Company Ratio

How do you use financial ratios to analyze a company's stock ?

Using Financial Ratios to Analyze a Company's Stock Financial ratios are essential for analyzing a company's stock, providing insights into financial health, operational efficiency, and profitability. By calculating and interpreting these ratios, investors can make informed decisions about buying, holding, or selling stock. There are four main types of financial ratios: liquidity, solvency, operating, and profitability. To analyze a company's stock using financial ratios, gather financial data, calculate the relevant ratios, interpret the results, and make investment decisions based on your analysis and other factors.

How important is student-teacher ratio in school selection ?

The student-teacher ratio is a crucial factor in school selection, impacting academic performance, personal attention, and classroom management. A lower ratio allows for individual attention, customized learning, and timely feedback, promoting better understanding and improved academic performance. It also creates opportunities for mentorship, emotional support, and social development, contributing to a positive learning environment. Effective classroom management is more feasible with a lower ratio, leading to reduced discipline issues, increased participation, and flexible teaching strategies. Prioritizing schools with favorable ratios can contribute to a successful educational journey.

How do I file a claim with my sports insurance company ?

Filing a claim with your sports insurance company is important to ensure compensation for injuries or damages during sports activities. To file a claim, gather necessary documents, contact the insurance company, fill out the claim form accurately, submit it with supporting documents, and follow up on the claim's progress. Staying organized and persistent can increase chances of receiving deserved compensation.

How quickly can I get reimbursed by my travel insurance company ?

The time it takes to get reimbursed by your travel insurance company depends on the type of claim you are filing and the policies of your insurance provider. Emergency medical claims can be processed within a few days to a week, while non-medical claims can take longer depending on the nature of the claim and the required documentation. To expedite the process, it's important to read your policy carefully, keep all receipts and documentation, contact your travel insurance company promptly, submit complete and accurate information, and follow up on your claim if necessary. By following these tips, you can help ensure a smoother and faster reimbursement experience.

Are there any advantages to using a tax refund service company instead of doing it myself ?

Using a tax refund service company offers several advantages, including time-saving, accuracy, expertise, convenience, and peace of mind. These services can help maximize refunds or minimize tax liability by ensuring accurate tax preparation and staying up-to-date with changing tax laws and regulations.

How does sports sponsorship affect the overall perception of a company or brand ?

Sports sponsorship can significantly impact the overall perception of a company or brand, both positively and negatively. Positive effects include increased brand awareness, association with positive attributes, and customer loyalty and engagement. Negative effects may arise from negative associations, costly investments, and limited target audience. Companies must carefully consider the potential benefits and risks before committing to sports sponsorships.

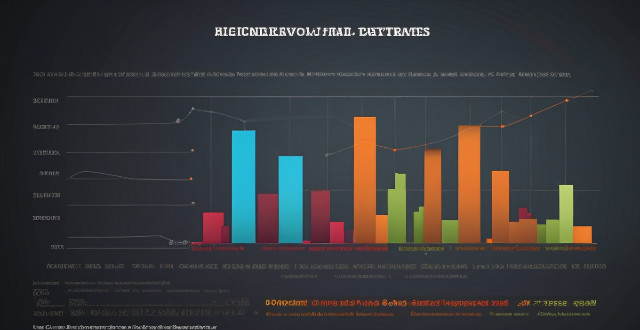

What are the key factors to consider when analyzing the stock market ?

Analyzing the stock market involves considering economic indicators, company financials, industry trends, market sentiment, technical analysis, and risk management. Economic indicators provide insights into the overall health of the economy, while company financials assess the financial health of individual companies. Industry trends help understand the prospects of the industry in which a company operates. Market sentiment can impact stock prices, even if it doesn't necessarily reflect the underlying fundamentals of a company or the economy. Technical analysis involves studying past price patterns to predict future movements. Proper risk management is crucial when investing in the stock market, including diversification, stop-loss orders, position sizing, and evaluating the potential rewards against the risks involved in each trade.

How do I choose the right stocks for long-term investment ?

