Port Bond

How can investors identify credible green bond opportunities ?

Investing in green bonds is becoming increasingly popular as more investors seek to align their portfolios with environmental sustainability goals. However, it is crucial for investors to identify credible green bond opportunities to ensure that their investments truly contribute to positive environmental impacts. Here are some key steps and considerations for identifying credible green bond opportunities: 1. Understand the definition of green bonds. 2. Look for certification and verification. 3. Examine the use of proceeds. 4. Assess the environmental impact. 5. Check transparency and reporting. 6. Consider the credit quality. 7. Review the legal framework. 8. Consult professional advice.

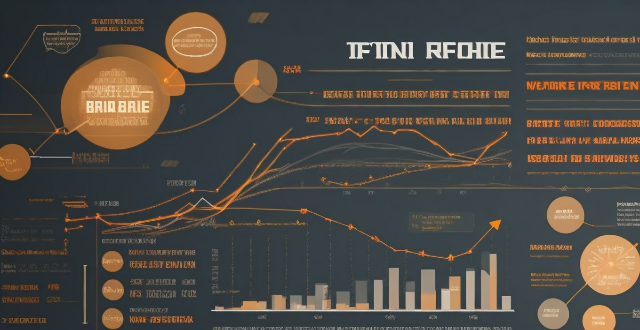

How do bond yields affect my investment returns ?

Bond yields significantly impact investment returns, particularly for bond and bond-related security investors. Yields represent the interest rate paid by bond issuers to holders and are crucial for expected returns. Higher yields generally result in increased interest income but can also cause price volatility. Inflation affects real returns, and lower yields may increase opportunity costs. Strategies like diversification, duration management, active management, and staying informed can help maximize returns amidst changing bond yield environments.

What criteria should be met for a bond to be classified as a green bond ?

Green bonds are fixed-income instruments specifically designed to raise capital for climate and environmental projects. To be classified as a green bond, the issuer must meet certain criteria, including how the funds will be used, which projects are eligible, transparency in reporting, certification and review by third parties, and additional requirements depending on the framework being used. These criteria ensure that the funds raised through issuance of the bond are used for environmentally sustainable purposes. Green bonds play a crucial role in financing sustainable development and promoting a low-carbon economy.

How do interest rates affect bond prices and yields ?

Bond prices and yields are inversely related to interest rates. When interest rates rise, bond prices fall, and vice versa. This is because the yield on a bond is determined by its coupon rate, which is fixed at the time of issuance. Therefore, if interest rates increase after the bond is issued, the yield on the bond will be lower than the current market rate, making it less attractive to investors. Conversely, if interest rates decrease after the bond is issued, the yield on the bond will be higher than the current market rate, making it more attractive to investors. Other factors that affect bond prices and yields include credit risk, inflation expectations, and economic growth. When interest rates rise, bond prices fall, and the yield curve steepens. When interest rates decrease, bond prices rise, and the yield curve flattens. To manage interest rate risk, investors can diversify their portfolio across different types of bonds and maturities, use hedging strategies such as interest rate swaps and futures and options contracts, and engage in active management through market timing and credit analysis.

How do I get started with bond investing ?

Bond investing is a popular way to diversify your portfolio and earn a steady income. Here are some steps to help you get started: 1. Understand the basics of bonds. 2. Determine your investment objectives. 3. Choose the right type of bond for you. 4. Consider the duration of the bond. 5. Research and select brokers or intermediaries. 6. Diversify your portfolio by investing in various types of bonds issued by different entities. 7. Monitor your investments regularly and adjust your portfolio as needed based on changing market conditions or personal circumstances.

How can I diversify my portfolio with bond investments ?

Diversifying your portfolio with bond investments can reduce investment risk and provide a steady stream of income. There are several types of bonds, including government, corporate, municipal, and foreign bonds, each with its own characteristics and risks. Bond mutual funds and ETFs offer automatic diversification across multiple issuers and types of bonds. When investing in bonds, consider factors such as credit quality, interest rate risk, inflation risk, and liquidity. To effectively diversify your portfolio with bonds, allocate a portion of your portfolio to bonds, invest in different types of bonds, consider bond maturities, and rebalance regularly. Consulting with a financial advisor can help determine the best bond strategies for your individual financial goals and risk tolerance.

What is the difference between a bond and a stock ?

