Term Board

How does private equity affect corporate governance ?

Private equity (PE) plays a significant role in shaping the governance of companies. It can have both positive and negative impacts on corporate governance, depending on various factors such as the PE firm's strategy, the nature of the investment, and the target company's existing governance structure. This article will explore the ways in which private equity affects corporate governance. ### Positive Impacts of Private Equity on Corporate Governance - **Improved Decision-Making Processes**: Private equity firms often bring fresh perspectives and expertise to the decision-making processes within a company. They may introduce new management practices or technologies that enhance efficiency and productivity. This can lead to better strategic planning and more informed decisions being made by the board of directors. - **Greater Transparency and Accountability**: Private equity investors typically demand greater transparency and accountability from the companies they invest in. This can result in improved financial reporting, regular board meetings, and increased communication between management and shareholders. Such measures help to ensure that all stakeholders are kept informed about the company's performance and future plans. - **Increased Focus on Long-Term Value Creation**: Private equity firms generally have a long-term investment horizon, which means they are more likely to focus on creating value over the long term rather than pursuing short-term gains. This can lead to a greater emphasis on sustainable growth, innovation, and responsible business practices. ### Negative Impacts of Private Equity on Corporate Governance - **Potential Conflicts of Interest**: Private equity investors may have conflicts of interest with other stakeholders, such as employees, customers, or suppliers. For example, a PE firm might push for cost-cutting measures that negatively impact employee morale or customer satisfaction. These conflicts can undermine good governance practices and harm the company's reputation. - **Pressure for Short-Term Profits**: While some private equity firms focus on long-term value creation, others may prioritize short-term profits at the expense of long-term sustainability. This can lead to excessive risk-taking, aggressive financial engineering, or even fraudulent activities aimed at boosting short-term earnings. Such behaviors can ultimately damage the company's reputation and financial health. - **Lack of Diversity in Board Composition**: Private equity firms often control a majority of the seats on a company's board of directors. This can limit diversity in terms of gender, ethnicity, and professional background among board members. A lack of diversity can lead to groupthink and reduce the effectiveness of the board in providing independent oversight and guidance to management. In conclusion, private equity has both positive and negative effects on corporate governance. The key is for PE firms to balance their pursuit of profit with a commitment to ethical business practices and responsible stewardship of the companies they invest in. By doing so, they can help build stronger, more sustainable businesses that benefit all stakeholders.

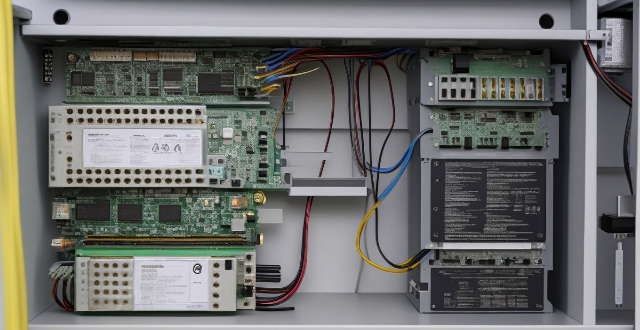

How do you connect an AC stepping motor to a microcontroller or driver board ?

Connecting an AC stepping motor to a microcontroller or driver board involves selecting the right board, connecting the power supply, attaching the motor, programming the board, testing the connection, and troubleshooting any issues. Materials needed include the motor, board, power supply, wires, and optionally a breadboard for temporary connections. Tips include double-checking connections and code, using a breadboard before soldering, and following safety guidelines when working with high voltages.

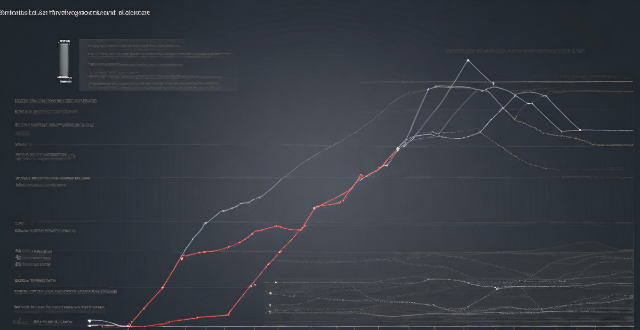

What is the significance of setting short-term versus long-term climate targets ?