When it comes to long-term investment, choosing the right stocks is crucial. Here are some key factors to consider: 1. Company Financials: Look for companies with consistent revenue growth, profitability, and manageable debt levels. 2. Industry Trends: Invest in industries with strong growth potential and companies with a competitive advantage. 3. Management Quality: Choose companies with experienced management teams who have a clear vision for the future. 4. Valuation: Consider the price-to-earnings ratio and price-to-book ratio to find undervalued stocks. 5. Dividends: If you're looking for regular income, consider stocks with a high dividend yield and consistent dividend growth. 6. Risk Tolerance: Diversify your portfolio and consider your risk tolerance when selecting stocks. By carefully considering these factors and conducting thorough research, you can select stocks that align with your investment goals and risk profile.

Are there any risks associated with investing in a celebrity-founded company ?

Investing in a celebrity-founded company carries several risks, including lack of experience, overreliance on celebrity status, limited diversification, legal and regulatory risks, and market volatility. It is important for investors to carefully consider these risks before making any investment decisions and to conduct thorough research and consult with financial advisors to ensure that their investments align with their overall financial goals and risk tolerance levels.

How do I analyze stocks before investing ?

The text is a guide on how to analyze stocks before investing. It suggests understanding the company's business model, financial health, and management team; analyzing the industry's competitive landscape and growth potential; evaluating the stock price using valuation metrics and technical analysis; and setting an investment goal.

What is the difference between fundamental and technical analysis in the stock market ?

In the stock market, two primary methods of analysis are used by investors to evaluate stocks and make investment decisions: fundamental analysis and technical analysis. Each approach has its unique focus and methodology, leading to different conclusions and strategies for investing.

In what ways can bad credit management lead to financial difficulties for a company ?

Poor credit management can lead to cash flow issues, increased costs, damage to supplier relationships, negative impact on business reputation, and legal implications. To mitigate these risks, companies should establish clear credit policies, conduct regular credit checks, maintain open communication with customers, leverage technology for payment tracking, and consider third-party services or credit insurance.

What are some examples of successful TCFD implementation by companies ?

The Task Force on Climate-related Financial Disclosures (TCFD) was established by the Financial Stability Board (FSB) in 2015 to develop a framework for voluntary climate-related financial risk disclosures. Since then, many companies have successfully implemented the TCFD recommendations, providing stakeholders with valuable information about their exposure to climate-related risks and opportunities. Here are some examples of successful TCFD implementation by companies: **Unilever** has conducted a comprehensive assessment of its climate-related risks, including transition and physical risks. The company has identified potential impacts on its supply chain, operations, and products due to climate change. Unilever publishes detailed reports on its website, outlining its greenhouse gas emissions, water withdrawal, and waste generation. The company also discloses its progress toward sustainability targets, such as reducing carbon emissions and increasing renewable energy usage. Unilever actively engages with stakeholders, including investors, customers, and employees, to understand their concerns and expectations regarding climate-related issues. This helps the company to identify and prioritize areas for improvement in its sustainability efforts. **Iberdrola** has integrated climate risk management into its overall risk management framework. The company assesses both short-term and long-term climate-related risks and opportunities, considering factors such as changes in regulations, market trends, and technological advancements. Iberdrola provides detailed information about its greenhouse gas emissions, energy consumption, and renewable energy production. The company also discloses its strategies for adapting to climate change, such as investing in renewable energy projects and developing new technologies to reduce emissions. Iberdrola engages with stakeholders through various channels, including annual sustainability reports, social media, and public forums. The company seeks feedback from stakeholders to improve its sustainability performance and ensure that it aligns with societal expectations. **Microsoft** has conducted a thorough assessment of its climate-related risks, focusing on both direct and indirect impacts. The company has identified potential threats to its infrastructure, supply chain, and customer demand due to climate change. Microsoft publishes detailed reports on its greenhouse gas emissions, energy consumption, and water usage. The company also discloses its progress toward sustainability targets, such as reducing carbon emissions and increasing renewable energy usage. Microsoft engages with stakeholders through various channels, including annual sustainability reports, social media, and public forums. The company seeks feedback from stakeholders to improve its sustainability performance and ensure that it aligns with societal expectations.

What is the typical structure of a private equity deal ?