Bonds and stocks are two different types of financial instruments that companies use to raise capital. While both are used for funding, they have distinct differences in terms of ownership, returns, risks, and other factors. Here are some key differences between bonds and stocks: - Bonds represent debt and provide regular interest payments with a fixed maturity date, while stocks represent equity and offer potential dividends and capital appreciation without a set maturity date. - When you buy a bond, you are essentially lending money to the issuer (usually a company or government). In return, you receive a bond certificate that represents your loan. You do not own any part of the company; you are simply a creditor. - When you buy a stock, you become a part owner of the company. This means you have a claim on the company's assets and earnings, as well as a say in how the company is run through voting at shareholder meetings. - The primary return from owning a bond comes from interest payments made by the issuer. These payments are usually fixed and paid at regular intervals until the bond matures, at which point the principal amount is repaid. - The return on stocks comes from dividends (if the company chooses to pay them) and capital gains (the increase in the stock price over time). Stock prices can be volatile, so the potential for high returns is greater than with bonds, but so is the risk. - Generally considered less risky than stocks because they offer a fixed rate of return and have priority over stockholders in the event of bankruptcy. However, there is still risk involved, especially if the issuer defaults on its payments. - More risky than bonds because their value fluctuates with market conditions and the performance of the underlying company. If the company does poorly, the stock price may fall significantly, and investors could lose part or all of their investment. - Have a defined maturity date when the principal amount must be repaid by the issuer. This provides a clear timeline for investors. - Do not have a maturity date; they exist as long as the company remains in business. Investors can sell their shares at any time in the open market. - Interest income from bonds is typically taxed as ordinary income. - Long-term capital gains from stock sales may be taxed at a lower rate than ordinary income, depending on the tax laws of the jurisdiction.

How does inflation impact bond investments ?

Inflation significantly impacts bond investments by decreasing purchasing power, increasing interest rate risk, creating opportunity costs, and affecting fixed-income investors. Inflation-indexed bonds can mitigate these effects.

Is it possible to explore port cities independently during a cruise ?

Exploring port cities independently during a cruise is possible but requires careful consideration of factors such as time in port, distance to city center, safety concerns, local customs and language barriers, transportation options, and cost considerations. To successfully plan an independent excursion, research your destination, plan your itinerary, arrange transportation, consider safety precautions, pack appropriately, and stay in touch with the cruise ship's schedule. By following these steps, you can ensure a safe and enjoyable adventure in each port of call while respecting local cultures and prioritizing safety.

What is the role of credit rating agencies in bond investing ?

Credit rating agencies are pivotal in bond investing, offering independent assessments of issuers' creditworthiness. They conduct thorough analyses and assign ratings reflecting the likelihood of default, aiding investors in risk evaluation and portfolio diversification. These ratings contribute to market transparency, efficient price discovery, and enhanced liquidity. They also play a role in regulatory compliance for institutional investors and capital markets regulation. However, concerns about conflicts of interest and rating accuracy during crises highlight the need for improved methodologies and increased accountability.

What kind of indoor games can parents play with their children to strengthen their bond ?

The article provides a list of indoor games that can help strengthen the bond between parents and children. The games include board games like Monopoly and Chess, card games such as Uno and Go Fish, puzzles and brain teasers like Sudoku and crossword puzzles, arts and crafts activities, indoor treasure hunts, and cooking/baking projects. These games not only provide entertainment but also offer opportunities for learning and quality time spent together.

What are the best car chargers for smartphones ?

Car chargers are essential for smartphone users who spend a lot of time on the road. Here are some of the best car chargers for smartphones, including Anker PowerDrive II Car Charger, Belkin Boost Up Car Charger, Aukey Car Charger, RAVPower 16W Dual Port Car Charger, Nekteck 4-Port USB Car Charger, Tecknet Pro Car Charger, Scosche ReVolt Dual USB Car Charger, Insignia NS-PCA203 Portable Car Charger, Choetech Car Charger, and Ventev Powercell 6000mAh Portable Car Charger. When choosing a car charger, consider factors such as how many ports you need, whether you require fast charging capabilities, and what kind of devices you plan to charge.

Are there any famous duos or groups of celebrities who are known for their strong bond and friendship ?

The text discusses several famous pairs or groups of celebrities known for their strong friendships and bonds. These include The Beatles (John Lennon and Paul McCartney), Tom Hanks and Rita Wilson, Tina Fey and Amy Poehler, Taylor Swift and Selena Gomez, Jay-Z and Kanye West, Oprah Winfrey and Gayle King, Lady Gaga and Bradley Cooper, and Chris Hemsworth and Chris Pratt.

What features should I look for when buying a car charger ?

When purchasing a car charger, consider factors suchWhen purchasing a car charger, consider factors such your device, charging speed, consider factors such as compatibility with your device, charging speed, number of ports, build quality and design, safety features, and price. Make sure the charger supports your device's charging port and has fast charging technologies if needed. Choose a charger with multiple ports or built-in wireless charging pads for convenience. Look for well-built and durable chargers with appropriate safety features to prevent damage to your device and ensure safe use in your vehicle. Finally, compare prices across different brands and models to find a balance between cost and functionality.