The article emphasizes the importance of setting both short-term and long-term climate targets to effectively address climate change. Short-term targets focus on immediate actions, creating urgency, measurable progress, immediate benefits, and building momentum for more ambitious goals. Long-term targets ensure sustainability, deep decarbonization, adaptation, and global cooperation. Achieving these goals is crucial for mitigating the worst effects of climate change and creating a more resilient future.

Is there a difference between short-term and long-term memory in scientific terms ?

Short-term memory and long-term memory are two different types of memory with distinct characteristics. Short-term memory has a limited capacity, typically able to hold around seven items for a brief period, while long-term memory has a large capacity, virtually unlimited, and can store vast amounts of information for an extended period. Short-term memory lasts only for a few seconds unless it is repeatedly rehearsed or transferred to long-term memory, while long-term memory can last for minutes, hours, days, years, or even a lifetime. Short-term memory acts as a temporary holding place for new information, processing it before transferring it to long-term memory, while long-term memory stores information for future use, including facts, experiences, skills, and knowledge. Short-term memory has a faster retrieval speed since the information is readily available in the mind, while long-term memory has a slower retrieval speed as it requires more effort to recall the information from the vast storage. Short-term memory is more susceptible to interference and forgetting due to its transient nature, while long-term memory is more stable and less prone to interference, making it easier to retain information over time. Short-term memory requires rehearsal or encoding processes to transfer information to long-term memory, while long-term memory involves consolidation processes that strengthen neural connections and make the memory more durable.

What is the importance of long-term climate data analysis ?

Long-term climate data analysis is crucial for understanding the Earth's climate system and its changes over time. It provides valuable insights into past climate patterns and trends, which are critical for predicting future climate conditions and developing effective adaptation strategies. By continuing to collect and analyze long-term climate data, we can better prepare ourselves for the challenges posed by a changing climate and work towards a sustainable future.

What are some long-term saving strategies ?

Saving for the long term requires a disciplined approach and a solid plan. Here are some strategies to help you save effectively over the years: 1. Set clear financial goals: short-term, medium-term, and long-term. 2. Create a budget and stick to it by tracking expenses, cutting unnecessary costs, and automating savings. 3. Build an emergency fund that is easily accessible and covers at least 3-6 months' worth of living expenses. 4. Take advantage of employer matches and maximize contributions to retirement accounts like 401(k)s and IRAs. 5. Invest wisely with diversification, risk management, and a long-term perspective. 6. Manage debt by paying off high-interest debts first and considering refinancing options. 7. Regularly review and adjust your financial plan, adapting to life changes as needed. 8. Plan for taxes by choosing tax-efficient investments and being strategic about withdrawals and contributions. 9. Consider estate planning with wills, trusts, and life insurance to protect your family's financial wellbeing. 10. Continuously learn and seek advice from financial professionals when needed. By consistently implementing these strategies, you can build a strong financial foundation for your future.

How do I invest my money wisely for long-term growth ?

Investing wisely for long-term growth involves setting financial goals, creating a diversified portfolio, considering risk tolerance, investing for the long-term, and monitoring investments regularly.

How accurate are long-term climate predictions ?

Long-term climate predictions are essential for understanding potential future changes in the environment, but their accuracy is often questioned due to the complexity of the climate system. Factors that influence the accuracy of these predictions include uncertainty in emission scenarios, natural variability, and model limitations. However, advancements in climate modeling, such as higher-resolution models, ensemble modeling, and data assimilation techniques, have significantly improved our ability to make accurate predictions about future climate changes. By continuing to invest in research and development, we can further enhance the precision and reliability of long-term climate predictions, providing critical information for decision-makers and the public alike.

What are the best board games for families to play together during weekends ?

This text lists some of the best board games for families to play together during weekends. The list includes Monopoly, Scrabble, Ticket to Ride, Catan, Pandemic, Codenames, Carcassonne, Dixit, Bananagrams, and Qwixx. Each game is described with its main features and suitable age range, number of players, and playing time.