The typical structure of a private equity deal involves several key components, including due diligence, investment structure, capital structure, governance and control, exit strategy, and legal agreements. The process begins with thorough due diligence to evaluate the target company's financial health, operational efficiency, market position, and growth potential. The investment structure defines how the PE firm will invest in the target company, while the capital structure determines how the target company will be financed after the PE firm's investment. Governance and control involve securing representation on the company's board of directors, gaining certain rights to veto major decisions, and bringing in new management or working closely with existing management to drive performance improvements. A successful private equity deal also requires a well-defined exit strategy for the PE firm to realize its investment return. Lastly, various legal agreements are put in place to govern the relationship between the PE firm and the target company.

What is the difference between a bond and a stock ?

Bonds and stocks are two different types of financial instruments that companies use to raise capital. While both are used for funding, they have distinct differences in terms of ownership, returns, risks, and other factors. Here are some key differences between bonds and stocks: - Bonds represent debt and provide regular interest payments with a fixed maturity date, while stocks represent equity and offer potential dividends and capital appreciation without a set maturity date. - When you buy a bond, you are essentially lending money to the issuer (usually a company or government). In return, you receive a bond certificate that represents your loan. You do not own any part of the company; you are simply a creditor. - When you buy a stock, you become a part owner of the company. This means you have a claim on the company's assets and earnings, as well as a say in how the company is run through voting at shareholder meetings. - The primary return from owning a bond comes from interest payments made by the issuer. These payments are usually fixed and paid at regular intervals until the bond matures, at which point the principal amount is repaid. - The return on stocks comes from dividends (if the company chooses to pay them) and capital gains (the increase in the stock price over time). Stock prices can be volatile, so the potential for high returns is greater than with bonds, but so is the risk. - Generally considered less risky than stocks because they offer a fixed rate of return and have priority over stockholders in the event of bankruptcy. However, there is still risk involved, especially if the issuer defaults on its payments. - More risky than bonds because their value fluctuates with market conditions and the performance of the underlying company. If the company does poorly, the stock price may fall significantly, and investors could lose part or all of their investment. - Have a defined maturity date when the principal amount must be repaid by the issuer. This provides a clear timeline for investors. - Do not have a maturity date; they exist as long as the company remains in business. Investors can sell their shares at any time in the open market. - Interest income from bonds is typically taxed as ordinary income. - Long-term capital gains from stock sales may be taxed at a lower rate than ordinary income, depending on the tax laws of the jurisdiction.

Can you explain the concept of market capitalization and its significance in stock analysis ?

Market capitalization is a crucial financial metric that reflects the total dollar value of a company's outstanding shares. It is calculated by multiplying the current market price per share by the total number of outstanding shares. Market cap helps investors and analysts assess a company's size and potential growth opportunities, serving as a fundamental tool in stock analysis. Large-cap stocks represent well-established companies, while mid-cap and small-cap stocks indicate potential for growth but come with higher risks. Market cap also influences investment strategies, such as diversification and index fund investing, and is used in valuation metrics like P/B and P/E ratios. Understanding market cap allows for informed decisions on portfolio construction, risk management, and valuation assessments.

How do negative product reviews affect a company's reputation ?

Negative product reviews can have a significant impact on a company's reputation, affecting everything from sales and profits to employee morale and customer loyalty. Here are some ways in which they can affect it: 1. Loss of Trust: Negative reviews can erode the trust that customers have in a company, making them less likely to do business with them in the future. It can also make potential new customers hesitant to try the company's products or services. 2. Decreased Sales: Negative reviews can lead to decreased sales as customers may be discouraged from purchasing the product. This can result in lost revenue for the company, which can ultimately harm its financial stability. 3. Damage to Brand Image: Negative reviews can damage a company's brand image, making it harder for them to attract new customers or retain existing ones. It can also make it more difficult for the company to launch new products or expand into new markets. 4. Loss of Market Share: If a company's reputation is damaged by negative reviews, it can lose market share to competitors who have better reviews and reputation. This can lead to a decline in profits and potentially even bankruptcy if the company is unable to recover. 5. Difficulty Hiring Talent: Negative reviews can make it harder for companies to attract top talent, as potential employees may be wary of working for a company with a poor reputation. This can limit the company's ability to grow and innovate, further damaging its reputation and financial stability. In conclusion, it is essential for companies to take steps to address negative reviews and work to improve their overall reputation to avoid these consequences.

What is the stock market and how does it work ?

