways can energy storage solutions improve grid stability and reliability ?

Energy storage solutions play a crucial role in enhancing grid stability and reliability. They contribute to balancing supply and demand, providing ancillary services, integrating renewables, improving resilience, optimizing economic efficiency, facilitating distributed generation, and supporting transmission and distribution systems. Energy storage systems can absorb excess energy during low demand periods and release it during peak times, helping to level the load on the grid. They also provide frequency regulation and voltage support, smoothing out the variability of renewable sources like wind and solar. Energy storage enhances resilience by providing blackstart capability and islanding, allowing parts of the grid to be isolated and continue supplying power in case of major faults. It optimizes economic efficiency by enabling arbitrage and deferring costly grid upgrades. Energy storage facilitates distributed generation by allowing consumers with distributed generation to store energy during off-peak hours and use it during peak time periods, reducing their electricity bills. Overall, energy storage solutions are becoming increasingly vital for modernizing and strengthening our electrical grids.

Where can I enjoy haute cuisine in Hong Kong without breaking the bank ?

Hong Kong is a food lover's paradise, offering a wide range of culinary delights at various price points. Here are some budget-friendly options for enjoying haute cuisine in the city: 1. **Tim Ho Wan** - The World's Cheapest Michelin-starred Restaurant offers dim sum dishes like Baked Buns with BBQ Pork for HK$20-50 per dish. 2. **Yung Kee Restaurant** - Affordable Roast Goose is renowned for its crispy and juicy roast goose, with meals costing HK$100-200. 3. **Tai Ping Koon** - Budget-Friendly Seafood Restaurant serves fresh seafood dishes like steamed fish and shrimp with garlic for HK$50-100 per dish. 4. **Lan Fong Yuen** - No-frills Tea House with Reasonable Prices offers traditional Cantonese tea and snacks since 1956, with prices ranging from HK$20-40 per person. 5. **Kau Kee Restaurant** - Affordable Noodles and Congee is known for its beef brisket noodles and congee, with meals costing HK$30-50. 6. **Lin Heung Kuttay** - Cheap and Cheerful Desserts specializes in traditional Chinese desserts like mango pomelo sago soup and durian pudding, with prices ranging from HK$10-30 per dessert. These options prove that you don't have to spend a fortune to enjoy delicious food in Hong Kong.

Are there any specific exercises recommended for improving balance and stability in older adults ?

Sure, here are some specific exercises recommended for improving balance and stability in older adults. Tai Chi is a gentle form of exercise that involves slow, flowing movements. It has been shown to improve balance, flexibility, and overall physical function in older adults. Yoga is another great option that combines physical postures, breathing techniques, and meditation to improve strength, flexibility, and balance. Standing on one foot is a simple exercise that can be done anywhere and requires no equipment. Heel-to-toe walk helps improve coordination and balance by walking heel-to-toe in a straight line. Leg lifts help strengthen the muscles around the hips and thighs, which are essential for maintaining good balance. These exercises are just a few examples of how older adults can improve their balance and stability through regular practice.

How can small businesses implement automation without breaking the bank ?

In summary, small businesses can effectively integrate automation into their operations by starting small, utilizing affordable tools, simplifying processes beforehand, implementing gradually, outsourcing when needed, and monitoring performance to make necessary adjustments. These strategies help in achieving efficiency gains without excessive costs, allowing for continuous improvement and growth.

What are the long-term implications of climate change for global food trade and market stability ?

Climate change is expected to impact global food production, trade, and market stability significantly. Reduced crop yields, unpredictable harvests, decreased livestock productivity, increased disease prevalence, shifting production zones, and increased competition for resources are some of the long-term implications. These changes can lead to price volatility, increased vulnerability to food insecurity, and economic challenges for farmers and consumers. Addressing these challenges requires a collaborative effort from governments, international organizations, and stakeholders across the food system to develop strategies that promote resilience and adaptive capacity in the face of climate change.

What challenges do climate refugees face when migrating to new countries ?

Climate refugees face various challenges when migrating to new countries, including social integration, economic stability, and legal recognition. Social issues involve cultural integration, access to education, and building social support networks. Economic challenges include finding employment, achieving financial stability, and accessing basic services. Legal issues encompass recognition as refugees, legal status and rights, and navigating the asylum process. Addressing these challenges requires efforts from sending and receiving nations, as well as international organizations.

Are there any specific exercises that can help prevent sports injuries ?

To prevent sports injuries, it's important to engage in specific exercises that focus on warm-up and stretching, strength training, plyometrics, and core strengthening. Warm-up exercises like jogging or brisk walking, along with dynamic stretches, help prepare the body for physical activity by increasing blood flow and reducing injury risk. Stretching exercises such as hamstring and quadriceps stretches improve flexibility and range of motion. Strength training exercises like squats and planks build strength in key muscle groups, improving stability and reducing joint stress. Plyometric exercises like box jumps and lateral bounds enhance power, speed, and agility. Core strengthening exercises like bicycle crunches and plank with hip dips provide stability and support during physical activities. By incorporating these exercises into your routine, you can reduce the risk of sports injuries and improve your overall athletic performance.

How does cryptocurrency work ?

Cryptocurrency is a digital or virtual currency that uses cryptography for security, operating independently of a central bank. It allows direct transfers between individuals without intermediaries like banks. Key components include cryptography (public and private keys, encryption, decryption), blockchain technology (decentralization, transparency, immutability, consensus mechanism), mining (Proof of Work, Proof of Stake, mining rewards, network security), and smart contracts (automation, efficiency, security, transparency). These technologies work together to create a secure, decentralized, and transparent digital payment system with fast, low-cost, and borderless transactions while maintaining user privacy and security.

How do banks manage credit risk ?

Banks manage credit risk through a variety of methods and strategies to ensure the stability of their operations and protect against potential losses. They identify and assess credit risk using credit scoring models, financial analysis, and credit reports. They mitigate credit risk through diversification, collateral and guarantees, and credit derivatives. Banks monitor and control credit risk by ongoing monitoring, loan loss reserves, and regulatory compliance. In case of credit risk events, banks recover through workout agreements, legal recourse, and communication with stakeholders. By employing these strategies, banks aim to minimize credit risk while still providing essential lending services to support economic growth and individual prosperity.

How do financial regulations impact banks and other financial institutions ?

Financial regulations are crucial for maintaining stability in the banking and financial sector. They protect depositors' interests, promote fair competition, prevent financial crises, and impact innovation and efficiency. Regulations like capital adequacy ratios, liquidity coverage ratios, and stress testing ensure depositors' safety. Antitrust laws and consumer protection laws encourage fair competition among banks. Prudential supervision and Basel III help prevent financial crises. However, excessive regulation may negatively affect innovation and profitability. Striking a balance between safety and promoting innovation is key.