How do I fix a squeaky floorboard without removing it ?

Squeaky floorboards can be a nuisance, but they don't necessarily require a full board replacement to fix. Here's a summary of steps you can take to quiet your floors without major renovation: 1. **Identify the Squeak's Source**: Locate the area where the squeak is loudest by walking over it and tapping nearby boards. Check for loose nails or screws. 2. **Tighten Loose Fasteners**: If the issue is due to loose nails or screws, tighten them using a drill with a screwdriver bit or a nail punch and hammer. 3. **Lubricate the Board**: Apply graphite powder, slide in shim coated with petroleum jelly into gaps, or use a lubricant spray to reduce friction. 4. **Add Support Underneath**: Use wood shims and construction adhesive to fill gaps and provide extra support. Reinforce or replace weak joists if necessary. 5. **Fill Gaps Between Boards**: For small gaps, use wood filler or apply wood glue along tongue and groove joints. Sand down any high spots. 6. **Maintain Proper Humidity Levels**: Use a dehumidifier in humid areas and ensure good air circulation beneath the floor. Monitor seasonal changes in humidity and adjust accordingly. By addressing these issues, you can eliminate squeaky floorboards without removing them. Regular maintenance and early problem detection can help prevent minor issues from becoming major ones.

What is the importance of long-term monitoring and evaluation in climate policy ?

The importance of long-term monitoring and evaluation in climate policy is discussed. Long-term monitoring and evaluation help ensure accountability for climate action, identify gaps and opportunities for improvement, inform future policies, build public trust, and promote sustainable development.

What are the best financial products for long-term investment ?

The text provides a comprehensive overview of the various financial products available for long-term investment. It explains the definition, benefits, and risks of each option including stocks, bonds, mutual funds, ETFs, and REITs. The text emphasizes the importance of considering one's investment goals, risk tolerance, and financial situation before choosing which products to include in a portfolio. Overall, the text serves as a useful guide for individuals looking to make informed decisions about their long-term investments.

What is the difference between term life insurance and whole life insurance ?

Difference between term life insurance and whole life insurance: - Term life insurance is temporary coverage, no cash value, renewable, and affordable. - Whole life insurance is permanent coverage, accumulates cash value, has level premiums, and is more expensive.

How can women protect their assets and ensure long-term financial security ?

The article provides a list of strategies that women can employ to ensure their financial security over the long term. These include building an emergency fund, investing in retirement accounts, purchasing life insurance, creating a will, considering long-term care insurance, educating oneself about finance, working with a financial advisor, and prioritizing career development. Each of these steps is crucial in its own way for safeguarding one's assets and ensuring financial stability.

What are some proven strategies for long-term wealth accumulation ?

Long-term wealth accumulation is a goal for many individuals, and there are several proven strategies that can help achieve this objective. Here are some of the most effective approaches: 1\. Start Early: The earlier you start saving and investing, the more time your money has to grow through compound interest. 2\. Live Below Your Means: Spend less than you earn and save the difference. 3\. Invest Wisely: Choose investments that align with your goals, risk tolerance, and time horizon. Diversify your portfolio to spread risk and maximize returns. 4\. Pay Off High-Interest Debt: High-interest debt like credit card balances can be a significant obstacle to wealth accumulation. Paying off these debts should be a priority. 5\. Increase Your Income: Increasing your income can provide more resources for saving and investing, which can help accelerate wealth accumulation. 6\. Plan for Retirement: Retirement planning is an essential component of long-term wealth accumulation, ensuring you have enough funds to support yourself during your golden years. 7\. Protect Your Wealth: Ensure that your hard-earned wealth is protected against unexpected events like lawsuits, accidents, or health issues.

Is social distancing a long-term solution for controlling the spread of viruses ?

Social distancing is an effective measure for controlling the spread of viruses in the short term, but its feasibility as a long-term solution depends on various factors such as the nature of the virus, availability of medical resources, and willingness of people to adhere to guidelines. Other measures such as mask-wearing, hand hygiene, contact tracing, regular testing, and vaccine development should also be considered alongside social distancing to effectively control the spread of viruses over time.