The stock market is a financial ecosystem where investors can buy and sell ownership shares of publicly traded companies. Companies use it to raise capital, while investors aim to share in the company's success. Prices of stocks are determined by supply and demand, influenced by various factors including company performance, market trends, and economic conditions. The market is regulated to protect investors and maintain fairness. Investing in stocks comes with risks but also offers potential rewards, making it a popular choice for long-term investments.

How much equity should I be prepared to give up for investment in my startup ?

When determining equity allocation for startup investment, consider theWhen determining equity allocation for startup investment, consider the type of investor, company value Finally, consider the company's goals and vision when deciding on equity allocation, as giving up too much equity can limit future options and affect control over decision-making.

What factors influence the performance of tech stocks ?

Tech stocks are influenced by macroeconomic conditions, industry-specific factors, and company-specific factors. Macroeconomic conditions include interest rates and economic growth. Industry-specific factors include regulatory changes and technological advancements. Company-specific factors include financial health and leadership and management.

Can I get a discount on my insurance premiums if I buy multiple policies from the same company ?

Bundling insurance policies with the same company can result in cost savings, simplified management, and customized coverage. Qualifying for a multi-policy discount often requires purchasing a minimum number of policies, having a good credit or claims history, maintaining continuous coverage, and paying premiums on time. To take advantage of bundling, assess your needs, shop around, consult an agent, review policy terms, request a quote, and make the switch if it's beneficial.

How do different types of sports sponsorship (e.g. title sponsorship, kit sponsorship) affect a company's brand exposure ?

This text discusses various types of sports sponsorship, including title sponsorship, kit sponsorship, venue sponsorship, event sponsorship, and team sponsorship. Each type offers different impacts on brand exposure, such as high visibility, brand association, targeted audience reach, community involvement, and potential for success sharing. Overall, sports sponsorship provides companies with opportunities to align themselves with the excitement and passion of sports, reaching diverse audiences and enhancing their brand image.

How can a company's culture impact workplace safety ?

The text discusses the significant role of company culture in shaping workplace safety. It highlights five key aspects of a company's culture that can impact safety, including effective communication and collaboration, leadership and accountability, training and education, respectful and inclusive environment, and continuous improvement. The article emphasizes the importance of fostering a work environment where employees feel comfortable sharing information, leaders set clear expectations, regular training is provided, mutual respect is promoted, and continuous improvements are made based on feedback and data analysis. Overall, the article underscores the need for organizations to prioritize these cultural elements to create a safer work environment for their employees.

What are the penalties for non-compliance with data protection regulations ?

Non-compliance with data protection regulations can result in significant penalties, including fines, legal action, and damage to a company's reputation. The specific penalties depend on the jurisdiction and the severity of the violation. Some common consequences include: - Fines and Financial Penalties: GDPR violations can result in fines up to €20 million or 4% of global annual turnover for less severe infringements, and up to €40 million or 8% of global annual turnover for more serious violations. CCPA violations can result in fines up to $2,500 per violation for each time a Californian resident's rights are violated, and up to $7,500 per violation if the violation involves selling or sharing personal information without consent. - Legal Action: Class action lawsuits initiated by individuals or groups may claim damages for non-compliance, with potential for large settlements depending on the number of affected parties and the severity of harm caused. Government investigations may involve possible subpoenas and audits to assess compliance levels and potential violations, as well as enforcement actions such as cease and desist orders or demands to implement corrective measures. - Reputational Damage: Loss of trust from customers when data breaches occur can erode customer faith in a company's ability to protect their information, and negative publicity from data misuse can permanently harm a company's brand image. Difficulty in partnerships and deals may arise, with other companies ending collaborations due to associated risks, and potential investors being wary of putting money into a company with known compliance issues. - Market Access Restrictions: In extreme cases, a company might be prohibited from handling certain types of data, and some regions might restrict entry to companies that have a history of non-compliance. - Corrective Measures and Costs: Technical and organizational changes may be required, such as upgrading systems to ensure compliance with technical standards like encryption and security protocols, and employee training to improve understanding of data protection laws and best practices. Legal fees for representation in legal proceedings or during investigations, and settlement payments to resolve class action lawsuits or government enforcement actions, may also be necessary. It is crucial for organizations to prioritize data protection compliance as part of their business strategy to avoid these adverse effects.