How can I make sure my fitness meal plan is sustainable long-term ?

A sustainable fitness meal plan is essential for achieving long-term health and wellness goals. To make it work, set realistic goals, plan ahead, incorporate variety, make it enjoyable, stay flexible, and seek professional advice.

What are the potential long-term effects of sports injuries on adolescent development ?

Sports injuries can have a significant impact on the physical, mental, and social development of adolescents. Potential long-term effects include chronic pain, limited mobility, disfigurement, anxiety, depression, low self-esteem, PTSD, isolation, bullying, and relationship difficulties. Proper treatment and rehabilitation are crucial for minimizing these effects.

Are ESG investments more resilient during economic downturns ?

The text discusses the resilience of Environmental, Social, and Governance (ESG) investments during economic downturns. It defines ESG investments as those that prioritize sustainability, fair labor practices, and transparent operations. The importance of ESG criteria is highlighted in terms of risk management, stakeholder engagement, and long-term performance. The historical performance data suggests that ESG investments have performed comparably to non-ESG investments during previous economic downturns, potentially offering diversification benefits. The impact of ESG factors on resilience is discussed, including environmental factors, social factors, and governance factors. However, risks and challenges such as market sentiment and liquidity issues are also mentioned. The conclusion emphasizes that ESG investments have shown resilience during economic downturns due to their focus on long-term value creation and risk management strategies. It suggests that a well-diversified ESG portfolio can provide a balance between financial returns and positive social and environmental impacts, even during challenging economic times.

How do climate model predictions differ from weather forecasts ?

Climate model predictions and weather forecasts differ in terms of time frame, purpose, methodology, accuracy, and impact on decision making, with the former focusing on long-term trends for policy-making and the latter offering short-term insights for daily activities.

Is there a financial case for divesting from high-carbon industries ?

The debate over whether there is a financial case for divesting from high-carbon industries is ongoing, with proponents arguing that it can improve risk management, long-term returns, and alignment with sustainability goals, while opponents contend that it can lead to lost opportunities, lack of evidence for financial benefits, and short-term costs. The decision to divest ultimately depends on individual investor preferences and goals.

How do retailers benefit from offering a buy one get one free promotion ?

Retailers can benefit from offering a "buy one get one free" (BOGO) promotion by attracting new customers, increasing sales, managing inventory more effectively, enhancing brand perception, and collecting valuable customer data. This marketing strategy not only boosts short-term revenue but also helps build long-term customer loyalty and brand equity.

How do ESG standards affect corporate responsibility ?

ESG standards shape corporate responsibility by providing a framework for measuring and managing company impact on the environment, society, and governance. They require companies to reduce their carbon footprint, ensure sustainable sourcing, promote diversity and inclusion, engage with communities, maintain ethical business practices, and encourage board diversity. Adhering to these standards demonstrates commitment to sustainability and social responsibility, leading to long-term success and profitability.

What is the difference between weather and climate ?

This text defines and differentiates between weather and climate. Weather is described as a short-term phenomenon, characterized by its variability, localized nature, and influence on daily activities. In contrast, climate is defined as a long-term pattern, distinguished by its stability, regional scope, and impact on ecosystems and agriculture. The text emphasizes the importance of understanding these differences for decision-making in various aspects of human life.

What is sustainable investing ?

Sustainable investing incorporates environmental, social, and governance factors into investment strategies. It aims for long-term financial returns while promoting positive societal change and minimizing harm to the environment. Environmental considerations include climate change and pollution prevention; social factors involve labor standards and community involvement; governance focuses on transparency and ethical behavior. Benefits of sustainable investing include risk mitigation, long-term returns, and impactful investments.

In what situations is it important to involve a financial advisor in budget planning ?

Involving a financial advisor in budget planning is crucial during significant life events, large investments, debt management, retirement planning, and tax planning. A professional can help develop a budget that meets short-term needs while achieving long-term goals.

How does sustainable consumption impact the economy ?

Reduced resource depletion, lower energy costs, increased innovation, and improved public health are some of the key benefits of sustainable consumption. While there may be short-term costs associated with transitioning to more sustainable practices, the long-term benefits far outweigh these costs.